India is moving towards a cashless economy as such online payment methods have become increasingly popular. Since the COVID-19 crisis, customers have further limited their cash use and are now opting for other alternatives.

As a result, it became increasingly important to choose a tailor-made payment gateway for startups. This not only boosts the business but also ensures secure transfer of funds to their business account.

Without question, there is a dire need for a payment gateway that is intuitive & affordable. Not to mention, one that helps the entrepreneur scale his/her business.

In order to grasp the scope of payment gateways, let’s get a better understanding of what they are.

Payment gateway basics: what are they?

Simply put, a payment gateway allows merchants to accept online payments from their customers.

It can be referred to as the “virtual” equivalent of a Point of Sale(POS). To complete the payment lifecycle, it transfers the data between the point of entry – either a website, or mobile app – and the payment processor.

When a Payment Gateway processes transactions, a number of stakeholders are involved. These include:

- Business — The startup selling a product or services

- Customer — The payer who makes a purchase

- Issuing Bank — Financial institution holding the customer’s account

- Acquiring Bank — A financial institution that holds the startup’s account and agreement

- Issuer Processor — The bank’s technical partner that handles most of the tech functions like pin validation (pinblock), 3D secure (ACS)

- Card Schemes Networks — Debit/credit card processing companies such as Visa, Rupay, Mastercard etc

- Acquirer Processor — Technical partner of acquiring bank, responsible for payment gateways and POS systems

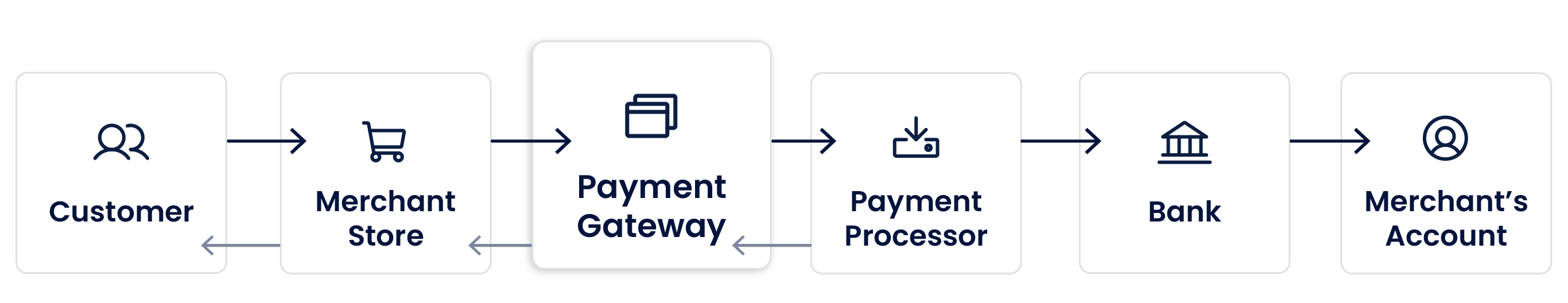

How does a payment gateway work?

To give you an idea of how Payment Gateways may work, here is an example:

- Step 1: When a customer purchases on your website, a payment is initiated

- Step 2: Payment card information is encrypted and sent from your website to the card network via the acquirer processor on behalf of the acquiring bank

- Step 3: Using the card details, the card network sends a transaction to the issuing bank via issuer processors to ensure the funds are available and to determine whether the issuing bank approves the transaction based on risk criteria

- Step 4: As soon as the issuer approves or declines the transaction, the issuer processor, card network, and acquirer processor send the response to the gateway

- Step 5: When the transaction is approved, the card network moves funds from the consumer’s account to the acquiring bank. The acquiring bank then moves the money to the merchant’s account, according to the settlement cycle

Choosing the right payment gateway for startups: what to look for?

With an understanding of payment gateways and how they work, we can tackle the bigger question—how can you choose a payment gateway that’s the best fit for your startup?

There are a number of payment gateway service providers on the market, so selecting the right one can be challenging.

An all-encompassing Payment Gateway solution

In order to meet the business needs of their merchants, payment gateway service providers offer several features. This is why it is crucial that you clearly communicate your needs to the service providers so they can provide you with a comprehensive and easy-to-use digital payment system.

Here are a few points to consider when choosing the most suitable payment gateway for your startup –

-

Robust Security

The security of your payment gateway is one of the most important features to consider. This is important not only for you, but also for your customers. Payment gateways that are PCI DSS certified provide the highest level of card data security, so ensuring that your payment gateway is PCI DSS certified should be at the top of your criteria list.

-

Ease integration

It’s important to choose a payment gateway that integrates seamlessly with the platform you already have. By enabling payment integration, you reduce the scope of errors and save time updating records manually. Various e-commerce platforms and plugins, such as WooCommerce, Shopify, and others, can be integrated with some solutions. Identify the most suitable payment gateway for your startup.

-

In-depth reporting

Many business owners consider a payment gateway to be just a virtual terminal that records transactions, but if set up correctly, it can do much more! A versatile payment gateway will offer you access to detailed reporting and automate the reconciliation processes, thus simplifying a lot of business processes.

-

Automated Invoicing

It is advantageous for businesses to have a secure payment gateway that is integrated with an invoicing function. This helps in streamlining the payment process and can offer a convenient way of accepting payments.

-

Assortment of payment options and a seamless customer experience

India is forecasted to be a $1 trillion market for digital transactions by 2025. With customers opting for digital payments, your payment gateway should accept a multitude of payment options such as UPI, credit/debit cards, wallets and online bank transfers to name a few. Having a payment gateway which offers flexibility to your customers during checkout ensures that they are able to make a hindrance-proof, swift transaction via their mobile phone or any device.

Facilities such as saving payment details for returning customers and having multiple payment options are few of the several factors that ensure your customers have a hassle free experience.

-

Affordability and effectiveness

In addition to having an easy-to-use, multi-functional payment gateway, it is equally important to ensure you are getting value for your money. Considering this factor, it is always advisable to choose a service provider that does not charge setup fees or Annual Maintenance Charges (AMC).

-

Prompt support and high success rates are essential

Payment gateways with low success rates negatively affect conversion rates. Startups can lose up to 30% of their earned revenue due to low Transaction Success Rates, and up to 33% of customers face declined transactions resulting in significant brand value loss. Make sure the payment gateway you choose has a high success rate. Furthermore, you should select a payment gateway that offers good customer service in the event of a server outage.

-

Quick and responsive on mobile devices

Today, customers make payments mostly via mobile phones. Consequently, it is essential to choose a payment gateway service provider with mobile SDKs for Android and iOS. This will make payments for your customers easier and faster.

So there you have it

If startups are to grow, they must focus on customer experience. And payment gateways play a big part in this by offering secure and convenient payment options. As a founder, you must keep the above points in mind when choosing a payment gateway for their business. Offering the best online payment methods will make you stand out from the competition.

OPEN, Asia’s First Neobank offers an innovative payment gateway solution for startups with easy integrations through APIs and SDKs. With 200+ payment options, OPEN allows customers to pay in any way they choose. With several features, including recurring payments, instant settlements and affordable pricing.