Get ready to say goodbye to regular accounts – virtual accounts are here to stay!

A Virtual Account, as the name suggests, is a non-physical bank account that you can create for your customers. These ‘new kids on the block’ have been the talk of the town and for all the right reasons.

Let me track this back a little for you – for a business figuring out ‘who paid for what’ is no stroll in the park. You’d typically get your team to manually track the payments with UTR numbers – a tedious process that we quite frankly dread.

It’s time to put all of that behind you! You can now easily track payments via Open’s Virtual Account to stay on top of your collections.

Further, businesses that expect thousands of payments coming in, can leverage the Virtual Account API, to reduce their operating costs. This is because managing multiple virtual accounts and reconciling payments is far easier than tracking them manually via a physical account.

Financial institutions, large and medium sized enterprises can expand their reach and speed of transactions, thereby boosting their efficiency (faster and less expensive) and also reconcile all transactions easily, once they integrate with Open’s Virtual Account API.

With this, they can have a complete view of their collections, thus simplifying bookkeeping. And by allowing customers to pay using their preferred payment method, it further enhances the customer experience.

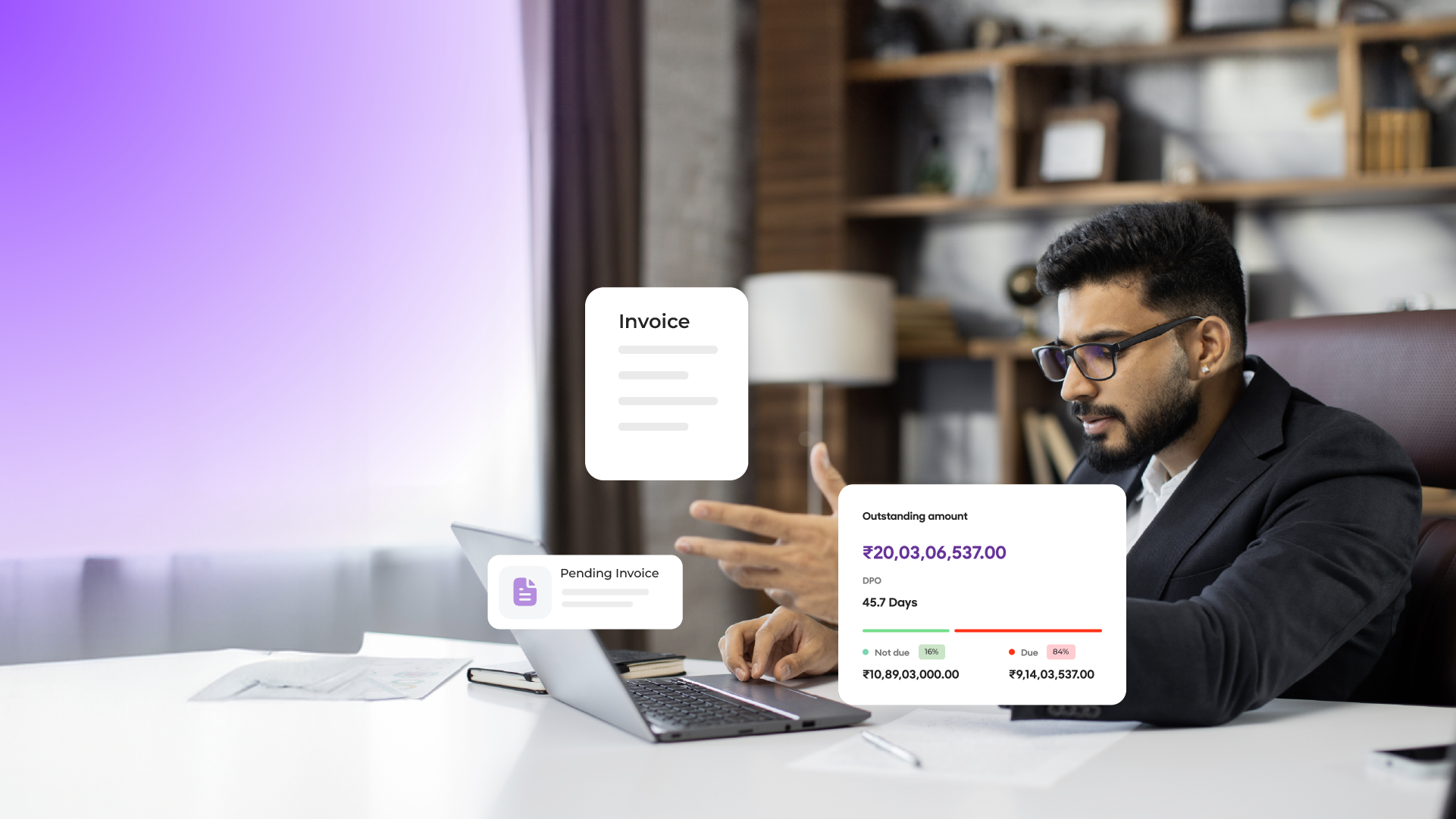

Open’s Virtual Account API allows you to create virtual accounts with a unique account number for each customer you collect from. Customers can make a bank transfer to these virtual account numbers, and as soon as the money hits your bank account, you get to know the payer’s details for each transaction.

Why integrate Virtual Account API?

Still, need convincing? No problem! ✌️

Let’s look at how transaction-heavy organizations such as educational institutions, fintechs, large corporations, and successful businesses can improve their payment systems.

- Track Payments with ease: Virtual account API resolves your never-ending reconciliation issues. You are immediately notified when your customer pays using their virtual account number. Simply, we help you reconcile effortlessly.

- From Bank Transfers to UPI, you’ve got it all: collect payments the smart way using Virtual Bank Accounts API. With bank transfers such as NEFT/RTGS/IMPS to UPI, you can accept payments via several modes.

Virtual Accounts API – Go pro with payment collection and tracking today!

Let’s get down to the basics and see how Virtual Bank Account API powers different businesses in collecting payments the smart way.

Educational Institutions

Schools and colleges have always needed help collecting fees, but OPEN’s Virtual Bank Account API makes the process easier. So, how does it work?

Assign a unique Virtual Account number to each student and all payments made using their virtual IDs reconcile automatically.

Now we’ll look at B2B E-distributors.

B2B E-Distributors

E-distributors work with over 1000 retailers and receive multiple payments each month. Now manual reconciliation of these many transactions is a task you would love to do away with! That’s where OPEN’s Virtual Account API steps in.

Assign a unique Virtual Account number to each retailer. As soon as a payment is received, a notification with the payee details will appear in your webhook URL.

Next, we’ve got loan repayments

Let’s take the example of NBFCs. With the rise of credit consumption in consumer-durable industries, there is an urgent need for a solution to help map the many loan repayments received via bank transfers.

Rather than having a manual reconciliation process using bank statements, Open makes it easy with batch allotments – an entire series of virtual accounts unique to your company.

Let’s see how this is done.

Say you own Finztant Limited, a full-fledged NBFC, and you turn to the pros – Open, to help collect all your payments. Once you have created an account on Open, go over to API docs to integrate with Open’s Virtual Bank Account API.

With batch allotments, we take it up a notch. Each customer receives a unique Virtual Account Number from this series. You don’t have to hit the APIs with every new customer manually. Once you receive a payment, we associate the Virtual Account Number with the customers who made the payment and provide you with all the required details.

Time to switch to Virtual Account API

So there you go – OPEN’s Virtual Account APIs are what you need to collect payments smartly.

Free yourselves from the burden of manual reconciliation and integrate Virtual Account API on OPEN today.

Related Articles –

Top 11 most asked questions about virtual accounts

All you need to know about Open – banking that gets your business

API Banking: The fast track to building fintech products

Neobanking for SMEs: A lawyer’s take on fintech

Simplifying business finances & accounting with Open

11 Startup Banking Challenges that Entrepreneurs Fret Over