The current challenges with vendor payments

Net banking- Once a new beneficiary (your vendor) is added for bank transfer, the cooling period takes anywhere between 30 minutes – 24 hours (or more), depending on the bank.

- Not just that — only a limited amount can be transferred the first time. 🤦♀️ And yes, that amount varies from bank to bank.

Cheque

Cheque

- Writing cheques is subject to human errors — this is undeniable.

- Also, making vendor payments via cheques demand your physical presence to sign the cheque.

- Tracking which payment was made to which vendor on which day, or in other words, tracking every vendor transaction via UTR is highly tedious & time-consuming. 😩

Automating vendor payments (The way forward!)

What if you automate vendor payments for your business?

Sounds doable? Well, to a great extent, yes! But the real question is what exactly are you achieving for your business by doing so. Or rather, what exactly do you want to achieve?

👉🏼 Do you want to save countless hours spent on manual reconciliation?

👉🏼 Or do you want to simply make & track vendor payments in the most simple manner possible?

If your answer is ‘both’, then listen up because we’ve got some good news to break. 📢

With Open, you can save tons of precious hours spent on tedious manual reconciliation. And at the same time, you can make & automatically track vendor payments, just like that.

Learn all about it in the below video.

How to make instant vendor payments on Open

Why make vendor payments via Open

- Start using Open with ZERO tech bandwidth

- Add the vendor only once for all your future transactions

- Start transacting immediately — no cooling period involved

- Create & send bills, receipts & debit notes in a few steps

- Track & view all aged payables vendor-wise & bill-wise

- Connect existing bank accounts & make payouts directly from them

- Use APIs to automate bulk payouts for your business

- Schedule for post-dated payouts

- Track vendor payments – bank-wise, account no. wise, payment status wise, date wise – so on & so forth

How to automate TDS payments for your business

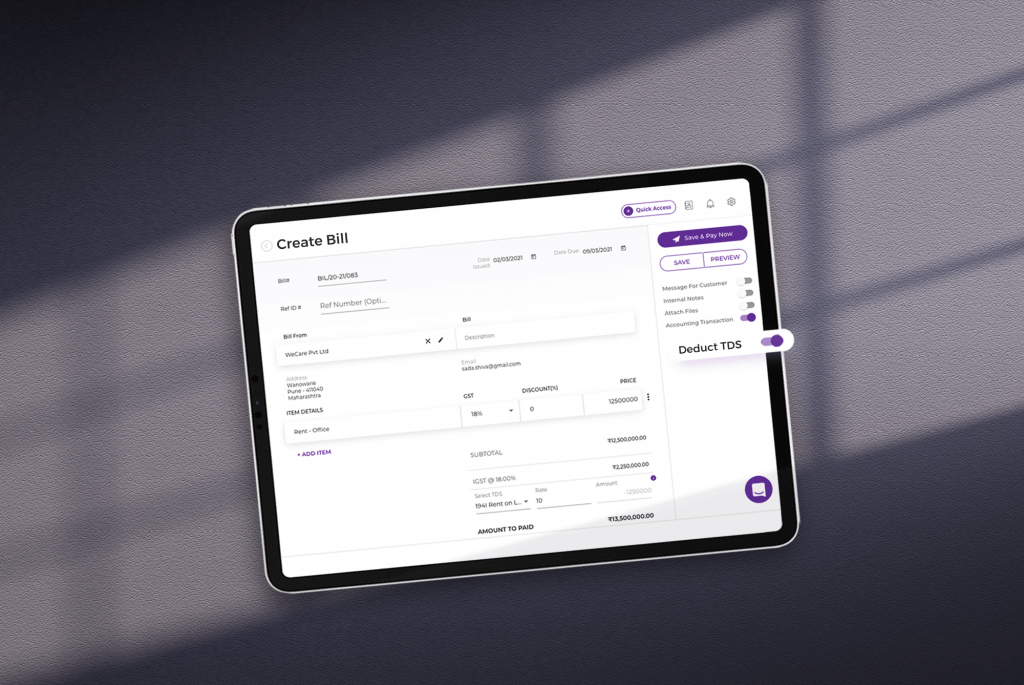

Calculation of TDS on bill amount is a cakewalk with Open. The same goes with making TDS payments. Watch the flow here.👇🏼Why manage your TDS payments via Open

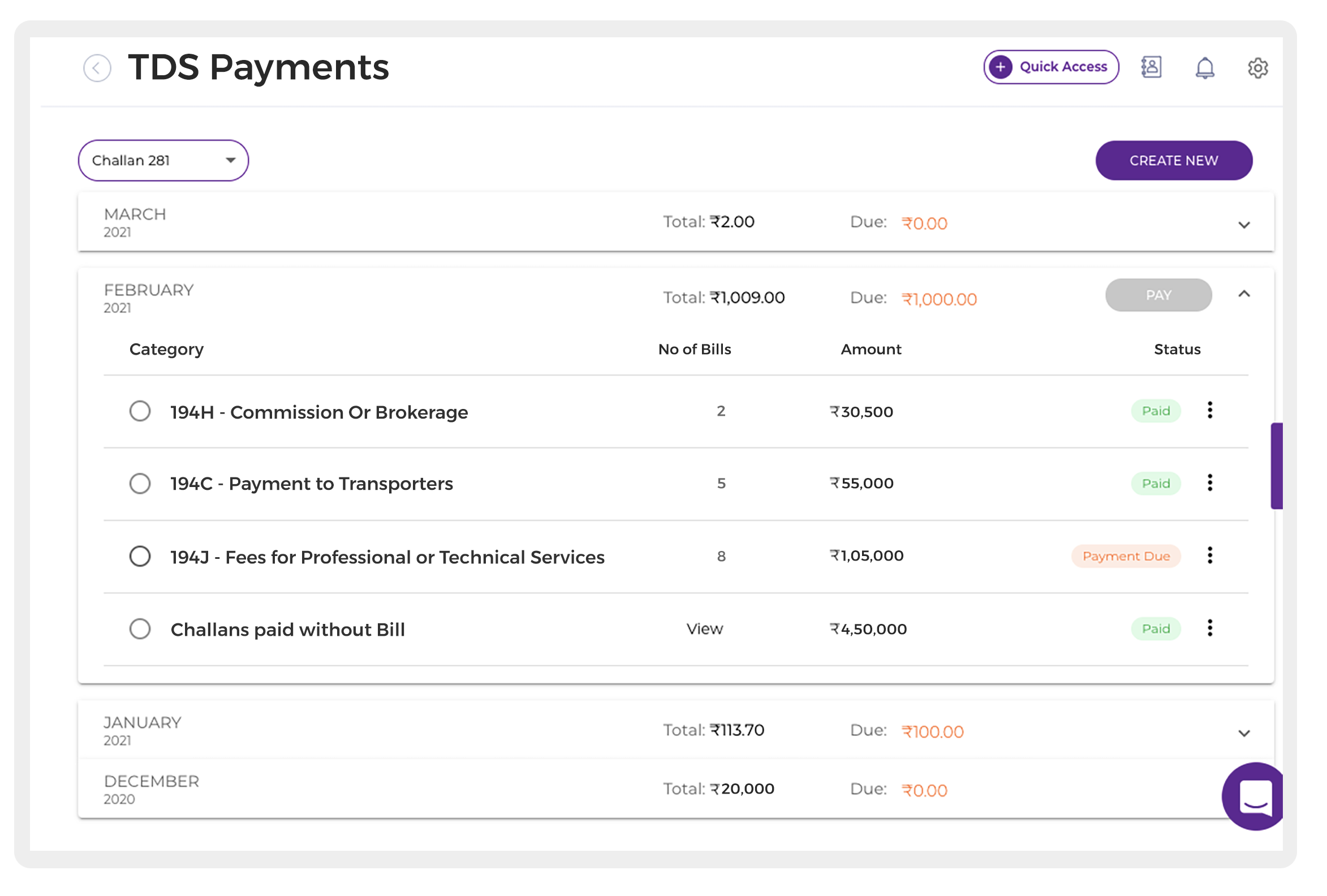

- Get all TDS-related info in ONE place — that too based on categories.

- Make TDS payments directly from Open.

- Avail TDS challan on the spot — like this.👇

- View TDS challan anytime, anywhere. No need to download & save it for tax filing purposes.

- Automated accounting of TDS liability. No more worrying about tracking & updating TDS info in your books of accounts.