Are you running a business? If yes, you are definitely using a current account. In most cases, even more than one. Currently, a lot of business owners use these multiple current accounts to manage different aspects of business. You may use one for certain types of clients, or for just collections, or use one to manage your operational costs, and several other reasons.

But is it really making your life easier? Yes, a little bit.

Is it the most efficient way to manage all your finances? No!

What is the solution?

You can simply link all your current accounts to one platform, manage all of them from one dashboard, make payments, collect money, sync your accounting books and so much more… using just one single platform!!!

It’s possible with OPEN!

What are the benefits of connecting all current accounts ?

While there are several benefits of connecting all existing current accounts together, here’s why business owners should do it

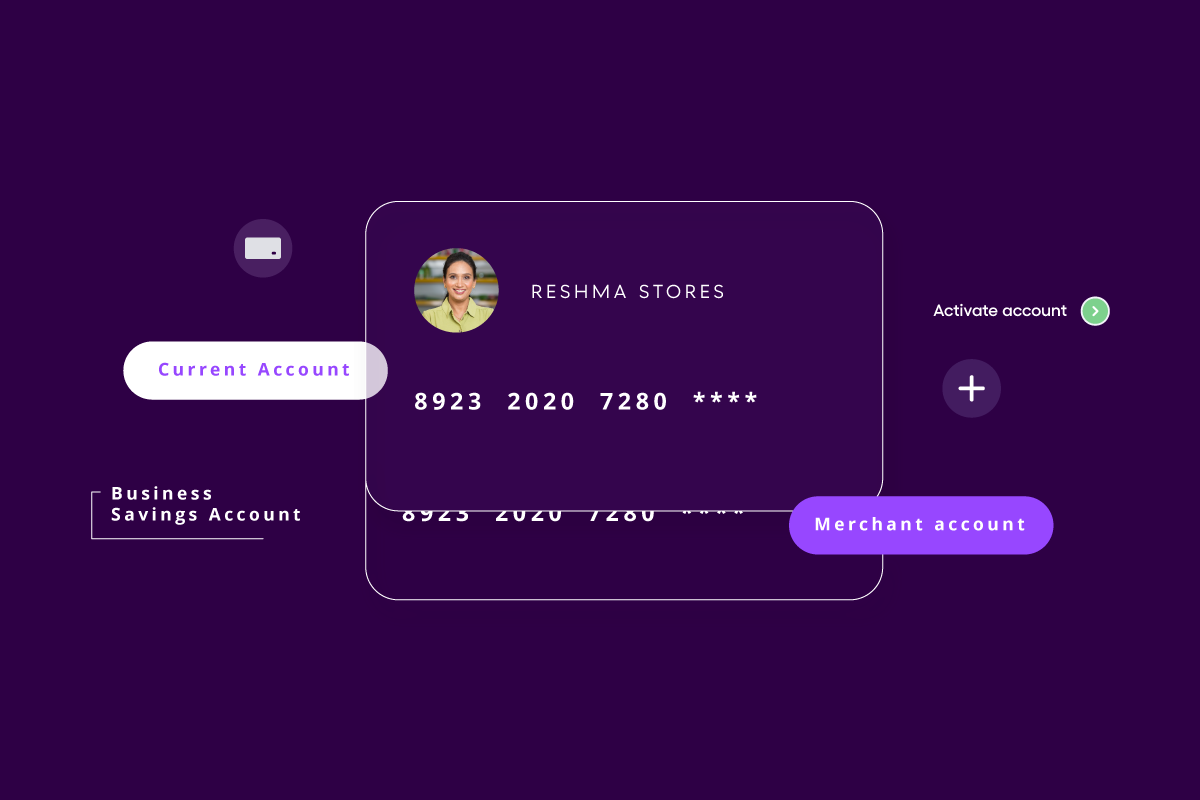

You can manage all your current accounts from one dashboard

You don’t have to log in to multiple net-banking portals of different banks. Once you link all your current accounts to OPEN, you can just access this from one dashboard.

Most SMEs and startups have multiple bank accounts, and managing them can be a daunting task. By connecting all the accounts to one platform, owners can easily manage all their current accounts and make payments from them.

This saves time and effort, allowing you to focus on other important aspects of your business and make better financial decisions.

You can pay vendors & collect from clients directly

Making vendor payments on time and monitoring collections from customers has always been the most important aspect of any business. Collections may be irregular; however, vendor payments need to adhere to strict timeframes.

Business owners thus prefer to have multiple current accounts so that they can allocate funds to desired accounts and make payments on time.

However, having multiple current accounts does not necessarily mean that this issue is solved. To begin with, you must add the vendor as a beneficiary to initiate the payment. There is then a cooling-off period that takes a considerable amount of time.

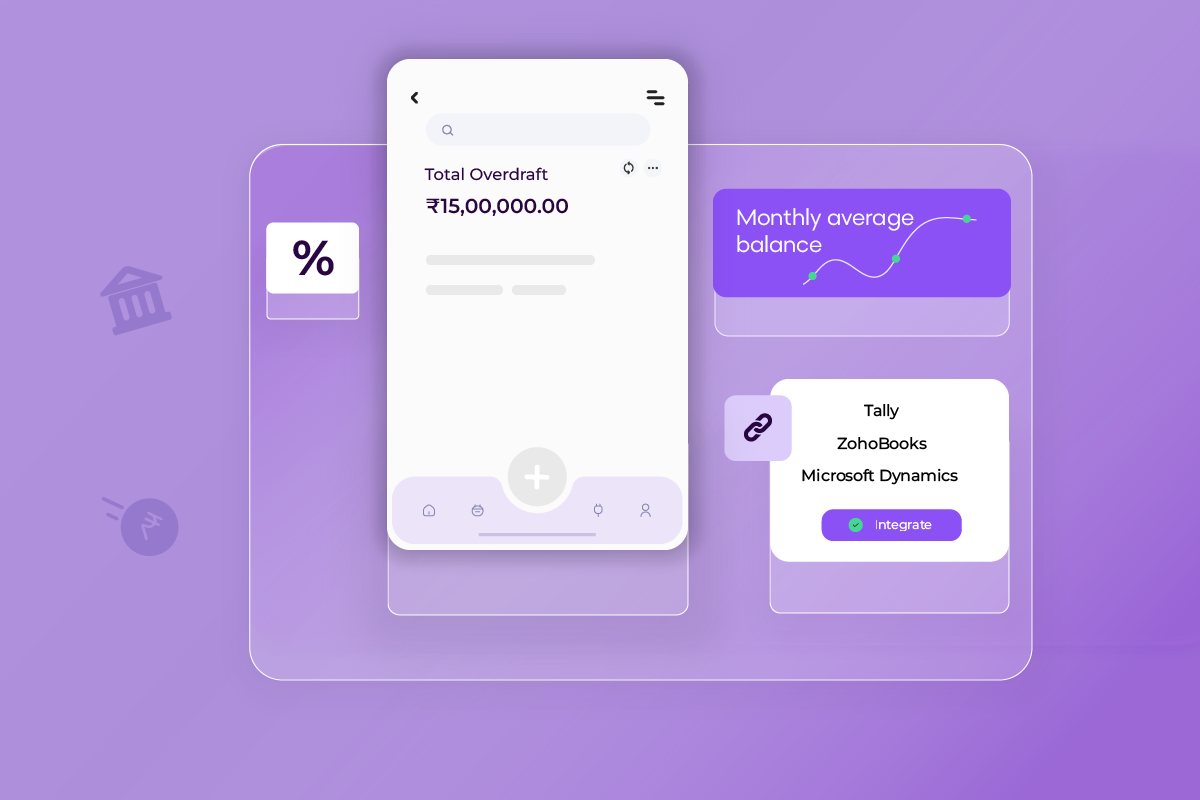

By connecting all current accounts in one dashboard, you get a complete view of balances across all accounts. Moreover, OPEN allows you to make instant vendor payments with no cool-off period after beneficiary addition.

You won’t lose time manually tracking each payment

Business owners spend most of their hours tracking transaction UTR-IDs to ensure timely and precise reconciliation for each and every invoice.

Having multiple current accounts increases this challenge, with multiple logins and each bank statement having a different format.

OPEN gives you complete visibility of all transactions from your connected current accounts. This allows you to map an invoice with its payment in just a few clicks.

Why should business owners link their current accounts with OPEN

In addition to the advantages mentioned above OPEN offers a simple and secure way to connect multiple current accounts onto one dashboard.

- OPEN being ISO 27001:2013 certified and PCI: DSS compliant, businesses never have to worry about data breaches.

- OPEN allows auto deduction of TDS for vendor payments which eventually helps in the effortless filling of tax returns whenever needed

Note: Auto-deduction of TDS is possible only from OPEN’s partnered banks

In Conclusion

With OPEN, businesses can enjoy seamless integration with their preferred banks without worrying about complex integrations or compatibility issues.

Additionally, OPEN offers robust security features to ensure that all financial transactions are safe and secure.

Overall, the platform is a great solution for businesses looking to simplify their banking processes, and connect multiple current accounts with ease.

Happy Banking!