Stay GST Compliant with OPEN’s E-Invoicing Solution

Eliminate manual data entry and streamline your GST compliance with OPEN's user-friendly e-invoicing solution. Generate e-invoices, create e-way bills, and stay compliant effortlessly.

Here’s How OPEN Can Simplify E-Invoicing For You

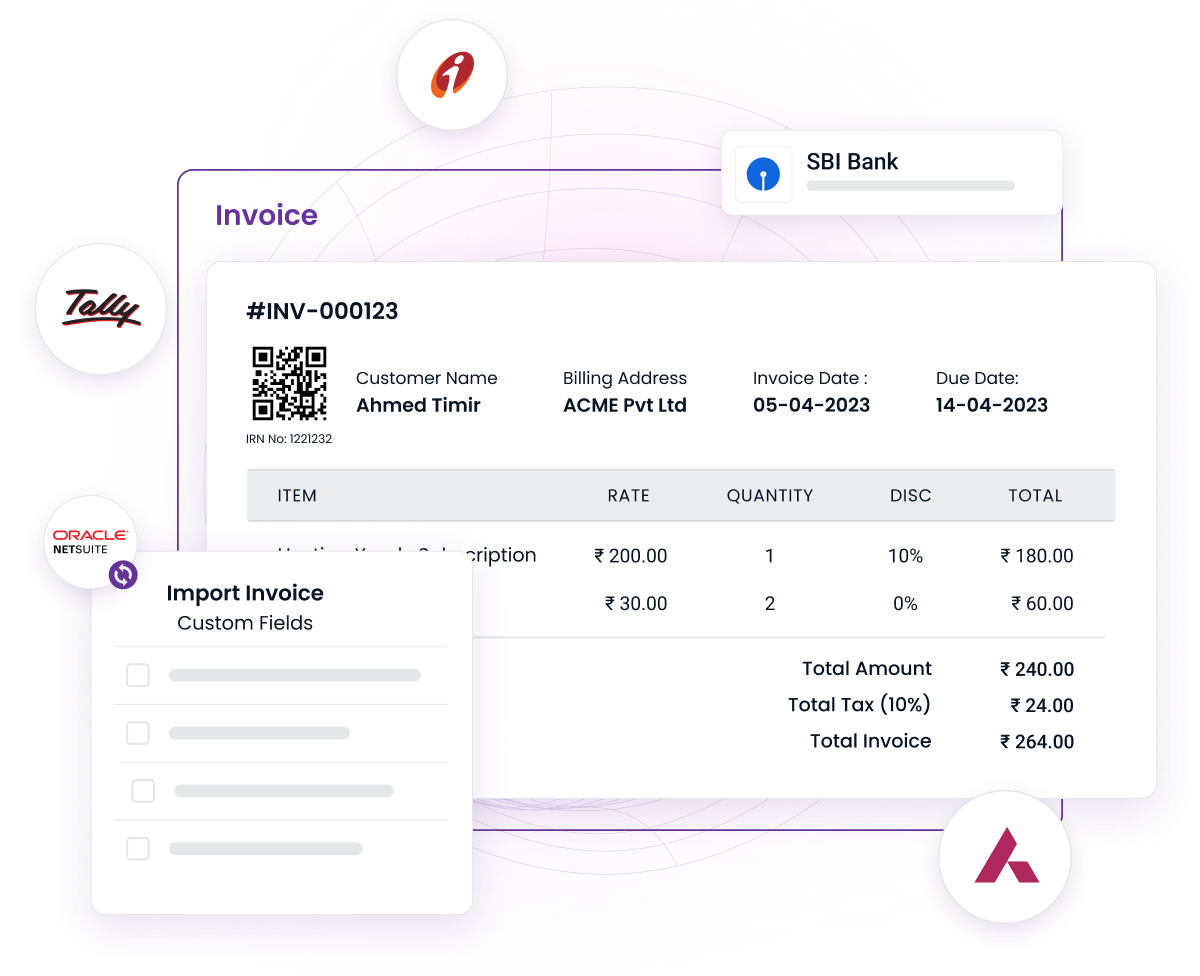

Faster Processing

Generate e-invoices and receive IRNs (Invoice Registration Numbers) Instantly.

Improved Accuracy

The auto-correct feature identifies & rectifies errors in real-time, minimizing manual intervention.

Reduced Costs

Smart GST validation ensures error-free e-invoices and e-way bill generation.

Simplified GST Compliance

100% compliant with GST regulations, ensuring regulatory adherence.

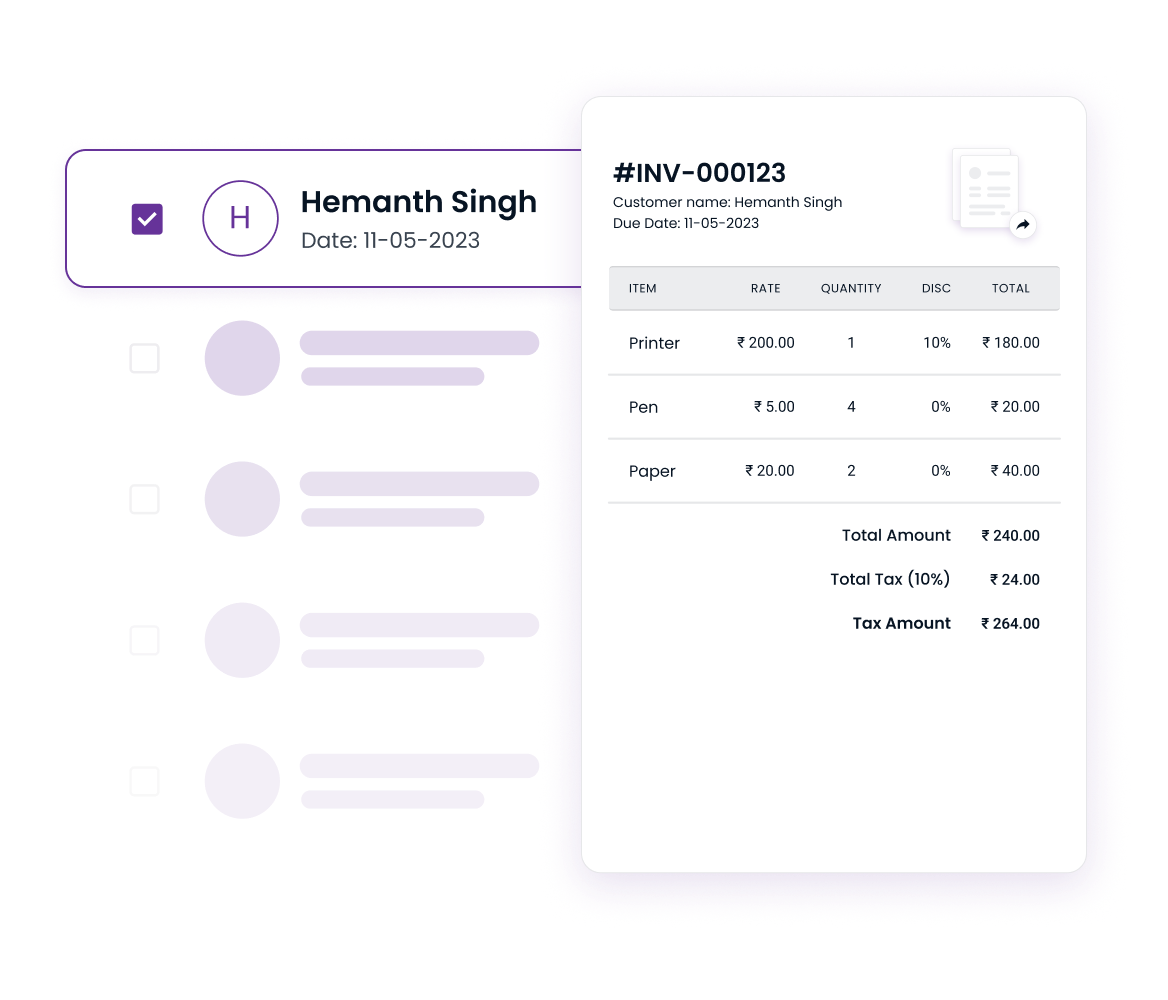

Experience 1-Click E-Invoicing Solution With OPEN

Simplify your invoicing process with Open's one-click e-invoicing solution. Our platform enables you to:

Generate e-invoices in a click and effortlessly manage e-way bill generation deadlines.

Leverage intelligent data validation algorithms to identify and rectify errors in real time.

Initiate e-invoice cancellations, ensuring timely resolution of any errors or discrepancies.