Contemporary business finance has evolved far from what we knew about the space. Modern-day financing proactively uses technology. Organizations use different payment tools, payroll solutions, ERP software, and data visualization platforms – all in hopes of streamlining financial processes. However, the thing that seems to be lacking here is connectedness. The emerging concept of connected finance addresses this via an integrated approach, consolidating all of a business’s financial functions under one cohort space. Along with better process streamlining, this aids in strategic decision-making and planning, which helps pivot business finance domains.

What Is Connected Finance?

Imagine a CFO who can seamlessly engage with the IT, sales, marketing, and operations teams. All of the financial details – are consolidated, charted, and visualized in a single space, which can be used to make big-picture decisions.

Connected finance is a financial management concept that uses technology and data analytics coupled with advanced financial tools. It leverages aggregating systems and data sources to support real-time business intelligence and financial functioning. Through interconnected applications and data transferring, businesses can oversee, control, and optimize their monetary operations across various channels from a single parent platform/interface.

Why Should Companies Implement Connected Finance?

Connected finance enables O2C streamlining via integration between sales, inventory, and finance systems. By optimally catering to O2C right from order initiation to cash collection, businesses can automate order entry, inventory management, invoicing, and payment processing.

Consolidated workflows can help with faster order fulfillment, cycle time reduction, accelerate processing times, and enhance customer satisfaction. Retail businesses can leverage this to lessen the chances of overstocking/stockouts. Organizations get to focus more on customer engagement and experience as financial and administrative tasks get seamlessly dealt with.

Not only this, but data-driven insights and financial systems aid operational efficiency, agility, and competitiveness.

How Does Connected Finance Work?

The following cutting-edge technologies play a critical role in connected finance functioning:

(1) Integration

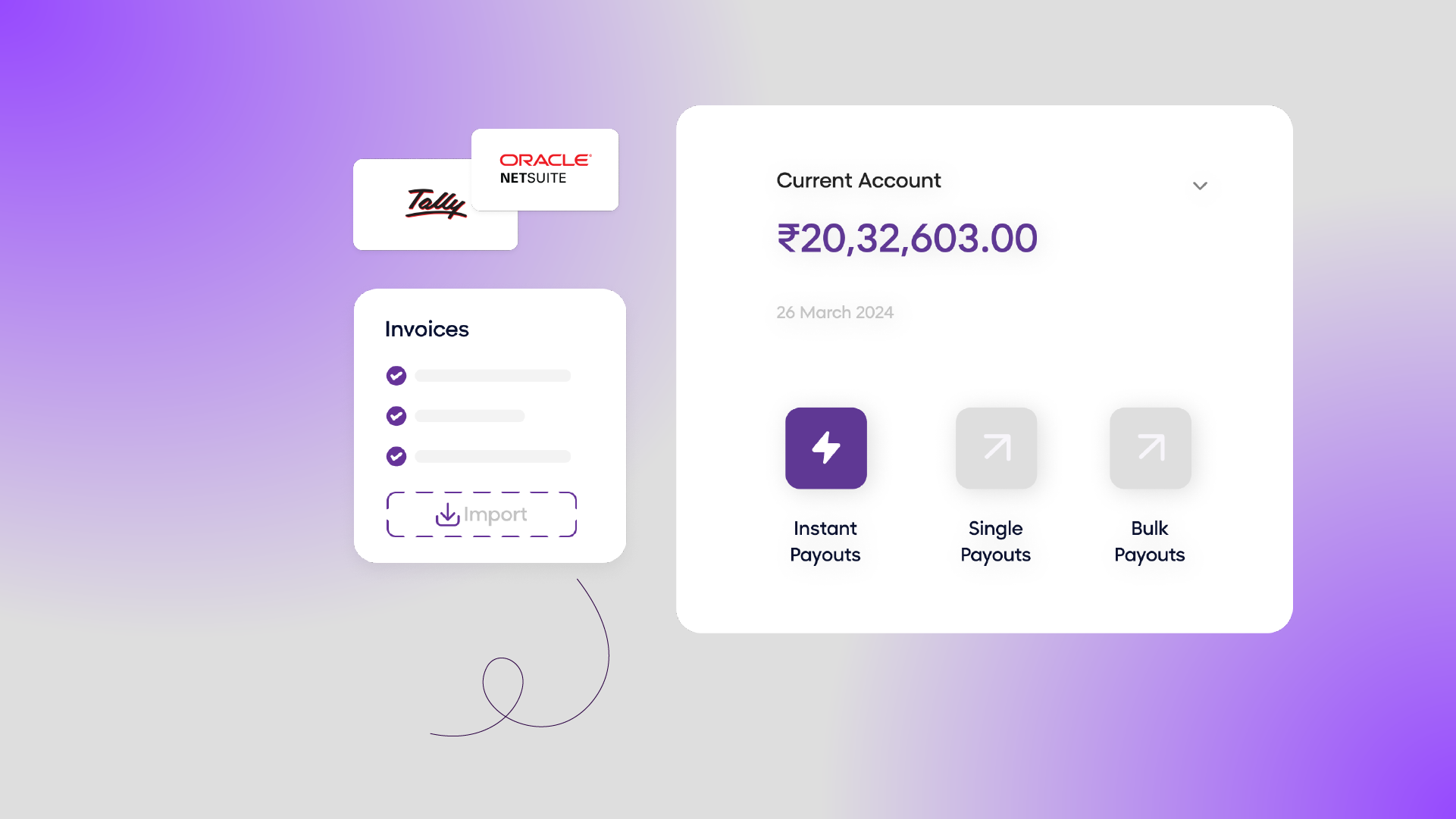

Technology connects different financial platforms using APIs (Application Programming Interfaces), enabling seamless data flow and integrated workflows. For instance, accounting software like Tally, Zoho Book, etc., can automatically download bank account transaction details without any manual intervention. Tasks like tax filing, and budgeting become one-click functions, all under one unified ecosystem for robust financial management.

(2) Automation

Automation streamlines and automates repetitive and time-consuming tasks, such as data entry, reconciliation, and payment processing. Your bills, subscriptions, and payrolls get automated and are made on time to omit late payments. You can also manage expenses by automating policy reinforcement, receipt scanning, categorizing, and reimbursing employee expenses. Robotic Process Automation (RPA) helps automate these tasks, freeing you to focus on more stringent operations.

(3) Real-time Insights

Technology enables real-time data analytics and insights, which helps make better and faster decisions. You can strategize your finance operations and pricing strategies for maximum profitability and business sustenance. Some connected finance platforms also allow access to market trends news, using which you can make investment decisions, all while having access to your capital gains and savings, all in one space.

How Will Companies Benefit From Connected Finance?

(1) Improved Financial Visibility & Insights

As per Blacklink’s latest survey, almost 49% of C-suite execs are worried about their companies making decisions based on inaccurate or out-of-date information. 44% say the lack of visibility over cash flow makes them less confident that their organization can remain competitive year on year.

Businesses get a comprehensive view of financial performance by integrating data from various sources. Connected finance facilitates real-time insights into cash flow, profitability, and operational expenses – all catering to the identification of underperforming areas, enhancing financial and accounting streamlining.

(2) Increased Efficiency & Productivity

Creating invoices, generating receipts, and statements earlier used to take hours, required crunching Excel sheets. PwC’s benchmarking work reveals that business partners still spend roughly 30% of their time collecting data and reconciling it between systems.

Connected Finance uses optical character recognition (OCR) and machine learning to extract data from invoices and e-receipts. Automated reconciliation processes maintain data consistency across different systems and update it when updated from any single point. All this saves much time, reduces errors, and frees one from repercussive expenses.

(3) Enhanced Collaboration & Communication

As per Salesforce reports, 86% of executives cite ineffective collaboration as a major contributor to business failures. A centralized repository ensures that every single one of your business stakeholders is working in sync and in collaboration. It reduces error potentials and scopes of miscommunication. This breaks free the silo mentality within teams and departments and allows accelerated data sharing, meaning a decision made by the sales team regarding raw material necessity instantly gets updated to the accounts department, which then takes permission from the higher management whether to reimburse or not. Everything happens in split seconds due to easier data accessibility through the connected finance platforms.

(4) Dynamic Decision Making

Data overload can definitely result in operational pitfalls for new-age businesses. Connected finance apps aid with prudent analytics, notifications, and output charting (e.g., delayed purchases, payment term updations, and banking norm changes). Speedy access to analyzed result robustness aids decisional dynamism and fuels optimal budgetary judgments.

(5) Reduced Risk & Fraud

Access to real-time zero-second data allows continuous transactional monitoring. You can flag out unusual estimations, purchases, and financial mishaps anytime, anywhere, right from your phone. Potential fraudulencies can be dealt with instantly, which can lead to enhanced financial reporting reliability and control. By combining internal procedures with technology, you can defend your finances without any worry.

What Are The Challenges In Implementing Connected Finance?

(1) Integrating data from different systems is challenging and time-consuming

Data integration challenges arise due to the diverse nature of organizational financial systems. Combining data from accounting software, CRM platforms, ERP systems, and banks requires critical mapping and transformation. Data gets fragmented due to the siloed functioning of these systems, consolidating which is essential yet becomes intensive.

(2) Most companies often lack the expertise and resources to implement Connected Finance

Connected financial management calls for a blend of technical expertise, project management, and intermediate/expert financial acumen. Businesses often lack the right in-house teams with the necessary skill sets to lead/handle connected finance implementation. Incoherence between different teams within the organization, lack of dedicated resources, and poorly allocated budget also impact implementation.

(3) Companies often face cultural resistance to change

Change is the only constant thing, given that such is constructively initiated. Implementing connected finance can significantly alter existing business workflows, processes, and overall culture. Years of substantiated work can stem resistance due to fears of potential job displacement, technological adoption reluctance, or simply being afraid of not being able to fit the technological disruption. Incremental implementation to ease the transition and foster connected finance acceptance among employees can aid with much better operationality. Employees can focus on other important tasks, leaving the financials on the connected platform.

(4) Multi-national data security and compliance validation can seem like a hassle for SMEs

SMEs often lack resources and knowledge of multi-national legal fronts, especially if they deal with localized finances. The international financial landscape calls for expertise and abundant bandwidth to adhere to regulatory and compliance standards such as GDPR and HIPAA. Data security and jurisdiction management add layers of administrative burden, making the adoption of connected finance complex.

Connected finance revolutionizes business management and financial operationality via tech integration and automation. It helps optimize order-to-cash through automation, increases order fulfillment rates, reduces transactional processing times, and improves customer satisfaction. By leveraging APIs, RPA, and real-time analytics, you can ensure elevated data flow and decrease repetitive tasks. Benefits include increased financial visibility, heightened productivity, collaborative decision-making, and reduced chances of fraud. However, system integration complexities, lack of expertise, reluctance to change, and compliance conflicts can delay implementation rollovers. If you, too, seek to establish a front-running business with a robust all-in-one-place solution, connected finance is your way to go. To learn more, visit open.money today!

Check out our product demo to learn how OPEN can benefit your business: https://register.open.money/product-demo/