Goods and Services Tax (GST) is a comprehensive indirect tax levied on the supply of goods and services across India. Introduced on July 1, 2017, GST replaced multiple indirect taxes such as VAT, service tax, and others, simplifying business tax compliance.

GST registration is a legal requirement for businesses meeting certain turnover criteria or engaging in specified activities. This guide covers eligibility, the registration process, required documents, and compliance obligations.

Who Needs GST Registration?

GST registration is mandatory for the following entities:

Turnover-Based Registration

- Businesses with an annual turnover exceeding ₹40 lakh (for goods) and ₹20 lakh (for services) in most states.

- For North-Eastern and special category states, the threshold is ₹20 lakh for goods and ₹10 lakh for services.

- Special category states include Arunachal Pradesh, Assam, Manipur, Meghalaya, Mizoram, Nagaland, Sikkim, Tripura, Himachal Pradesh, and Uttarakhand.

Mandatory Registration Regardless of Turnover

- Businesses involved in interstate supply of goods and services.

- E-commerce operators and sellers selling through e-commerce platforms.

- Casual taxable persons and non-resident taxable persons.

- Input Service Distributors (ISD).

- Persons required to deduct TDS under GST.

- Businesses supplying goods on behalf of another taxable person (agents or intermediaries).

Voluntary Registration

Any business can voluntarily register under GST to avail Input Tax Credit (ITC) and enhance business credibility.

Benefits of GST Registration

- Conduct legally compliant operations: Avoid penalties and legal repercussions by registering for GST as per the law.

- Avail Input Tax Credit (ITC): Registered businesses can claim ITC on purchases, reducing tax liability.

- Interstate business expansion: Businesses can trade freely across India without restrictions.

- Competitive advantage: GST registration boosts credibility with buyers, suppliers, and financial institutions.

- Participation in Government tenders: Many government contracts require GST registration.

GST Registration Process: Step-by-Step Guide

GST registration is done online through the GST portal (www.gst.gov.in). Here’s how you can register:

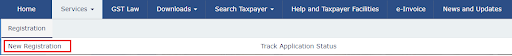

Step 1: Visit the GST Portal

- Go to the GST registration page on the official GST website.

- Click on New Registration under ‘Services’.

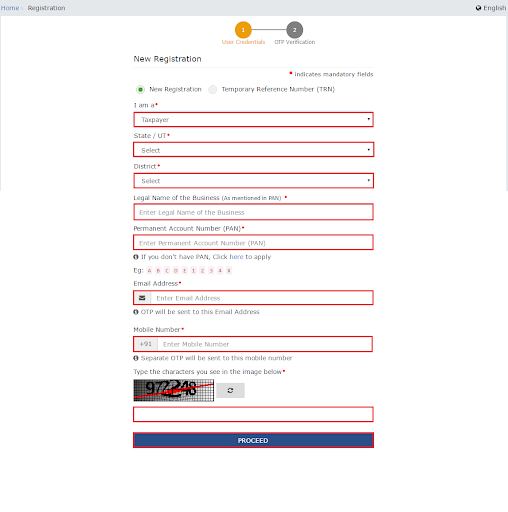

Step 2: Fill Part A of the Application

- Choose Taxpayer as the type of applicant.

- Select the state where the business is registered.

- Enter the legal name of the business (as per PAN), PAN of the business, mobile number, and email ID.

- Click the PROCEED button.

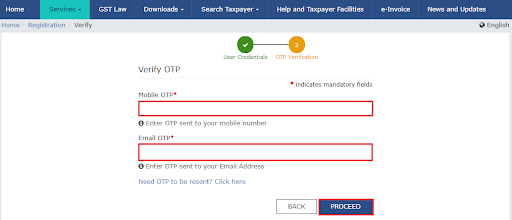

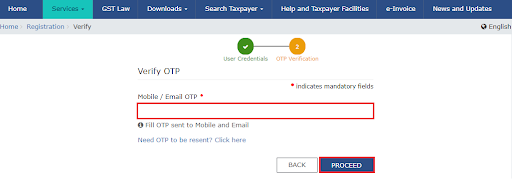

- Verify the OTP received on the registered mobile number and email. OTP sent to the mobile number and email address are different.

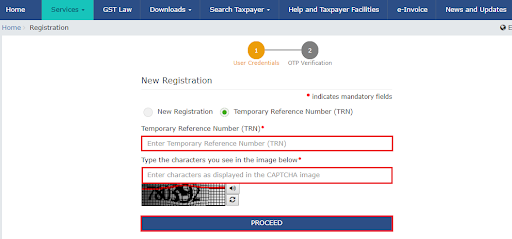

- A Temporary Reference Number (TRN) is generated.

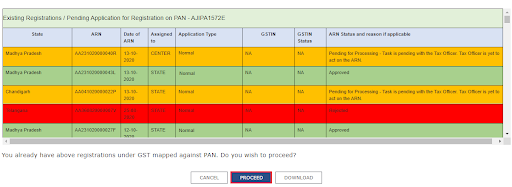

Note: On clicking proceed, the GST Portal displays all the GSTINs / Provisional IDs / UINs / GSTP IDs mapped to the same PAN across India. The GST portal displays all the GSTINs / Provisional IDs / UINs / GSTP IDs mapped to the same PAN across India.

- You can download the existing registration details in PDF format.

- Following color code has been used to donate different statuses of the ARN:

- Green Color: Approved Registration Application.

- Red Color: Rejected Registration Application.

- Orange Color: Pending for Processing/Pending for Order Registration Application.

Step 3: Fill Part B of the Application

- Login using the TRN and complete the form.

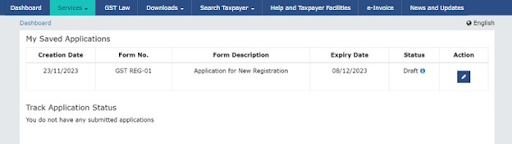

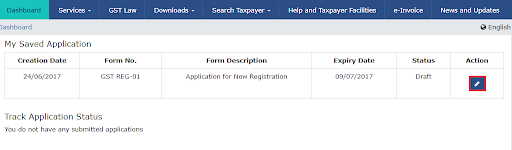

- After login, the ‘My Saved Application’ page is displayed. Under the ‘Action column,’ click the Edit icon.

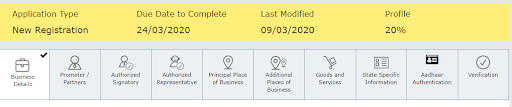

- Provide business details, including trade name, constitution of business, and principal place of business.

- Mention the HSN (Harmonized System of Nomenclature) codes for goods/services supplied.

- Specify the bank account details (optional).

- Upload required documents (list provided below).

- Complete the application as instructed on the screen.

Note:

- Notice the Expiry Date shown in the screenshot above. If the applicant doesn’t submit the application within 15 days, the TRN and all information filed against that TRN will be purged after 15 days.

- The registration application’s status is ‘Draft’ unless it is submitted. Once it is submitted, the status is changed to ‘Pending for Validation’.

Documents Required for GST Registration

For Sole Proprietors/Individuals:

- PAN Card of the applicant

- Aadhaar Card

- Passport-sized photograph

- Business address proof (electricity bill, rental agreement, NOC)

- Bank account details (statement or canceled cheque)

For Partnerships/LLPs:

- PAN Card of the partnership firm

- Partnership deed

- PAN & Aadhaar of partners

- Address proof of business

- Bank account details

For Private/Public Limited Companies:

- PAN of the company

- Certificate of Incorporation

- MOA & AOA

- PAN & Aadhaar of directors

- Board resolution authorizing a director for GST compliance

- Business address proof

- Bank account details

Step 4: Verification and Submission

- Verify the details using a Digital Signature Certificate (DSC) or Electronic Verification Code (EVC).

- Submit the application and receive an Application Reference Number (ARN) via email/SMS.

Step 5: GST Officer Approval

- The GST officer verifies the application and documents.

- If any clarifications are required, the officer may request additional documents.

- Once approved, the GSTIN (GST Identification Number) and registration certificate are issued.

How to Check GST Registration Status?

To track the status of your GST registration:

- Visit the GST portal.

- Click on ‘Track Application Status’ and enter ARN.

- Check approval status.

GST Registration Fees

GST registration is completely free of cost. However, businesses may opt for professional assistance at an additional service charge.

Penalties for Non-Compliance

Businesses failing to register under GST when required are subject to penalties:

- For unregistered businesses: 10% of tax due (minimum ₹10,000).

- For deliberate evasion: 100% of tax due.

Post-Registration Compliance

Once registered, businesses must comply with GST regulations:

GST Returns Filing

- Monthly/quarterly returns (GSTR-1, GSTR-3B)

- Annual return (GSTR-9)

E-Way Bills

- Required for transporting goods exceeding ₹50,000 in value.

GST Invoice Compliance

- Issue GST-compliant invoices with GSTIN, HSN/SAC codes, and tax breakup.

GST Payments

- Timely GST payments through the portal to avoid penalties.

Compliance with E-Invoicing (if applicable)

- Businesses with turnover exceeding ₹5 crore must generate e-invoices.

GST registration is essential for businesses to operate legally and avail of certain tax benefits. It streamlines taxation and facilitates seamless trade across India. Ensuring timely registration and compliance with GST laws can help businesses avoid penalties and enhance credibility. If you are unsure about the process, consider seeking professional assistance to ensure smooth GST compliance.

Did You Know

Zwitch’s (Powered by OPEN) GSTIN Verification API enables businesses to instantly validate GST details in real-time, helping avoid errors in compliance and ensuring seamless business transactions.

Disclaimer: The information provided in this article is for informational purposes only. Please refer to the official GST portal or consult a tax expert for specific guidance.