If you look at the payments industry as a whole across the globe, it has evolved in the most fascinating way when compared to other industries.

Back in the days, we relied on cash, cheques, and DDs to pay and get paid. Nowadays, we barely visit a bank; yeah, I mean the physical ones where you end up standing in a queue for long! 😤

Today, we prefer to make & receive payments online. If you look at the B2C/C2B payments market in India, we’re pretty well established.

Businesses have evolved as well. We are living in an era where cash payments are slowly fading between businesses and advanced payment methods are coming into play. Pure-play digital banks, UPI, Neobanks (my personal favorite!) are disrupting the payments segment rapidly.

Well, B2B is not far behind. 😎

But, what about India? Believe it or not, we actually ace it! 😉

In fact, according to FPII, it was only India’s IMPS service that got a rating of 5 (the highest) leaving behind countries like the UK, Singapore, Denmark, Switzerland, China, Japan, and others.

A BCG-Google report projects that B2B Payments through digital instruments will account for $150 billion in India by 2020.

BCG-Google Report

Even with this rapid pace of development, Indian SMEs still rely on legacy systems to get done with their payments and other financial work.

There’s a Need for a Better Solution

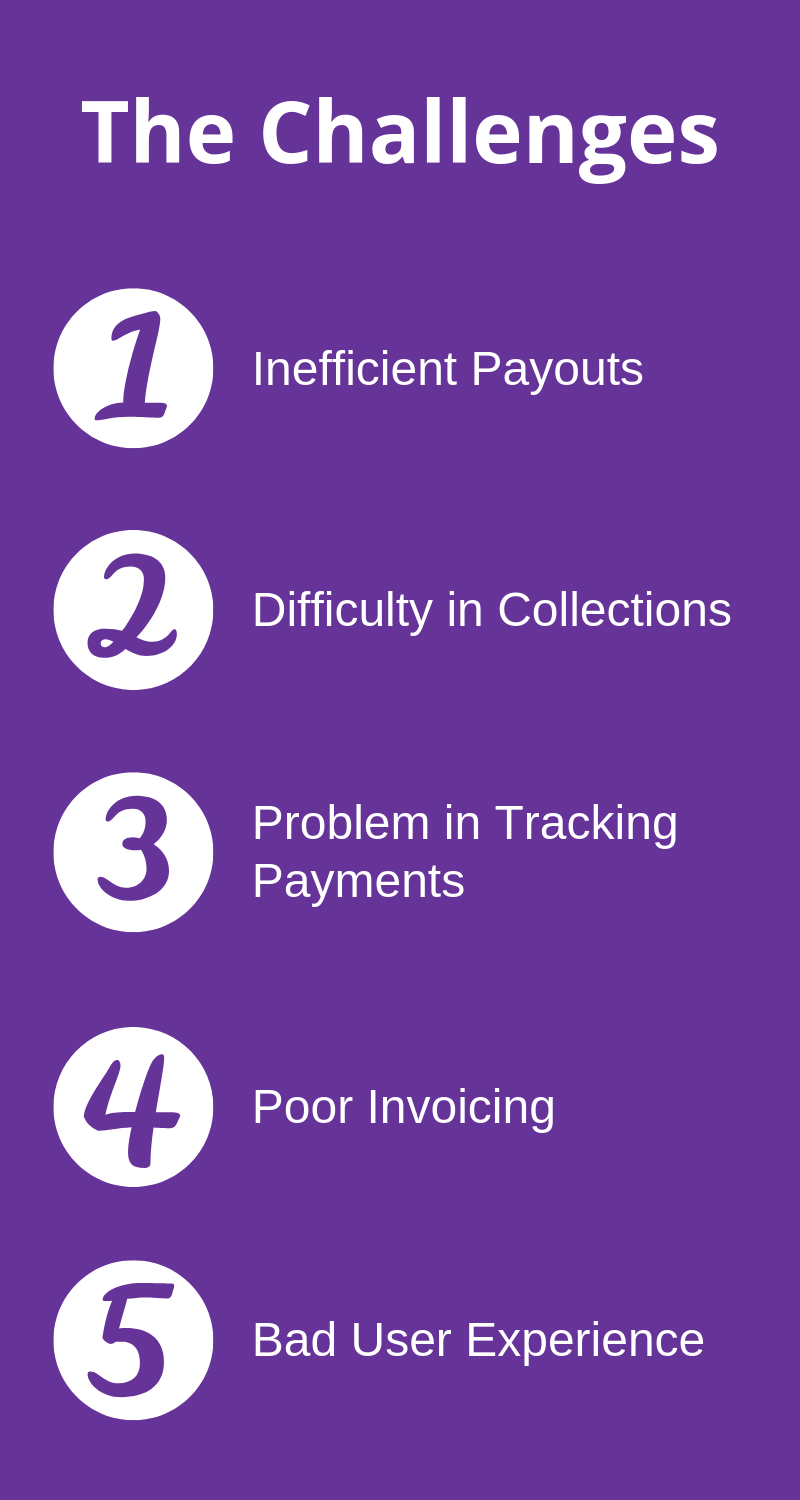

In India, most traditional businesses and SMEs predominantly pay & get paid via cash, cheques, or DDs. The ones that are a little more advanced, will probably do an online bank transfer via RTGS, NEFT or IMPS. In fact, there is a slew of challenges surrounding the finances of an SME.

Curious? 🤔Me too! Let’s look at some of the prevailing challenges here:

- Inefficient Payouts: If you are an SME business owner, ideally, at some point in time you would be making payouts to vendors, or paying salaries, commissions. And again, you would be doing this via a bank. I think we can agree that the experience is less than ‘decent’. And things only go further south once you start doing bulk payouts. The cumbersome looking excel sheet that you fill for 2 hours and redo after making a few mistakes and then finally send it over to the bank. Not a very “all’s well that ends well” experience, is it?

- Difficulty in Collections: Similarly, collecting payments is another hassle you might face all the time. Either you have to send them your bank details or ask them to cut a cheque for you or deposit the amount in a bank branch itself. None of the above seem that convenient to me, what about you?

- The problem in Tracking Payments: Did you ever receive a cash payment and forget to enter it into your accounting books? Happens with the best of us. This is a common problem for almost 90% of the SMEs. Tracking UTR numbers, calling up your customers/vendors for the same, reconciling it, etc. is an everyday problem. Some SMEs go as far as to keep a dedicated team to handle this.

- Poor Invoicing: Any SME would definitely be creating a ton of invoices every month. Is the process easy? I think not. 8 out of 10 SMEs in India don’t have a proper invoicing tool. Mostly because the existing systems are not as seamless and efficient as they are supposed to be.

- Bad User Experience: Last but not least, the overall experience of the existing banking infrastructure. Let’s be honest. It’s cluttered. Important features don’t work half the time and then there’s the difficulty of finding stuff. I’d say it’s a pretty daunting experience, won’t you agree?

Although these things dominate the SME banking industry, there are a few solutions that strive to solve the same. 😌

Enter Neobanks, the ‘Ideal’ Solution

One of the best and most popular ones being Neobanks. Now, what is that? A Neobank is essentially a business banking platform that offers innovative banking services & offerings that are very different from what traditional banks have to offer.

“Most of them (neobanks) are subsidiaries of the banks that they are making fun of and competing against.”

said Dan Bass, MD, Performance Trust Capital Partners, Houston.

So, how does a Neobank work? They partner with a licensed bank and offer enhanced banking solutions on top of them. Services such as bank account opening, P2P lending, basic accounting on-the-go, expense management, prepaid and credit cards, etc. are a few things that you’d see on a classic Neobank feature menu.

But you might be asking, ‘Why is this a big deal?’. Fair enough. 👍

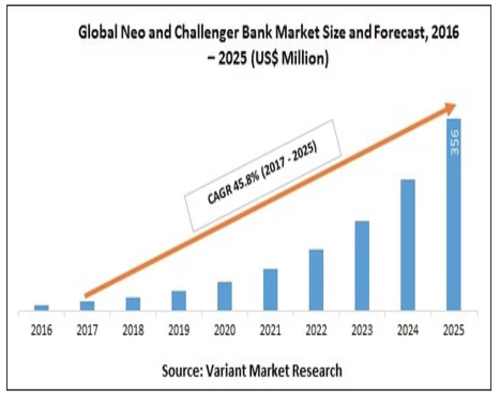

A recent Allied Market Research study forecasted that the global neo and challenger bank market is expected to reach $356 Million by 2025 from $17 million in 2017, growing at a CAGR of 45.8% from 2017 to 2025.

Allied Market Research study

Convinced yet? Neobanking is revolutionizing the Banking & Financial Services industry as a whole and the payments ecosystem in particular.

How? 🤔Well, here are a few ways in which it is doing so:

- Easy Payouts & Collections: When it comes to doing payouts (especially bulk payouts) and collecting payments, few solutions offer an experience as seamless as Neobanks. Most of them offer an integrated payment gateway to collect payments. While a few other Neobanks like Open offer an easy solution for doing bulk payouts, which otherwise can be quite a bothersome task.

- Easy Payment Tracking: No more tracking UTR numbers and managing cash/cheque payments. With neobanks, you can automatically track your payments. Best of all, it’s DIY. You don’t need a team or an external agency for that.

- Expense Management: As an SME owner, you would incur a bunch of expenses on a daily basis. Can you keep track of all? The most popular answer would be ‘No’. A lot of Neobanks also offer customizable expense management solution for startup and SME owners.

- Seamless Invoicing: Neobanks know that invoicing is a major feature for SMEs. That’s why neobanks like Open have built a seamless invoice creation system that is integrated with other banking and financial services the platform has to offer.

- User Experience: Last and the biggest advantage of all is the enhanced user experience that they offer. Most neobanks tend to have a smooth design that makes it easy for you to get the flow. You can find the features pretty easily. Plus, they also offer all of the services of a traditional bank in an innovative and convenient manner.

- On-the-go Banking: With neobanks, your banking and pretty much all of your business finances can be managed on-the-go via your mobile (enabled through apps).

The kind of services neobanks provide coupled with the best user experience, is bound to shake the payments and the banking industry in India.

In a market that is dominated by traditional banks with age-old systems, neobanks come in as a ray of hope for the SME segment. Neobanks tend to operate on a “customer first” model wherein they actually cater to the woes of the SME segment and create products or services around the same.

Related Articles –

Neobanks 101: Everything you need to know about neobanks

What is Neobank? Everything you need to know in detail!

Decoding neobanking: Why neobanks are winning over businesses

How neobanks are disrupting the banking space

Neo banking — What does it mean?

All you need to know about BaaS