Richard Branson, the UK-based entrepreneur rightly said,

“You don’t learn to walk by following rules. You learn by doing and falling over.”

Founders tend to wear multiple hats with endless efforts, day by day while mapping growth plans for their business. Some responsibilities that they need to take care of at the minimum include –

- Create and optimise the organisation’s vision, culture and values

- Build and lead the executive team in line with the vision and business plan

- Analyse productivity results and indulge in self-learning and improvement

- Plan vital managerial and operational decisions

- Engage in outreach, growth and leadership activities

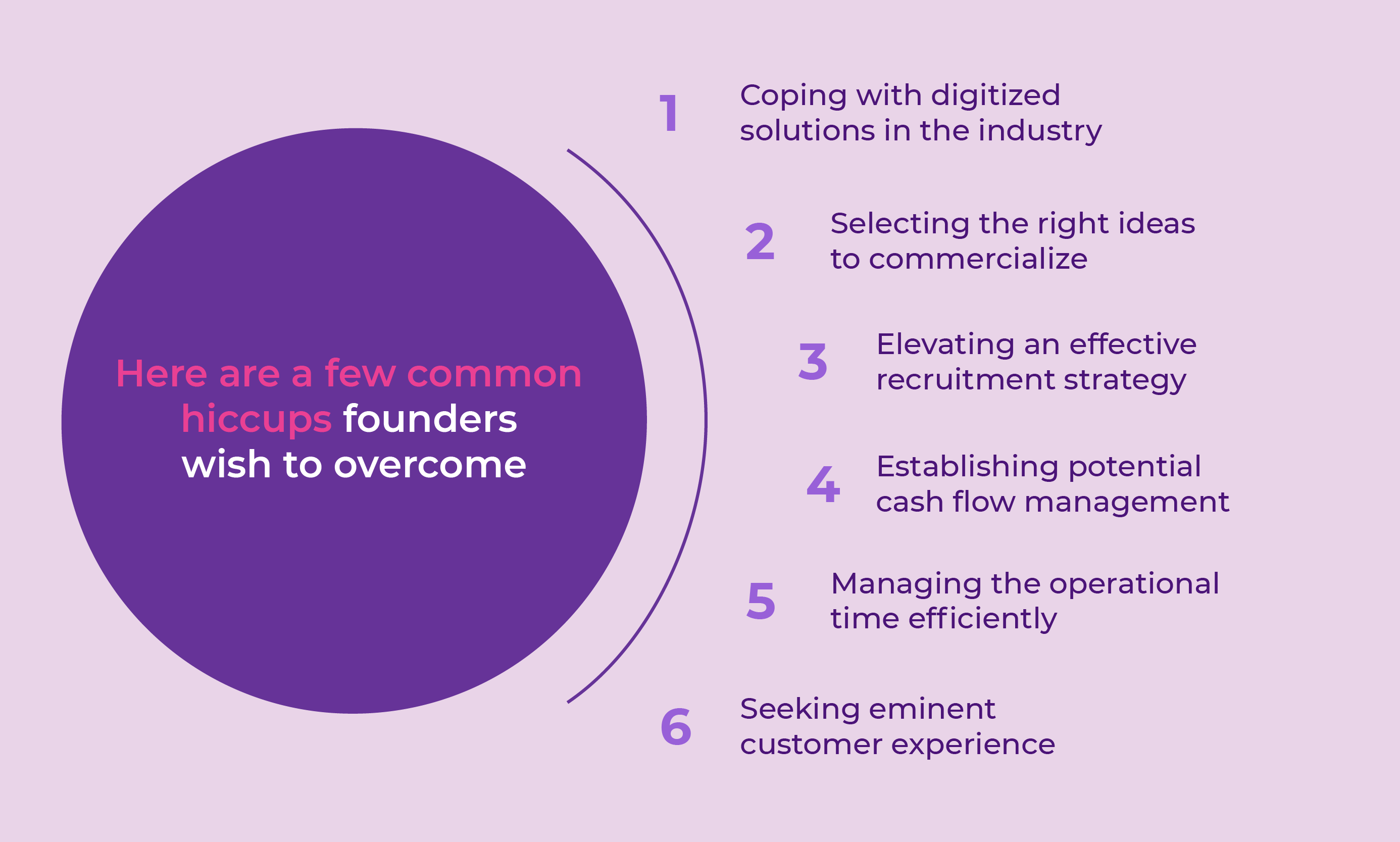

Before we get in to what exactly does the month of a startup founder comprise of, let’s quickly dive into what often holds importance in their plans. How about starting with a weekly assessment?

The first half of a week is extensively focused on having 1-on-1 internal meetings to strategise activities for the rest of the week. Founders don’t really get any ‘Monday blues’, as for them Monday motivation rises higher with evaluating the previous week’s activities and planning ahead. Not to mention, it’s a rigorous journey to stick to a strategic business plan.

Mid-week is the best time to execute the scheduled plans. With a buzz around some incredible startup missions currently underway, you’d expect the traditional banks to endow them with capital to drive the economy, right?

But, that’s not the case!

Even a late-stage startup can very well relate. Thankfully, we have been able to hash out this struggle lately; wherein startups can create an instant business account. An account that offers a lot more than a traditional bank account and fits the exact needs of a startup.

Days nearing the weekends merely go with concluding the weekly projects and with proposing ideas for the coming week. Any business plan needs frequent monitoring with necessary adaptations along a project lifecycle. Enhancing and mapping a better customer journey holds vital importance when it comes to leveraging a startup.

Heading to the end, there are some recap meetings, review of financial goals, and getting prepared for the following week. Unlike the refreshing weekends, the end of each week comes with the task to wrap up the accounts payable by organising invoices and vendor payouts. Alongside, it’s a great time to analyse the customer journey and experience while trying to improvise it.

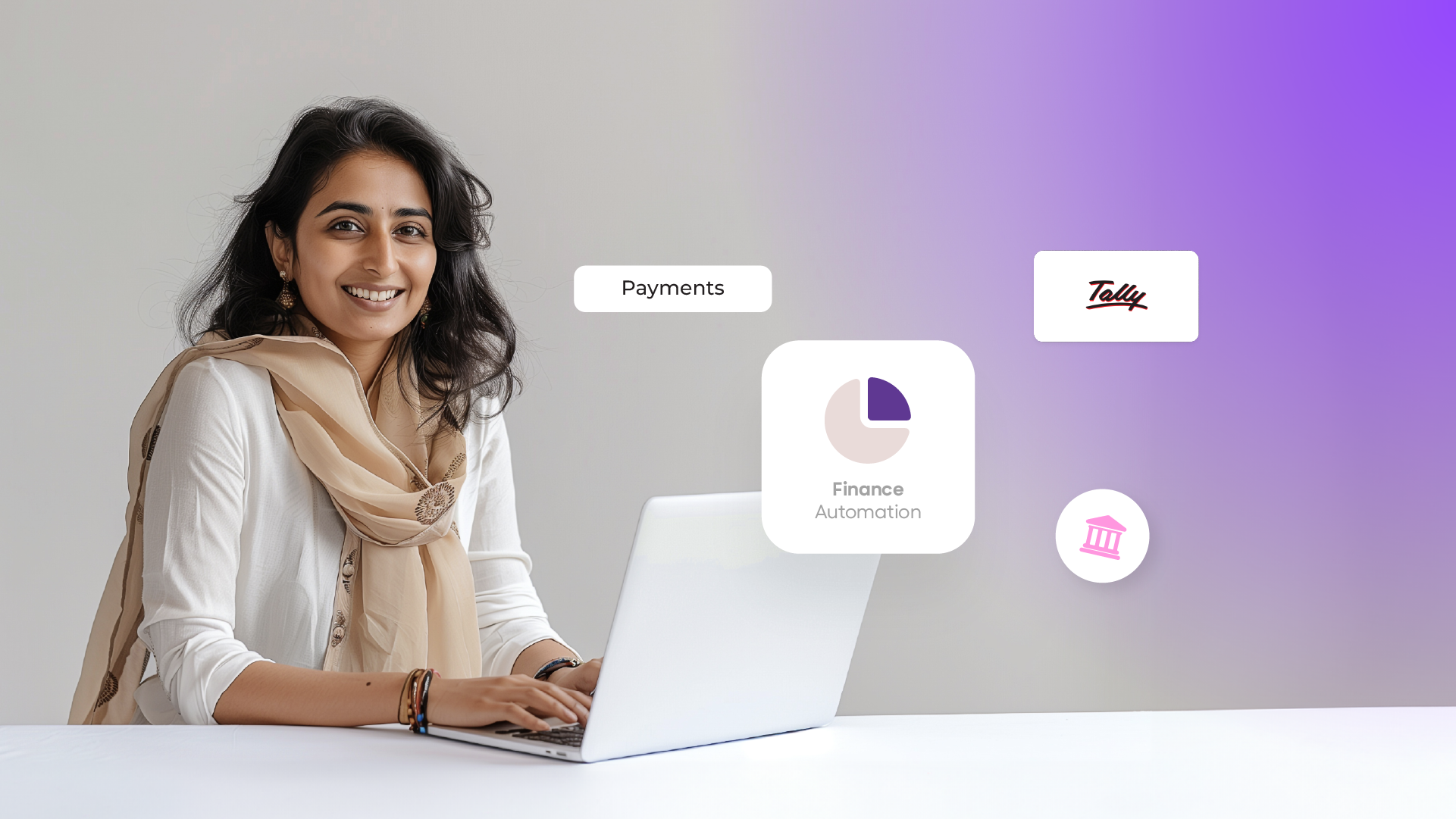

Not monitoring the cash flow and expenses regularly is one of the many pitfalls that startup founders fall into while creating and maintaining their financial structure. However, indispensable technology woos the startups with solutions offering automation in tedious processes such as invoicing and payouts. Also, it is vital for a new-age or any established startup to strictly adhere to a business budget and financial projections. Expecting the employees to follow the budget is not going to solve the budget issues. Open’s virtual cards and expense management module make this entire process as simple as it could be. It helps startups to manage, track and control all their expenses in real-time, eventually minimising efforts, hours and frauds.

Moreover, the month of March recently waved goodbye! How could one forget about taxes? Keeping tax records updated is crucial in order to stay away from the regulatory headaches. Businesses can be on the ball with keeping a note of every little detail and outgoing that can be reclaimed.

Is that too much to sink in?

Well, we believe in a founder’s aspirations, and hence we got your back! Open is here with the smartest business banking solutions for startup founders across India. These days, the entire tech ecosystem rides on API-driven solutions. APIs help startups build products faster, save money, and build a great customer experience, ultimately focusing on what matters to them most. Unboxing new possibilities and building robust customer-centric solutions are vital to exploring new routes of project execution. Founders have started consuming outsourced expertise to scale quickly and cost-effectively. It’s time to focus on your business plans, reimagine and sharpen your competitive edge with us!