Accounts payable (AP) is a crucial function for companies as the process determines the quality of supplier relations, purchase workflows, and the overall efficiency of the finance operations.

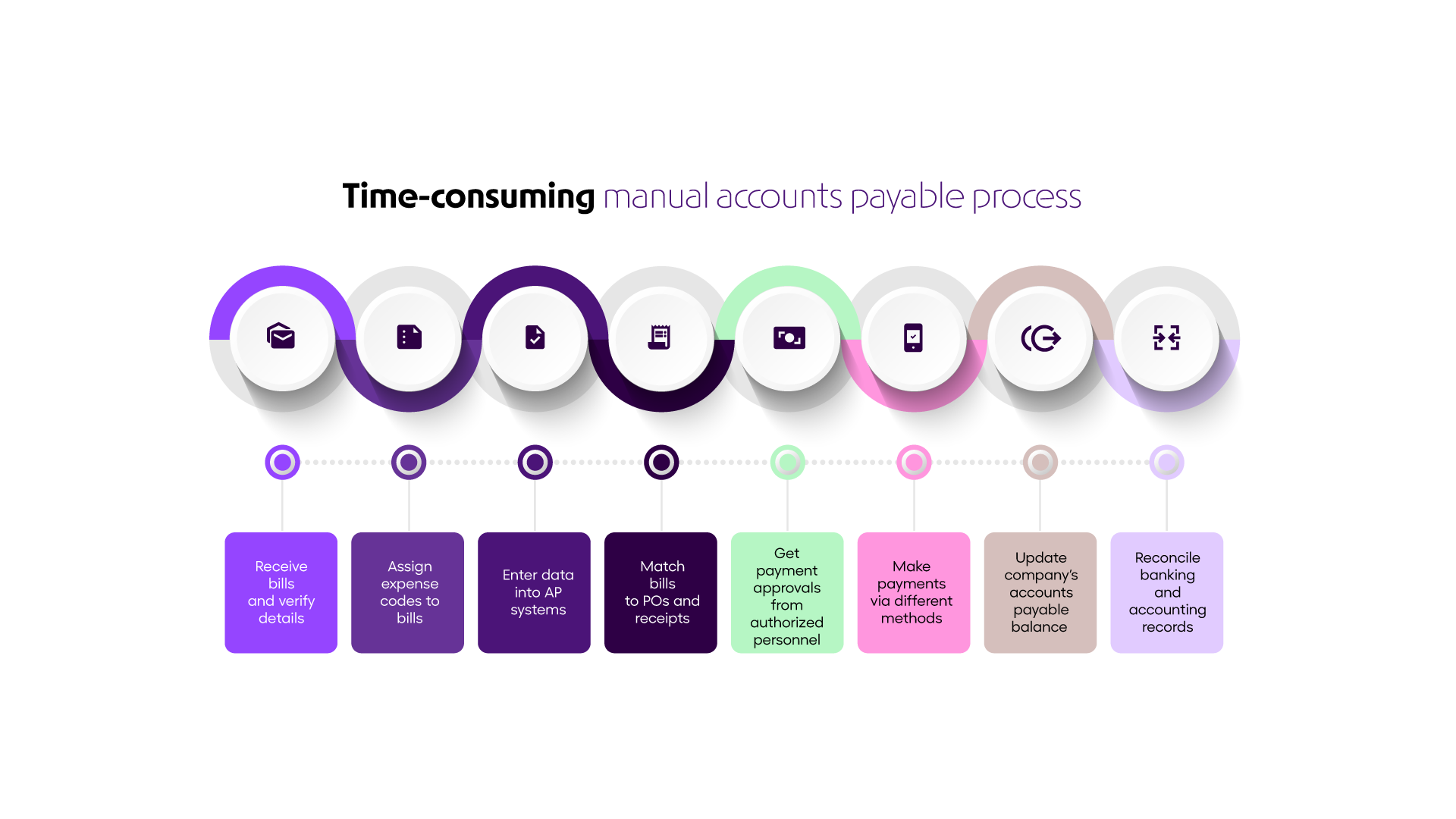

Several factors make AP a complicated and error-prone function. To begin with, the AP workflow involves a set of recurring and tedious tasks that require processing copious volumes of vendor & supplier bills (new and existing), updating their status, maintaining consistent communication with the suppliers, and processing and reconciling bulk payments.

Along with being complicated, it’s also a high-stakes task. Meaning, in case the accuracy or pace of the work is compromised, it could have dire consequences for the company.

This explains why smarter companies, big and small, are choosing to automate the accounts payable workflow/systems. This helps them with seamless processing of bills and analytics, faster turn-around time, and reduced operational costs and data risks.

Through this article, we intend to serve one purpose for you: leaving no gaps in your understanding of accounts payable automation and throwing light on what it can do for you.

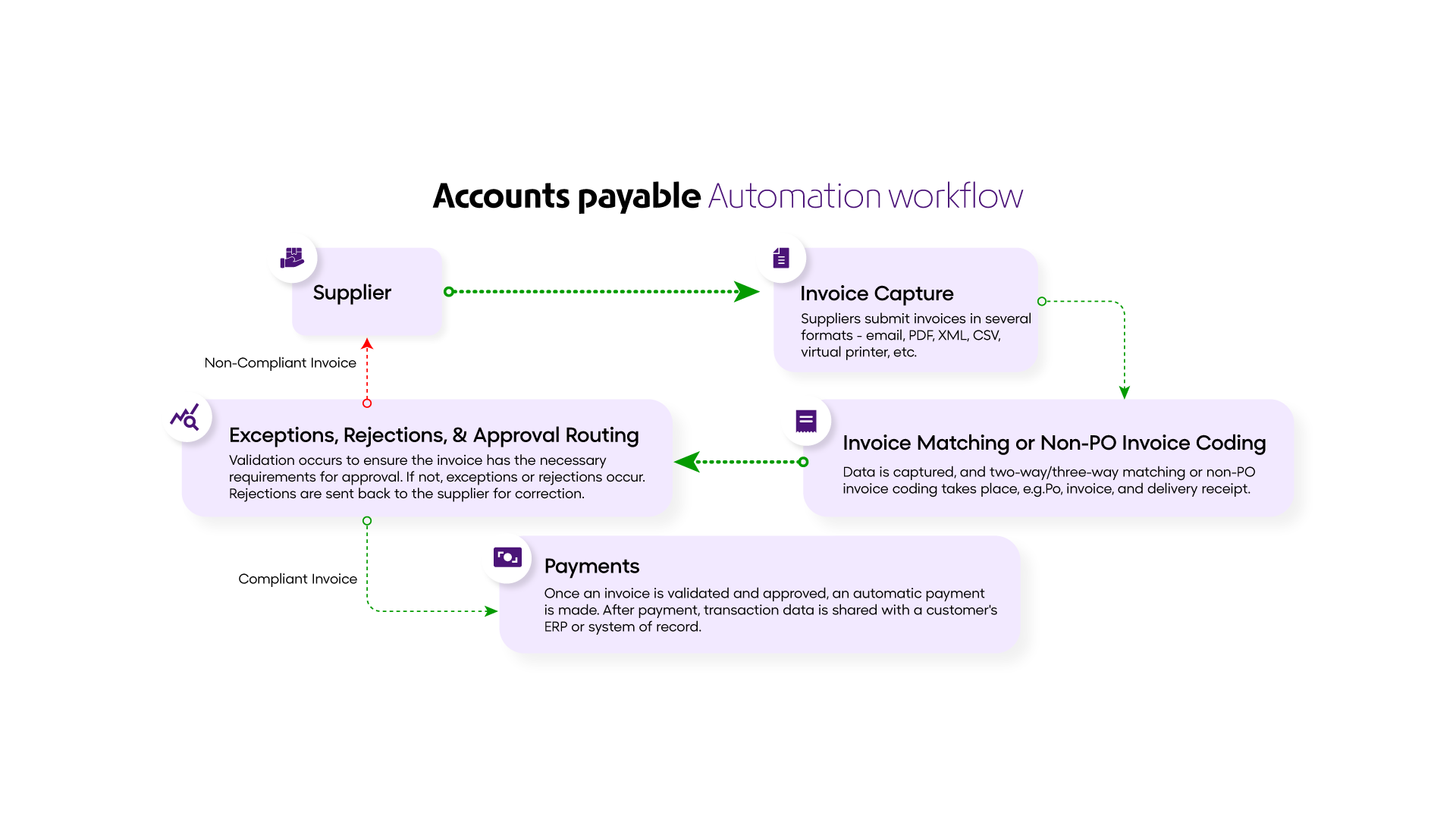

Here’s how Accounts Payable Automation works.

Here’s an elaborate list of all that accounts payable automation does to transform your AP system. Let’s dive in:

(i) Bill Capture:

Bill Capture is the initial process of capturing (extracting) data from the bills generated & shared by suppliers or vendors. The accurate and efficient flow of these data sets the AP workflow in motion. However, more often than not, the bills that your AP team receives are scattered between emails and physical bills, calling for copious amounts of manual entries. This not only hinders productivity but also leaves room for mis-keys, bill losses, and restricted visibility of the whole process.

An end-to-end AP automation software will swiftly and accurately extract data from bills of all formats, re-align them to usable, structured, and classified data, and automatically import all the entries into the AP system with minimum to no human assistance.

(ii) Data Extraction and Validation:

The AP team has to consistently extract all useful information from the bills and documents, validate it against the source documents, and also make sure that they adhere to a predefined standard that ensures the accuracy and usability of these data throughout the process.

When dealing with copious volumes of data regarding the price, quantity, and resources that often differ only minorly from each other, the team tends to make several negligence errors.

Once automated, the system efficiently and instantly extracts all the required key information from the bills (physical and digitized), validates it against the source documents, and also makes sure that the pre-set standards are followed without any inconsistencies or gaps.

(iii) Matching Bills to Purchase Orders:

Matching bills to purchase orders is another error-prone and time-consuming task, where the purchase orders must be compared against their supporting documents before processing and releasing the payments. This process imposes cognitive stress on the AP team, as every payment is preceded by a document verification process and recording of several details from the bill, like amount, quantity, receiver, reception date, value of the resource, and any other details as required by the particular team.

These bills go through multiple (three to four) stages of approval, and after each of these stages, the bill details must be verified once again to ensure consistency.

Manual bill-matching processes can result in several price and quantity discrepancies.

An AP automation system can automatically match the bill at all stages, including the purchase orders, receipt notes, and inspection documents, with almost accuracy and seamless pace.

(iv) Workflow Routing:

Accounts payable runs on a rather complex and dynamic workflow that requires efficient communication and cooperation among team members and teams from other companies.

The primary core processes here include:

- Receiving the bill from the supplier

- Verifying data, validating, and maintaining records

- Flagging discrepancies and inconsistencies and correcting them before approval

- Settling the payments,

An automated AP workflow will transform this dynamic process into a single and easily manageable console that will automatically trigger real-time notifications to appropriate personnel regarding the flagged errors, approval requests, and more, which they can digitally respond to and simultaneously update the entire team about the status of each bill. The system can even assign tasks to individuals and record their completion, eradicating the need for personalized communications, phone calls, and meetings and micro-managing each stage of the process.

(v) e-statement Reconciliation:

Even though AP teams’ primary function is to calculate and deliver all the due supplier payments on time, it is sometimes humanly impossible to ensure that the general ledger and AP balances are accurate. The team could take several weeks or monthly payment cycles before these errors are caught, flagged, and redressed/remedied.

Automating this process would imply that the system can automatically import item details from the bills directly through the source systems and match them with the e-statements of linked bank accounts based on the predetermined matching rules. This also allows the team to access all the e-statements and other details through a consolidated panel for a transparent and smooth process.

(vi) Integration with Accounting Software

An automated AP system also offloads the team from updating the bill data separately on the accounts software, as the AP system is already integrated with the company’s internal account software. This is a fairly simple but tedious process when assigned in high volumes that tire the team members and exhaust their potential on a repetitive and mechanical task. Automating this process ensures that the general ledger is updated automatically and simultaneously.

(vii) Payment Processing:

Payment processing is a core process of AP teams, and automating it relieves the team from any additional pressure to facilitate payment processes manually, seeking updates of receipt from the suppliers and then closing the tab on each particular payment.

AP automation tools are fully facilitated to take over the payment process. The system can enhance the team’s efforts further by providing a consolidated and interactive dashboard of pending payments. This fastracks the communication, decision-making, and cash flow management for the businesses.

(viii) Reporting and Analytics:

Since the AP automation software is linked to the current accounts and has all the vendor or supplier bill data, they can automatically read the numbers together and generate easy-to-interpret reports of several metrics like outstanding bills and dues, payment timelines and cycles, supplier spending, and much more.

These reports not only help their teams make better decisions and analyze their performance and scope of improvement but also give valuable inputs that can help the overall AP process negotiate for better terms with suppliers and enhance cash flow management.

(ix) Security and Compliance:

AP teams deal with sensitive data that must be protected against breaches, losses, and any other system storage vulnerabilities. Companies that outsource the AP process are at a higher risk of cyber threats. Even companies that nurture internal teams are often subject to fraud, misplacements and losses of digitized bills and documents, leading to monetarily heavy consequences for the company.

Modern AP automation solutions incorporate security measures to protect sensitive financial data, with network and data encryption, intrusion detection and prevention tools, and frequent cloud backups.

What are the benefits of Accounts Payable Automation?

Automating the AP process is beneficial for all the stakeholders closely involved with the process, like finance and accounting managers, the procurement department, the top-level management like the CFO, and even the suppliers and vendors associated with the company.

Want to learn more about Business Finance Automation & how are CFOs evolving?

Visit – https://register.open.money/business-financial-automation-ebook/

Automation of the end-to-end Accounts Payable process will provide the following benefits:

- Time and Cost Savings: Eradicating the need for manual interference in data entry and document management, AP automation saves the team a lot of time. It even has a positive effect on cost as the storage, printing, and physical mailing processes can be done freely through the system.

- Improved Accuracy and Reduced Errors: To err is human, and that’s why we automate. With smart tools like optical character recognition and intelligent data extraction, the system provides unparalleled accuracy with the data captured and stored from vendor & supplier bills and other documents.

- Enhanced Visibility and Control: With consolidated dashboards that give access to the real-time status of all accounts, details, and payments, the AP team can make decisions and negotiate terms more swiftly.

- Faster Processing and Approval Cycles: with fully automated communication, verification, data entry, and matching processes, it alleviates the time-consuming and burdening manual processes and delivers faster and more effective processing and approval workflows.

- Vendor Relationship Management: Automated AP systems allow transparency and efficient communication with the vendors and process due payments without missing a beat or deadline, eventually improving the company’s relationship with the vendors.

- Strategic Insights and Reporting: The automated AP systems collaborate all the data that it receives on a day-to-day basis and deduce valuable insights about bill process cycles, cash flow forecasts and trends of payments.

So, that was everything you needed to know about automating your AP system. Companies all around the world are transforming to automated AP software and utilizing the abundant perks of financial automation! Your turn?

Read more: Finance Automation and Its Critical Role in Streamlining Financial Processes

What worries you about automating your Accounts Payable process? We would love to know what we missed. With OPEN, you will have a fully automated, error-free, and efficient AP system that your staff and vendors will equally agree on. Get in touch with us today!

Take a look at our product demo to see how OPEN works: https://register.open.money/product-demo/

What’s Connected Bank? Read More!

Subscribe: YouTube