What’s better than starting your own business, right?

Before you can run a business, however, you need to take care of the basics. Opening a current account for your business is one of them.

Unlike a savings account that is meant for saving money, Current Accounts cater to business owners like you. Current accounts allow you to transact frequently while simplifying the taxation process applicable to your business.

Now, let’s get down to the nitty-gritty of a current account.

In simple terms, what is a current account?

A current account is a facility banks provide for business owners who require a high volume of daily transactions. It has several associated perks that are favorable for firms, companies, businesses, and public enterprises.

You can easily customize the current account based on your requirements. Banks offer facilities such as cheque books, unlimited NEFT and IMPS transactions, subject to different conditions based on your business, and the frequency of transactions.

Current accounts deal with liquid money and hence require a higher minimum balance at the time of account opening.

Current vs. Savings Account: what’s the difference?

While starting a business, it can be confusing to understand the differences between a current account and a savings account.

Here’s a comparison that will clear everything up.

| Category | Current Account | Savings Account |

| Objective | Continual and frequent transactions | Promote saving habits |

| Applicability | Business owners and enterprises | Everyone |

| Usage | Frequent transactions and withdrawals | Save and earn interest on a fixed rate |

| Transactional Limitations | Unlimited monthly transactions | Restricted monthly transactions |

What are the benefits of a current account?

There are numerous advantages to opening a current account, from managing your finances to making your business more credible. For example, leading fintechs now offer business loans based on the current account statements as it reflects on the cash flow of the particular business.

Here are a few benefits of why current accounts are a must-have for businesses.

- Current accounts allow large volumes of inward and outward transactions

- Current account holders can avail overdraft facilities from the respective banks

- Facilities such as Internet banking, and mobile banking enable you to carry out important business transactions promptly and with ease

- Assists your creditors with information on your creditworthiness through interbank connections

Learn more on how a current account benefits your business.

Is there more than one type of current account?

Yes, there are multiple types of current account, and while finalizing on one, you should thoroughly understand your business’s needs.

For instance, a basic current account may be suitable for those who want to manage their day-to-day banking, while a premium current account offers more features, such as a higher overdraft limit.

Listed below are the types of current accounts banks offer:

| Terminology | Use Case |

| Standard Current Account |

|

| Premium Current Account |

|

| Packaged Current Account |

|

| Foreign Currency Account |

|

| Single Column Cash Book |

|

How to open a current account?

A business can open a current account at a branch of their preferred bank or online by visiting their website.

Here are the basic steps to open a current account:

- For example, NRIs can only open a Current Account using proceeds from an NRO (Non-Resident Ordinary)/NRE (Non-Resident Rupee)/FCNR (Foreign Currency Non-Resident) account; criterias vary depending on the type of current account as well

- The account opening form can be downloaded from the bank’s website or obtained from the branch of your choice

- Complete the opening form with all the relevant and necessary information

- Submit all the required documents the bank needs. They may require different documents if you are already a customer and complying with KYC regulations. Therefore, it is essential to know what needs to be submitted

- The bank will get back to you once the account has been opened

Who is eligible for a current account?

If you fall into any of the following categories, you are eligible to open a Current Account:

- Resident Individual

- Sole Proprietorship Firms

- Partnership Firms

- Limited Liability Partnership Firms

- Private and Public Limited Companies

- Trust

What are the documents required to open a current account?

There are some documents that are required regardless of the type of business, while other documents differ according to the type.

Here are the most common documents you’d need:

- Address proof

- Identity proof

- Business registration proof or incorporation certificate

- Business PAN

- Latest passport size photographs

- Account opening cheque from an existing bank account

Note: Verify that KYC documents for all the authorized signatories are valid on the date of submission.

Refer to the KYC Guidelines by RBI for more detailed information.

What are the different charges related to a current account?

Based on the range of features, current accounts are curated for customers, such as sole proprietors, corporates, and small and medium-scale enterprises.

As such, the charges of opening a current account also differ from one type of account to another.

These charges include:

-

Minimum account balance (MAB) or average quarterly balance

Most banks require you to maintain a MAB quarterly. It is the average of daily closing balances of each day spread over three months.

-

Non-Maintenance Charges

Non-maintenance charges may apply if the Minimum Account Balance (MAB) is not maintained. These charges vary between banks.

-

Charges for additional facilities

Banks charge a nominal fee for various current account facilities such as requests for duplicate account statements, remittances as demand drafts, pay orders, or cancellations.

-

Bulk transaction charges

Based on your package account, you are limited to the number of free bulk transactions you can make per month. After that, you are charged a very nominal fee per transaction.

-

Collection and bounced cheque charges

Some Current Accounts require you to pay a minimal amount for outstation cheques at bank branches or for cheque collections at the corresponding bank branches.

You will have to pay a nominal fee if cheques drawn on the bank bounce because of insufficient funds or due returns.

If cheques bounce for technical reasons, you do not have to pay anything.

-

Miscellaneous charges

Other charges on a regular current account may include balance inquiries, balance confirmation certificates, interest certificates, identity verification, PIN/TIN regeneration, and account closure.

What is the minimum balance required to open a current account?

Most banks require current account holders to maintain a minimum account balance on average within a quarter or month. This amount usually starts from 10,000 INR, but this may vary depending on the current account you are opting for.

However, there are banks in the market that now offer Zero Balance current accounts on specific terms and conditions.

Is GSTIN mandatory for opening a Current Account?

A GSTIN – Goods and Services Tax Identification Number – is provided to all businesses consolidated under the GST scheme when they register under it.

The GSTIN is not mandatory when you set up your Current Account with any bank.

However, when you register under the GST scheme, you require a functional Current Account.

Do banks pay interest on a current account?

No, banks do not pay any interest to current account holders.

Why?

Banks incur high operational costs for current accounts which are mostly waived off for businesses.

How can cash be deposited into a current account?

There are several ways in which you can deposit cash into your current account, major ones include:

- Digital transfers

- Cheques

- Wire transfers,

- Deposits directly at the bank branch

How to choose the right current account for your business?

Choosing the right current account for your business can be very confusing when there are so many options available. Keeping the following points in mind can help:

- Be sure to read the list of charges meticulously and follow the guidelines for maintaining a monthly average balance

- Choose a current account based on its overdraft limit, number of free demand drafts, and other features that are most beneficial to your business

- Make sure the bank provides dedicated customer support

- Select the bank with digital infrastructure so that you can limit the number of bank visits required

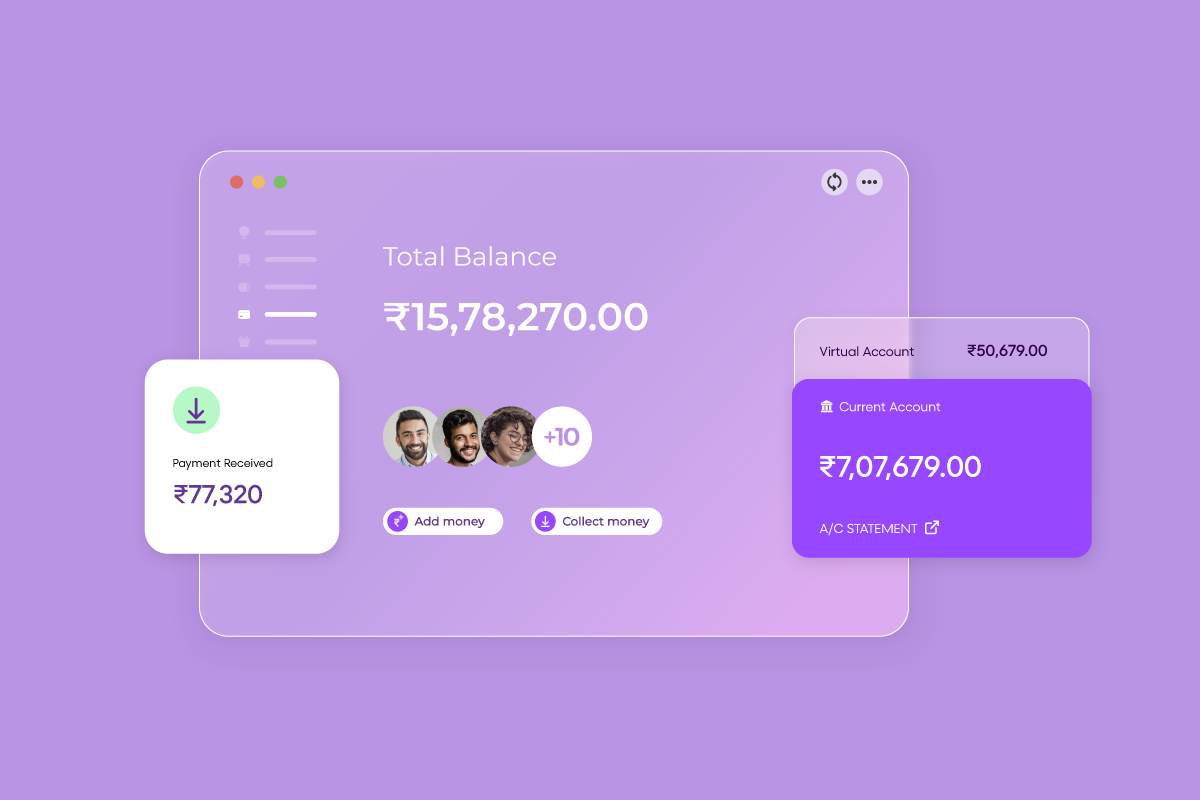

How can OPEN’s current account help businesses?

Imagine if you could receive all the benefits of a traditional current account, plus some more.

OPEN’s current account (partnered with RBI-regulated banks) simplifies your entire banking experience and reduces administrative burdens, enabling you to focus on core business operations.

Today, OPEN’s Current Account comes with:

- A VISA Business Card

- Unlimited Bulk Payouts

- In-built accounting

- TDS payments & so much more…

Here’s your cue to start exploring current accounts for your business and move forward.