Today, Chief Financial Officers have evolved from being the financial guardians of an organization to becoming strategic advisors. They actively participate in operations, leveraging their financial expertise to help achieve the organization’s financial goals.

Among the most important responsibilities of the CFO is optimizing Accounts Payable for the business. How do they do it? There are many ways to measure the success of AP for CFOs. However, the best way is to establish and regularly track certain Key Performance Indicators (KPIs).

Accounts Payable KPIs are quantifiable metrics that act as a compass for guiding CFOs toward optimized AP performance and maximizing value and efficiency within the organization. So, let us have a look at the Accounts Payable KPIs that every CFO should track.

Essential Accounts Payable KPIs for CFOs

- Invoice Processing Cycle Time

This basically revolves around the time it takes, on average, for an invoice to be processed from the time of its receipt until payment. A shorter duration means more efficiency, improves cashflows by freeing working capital sooner, and minimizes overdue payment penalties. It also betters supplier relations. This is also important because, according to a report by Mineral Tree, following up on an invoice/payment is the most significant pain point for vendors.

- Invoice exception rate

This implies the percentage of invoices with errors or missing information that require additional attention and correction. If the exception rate is high, there can be delays, frustrations among suppliers, and fraud risks. Thus, tracking this measure enables CFOs to pinpoint bottlenecks and introduce correcitional measures to minimize exceptions.

- Early payment discount capture rate

This indicator tells us how many early payment discounts are being captured. Many vendors give discounts for immediate payment. High capturing rates can save a great deal on costs. This is an important KPI of Accounts Payable for CFOs who can use optimal payment methods not to compromise cash flows and still benefit from early discounting.

- Supplier satisfaction score

Having good relationships with your suppliers is obviously essential for any company. However, in recent years, this metric has gained more significance. According to a recent survey, 66.2% of finance leaders agree that vendor relationships have grown in importance.

This KPI quantifies supplier satisfaction levels regarding the firm’s practices on payments and communication – usually through survey questionnaires administered among such stakeholders. If it is high, then a strong relationship exists that could eventually bring about favorable pricing policies and terms by the suppliers themselves.

- Cost per Invoice Processed

This particular metric reveals the average cost associated with processing a single invoice. The cost is estimated by encompassing employee salaries, technology expenses, and other factors involved.

Tracking this KPI helps CFOs identify areas for cost reduction through automation or process improvement initiatives. According to a study, 49.1% of AP teams have reducing processing costs as their top priority in the current economic environment.

Establishing KPI benchmarks and targets based on industry best practices

Tracking KPIs alone isn’t enough. To truly optimize AP, CFOs must first benchmark their performance against industry standards. Industry associations and research firms provide valuable data on average AP cycle times, exception rates, and other metrics.

Once benchmarks are established, the next step is to set realistic yet ambitious targets for each KPI. These targets should be aligned with the company’s overall financial goals and revised over time as the AP function matures.

How Can Technology Change AP for CFOs?

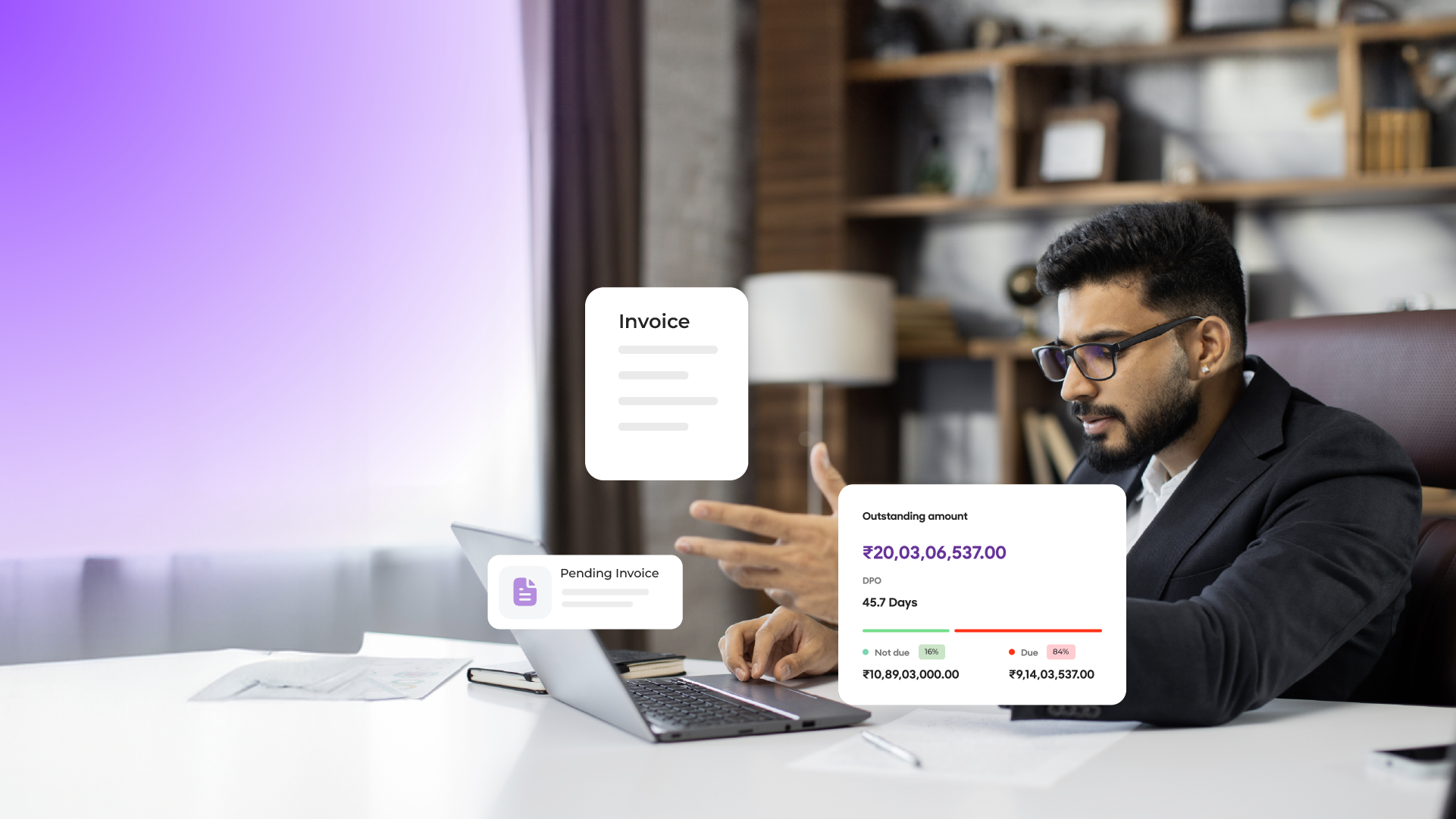

Today, technology plays a transformative role in AP optimization. Chief Financial Officers can now use automation to track KPIs and stay on top of the organization’s financial developments.

According to a recent survey, 52.1% of finance teams want to automate all or some of their AP processes. This is because of the multiple benefits of automation tools that can greatly benefit businesses by significantly saving their time and money.

These tools can streamline invoice processing workflows, automate data entry tasks, and point out potential exceptions for review. Established KPIs can be tracked effectively using analytical tools and dashboards provided by the automation tools.

Moreover, by leveraging technology, CFOs can significantly reduce invoice processing time, minimize errors, and free up valuable resources and time for strategic analysis.

Using Accounts Payable KPIs to identify process improvement opportunities

Accounts Payable KPIs offer a wealth of information, but the true value lies in utilizing these insights to identify process improvement opportunities. This is why it is very important that you regularly track your Accounts Payable KPIs.

For instance, a consistently high invoice exception rate might indicate the need for improved supplier onboarding procedures or better invoice formatting guidelines. Similarly, a low early payment discount capture rate calls for a review of payment terms to optimize them for cost savings.

Remember, KPIs are just data and insights into your Accounts Payable performance. What really matters is how you use that data to better your processes and operations.

Best practices for communicating and acting on Accounts Payable KPI insights

Here are some actionable steps that you can take to communicate the KPI insights and their impact to the stakeholders:

Regular Communication: AP teams should have regular sessions (monthly/ quarterly) to discuss how their performance impacts Accounts Payable KPIs. This creates an environment of accountability and ensures that everyone knows where they are in relation to meeting their targets.

Tailored Reports: Avoid using complicated jargon in reports that can confuse stakeholders. Prepare customized reports for different audiences. For instance, develop summaries highlighting major trends for executives while at the same time providing detailed drill-down reports to AP team members.

Transparency and Collaboration: Never hide challenges arising from KPIs. It is important that all relevant parties understand what improvements have been planned to achieve them. Foster open communication and collaboration between procurement, AP, and other departments to come up with solutions.

Prioritization: By using the insights derived from KPIs, rank the importance of projects accordingly. Pay attention mainly to those areas which could lead- if addressed- to significant efficiency gains or cost/collaboration advantages with suppliers.

Resource Allocation: To be implemented, the action plans need adequate resources, including budgets and personnel.

Track Progress: Measure progress made on various action plans and regularly observe changes in the KPIs related to Accounts Payable. As such, it becomes possible to determine whether or not changes were effective after implementation.

Invest in Training: Provide training to Accounts Payable team members to effectively utilize the KPI insights and educate them on their importance.

Conclusion

By leveraging AP KPIs and technology, Chief Financial Officers can transform their AP departments from cost centers to strategic value drivers. Moreover, by continuously monitoring performance, setting clear targets, communicating AP insights, and acting on data-driven insights, CFOs can unlock hidden value, optimize cash flow, and ultimately contribute to the company’s long-term success.

In today’s competitive market, a smooth AP function can be the difference between financial stability and missed opportunities.