Let us check out a typical “payments day” for Raj, a Proprietor of a supermarket with two outlets and his accountant before adopting connected banking.

The accountant logs into the accounting tool and the two current account banking portals. Through the first one, he pesters Raj for OTP for each payment, while through the other current account, he uploads an Excel sheet with 14 columns of payment details. Later pesters Raj to go through the entire sheet and approve. Then, the accountant downloads the e-statement and manually matches them with the entries in the accounting software. By now, the day is already over.

However, he still has to make journal vouchers for unaccounted entries and Raj is waiting for an update.

Raj owns multiple current accounts and yet struggles to leverage their current accounts and manage their business finances better. That’s why most banks including – SBI, ICICI, Axis, Yes Bank, and 11 other banks have partnered with business payment platforms such as OPEN, offering Connected Banking as a feature to their current account holders.

With frustration, both Raj and his accountant finally looked for a solution and came across “Connected Banking”.

What is Connected Banking and how has it transformed his life?

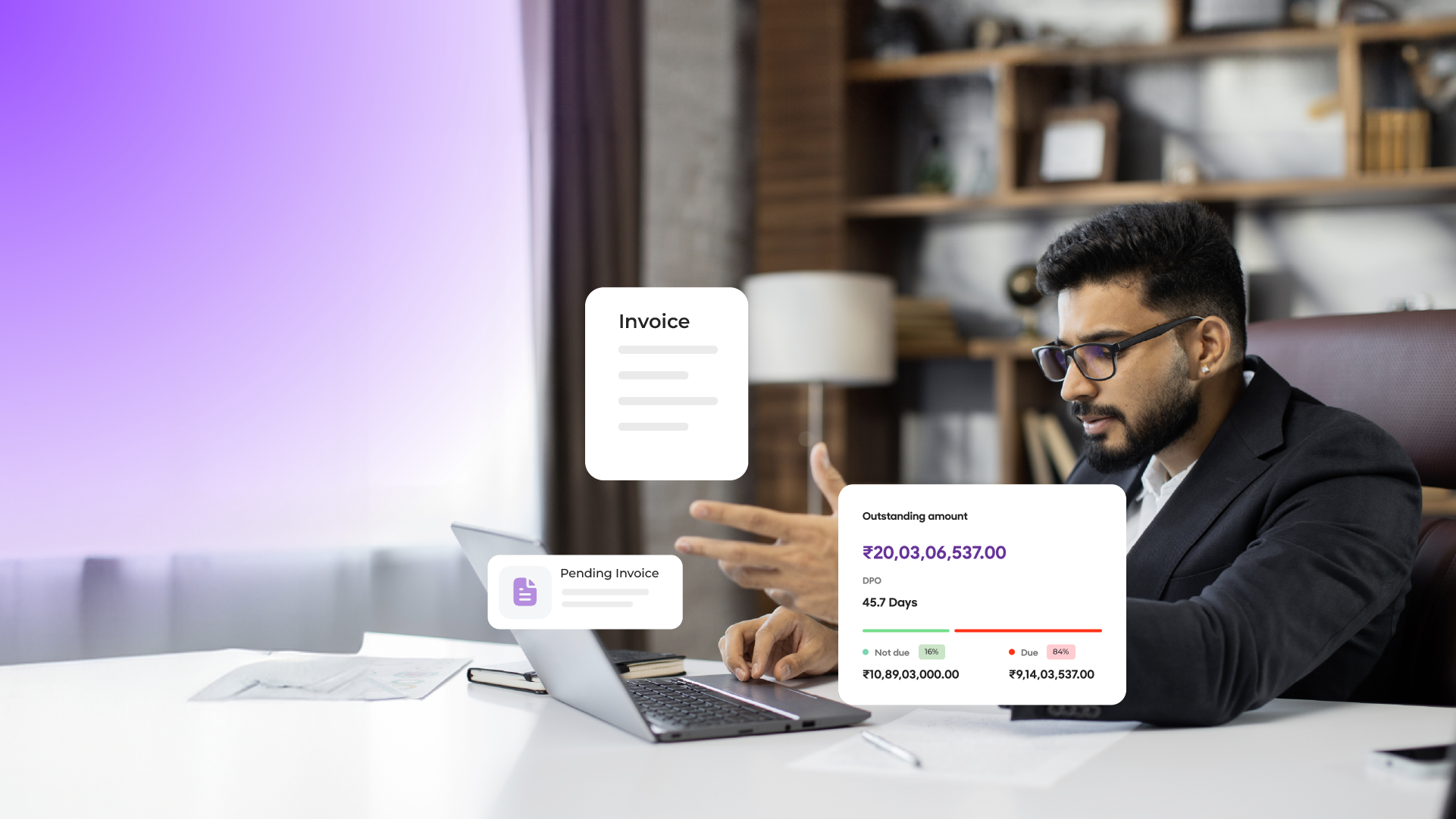

Raj quickly connects both the current accounts and the accounting tool with the Connected Banking platform. This unified solution empowers the accountant to effortlessly make payouts against invoices and collect payments from customers against bills directly from the accounting tool.

Bank balances and e-statements seamlessly flow into the accounting tool, making reconciliation 90% faster and the balance sheet accurate.

As a result, Raj can eliminate almost all manual efforts and errors in AR & AP and stay in control of their cash flow.

Why do SMEs need Connected banking?

It is simple: To manage all bank accounts in one place. However, let’s go one by one.

1. Piling Payouts

Carrying and transferring cash itself incurs costs. Writing, tracking, and depositing cheques consume valuable manpower. While bank transfers are secure, dealing with numerous OTPs or preparing spreadsheets for bulk payouts eats accountant’s as well as proprietor’s efforts for breakfast, lunch, and dinner.

Then comes the need to create payment entries with the UTR number for all these payouts in the accounting tool which secretly eats up your energy for an evening snack.

Amidst these manual efforts, payments to vendors might get delayed, placing the vendor relationship in jeopardy.

Features of Connected Banking that simplify payouts:

- Accountants can initiate multiple payments in one go

- Payment entries are automatically created with the UTR number in the accounting system

- Ensure on-time payments to vendors and build the trust

2. Chasing Collections

Who would say No to faster payments? Not a business owner for sure! Late customer payments lead to cash crunches; constant manual reminders and follow-ups are pushed to avoid that.

Last but not least, a mandatory UTR number validation process; just to make sure the payment has landed. Only God knows, how many calls and WhatsApp messages will flow in either party’s organisation.

On a Connected Banking platform:

- Create and share sales invoices with payment links and multiple modes of payment

- Send auto-reminders when the credit period is almost over

- Transaction details such as UTR number will automatically flow into the system. Moreover, the UTR number verification step will get eliminated as collections will be directly done on OPEN through payment links

3. Repetitive Reconciliation

We all know someone who aches for manual effort and errors, BRS (Bank Reconciliation Statement). E-statements in current accounts need to be manually matched with entries in the accounting software:

- To identify the entries which are in e-statement but not in accounting software

- To track every Rupee debited and credited

Sounds easy right? Assume there are 100 entries to match from two current accounts.

Let us check out the benefits of Connected Banking in reconciliation:

E-statements from all linked banks will flow into the accounting tool with a click.

- So first, all the transactions (payouts and collections) made through connected banking will be auto-matched with the transactions in the e-statement

- Next, you’ll be left out with entries that were not made through Connected Banking, (eg, directly from the internet banking portal). These can be manually, but easily matched with the entries in the accounting tool

- Finally, we’ll identify the entries that have been hiding from our eyes such as auto-renewals, collections without receipt entries, etc… For these, you can easily prepare a JV and auto-push into the accounting tool

If reconciliation is skipped then the P&L, and balance sheet won’t be accurate. Might even lead to incorrect tax collections thus missing out on GST returns.

What does India’s best Connected Banking platform offer SMEs?

It connects multiple current accounts to its own fully-functional accounting tool as well as pulls and pushes data from/to leading accounting tools such as Tally, ZOHO Books. Apart from that, you can:

- Open a new current account on the OPEN platform

- Create and process AP and AR with ease

- Pay multiple vendors and employees at one go

- Collect payments 30% faster with payment link-embedded invoices

- Reconcile in less than 5 mins

- File GSTR 1 on the go

Well, those are the benefits OPEN brings to the table. Additionally, OPEN caters value-added services on the same platform such as spend management, e-invoicing, and full-fledged payroll software.

How does Connected Banking work on OPEN?

What are you waiting for?

Grab the fruitful outcomes that 35,00,000+ businesses are benefiting from OPEN (trusted by and partnered with 14+ top national banks such as SBI Bank, ICICI Bank, Axis Bank) and manage business finances smarter!