Deep-dive into banking

After I had graduated, I began my full-time career as a management trainee with the bank. There, I was exposed to how a retail branch actually functioned – from ensuring treasury management to providing customer support. It got me thinking why so little technology had actually seeped into traditional banking systems. Within a few months, I had transitioned into my designated role of handling legal matters for the corporate banking teams. In this role, I was reviewing contracts with large corporates & SMEs and had also started handling recovery/litigation in such cases. This stint exposed me to the entire lifecycle of a banking transaction – from when a loan was disbursed to an event of default, where the loan had to be recovered using legal recourse. What piqued my curiosity was – ‘Who was financing the Average Joe’s businesses – like the local textile shop owner, kirana-store owner, or a freelancer? Were they benefitting in any way from the formal banking system? If not, what are the options that they banked on for financial support? ‘Developing a passion for technology

After completing a stint of more than 5 years with the bank I made a career-shift into a prestigious law firm that had a thriving practice in banking & finance. During this stint, I was favoured to receive diverse exposure to banks, investment firms & start-ups, of which, I eventually grew particularly fond of working on Fintech matters. While advising Fintechs on investments, I grew interested in their offerings & the manner in which they were capable of democratizing & distributing financial services for the benefit of entrepreneurs & small-scale businesses using technology.Banks & NBFCs face challenges in lending to SMEs due to the lack of financial information & historical cash-flows. Since SMEs are unable to avail credit from formal sources, they turn to money lenders who lend at inflated interest rates & unreasonable repayment terms. And then, there are Fintechs, which reach out to under-banked segments of the population – a segment that traditional banks don’t cater to.

My gateway to neobanking

At this juncture, I saw an opportunity at Open, Asia’s 1st neobanking platform for SMEs, startups & freelancers. After a bit of research, I found that Open was founded by a team of serial entrepreneurs & came with a mission statement to make business banking simpler for SMEs. However, the terms that were evangelized by Open: neo-banking, open banking, banking-as-a-service, etc. were relatively new to me (despite working in the banking space for so long). During my interview, I realized that there was authenticity in Open’s aspirations & that the spirit of entrepreneurship was embedded in the company’s DNA. A few days later, I was thrilled to receive an offer from the company to head its legal department!BaaS adventure

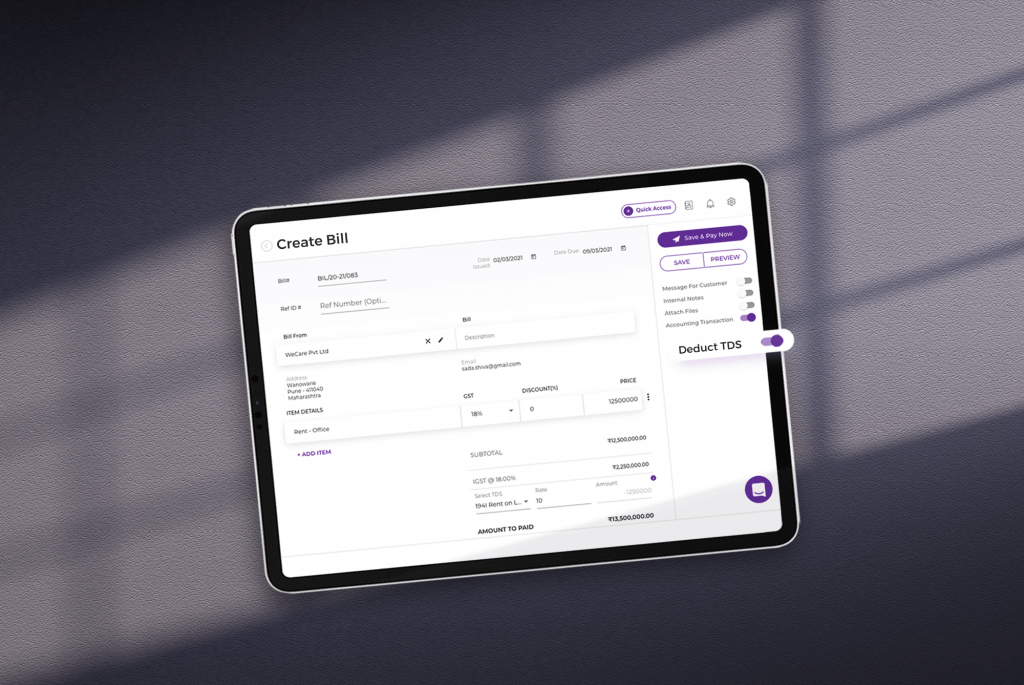

One of the most interesting projects I have worked on at Open was to frame & formalize documentation for a new business vertical: banking-as-a-service (BAAS) products. In simple words, BAAS is a business model that exposes banking technology & processes to fintech. The beauty of BAAS is the fact that it can dramatically reduce the barriers to entry into banking by virtually enabling any business to offer banking services in record time without investing the costs & efforts of signing up with a bank. As the idea was still novel to me then, I was eager to gather inputs from all the stakeholders to ensure that the documentation I was framing was in line with the business requirements. It’s been almost a year since this project was completed. I am still deeply invested in banking & finance work at Open & learning new things everyday keeps me on my toes. I’m also blessed with warm colleagues & a fun work atmosphere at Open. Our progress can be largely attributed to the work culture, which invokes & promotes the spirit of entrepreneurship in everyone.

Sometime during the first week of my joining, I remember we had celebrated thanksgiving day at Open by exchanging thanksgiving notes. I was really touched by the number of notes I had received during my first days at work & the sincerity with which each note was written. It is not so often that gratitude is expressed in workplaces and this was the first of many benevolent gifts I received from Open.

Only an Entrepreneur can understand & solve the pain points of another entrepreneur. This requires a good amount of empathy & a great amount of innovation.

Related Articles –

Fast & Furious: The metamorphosis of fintech

The evolving fintech paradigm – BAAS will lead the way

API Banking: The fast track to building fintech products

Simplifying business finances & accounting with Open

Why you need a business account, now more than ever

How neobanks are disrupting the banking space

It’s been almost a year since this project was completed. I am still deeply invested in banking & finance work at Open & learning new things everyday keeps me on my toes. I’m also blessed with warm colleagues & a fun work atmosphere at Open. Our progress can be largely attributed to the work culture, which invokes & promotes the spirit of entrepreneurship in everyone.

Sometime during the first week of my joining, I remember we had celebrated thanksgiving day at Open by exchanging thanksgiving notes. I was really touched by the number of notes I had received during my first days at work & the sincerity with which each note was written. It is not so often that gratitude is expressed in workplaces and this was the first of many benevolent gifts I received from Open.

Only an Entrepreneur can understand & solve the pain points of another entrepreneur. This requires a good amount of empathy & a great amount of innovation.

Related Articles –

Fast & Furious: The metamorphosis of fintech

The evolving fintech paradigm – BAAS will lead the way

API Banking: The fast track to building fintech products

Simplifying business finances & accounting with Open

Why you need a business account, now more than ever

How neobanks are disrupting the banking space