Manual processing of documents is a nightmare for accountants. With non-reconciled invoices and unpaid bills piling up, it becomes increasingly difficult for accounting professionals to keep day-to-day track of the books of account.

As such, automated bookkeeping has become a must-have for businesses of all sizes. Automated bookkeeping helps accountants be more efficient and effective.

And it becomes the responsibility of the business owner to ensure accountants have access to such tools. So, before we begin, let’s go back to the basics of bookkeeping and find the gaps that were overlooked for a long time.

Bookkeeping as it is and the challenges it presents

Bookkeeping is the act of documenting every financial transaction of a business on a daily basis.

No matter how much time it takes or how monotonous it can get, accountants and bookkeeping professionals are bound to do this. That’s because there is no other way to translate a business’s monetary success.

To understand the problems associated with such a manual infrastructure, let’s take a look at how bookkeeping is currently being taken care of.

For this, we reached out to Rajesh, who owns a coffee shop in an affluent area in Bangalore.

Currently, Rajesh rechecks his total sales and expenses for the day. The major dependency is on his accountant to raise invoices as and when a sale takes place.

Rajesh also has to manually record all the bills on a daily basis. With piles of physical bills and invoices, closing books at the end of the month is not an easy task. Not surprisingly, he faces multiple issues while closing his books of accounts. For example:

- Bills, invoices, and other important paperwork fade away with time, and in the worst-case scenario, they are lost

- There is always a high probability of data entry errors in ledgers and sub-ledgers due to similar-looking invoices and bills. Due to this, he spends multiple hours rechecking the bills and invoices.

- Because accounting and taxes are interrelated, bookkeeping errors lead to severe tax complications, which end up being very expensive for him.

Could there be a way to relieve him and his accountant from some of these burdens?

Yes, Automated bookkeeping solutions do exactly that

Automated bookkeeping refers to the process of keeping track of financial transactions with the help of accounting software that uses AI Artificial Intelligence (AI), Machine Learning (ML), Robotic Process Automation (RPA), etc.

Automation in bookkeeping eliminates the need for manual tasks such as data entry. This allows accountants to focus on things that really matter.

How to get started with automated bookkeeping?

The key areas of bookkeeping that need automation depend on the accounting solution a business is currently using.

Having said that, here are some core bookkeeping tasks that can be automated easily.

- Accounts Payable (AP) and Receivable (AR)

Automating the AR & AP is the go-to way to free up cash flow and reduce human dependency.

For example, all invoices are created, verified, submitted, approved, and paid for within a single dashboard. Not just that, with “role-based access” individual stakeholders can address challenges on the go.

Recommended read: https://open.money/blog/account-payable-automation-all-you-need-to-know/

- Expense Management

Bookkeeping automation enables accountants to track business expenses as they occur, get faster approvals, and improve the turnaround time for expense reimbursements. It also helps in accurately forecasting expenses resulting in improved financial decision-making.

Expenses, if managed manually, would need tons of paperwork and multiple employees to ensure that they are recorded accurately.

- Monthly finance closes

According to an SAP press survey, less than 38% of businesses close their monthly books within the industry standard of 5 days. Although some close their books within a week, they still take at least a week after the technical close to reconcile their data and provide accurate analysis.

It’s redundant to say this needs to be changed. Automated Bookkeeping software not only takes the pressure off accountants but also ensures they are providing the most accurate report possible.

After all, time is money, and shortening the closing process brings big advantages.

- Payroll

Similar to how delays in bill payments impact the relationship between a business and its vendors, deferments in salary payments tarnish the reputation of the owner as an employer.

When employees see an erratic nature of salary payments, they are most likely to leave.

As such, when a business is in its growth phase investing in a bookkeeping tool that comes with an in-built payroll solution makes a lot of sense. This enables HR teams to be more efficient and precise.

- Spend Management

Managing purchase orders and debit notes from multiple vendors has always been a struggle for accounting professionals. These documents can be streamlined with automated bookkeeping services ensuring nothing gets missed out.

Benefits of bookkeeping automation

There are many reasons why automated bookkeeping services have been a game-changer for both accountants and business owners.

While each part of accounting can be automated, the role of bookkeepers has been and will continue to be critical. Accounting and bookkeeping automation exists only to maximize accountants’ potential, meant to be used like a superhero suit.

With that, let’s look at what the core benefits related to automation in bookkeeping processes are.

- Time savings

Perhaps the most tangible benefit of bookkeeping automation is that it saves countless hours which is otherwise spent on doing things manually.

Let’s suppose a single team member can file, i.e., receive the document, move it to the appropriate location, manually extract the data, and then finally make an entry, taking approximately 10 minutes for a single invoice.

Thus one full working day of 8-9 hours brings us to a mere 48-54 invoices, which honestly can be done within a couple of minutes if the same employee is equipped with automated bookkeeping tools.

- Increases overall team productivity

“Automation is driving the decline of banal and repetitive tasks”, Amber Rudd, former Home Secretary of the UK.

Doubling down on our previous point on time savings, bookkeeping automation clears out some of the calendar space of an accountant, enabling them to focus on more profound tasks, such as.

- Identifying vendors and contractors who are late with their liabilities, therefore easing the debt collection process.

- Fixing cash-flow leakages occurring internally, which others would have missed.

- Forecasting accurate and timely reports on the financial situation of the business.

- Reduces the chances of errors

Bookkeeping automation helps in preventing errors. Businesses tend to lose a lot of money due to delayed payments and a lack of transparency in accounting processes.

Of course, people do make mistakes when they are having a bad day at the office. However, when it comes to automated solutions, there is no such thing as a “bad day”.

Automation in bookkeeping results in fewer errors saving both time and money.

- Speeds up access to data

Cloud-based bookkeeping software is designed to ensure easy access to important accounting documents such as invoices, bills, bank statements, etc.

Additionally, such cloud-based solutions are far more secure as they comply with the guidelines laid down by the RBI.

Easy access to accounting documents makes it much easier for accountants to file tax returns on time. For example, compulsory fields on the GST portal are mostly prefetched, which otherwise takes several minutes to fill manually for a single invoice!

Now that we have a fair bit of understanding about what bookkeeping automation aims to achieve, let’s look at a few use cases where automation makes sense.

Want to learn more about Business Finance Automation & how are CFOs evolving?

Visit – https://register.open.money/business-financial-automation-ebook/

Implementing bookkeeping automation in real-world scenarios

Automated Bookkeeping software keeps track of business transactions in real-time and creates reports and financial statements based on that information.

Here are some use cases where automation is a game changer.

- Data Processing

Identifying, processing, and adding transactions to the chart of accounts is the first basic step in accounting. This data is critical and needs to be accurate every single time for the reports and financial analysis to be correct.

Automated bookkeeping solutions make sure that the financial documents are factually correct. Additionally, they integrate with other ERP and accounting solutions very easily.

- Bill Payments

As a business scales, the number of vendors it deals with increases at the same pace.

With this, the number of bills generated towards the business piles up, and it is of utmost importance to clear the debts as soon as possible to ensure smooth supply chain operations.

Find out more on how OPEN simplifies vendor management.

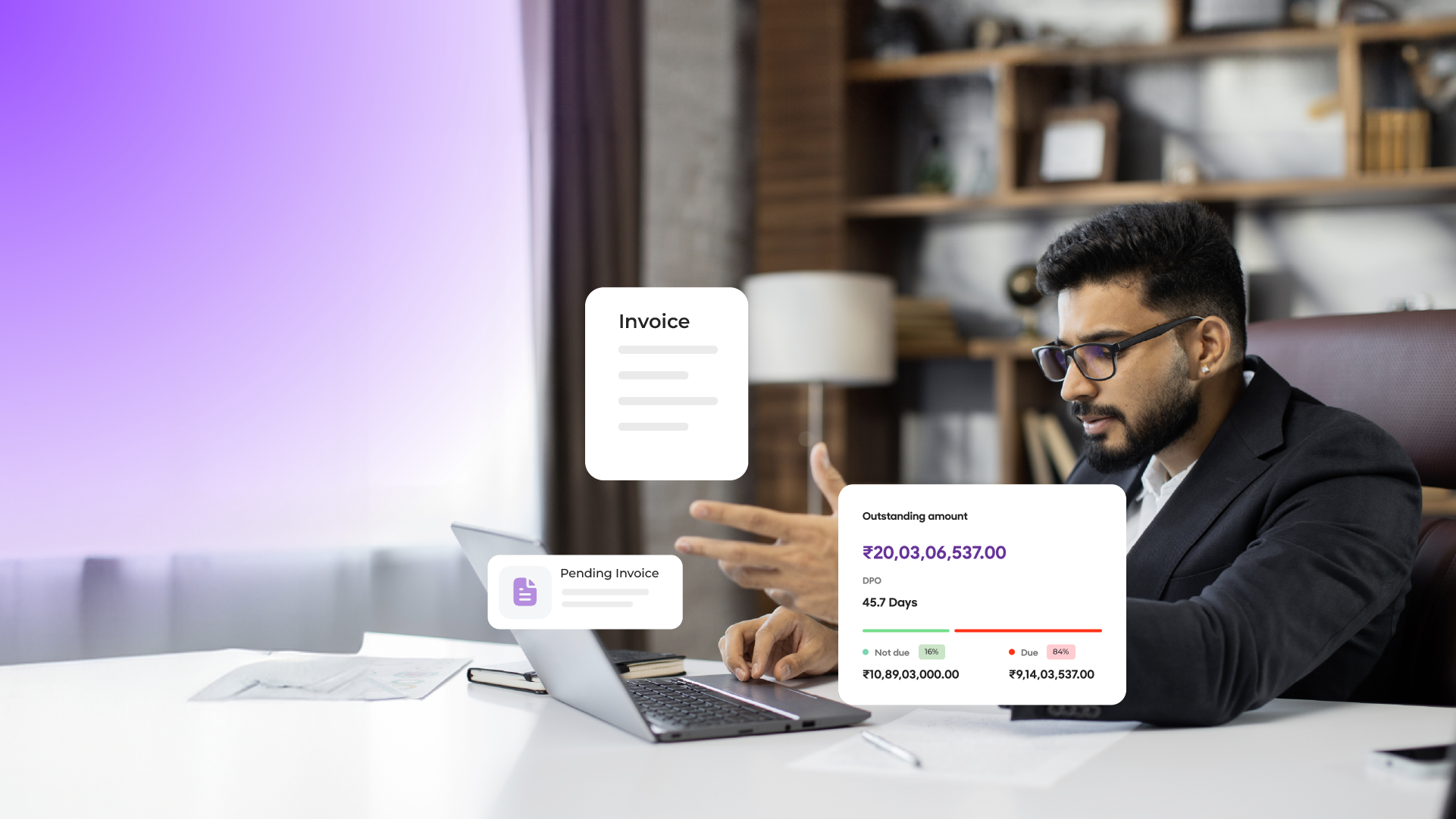

- Managing Accounts receivables

Getting paid on time is extremely important for any business, big or small. They need to offer customers more flexibility in payment options.

Keeping track of dues and sending timely payment reminders plays a critical role in accurate cash flow forecasts.

Nowadays, automated bookkeeping solutions are capable of this and much more! This comprises everything from invoicing with in-built payment links where accountants are notified as soon as a payment is made to maintaining the customer’s entire purchase history.

Such solutions can provide valuable insights into consumer behavior which is vital for any business.

Parting Shot

Bookkeeping automation, although a tiny portion of the vast scale of accounting, remains the most important one. The automation of bookkeeping relieves accountants from tedious, repetitive accounting tasks, allowing them to focus on better strategic planning.

This is the way of the future, not because accountants will be replaced, but because it will improve the efficiency of accounting teams.

OPEN’s automated accounting, effortless invoice recording, and seamless payments are here to make your bookkeeping journey even more fantastic. Businesses can track and monitor their invoices for accurate AP/AR and manage their vendors from a single platform.

So, if you’re still using an outdated bookkeeping system, it’s time to upgrade. Your business will thank you for it.

Checkout our product demo & see how OPEN can help your business: https://register.open.money/product-demo/