Every tax professional knows that handling GST notices isn’t just about responding on time – it’s about accuracy, documentation, and complete visibility. From mismatch communications to scrutiny notices, the volume and complexity of notices have increased as the GST ecosystem matures. For CAs and enterprises managing multiple GSTINs, manually tracking and replying to notices on the GST portal has become both time-consuming and error-prone.

That’s where a GST notice management solution can make a difference. But with many tools claiming automation, how do you identify one that truly improves efficiency? Here’s a detailed look at the key features you should look for in a modern GST notice tracking system.

1. Centralized GST Notice Tracking System

A good GST notice management platform must bring every notice across all GSTINs and entities onto a single, searchable dashboard. Instead of sifting through emails or logging into the GST portal separately for each GSTIN, users should be able to:

- View real-time notice status (new, pending, replied, closed).

- Assign notices to team members or clients for quick collaboration.

- Access historical replies, deadlines, and attachments from one place.

This ensures no notice is missed or duplicated, a major risk when managing multiple registrations.

2. Automated GST Notice Handling and Classification

Manual tagging of notices is inefficient and error-prone. Look for a system that auto-detects and categorizes notices based on:

- Notice type (scrutiny, demand, audit, mismatch, etc.)

- Source (GSTN portal, DRC-01, DRC-07, email, or physical).

- Urgency and due dates, ensuring escalations before deadlines.

An automated GST notice handling engine should also extract relevant fields such as reference numbers, issue date, and responding officer, using OCR or GST API sync. This enables faster preparation of replies and avoids data entry fatigue during peak filing cycles.

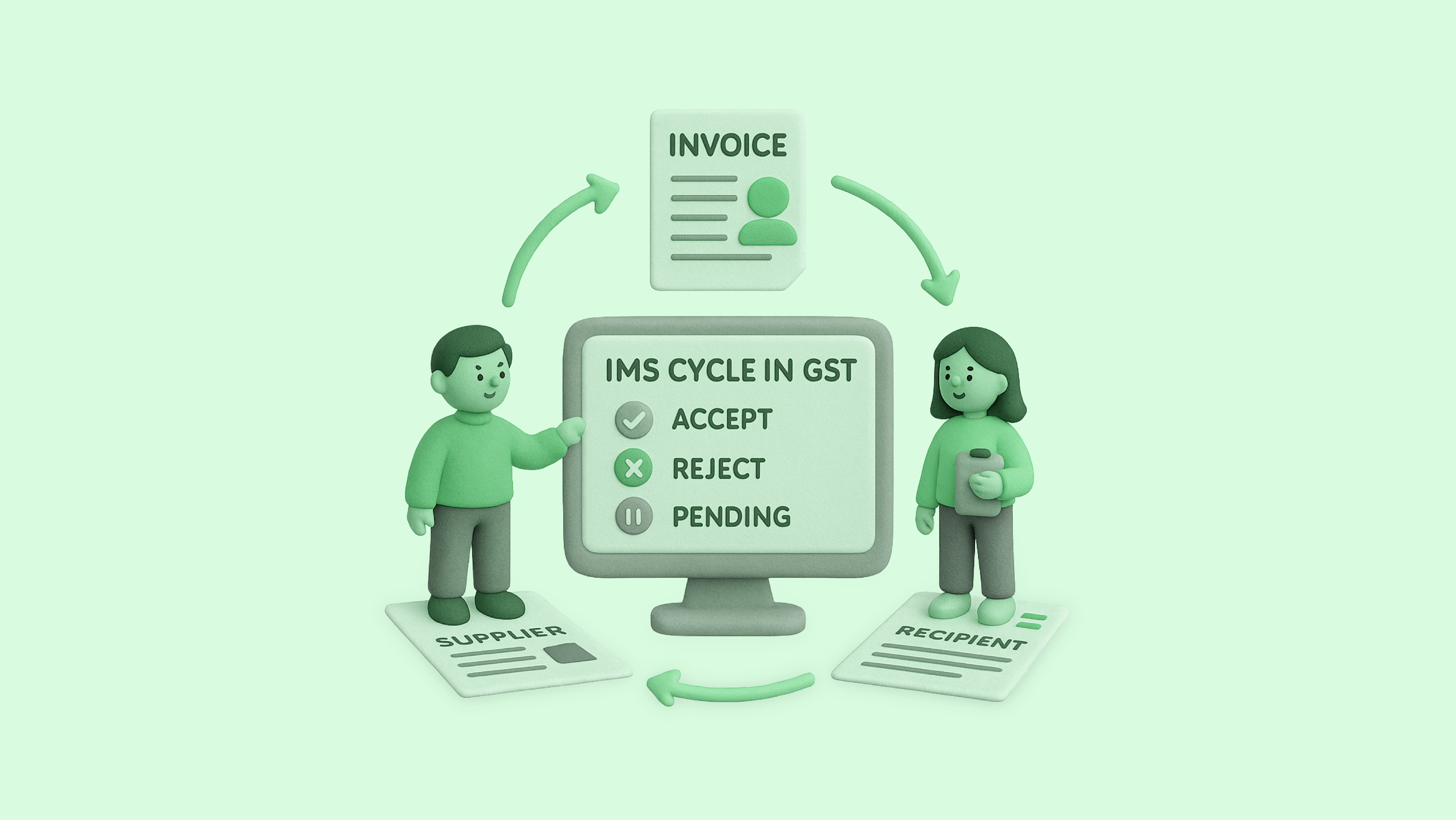

3. Seamless GST Portal Integration Features

The power of a strong GST portal integration lies in reducing manual dependency. Modern notice management tools connect directly with the GST system through secure APIs, enabling:

- Auto-fetch of notices and DRC forms from the GST portal.

- Real-time acknowledgment tracking when responses are filed.

- Status synchronization to show whether the response has been accepted, rejected, or pending review.

This reduces the risk of outdated information and ensures your internal records always reflect the live status from the government portal, crucial during audits and compliance reviews.

4. AI-Based GST Notice Management for Faster Insights

Artificial Intelligence has begun transforming compliance operations. An AI-based GST notice management module can:

- Identify recurring notice patterns, for example, repeated mismatches with the same vendor or recurring e-way bill discrepancies.

- Recommend draft responses by referencing similar past cases.

- Flag high-risk notices likely to escalate into demands based on historical response outcomes.

Over time, AI models learn from your firm’s or company’s past handling behavior, helping reduce manual review effort and standardize response quality across teams.

5. Collaborative Workflow and Role-Based Access

For CAs, enterprises, and tax teams, collaboration is key. Your solution should support:

- Role-based access controls (partners, juniors, reviewers, clients).

- Internal comments and document sharing without leaving the platform.

- Audit logs that capture every action taken, from draft replies to submission approvals.

Such workflows don’t just streamline communication; they also create accountability and traceability, essential for defending compliance in future scrutiny or litigation.

6. Smart Notifications and Deadline Alerts

Every missed notice deadline can mean penalties or blocked refunds. Look for configurable alerts that send reminders across email, SMS, or WhatsApp for:

- New notices fetched from the GST portal.

- Upcoming reply or hearing deadlines.

- Response submission acknowledgments.

Some tools also integrate with task management apps to help compliance teams plan their week around GST priorities.

7. Document Repository and Template Library

A powerful GST notice tracking system doubles as a digital document vault. It should securely store:

- Reply drafts and final submissions.

- Officer correspondence and evidence files.

- Templates for standard responses (DRC-01A, audit, or mismatch).

Having these organized and version-controlled saves hours during repeat cases or when multiple clients face similar issues.

8. Analytics and MIS Reporting

The best solutions go beyond tracking and actually help you measure compliance efficiency.

You should be able to generate reports such as:

- Entity-wise or GSTIN-wise notice volume and closure rate.

- Average turnaround time for replies.

- Category-wise risk distribution.

For CA firms managing several clients, this enables data-backed advisory, showing which clients consistently trigger scrutiny or where internal process improvements can reduce notice frequency.

9. Security and Data Privacy Controls

Since notice management involves confidential business and tax information, ensure the solution offers:

- End-to-end encryption for data in transit and at rest.

- Access logs and two-factor authentication for users.

- Audit-ready backups stored in compliance with Indian data protection norms.

This ensures that sensitive taxpayer data remains secure even when multiple users or external consultants access the system.

Why It Matters

Managing GST notices is no longer a reactive process. With automation, portal connectivity, and AI-driven insights, businesses can turn compliance from a burden into a strategic advantage.

A solution like Optotax’s Notice Management brings together all these capabilities, from auto-fetching notices and classifying them intelligently to enabling structured workflows and analytics, helping CAs and enterprises stay ahead of every deadline, every time.

Final Thoughts

Before choosing a notice management platform, evaluate how deeply it integrates with your GST operations: reconciliation, response drafting, filing, and challan workflows. The goal isn’t just automation; it’s to ensure accuracy, transparency, and control across every stage of compliance.

When implemented well, a robust AI-based GST notice management system can save hundreds of work hours annually, minimize non-compliance risk, and give your team the peace of mind that nothing slips through the cracks.