The Bharat Bill Payment System (BBPS) has been a game-changer for bill payments in India, offering a unified platform for all billers and customers to interact seamlessly. However, businesses across India have been struggling with outdated and inefficient Business-to-Business (B2B) payment processes.

To address these challenges, NPCI Bharat BillPay Limited (NBBL) and RBI developed Bharat Connect for Business (formerly known as BBPS for Business, a robust framework that ensures transparency, efficiency, and security in B2B transactions.

This article explains everything about Bharat Connect for Business, including the challenges in the current B2B payment system, how Bharat Connect for Business works, the key players involved, and important features and benefits.

What are the current challenges with B2B payments?

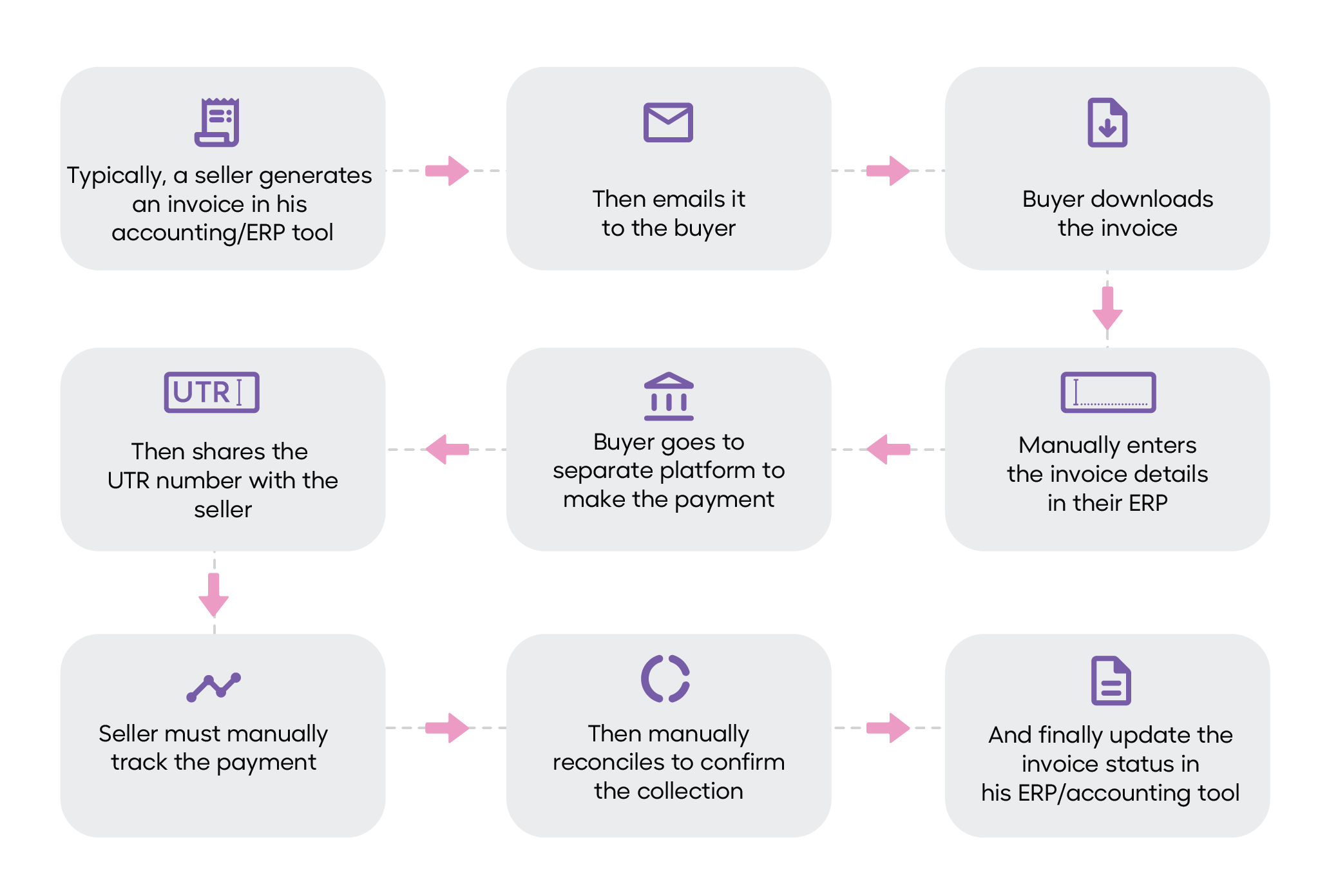

Traditionally, B2B payment processes have been challenged with a cumbersome, time-consuming series of manual tasks.

Here’s what a typical B2B payment process looks like:

With this siloed and manual workflow, businesses face challenges such as:

- Cumbersome invoicing

- Increased risk of errors

- Delayed vendor payments

- Overdue collections

- Time-consuming reconciliations

How does Bharat Connect for Business work?

Bharat Connect for Business, built on NPCI Bharat BillPay Limited’s (NBBL) interoperable BBPS network, offers a comprehensive solution to businesses’ challenges. This innovative payment system seamlessly interconnects ERPs, accounting software, and payment platforms, eliminating the need for manual intervention and delays.

The Bharat Connect for Business process is designed to streamline the entire payment workflow:

- Seller creates invoices using their existing accounting software or ERP.

- Buyer can instantly access it on their ERP.

- They can either accept, reject, or return the invoice

- Buyers can pay the accepted invoices directly from ERP via bank transfers, corporate cards, or payment gateways.

- Transaction status is updated in real-time for both seller and buyer.

Who are the key players in Bharat Connect for Business?

The Bharat Connect for Business ecosystem comprises many key players:

- BBPS Central Unit: The central system managed by NBBL, which operates the Bharat Connect for Business platform.

- Operating Units (OUs): Entities like OPEN bring accounting capabilities and banking partnerships to the platform.

- Agent Institutions (AIs): These are the front-end players, such as accounting software providers, ERPs, and payment enablers.

- Banking Partners (BPs): The banks that play a crucial role in payments and settlements.

What are the important features of Bharat Connect for Business?

Bharat Connect for Business is set to redefine how businesses handle their payments, offering a streamlined, secure, and efficient platform catering to the specific needs of B2B transactions.

It comes with:

- Seamless integration across platforms: Businesses can be easily identified and connected across various platforms, reducing the friction in payment processing and reconciliation.

- Enhanced security and compliance: The robust KYC process managed by OUs ensures that businesses on the network are verified, reducing the risk of fraud and improving trust between businesses.

- Scalability for businesses: Bharat Connect for Business supports scalability, allowing the onboarding of multiple businesses and managing numerous transactions efficiently. This is particularly beneficial for large enterprises with complex billing needs.

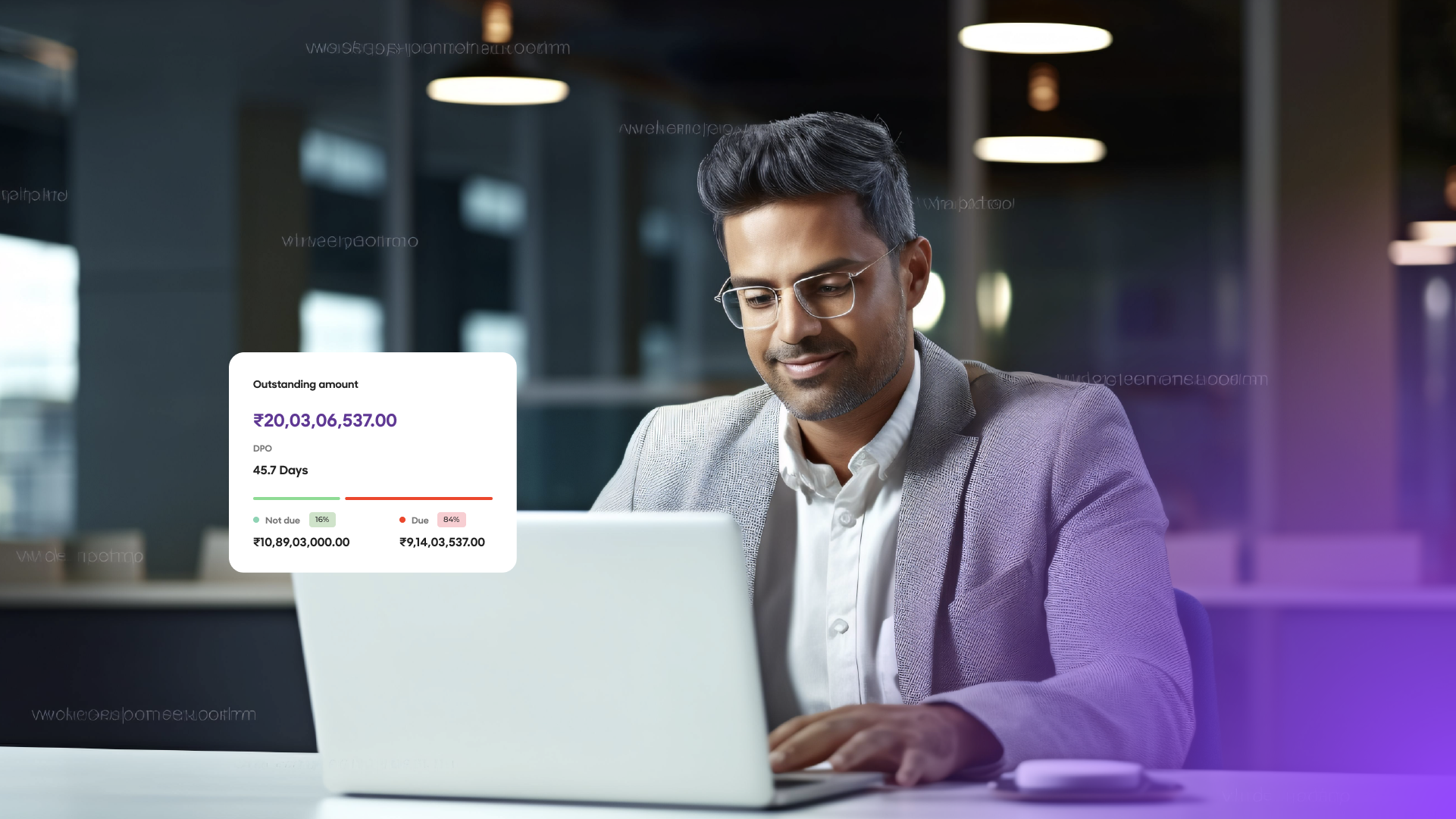

- Improved cash flow management: With real-time updates and the ability to automate payments through ERP systems, businesses can ensure timely vendor payments, reducing delays and improving cash flow management.

What are the benefits of Bharat Connect for Business?

Bharat Connect for Business offers a range of benefits for businesses, regardless of their size:

- Easy invoicing and collections: The seamless integration of invoicing and payment processing streamlines the entire workflow.

- Real-time payment tracking: Businesses can monitor the status of their vendor payments in real-time, ensuring better visibility and control.

- Reduced errors: The automated reconciliation process minimizes the risk of manual errors, enhancing accuracy.

- Improved efficiency: Eliminating manual tasks and delays leads to more efficient financial operations.

These advancements have the potential to significantly streamline businesses’ financial operations, resulting in a new era of efficiency, transparency, and accuracy in B2B payments.

Bharat Connect for Business represents a significant leap forward in the digital payments landscape. By addressing the pain points of current B2B payment processes, this innovative solution promises to revolutionize how businesses handle their financial operations.