You’d certainly agree that an online current account for startups and SMEs is more essential than a regular bank account! Whether you’re a small business owner with an uninterrupted cash flow or an established entrepreneur whose company is in the growth stage — you must’ve faced quite a few challenges while setting up the best current account for your startup or small business.

Setting up a current account for a startup is difficult, isn’t it?

Business banking often seems difficult because traditional banks have a set infrastructure. This limits them from offering customised banking services to SMEs and startups. And let’s be honest, keeping up with the never-ending processes of setting up a current account takes a lot of your time — causing further inconvenience.

Let’s take a look at all that stands in the way between you and the best current account for your small business or startup.

Cons of setting up a regular current account for startup

Setting up a business current account takes 15-20 days

Opening a business current account includes excessive paperwork which usually takes around 15-20 days, and requires small businesses to maintain a quarterly minimum balance. This process often pushes businesses towards making use of personal savings accounts to sort business spends.

Strict compliance causes delay

Banks have a standard set of rules & regulations for compliance. For small businesses or startups, the co-founders or business head(s) need to sign an indemnity bond to process salaries or other payments. This often causes delays in rolling out payouts for small businesses.

Accurate turnover reports demand more time and efforts

The CEO or the respective decision-makers of the company need to maintain quarterly balance sheets & submit turnover reports while creating a current account for their businesses. The entire practice is time-consuming, to say the least.

Using 3 current accounts seems like the best practice

Companies juggle between multiple online bank accounts. One for tracking account payables, the second for receivables, and others for miscellaneous expenses. This routine turns chaotic when it comes to tallying up the finances at the end of tenure.

Managing multiple account requires multiple phone numbers

Can you have multiple online bank accounts with the same bank? Well yes, you can. But doing so, comes with its own set of challenges.

Teaming up with one partner bank is ideal but requires businesses to have alternate contact details for the different business current accounts. Registering the same number for multiple bank accounts isn’t an option.

This puts especially the finance team in a tough spot as they alternate between phone numbers, making it difficult to track multiple OTPs generated for transactions.

Requirement of adding payee details & additional cooling-off period

With the requirement of adding a beneficiary & waiting during the cooling-off period can take up between 30 minutes to 24 hours. This makes salary disbursements, vendor payouts or employee reimbursements a time-consuming and tiring process for small businesses.

Reconciliation for inward & outward payments

The finance teams are seen struggling when it comes to reconciling payments, as companies use different online bank accounts for business transactions. And since there’s no automated way to track payments with UTR numbers, one needs to verify the same manually. This results in unwanted disruptions in tallying all receivables and payables.

Managing the regular business account sounds stressful, ain’t it?

Perhaps now is the time to rethink which current account is best for your small business or startup.

Hence we recommend you create an online bank account with

Open — a business banking platform empowering 25,00,000+ SMEs & startups to manage their finances the smarter way!

Here’s why Open’s online bank account is the best current account for Startups and SMEs!

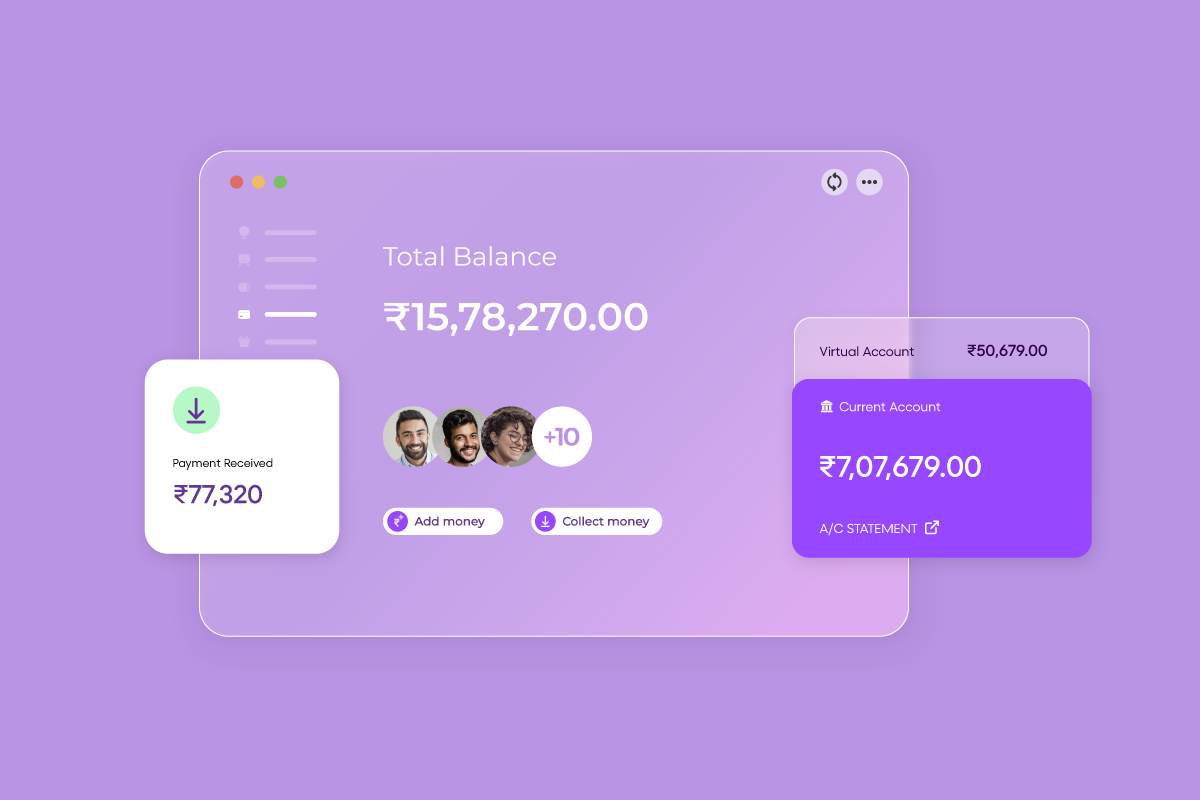

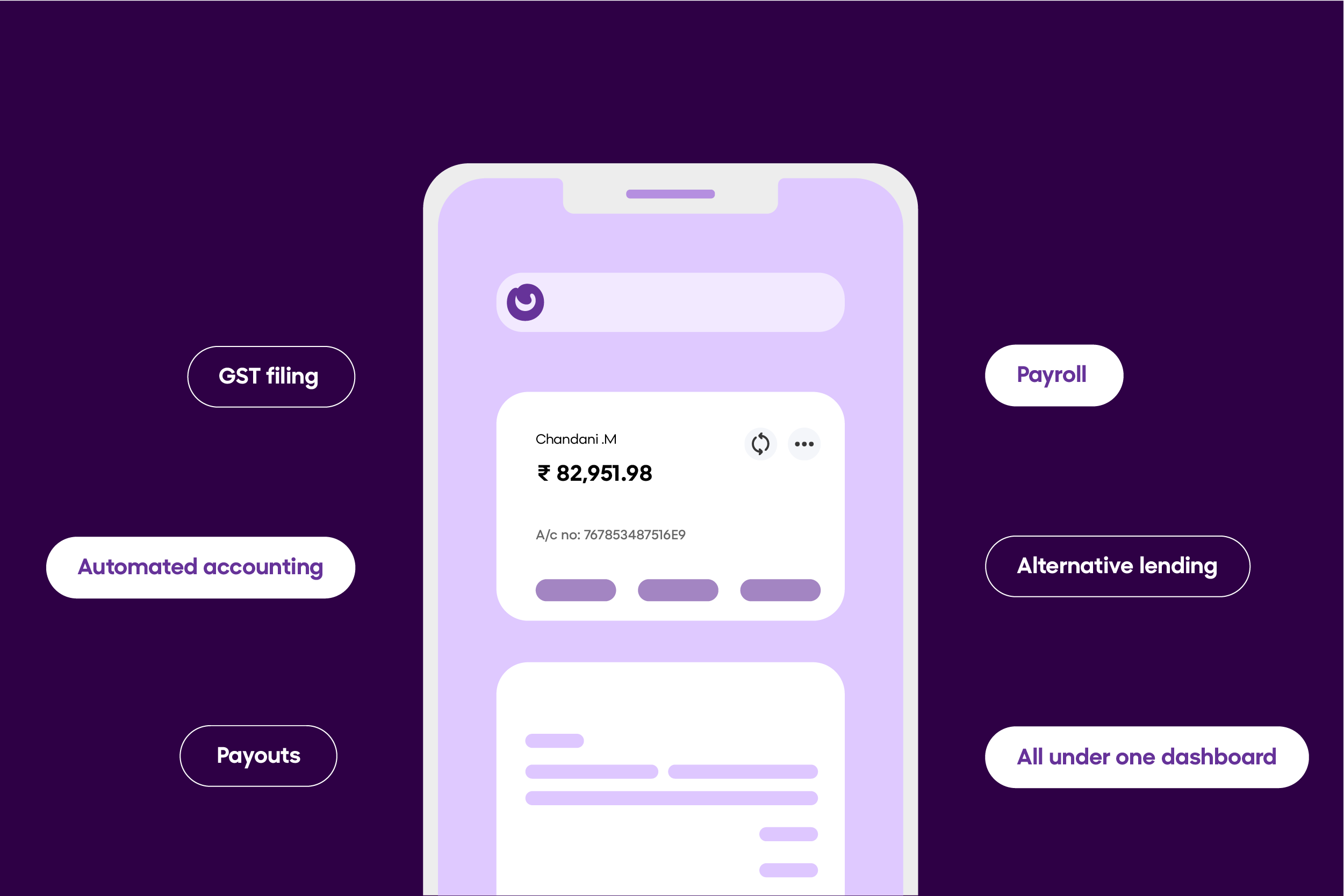

Open business account is an all-in-one online bank account that simplifies your business banking experience. With Open’s business account, you get access to corporate cards to manage all your offline and online business expenses effortlessly. Moreover it enables you to make instant vendor payouts and send GST compliant invoices with in-built payment collection links. You can link multiple current accounts and auto-reconcile all your business payments and a lot more, all from one – Open dashboard.

Rest assured, there’s so much you can do with just one Open’s current account for your startup or SMEs!

Set up an online bank account in minutes

Based on your previous banking experience as a startup or a small business owner, you are bound to use 2-3 business accounts for cash management. With Open, you can create an online bank account within minutes and link your existing accounts to it. The best part? Do all of this without any paperwork.

Sign up now to complete your KYC and be a master of managing your business finances.

Track all receivables & payables from one online bank account

Tracking every single transaction & reconciling payments for all of them is a complex yet necessary task.

Get Open’s online bank account, manage all account receivables & payables for your business in one place. Don’t get stressed about tallying up the payments manually when you can track them in real-time with Open.

Do accounting the easy way

With a regular business current account, the process of reconciling payments against business transactions gets messy as there is no method to tag successful payouts or outstanding payments.

However, once you create an online bank account with Open, you can create & send invoices, collect payments, and tag transactions easily. Automate your accounting with Open’s user-friendly dashboard and stay on top of your business expenses.

No more adding beneficiaries & waiting out the cooling-off periods

In today’s digital era, payments need to be sent out and tracked instantly. Now make direct payouts without adding beneficiaries and bid farewell to the cooling-off period. With Open’s online bank account, you can start transacting soon after you sign up and complete the KYC process.

Manage multiple business current accounts from ONE dashboard

Your overall banking experience is going to be far more superior with Open. When managing multiple bank accounts for your business is taking a toll on you, get Open’s online bank account. Integrate & manage your existing business current accounts and get a complete overview of your business cash-flow from a unified dashboard.

Make hassle-free single or bulk payments

We understand that making payouts without hassles is a challenge for SMEs and startups! Your new online bank account is here to change that. Make single or bulk payouts with a simple file upload on Open instead of adding beneficiaries each time. With this you can eliminate the troublesome approval process for making payouts.

Bonus read – Learn how this IT services company makes multiple vendor payouts in minutes on Open!

That’s not all! Like we mentioned earlier, Open’s online bank account has a lot more to offer.

In addition to simplifying your business expenses, you can also set up an e-commerce store via OpenStore available on your Open dashboard.

If you have a pre-existing e-commerce portal, you can integrate Open’s developer-friendly APIs & collect payments seamlessly via your website/ application. This helps you in reconciling your payments automatically using the Open account.

With almost every business (and it’s customers) going digital, you need a business current account now more than ever. With a platform like Open, you can get one that helps manage all your business banking requirements from one place.

Why wait? When you can do so much more right now.

Set up Open’s online bank account and welcome a more simplified way of managing your business finances.