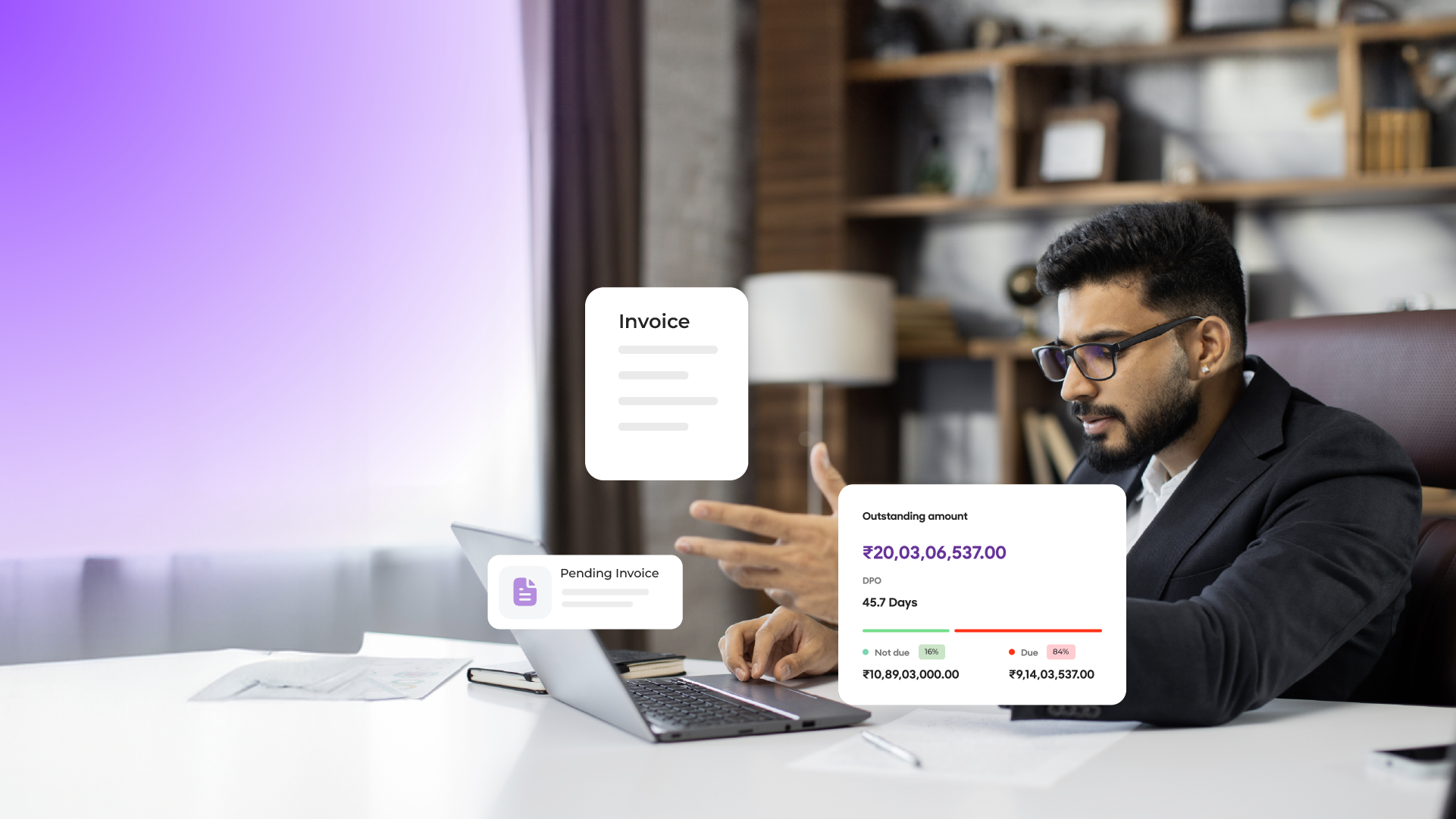

The Government of India introduced e-Invoicing in October 2020 through the Goods and Services Tax (GST) System. Although e-Invoicing is not a new technology, its relevance has grown multi-fold in recent times. The pandemic pushed several businesses to develop digitally overnight and adopt technologies such as e-Invoicing for more reasons than one.

And while e-invoicing will be implemented from 1st October 2022 for businesses with an annual turnover exceeding 10 crores, the govt plans to make e-invoicing mandatory for small businesses with an aggregate turnover of ₹5 crores very soon.

e-Invoicing is more than replacing paper invoices with electronic invoices. It involves integrating business processes and systems. It is an integrated solution that seamlessly enables a fully automated flow from one ERP system to another with enhanced security and traceability.

e-Invoicing aids the opportunity for businesses to transform digitally, with real-time e-Invoice generation and an automated e-trail. Download our e-Book on e-Invoicing to learn more details on emergence of e-Invoicing, its journey and its adaptation by small and medium businesses.