New Year itself has a very celebratory ring to it. Most people ring in the new year with ‘New year, New me’ pledges. But not everyone shares the same enthusiasm. While most of us go all out to celebrate the new year, businesses all over sweat it out so that the party goes on! No wonder the businesses push their new financial year to a much later date on 1st April.

Unfortunately, the financial new year is one that calls for loads of paperwork rather than celebrations. And with the recent Covid-19 spread most of the businesses are now finding it difficult to conduct business as regular. So financial year closing which in itself is a gigantic task has become burdensome for all.

If you work for the finance team or run a business, then chances are you are already overwhelmed by the sheer amount of paperwork that is glaring back at you. The planning for a new financial year starts much before the end of the previous fiscal year. It starts with the year-end closing and making sure that you wrap up the finance books of the current financial year.

Let’s take the example of a cricket match. If there are no scores being tracked, then we would never know whether the team won or lost.

Similarly, how this will go down on the business front – if the finances are not sorted, how would businesses remove redundancies, meet their goals and go on to make profits?

Someone(not Peter Parker’s uncle) correctly said, “With work of great importance comes lots of problems”.

Here are some of the most common problems which businesses face during the financial year-end:

- Consolidating the balance sheet: Most businesses have multiple bank accounts. This makes it really tough for the finance team to consolidate all the financial data on expenses and earnings.

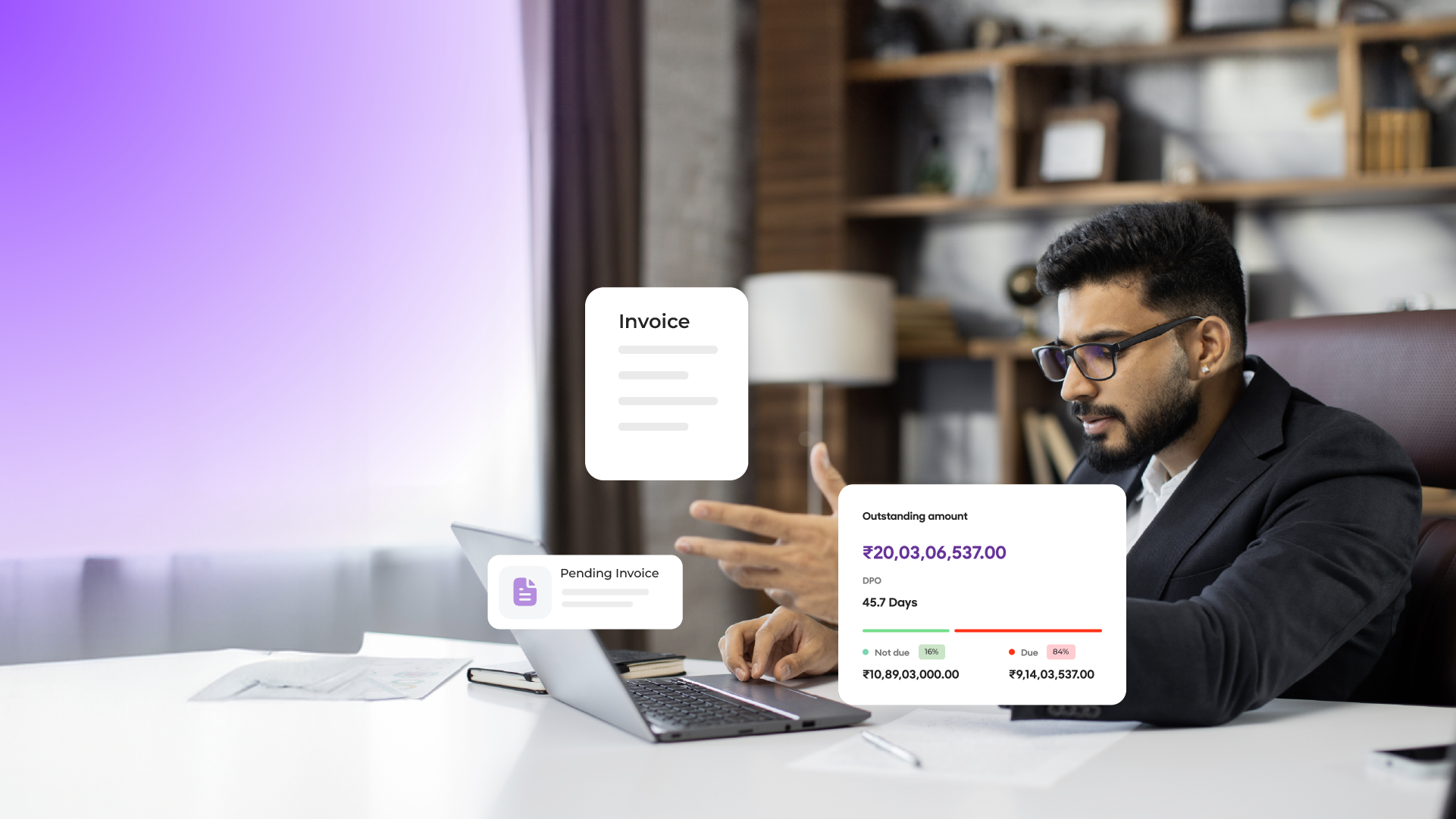

- Payments collection from various clients: More than often, there are a couple of payments that are due from the client’s end, and managing those invoices becomes a nightmare.

- Expenses from various sources managed: Most businesses juggle one credit card across departments for various business tasks. This makes bookkeeping quite tedious.

- Error in the entry of any data: Human error is possible everywhere, but it can be disastrous in financial planning or reports. One zero less or more can have far-reaching effects than imagined.

So closing the previous year’s financial book itself is the first step towards planning for the new financial year.

Here’s a checklist that can help ease your efforts at financial year-end closing:

- Review and audit of the previous financial year: This is the most important aspect of financial year-end closing and planning for a whole new year. It helps you come up with a sound plan based on the entire year’s finances.

- Assessment of all the assets: This is an integral part of planning for the next fiscal year. It’s critical for businesses to have their assets in place and plan for the coming year for smooth operations.

- Taxes filed: Taxes need to be calculated based on the income and should be paid in advance. Adding on, all tax-related documents should be kept ready for filing.

- Reconciliation: Payments received from clients should be declared in the accounts. And in case of any pending amount, the amount expected should be passed on to the next financial projection.

- Cash flow: All the reports related to cash-flow must be analyzed well so that there is no error in the balance-sheet. Any mismatch in any data or number may result in the profit and loss reports of the business.

Does this have to be this hard to manage?

Not at all!

At Open, we’ve got everything you need to breeze through the otherwise daunting task of planning for a new financial year. Open is loaded with a host of features to help you combat and overcome financial planning troubles with ease. Let’s find out how:

- We empower you with exclusive reports including a Balance sheet, Profit & Loss report, expense management, etc that will sort out the review and audit for the financial year.

- Next up, reconciliation and payments are simplified with Open’s bulk payouts and our feature-rich payment gateway.

- Get a hawk’s view of your transactions by syncing up all your bank accounts on Open

So does Open sound like an easy way to manage business finances and do business banking?

Plan your financial year better

Prepare for the roller coaster that financial year-end is by making a better financial year plan. Start your financial new year with a bang by following the above checklist and not missing the essentials. If all of these factors are kept in mind, then you’re sure to have a smooth start to a new financial year.

Related Articles –

Reimagining credit decisioning in today’s day and age

How to score additional capital sources for your business

Pivoting Business Models in the ‘New Normal’ of COVID-19

How to boost your business runway beyond COVID-19?

Step up your expense management game with virtual cards