I like to think of my journey so far, a decade long career, as what they call a “Portfolio career”. I come from a background in product management – edtech, fintech, and core banking, credit risk, analytics, content, and operations. I have worked for a mix of large and small firms – two multinational banks and one startup prior to Open. While I have degrees in Engineering & Economics, my goal has always been to chase interesting challenges to take on in my career.

Gone are the days of rising up the ranks over 30 years in one place – also gone is the Indian middle-class myth that we grew up with – “get into a nice engineering/medical college and your life is set”. I believe the idea is to keep pushing your way into new horizons and find ways to make your mark.

How Open caught my attention

I love reading about startups in my spare time and what stood out about Open was how they were the first to solve a massive unaddressed customer need- Banking for small businesses.

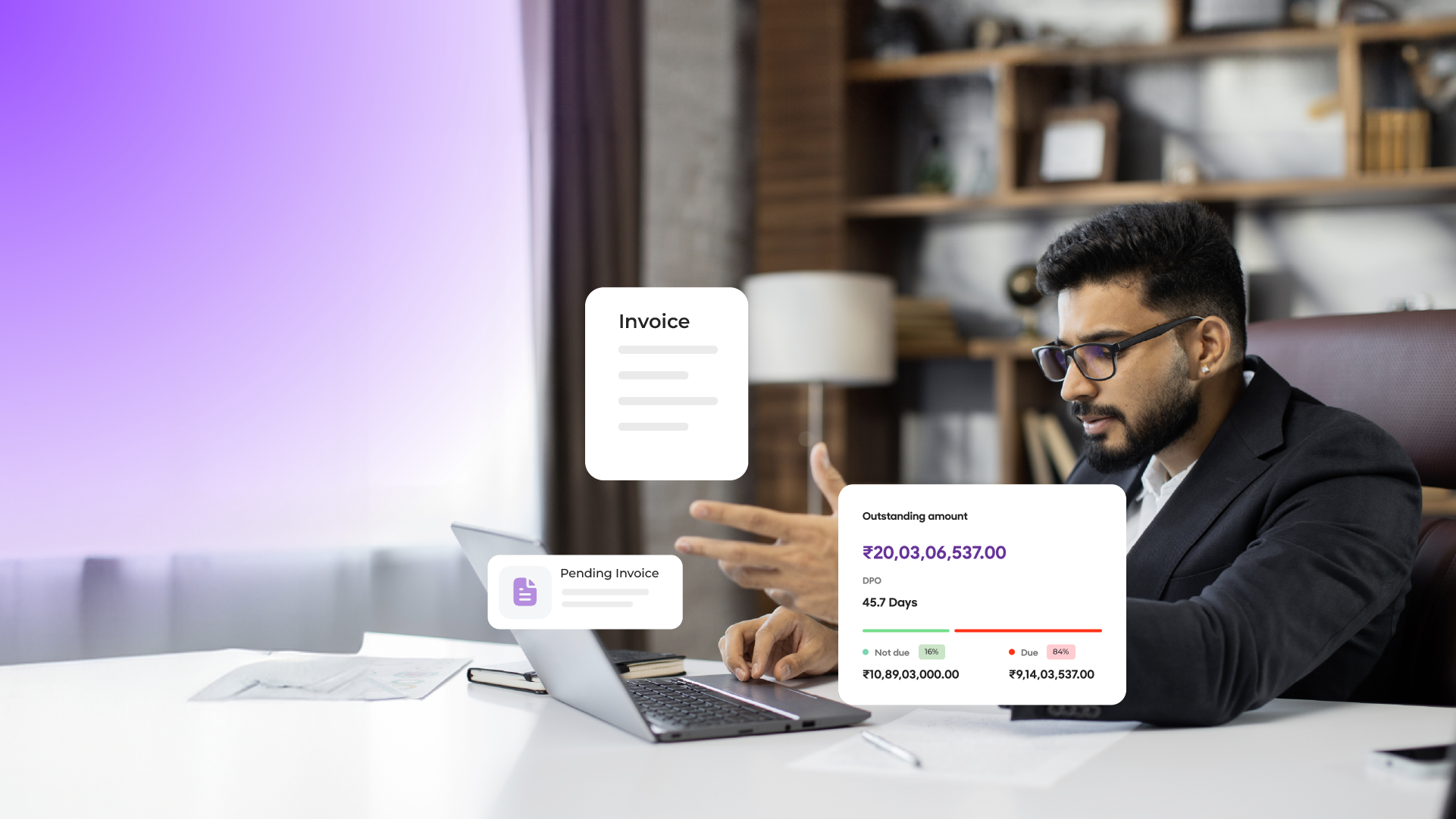

Today, big banks are too self-involved or focussed on large clients that they have lost touch with the challenges faced by small businesses. Simple things like setting up a current account, using it to reconcile payments, raising tax-compliant invoices, collections against invoices, and expense management are a challenge for new businesses.

Before Open came along, businesses needed multiple apps/accounts and a Chartered Accountant to manage all their finances. I was stupefied to find that no one had thought of putting all these pieces together before – especially banks.

I joined Open after a five-year stint in an entirely different role where I predominantly monitored and analysed risk in credit card and business loan portfolios. However, what helped was I worked on fintech partnerships as an added responsibility and I read up extensively on what pain points ‘neobanks’ were solving for.

I knew that startups were innovative and unconventional and expected something exciting to work on- and that’s exactly what I got.

Jumping right into the Open universe

While Open simplifies banking for small businesses, it also offers many value-added services through its app store and it is here that my journey started. I was given an interesting problem to solve that involved creating something from scratch that did not exist inside a ‘neobank’ before.

Interesting beginnings

In August 2019, when I joined Open, we had about 450,000 businesses using it for banking and payments. We thought, if we could create a channel for them to advertise their products and services and trade with each other, it’s a win-win for both the small business and us.

We could then keep the whole sales and payments cycle completely inhouse- something that none of the marketplaces today can boast of. Ultimately, bringing sales, banking, and payments together thus enabling customers to manage their finances & grow their business – all in one place.

As a new joiner, diving in to create this, involved talking to design, engineering, marketing, and sales and getting everyone excited about it. This experience gave me a complete sense of ownership. People also associated me with this product feature for a long time- that it became my introduction. This connected B2B marketplace christened as Open Hub was launched within four months and it was a huge thrill to see the first 1000 users start using it. It’s a thrill that’s often missing in large companies.

The second ad’venture’

The second challenge that awaited me after Open Hub, was on a line that I have not worked on before- running a business unit. I now head the lending and wealth unit at Open. In all my past roles, I had chosen very technical and logical things to do- and this was definitely out of my comfort zone. But I jumped at the chance to run a “startup within a startup” of sorts and I also had the vast experience of the serial entrepreneurs at Open to guide me which has made the journey quite smooth for me. On a lighter note, the one challenge I now face is having to remember the names of the many new people I talk to all day long- I am much better at remembering numbers. 🙂

So back to what I am working on- We are connecting small businesses to the capital they need to grow. We offer term loans, a line of credit, invoice discounting, and credit cards. As with all our other offerings, we are making these products extremely customer focussed, flexible, and intuitive.

On the wealth side, we are building investment products tailored for small businesses- while we see so many SAAS products for individuals now, we are yet to see solutions for managing surplus capital for small businesses on a fully digital platform.

Along with this, we are building an embedded fintech platform that any business can use off- if they want to ’embed’ payments or lending into their customer journeys- from a ride-sharing company wanting to give credit cards to its drivers or an e-commerce platform wanting to give loans to its sellers or farmers getting financing for their equipment – the platform is fungible to accommodate all types of use-cases.

My Open journey has only started

It’s been a very exciting and fulfilling journey so far and I can’t wait to grow this lending wing into a huge vertical for Open.

In terms of culture, while everyone has ideas to make work interesting, Open does things in its own unique way- from how new joiners are welcomed, to our town halls and the creative workshops, there is something special about the care taken to ensure it’s a good place to work and grow. As for startup enthusiasts, Open is a place you will love if you enjoy challenging the status quo. If you are passionate about fintech, this is the company you need to be at.

Related Articles –

How entrepreneurship helped me become a true-blue product manager

Neobanking for SMEs: A lawyer’s take on fintech

Going the distance: How entrepreneurship made me a better product manager

Redefining leadership at work – the Open way

Openers take on team building – the remote way

How Openers took on WFH with full force