Is your loan taking a while to get sanctioned? Are your documents not being accepted at the branch? We hear you!

Getting a loan may seem like just the boost your business needs right now, but several factors make it difficult for a small or medium-sized enterprise (SME) like yours to apply for a loan.

And you’re not alone in this: While SMEs and MSMEs are the cornerstone of India’s economic growth, tens of thousands struggle to access capital every year.

“40% of Indian SMEs are credit constrained”

Reasons SMEs struggle to get loans

| Not fitting the bank’s acceptance criteria: It is often tricky for SMEs to produce strong credit histories because of inadequate financial data. Having to convince branch managers, long turnaround times for loan disbursement, and complicated application processes compound SMEs’ problems of getting timely loans. | Need for collateral: Borrowers must pledge collateral, or an asset, that the lender accepts as security against the loan amount. For businesses, it can mean real estate, machinery, or inventories. In a situation where a business is about to incur a loss, having to produce collateral can deter the company from getting much-needed capital. |

| High rates of interest: Lenders often process loans at high rates, regardless of how your business is doing. Whatever your financial blueprint, your credit score, and the nature or turnover of your business may be — high interest rates unexpectedly disturb your business plans. | Hefty pre-closure charges: As a business owner, you probably dream of prepaying a loan and becoming debt-free at the earliest, especially when the business is doing well. However, many lenders levy foreclosure charges on single complete loan repayment, which can be between 2-5% of the remaining loan amount. |

In sum, several forces hinder SMEs from getting loans that can help them fuel growth and innovation, create links with customers and other businesses, and as a result, have a competitive edge in the market. Unfortunately, many promising businesses often lose their advantage because of the aforementioned barriers.

Easy application for SMEs: Support your dream with instant loans!

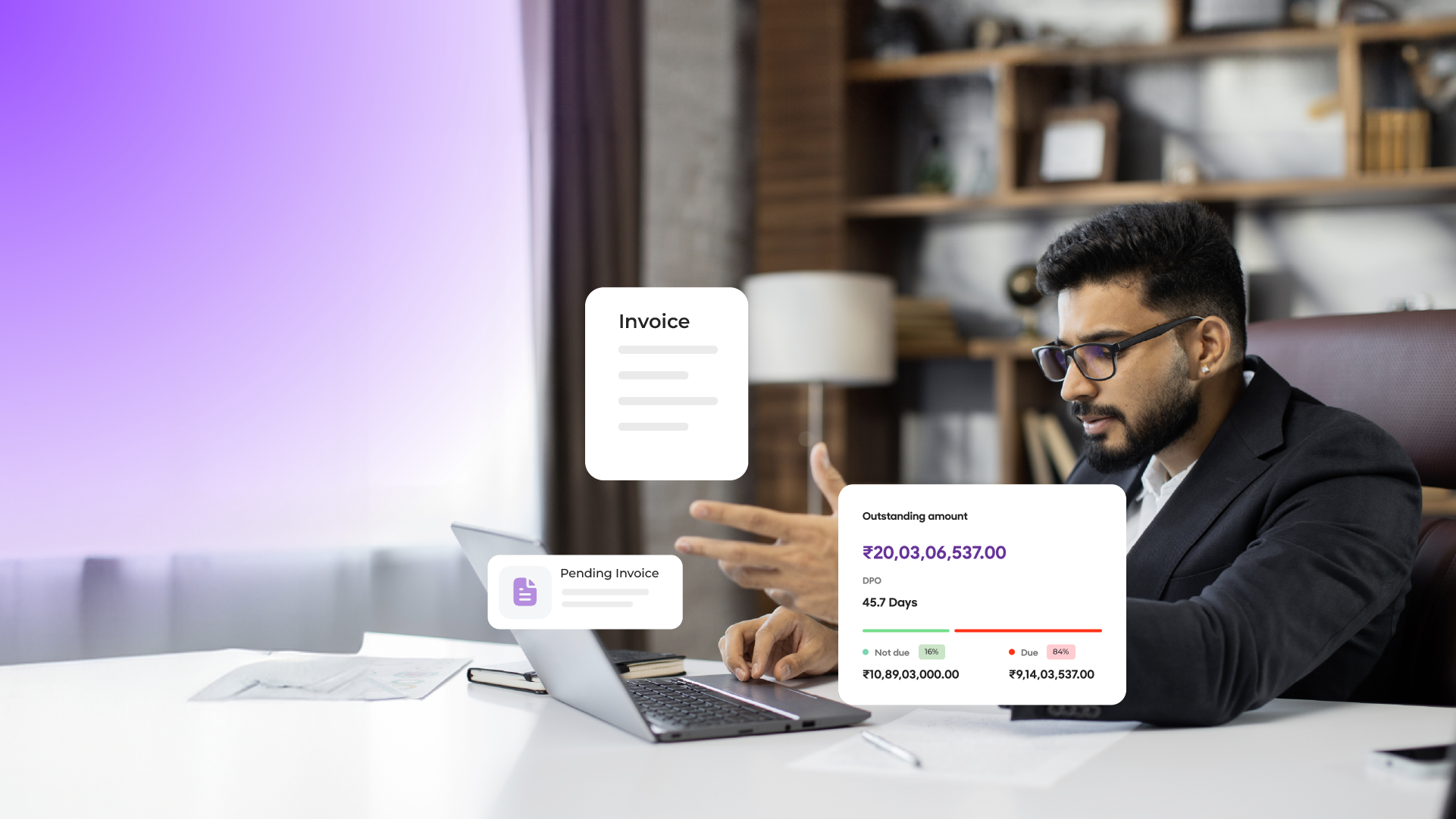

There is no reason to worry! Fintech, or financial technology, is the new player changing how traditional banks or institutions lend. The emerging tide of fintechs has transformed lending with the introduction of innovative solutions and increasing access and affordability for SMEs.

As a fintech platform dedicated to serving the business needs of SMEs, OPEN provides instant business loans. Once you apply for an instant loan, the amount is usually disbursed to you within 24 hours in a seamless online process which excludes paper documents or queuing up to meet a branch manager.

Here are some more attractive benefits of applying for a loan with OPEN:

- A quick and easy application process that is 100% online and paperless

- No need for collateral or any loan-repayment guarantee

- Low interest rates, starting from 1%* per month

- Loan disbursal in 24 hours on completion of application process

- Zero pre-closure charges

- Trusted by 30,00,000 businesses