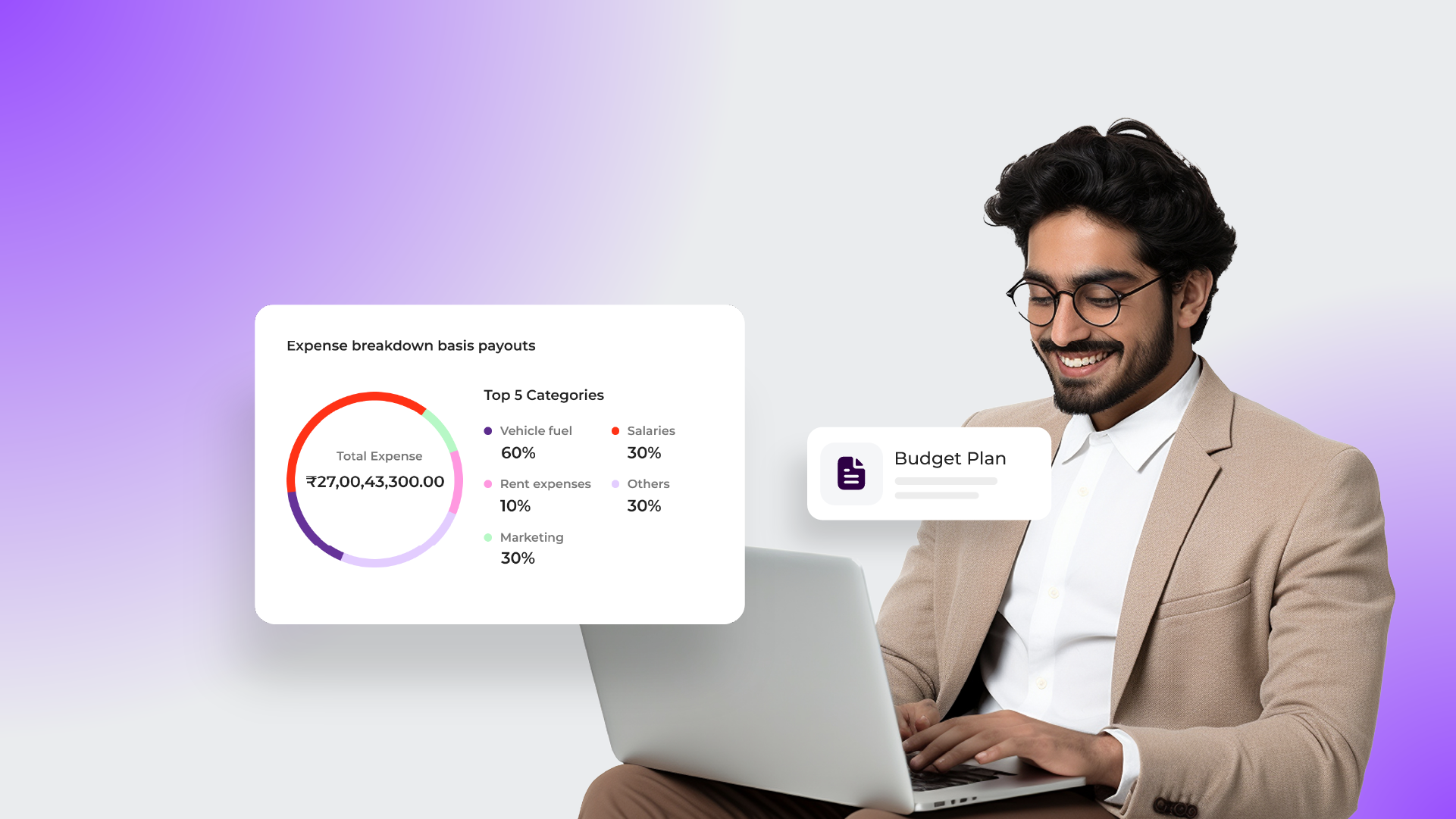

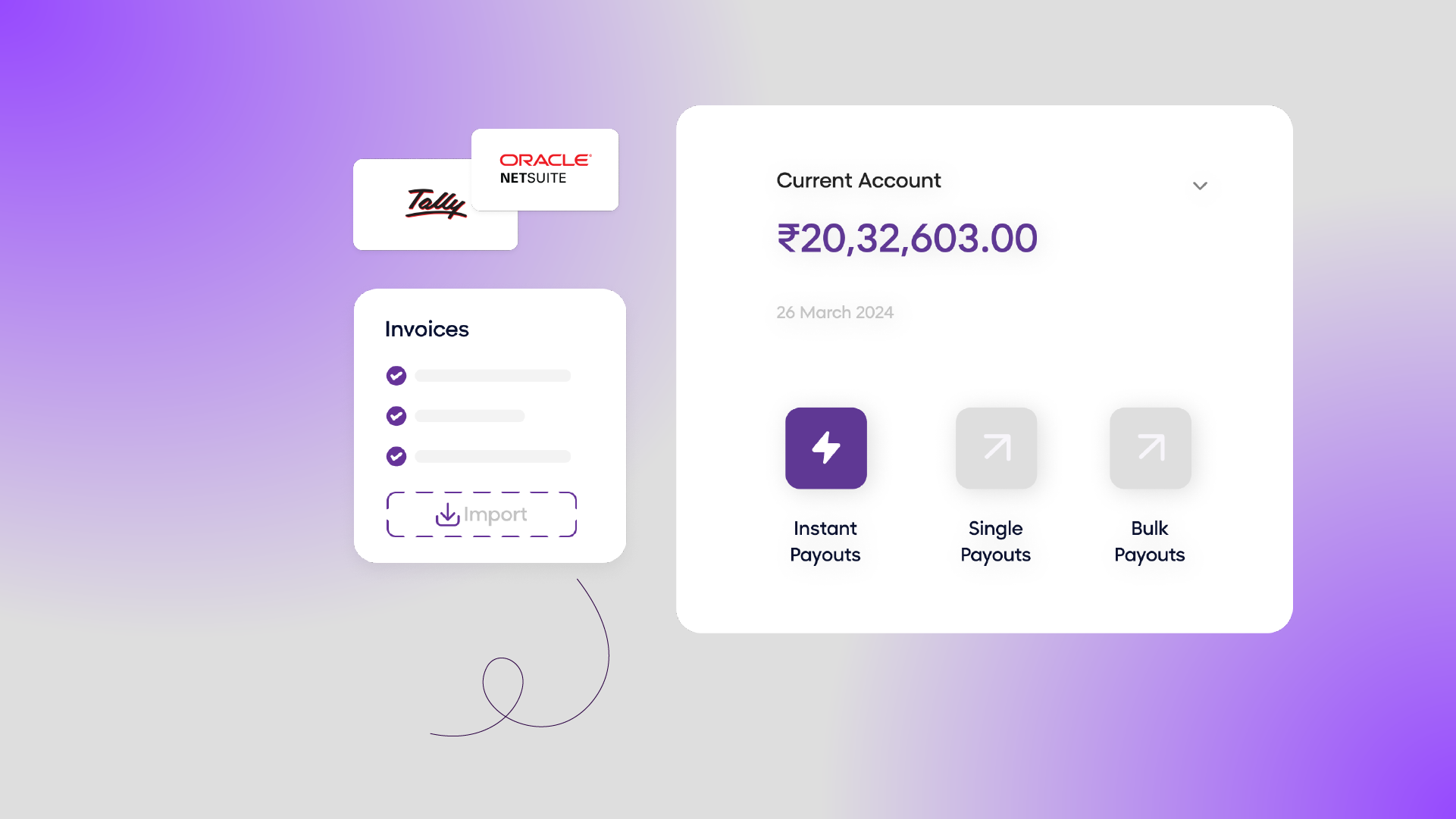

Largely driven by technological advancements and changing market demands, the evolution of accounts payable is undergoing a significant transformation. As businesses aim for better financial operations, they’re turning to Accounts Payable automation for efficiency and accuracy, shaping the future of …

Unlocking the Power of Accounts Payable Automation: Strategies for CFOs to Drive Growth and Reduce Costs

- By Shweta Singh

- July 26, 2024

- 5 min read