D2C (Direct-to-Customer) businesses are typically defined as eCommerce businesses that sell directly to their customers, i.e., without any involvement of retailers, distributors, vendors, resellers, etc., in the sales journey. Generally, this translates to a majority of conversions happening through digital channels such as the brand’s website, Amazon, WhatsApp, etc., and therefore to a greater need for digital marketing.

According to Inc42, Indian D2C brands spent $157 Mn on advertising in FY21. This number is only expected to rise in the coming years—IndiaRetailing’s research, for instance, suggests that D2C brands are increasing their spending on Google Ads by 47%. More than one-third (36%) of the brands surveyed said they are increasing their investment in influencer marketing.

Fundraising vs. Expense Management

If we were to ask a layperson or even someone who has just begun to dip their toes into the waters of entrepreneurship on what they think is the biggest challenge in running a D2C business (or a startup, for that matter), the odds are they would say fundraising.

Fundraising is the most challenging and the most glamorized part of being an entrepreneur. It gets its fair share of exposure in popular culture with shows such as TVF Pitchers, Silicon Valley, and Shark Tank (perhaps the most topical one at the moment), etc. D2C businesses, like other firms and startups, spend months trying to raise funds from VCs (Venture Capitalists). In addition to the financial relief it entails, it is also a matter of prestige (and good PR opportunities) to finally crack those deals. However, very little focus falls on managing the funds raised and ensuring that the expenses are tracked and controlled in real-time.

There are many places where business owners can optimize expenses, including manufacturing, delivery logistics, packaging, etc., but since a significant part of spending by D2C businesses is for marketing, it makes sense to start optimizing the marketing expenses first. And how do you do that? Well, virtual cards can be a great help for sure.

What are virtual cards?

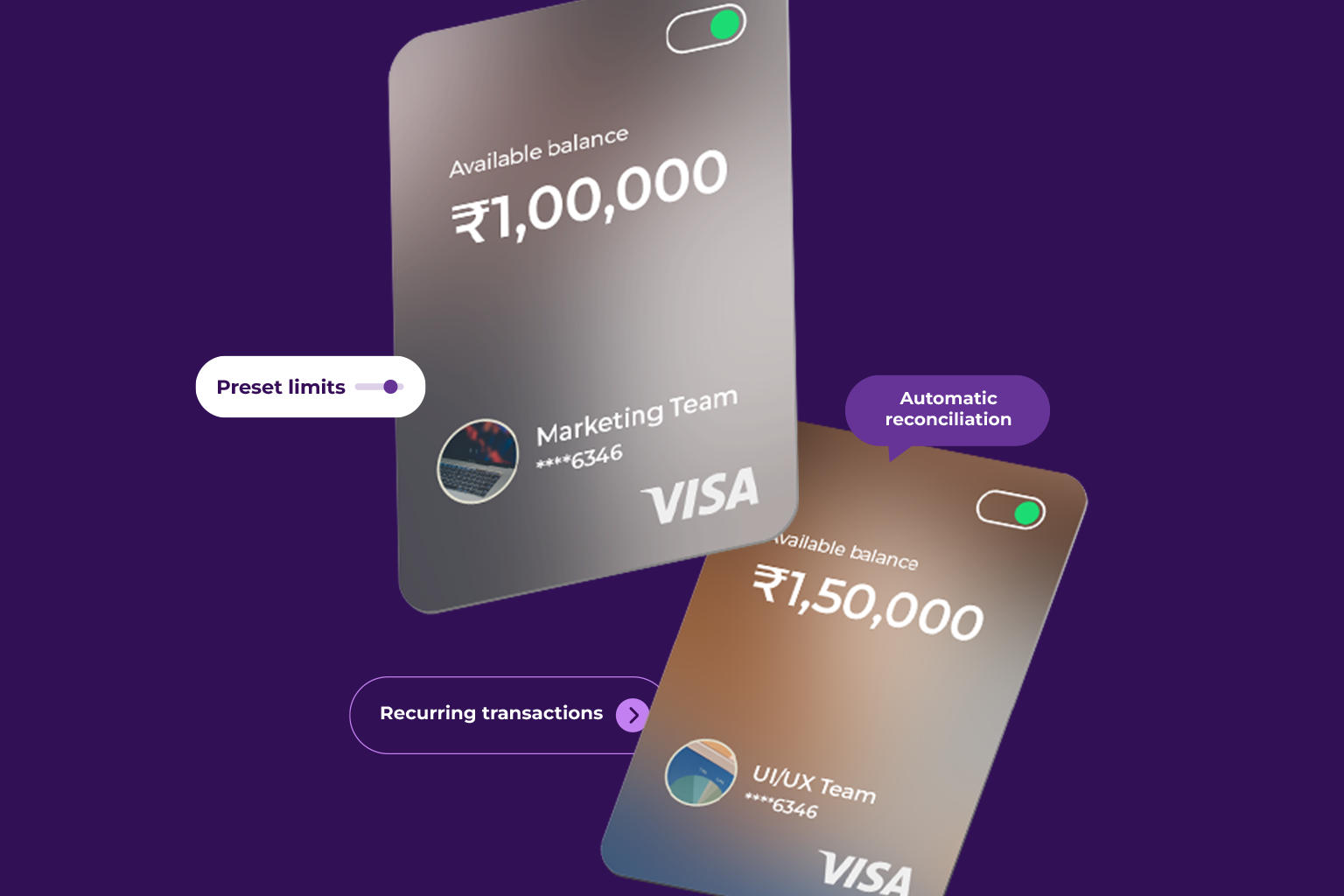

Virtual cards, also often called virtual credit cards, are unique & digitally generated 16-digit credit card numbers that let you pay for all your SaaS subscriptions. You can use these numbers just as regular credit cards, with many added advantages that make it optimal for SaaS expense management.

You can find out the answers to all your questions about virtual cards here. Now, let’s look at a few ways in which virtual cards can help you manage your SaaS marketing spending.

As previously said, virtual cards work precisely like actual credit cards, with the exception that you can create them whenever you want and take advantage of other significant benefits. Here are some effective ways that virtual cards can assist you in managing SaaS subscriptions:

Don’t max out your personal credit card

As a D2C founder, you may often find your credit card maxed out by marketing expenses, and that may come as unwelcome surprise sometimes, especially when you have to make urgent transactions. By assigning virtual cards for marketing spending, you ensure that your personal card is never maxed out.

Effortlessly control advertising expenses

Allocating several virtual cards to various ad networks such as Facebook and Google, you may streamline your digital spending and improve budgeting. It gives you a better view of how different platforms are working out for you because you know exactly how much you are spending where.

Adhere strictly to your digital spending budget

Virtual cards allow you to monitor and manage all purchases in real-time. You can also place spending caps on the cards to help you stick to your spending limit.

Never miss a deadline by automating payments

You can set up recurring payments on numerous platforms by using Virtual Cards for business expenses to ensure that everything continues to run properly even if you forget to renew your subscription on time.

Put an end to your concerns regarding unmitigated expenses

Real-time transaction tracking is one of the best features of virtual cards. You are aware of the precise recipient and use of each card. Additionally, to ensure that you always maintain total control over your SaaS spending, most Virtual Cards platforms also provide a one-click activation/deactivation feature.

No more tedious reconciliation

You can benefit from having all your transactions done with Virtual Cards reconciled automatically through digital banking platforms like OPEN, saving you hours of tedious reconciliation work and allowing you to concentrate on expanding your business.

So, make it a little bit easier for yourself to run a business and let virtual cards simplify your marketing expenses today! Also, if you liked reading about virtual cards, you may also benefit from looking in on how you can use prepaid cards to sort out employee expenses.