In January 2020, the RBI extended the recurring payments feature to UPI. Since then, UPI AutoPay has been one of the most awaited features for many small businesses in India. Till now, that is. We circle back to this later, but let’s set the context first.

Recurring payments are nothing but the subscriptions that you as a business or service provider collect from your customers on a timely basis (daily/ weekly/ monthly or yearly). This can be monthly school fees, gym membership fees, insurance premiums, SAAS & OTT subscriptions, EMI payments, etc.

From the day the first transaction was initiated, UPI transactions volume has grown by leaps and bounds. Having recorded close to 2 billion transactions in October 2020, NPCI is about to mark the 2X year-on-year growth for UPI payments. After seeing the rapid rise in UPI adoption in such a short time period, NPCI announced UPI AutoPay feature during the Global FinTech Fest 2020. It is widely accepted as the best method to collect recurring payments as it provides a much better user experience & transparency to the customers.

What is UPI AutoPay?

UPI AutoPay is a feature that allows customers to do recurring payments using any UPI application. Customers can now enable e-mandate for recurring payments, such as mobile bills, electricity bills, EMI payments, entertainment/OTT subscriptions, insurance, mutual funds, among others.

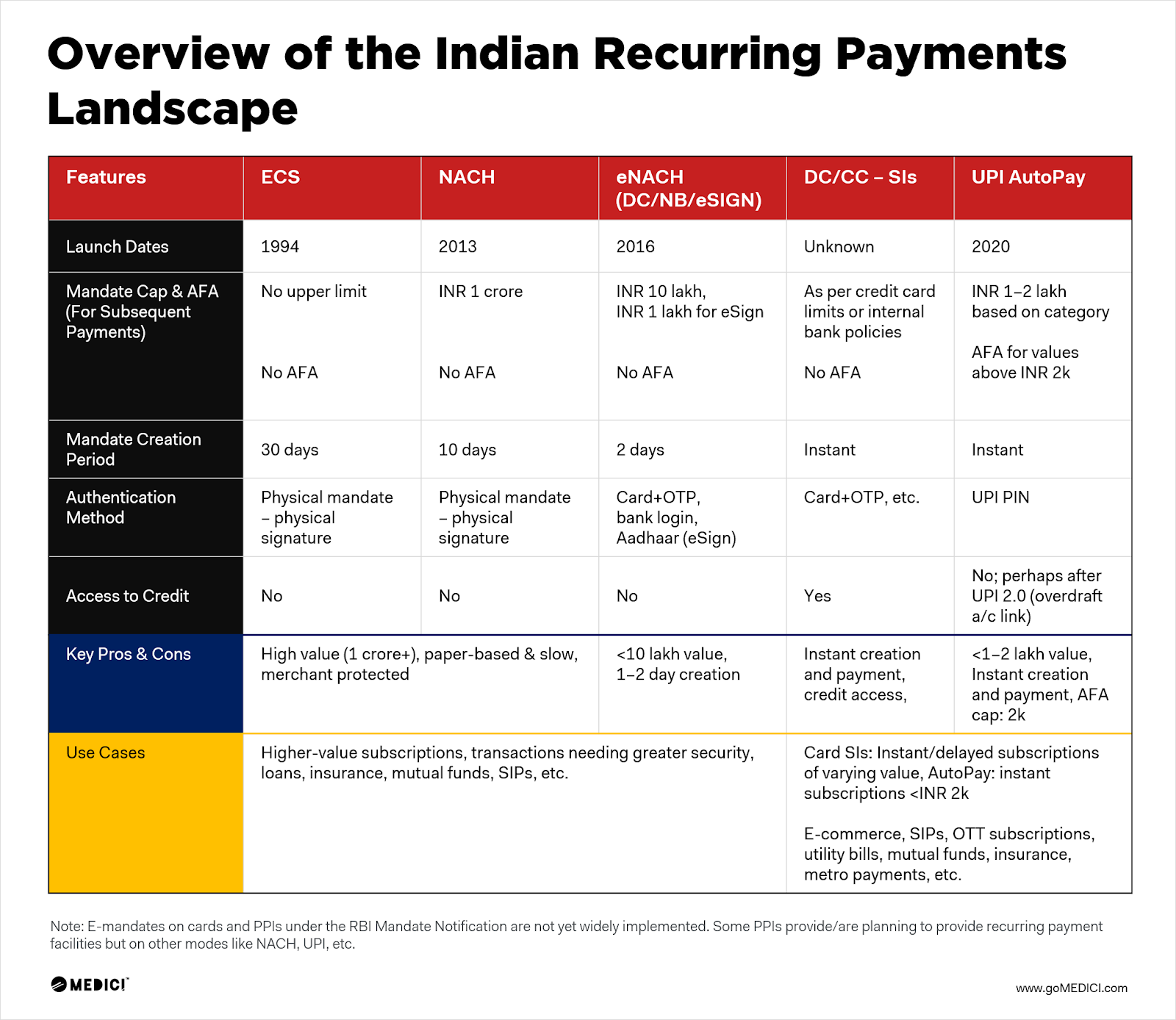

Until recently, you as a customer could only use credit cards to make recurring payments. While you could use debit cards earlier, RBI recently put that facility on hold due to security issues & fraud cases. The auto-debit feature by UPI will empower customers to do away with payment authentication time & again.

In the realm of small business banking, Open is the first to roll out UPI AutoPay feature to its users. Recurring payments turned out to be the biggest pain point for small businesses due to continuous lockdowns that happened due to the spread of COVID. Merchants had a tough time collecting subscriptions due to social distancing and movement restrictions. Enabling this feature will help small businesses automate their payment collections so that they can stay safe & focus on their business.

UPI AutoPay helps businesses as they can generate mandate instantly and send it to customers for authorization. Once the customer approves it, a fixed amount gets deducted automatically on the authorized date.

What are the benefits of UPI AutoPay?

UPI AutoPay will empower users by providing them with a comfortable and secure way of making recurring payments. Here are some main benefits of this feature:

(1) Recurring payments get activated with a onetime authorization

With UPI AutoPay, customers can pre-authorize (onetime activity) & make payments on a particular date. Once you’ve generated the mandate, the payments will get deducted automatically on the authorized date. These mandates can now be instantly generated & require onetime authorization.

(2) Real-time mandate confirmation

Till recently, to enable recurring payments, one had to wait anywhere between two days to two weeks. UPI AutoPay, on the other hand, gives you a real-time mandate confirmation. Now you can set mandates irrespective of the payment frequency – onetime, daily, weekly, fortnightly, monthly, bi-monthly, quarterly, half-yearly, and yearly.

(3) Grow your customer base

Earlier, subscription-led businesses could only process recurring payments through credit cards. Hence they couldn’t target a large section of the demographic who don’t possess a credit card.

UPI AutoPay helps merchants reach out to a new segment of customers who can now make recurring payments directly via their UPI applications.

(4) Lower chargebacks due to complete transparency

This feature allows customers to view, suspend, or revoke a digital mandate via their UPI application. This results in lower chargebacks. Merchants will be notified in real-time once this action is taken by customers.

(5) Better success rates

UPI AutoPay feature improves the success rate, as customers will receive a pre-debit notification one day before the debit occurs. This will provide customers with enough time to arrange funds to ensure that the auto-debit transactions are successful.

(6) Timely payments

With this feature, you can automate bill payments, which in turn ensures that payment collection is done on time. These automatic & timely payments will help customers improve their credit score.

How does UPI AutoPay work?

The autopay request initiated by merchants has these four important steps to it:

(1) Merchant shares a mandate

Merchants can register with a payment service provider like Open that supports UPI AutoPay to offer recurring payments to their customers. They can share a UPI AutoPay mandate request with the customer on the UPI enabled app.

(2) Customer authorizes the mandate

Customers can authorize the mandate by entering their UPI PIN.

(3) Recurring payments via UPI AutoPay gets activated

Once a customer authorizes the mandate, recurring payments get activated via UPI AutoPay.

(4) Auto-debit happens on authorized dates

For every future auto-debit, the customer will receive notification 24 hours before debiting his account. Once he/she is notified, the amount will be auto-debited from the bank account linked to the customer’s UPI ID on the authorized dates.

Where all can one use UPI AutoPay?

With this new facility of UPI AutoPay, customers can use UPI applications for automating recurring payments such as subscriptions, fee collections, collecting donations, etc. If you’re a business owner, you can now set up customised plans like:

(1) SAAS Subscriptions Fees

With the introduction of UPI AutoPay, SAAS companies can now automate their subscription collections.They can now set up customized subscription plans, and collect payments from their customers on a timely basis (monthly, quarterly, half-yearly, yearly). The users can enable recurring payments through their UPI application for settling their SAAS subscriptions.

(2) School Fees & Gym Membership Fees

Customers can pay their monthly tuition fees or gym membership charges using UPI AutoPay. Educational institutions and gyms can now set up customized packages for their users.

(3) Getting donations from NGO

UPI AutoPay will solve one of the major challenges faced by NGOs – converting one-time donations to monthly donations. All that NGOs need to do is ensure that the donors have an option for continuous and assured contribution. NGOs can then set up recurring payments from different donors, thereby bringing transparency & flexibility in collecting donations.

(4) Premium collections for mutual funds & insurances

Mutual funds and insurance providers have always struggled at making their propositions affordable to the general public. UPI AutoPay simplifies this by collecting payments or premiums on a monthly or the agreed-upon frequency basis, making it affordable for the end customer.

(5) EMI collections for e-commerce companies

Massive internet penetration has put the Indian e-commerce market on an upward growth trajectory. All e-commerce companies from bigger names like Amazon & Flipkart to niche players are making huge bets on revenue through EMI collections.

UPI AutoPay is a win-win for businesses & customers

The Indian subscription market is currently at an aggressive growth stage. Introduction of new features like UPI AutoPay will make companies agile & efficient – allowing them to attract, package, price, sell and bill seamlessly & faster.

This is a win-win for both businesses and their customers.

Enabling this winning payment collection feature for your business is super easy with Open’s UPI AutoPay. You can experience by signing up on Open today.

Related Articles –

What is Neobank? Everything you need to know in detail!

How neobanks are defining the future of banking

Top 11 most asked questions about virtual accounts

How Open brings banking & finance together for your business

How hyperlocal delivery businesses can streamline banking & finances with Open

What are the pros and cons of having multiple payment gateways on your website?