CFOs today direct their organization’s growth strategy rather than just focusing their efforts on managing financial and risk management.

They are expected to be strategic partners to the CEO in business planning, write down the financial roadmap, communicate a clear financial picture of the stakeholders, and collaborate with CIOs to protect proprietary financial data. The financial roadmap ultimately guides the strategies for market expansion, acquisitions, organic growth, and new product initiatives.

The changing role of CFOs in the digital age

In all this, especially business planning and budgeting, the primary role of CFO is to be agile, forward-looking, and adaptive to new technologies. Deloitte findings reveal that 75% of CFOs believe that agile financial planning is essential for business success.

Budgeting has seen maximum transformation over the years as a methodology and practice. The role of CFOs is increasingly getting focused on opting for agile financial planning methodologies and automation via accounts payable automation and other finance reporting solutions to enable accurate forecasting and collaboration across teams.

CFOs are also adapting to the latest technologies, such as AI and ML, automation, etc., to enhance flexibility, responsiveness, alignment with business objectives, and changing market conditions.

Daimler Mobility built a forecasting engine to automate high-quality forecasting on a monthly basis. CFOs and top management allow the overwriting of these algorithmic forecasts so that the budget incorporates the information the forecasting engine couldn’t accommodate. This process at Daimler Mobility keeps budgeting agile, tech-driven, and forward-looking.

While the objective of budgeting hasn’t dramatically shifted, the context in which a budget exists has changed dramatically. Let’s discuss the evolution of budgeting and how technology interlaced with modern budgeting approaches has made CFOs into strategic partners today.

The limitations of traditional budgeting methods

If we delve a bit into the history of budgeting in business, budgets were always meant to ‘manage expectations.’ An organizational budget would be about the specific allocation of scarce resources during a particular financial year and cover a few key aspects, such as:

- The kind of resources

- Deployment of these resources

- The users and usages of these resources

- Controlling and measuring parameters

CFOs earlier were relentlessly trying to square a circle when it came to budgeting, while the budgeting process itself was an attempt to meet entirely incompatible objectives. Also, traditional budgets were rigid and inflexible.

BCG Consulting explains the trilemma that traditional budgets face:

- Target setting: Finance teams set targets to motivate and encourage employees to perform. This function requires directional and stretch goals.

- Forecasting: Budgeting provides forecasts of future developments. However, these forecasts work only when they are realistic and unbiased. A good example of this could be the expected sales target for the production department, which would work better than the stretch targets the sales department attempts to meet.

- Resource allocation: The C-suite allocates resources to the most value-creating opportunities. However, the management is always there to set boundaries around spending and intervene to control costs.

Traditional budgeting has conflicting objectives that will always clash and make achieving goals impossible. Also, a company’s operations never run in watertight timeframes. For instance, some accounts payable invoices will carry forward to the next FY, while others may become an NPA. A 12-month period may prove too long or too short, depending on the type of goals the management wants to achieve.

BCG enlists some disadvantages that accompany traditional budgeting:

“The traditional budgeting process leads to a long list of problems and challenges, ranging from the significant cost and effort required to create the budget to counterproductive motivations, unrealistic targets, gaming, and year-end spending fever.”

Emerging budgeting techniques and their advantages

Today, the CFO’s expectations around budgeting outcomes have evolved. CFOs recognize that ‘short-term goals must lead to achieving long-term strategic goals that increase shareholder value’ for achieving efficiency in their accounts payable and receivable processes.

CFOs realize the need for organizational nimbleness, translating into budgeting techniques that involve constant revisits and updates relative to changing business conditions. Some of these emerging business techniques are as follows:

Rolling forecasts

Rolling forecasts is a budgeting technique involving continuous planning, unlike static budgeting.

A static budget, like an annual or quarterly budget, sets out the entire spending cycle for a company’s teams and departments in advance for a set time period. However, a static budget has an obvious flaw. It’s too rigid to accommodate all financial events and their impact on a company within that set time frame.

Rolling forecasts also work on a set time frame but without an end date. A typical 12-month rolling forecast is updated quarterly or monthly. This ensures you always have a plan in hand for the upcoming 12 months whenever you look at the budget.

Rolling forecasts allow real-time decision-making and planning outcomes based on actual results rather than future performance.

Energy company Equinor switched to dynamic forecasting around a few time zones. The finance team creates new forecasts when circumstances change, and a common forecasting database for accounts payable and receivables enables a companywide forecast.

Zero-based budgeting (ZBB)

Zero-based budgeting, or ZBB, involves beginning afresh from scratch with a new budget instead of adjusting the previous budget.

Under ZBB, every function is analyzed to determine the needs and costs for the upcoming period. This helps teams to align their needs with expected returns.

ZBB is great for organizations working to eliminate inefficiencies accumulated from previous budgets and revamp their existing cost structure based on actual business needs.

Driver-based budgeting

True to its name, driver-based budgeting, or DBB, focuses on key business drivers. DBB involves identifying the activities or primary factors that ultimately influence an organization’s financial performance and developing a budget based on them.

DBB is advantageous because it helps link financial projections and costs to operational drivers such as the customer base, number of units being produced, sales volume, etc. DBB establishes the cost-and-effect relationship between outcomes and operations.

DBB is great for rapidly evolving industries and organizations that rely heavily on operational efficiency and must monitor their KPIs. Given its agility, DBB is a preferred budgeting technique for many CFOs.

The impact of advanced technologies on budgeting

Financial planning involves handling large amounts of data, which can be difficult to manage. Also, at the speed at which business conditions change, it is difficult for finance professionals to balance long-term and short-term strategies. That’s where technologies like AI, ML, and predictive analysis help.

Here are a few ways technology can help CFOs in budgeting and financial planning:

- To automate repetitive tasks, such as data entry and reconciliation, freeing up more time for strategic decision-making

- To automate data capture, aggregation, and analysis for informed decision-making

- To develop comprehensive financial forecasts and models that can help CFOs to identify potential risks and opportunities.

- To facilitate communication and collaboration for real-time updates and information sharing

- To integrate accounting and ERP systems, such as accounts payable and receivables, to ensure that the CFOs remain up-to-date

- To provide real-time reporting and analytics to help CFOs make decisions based on real-time information and analysis.

Strategies for CFOs to lead the transition to modern budgeting practices

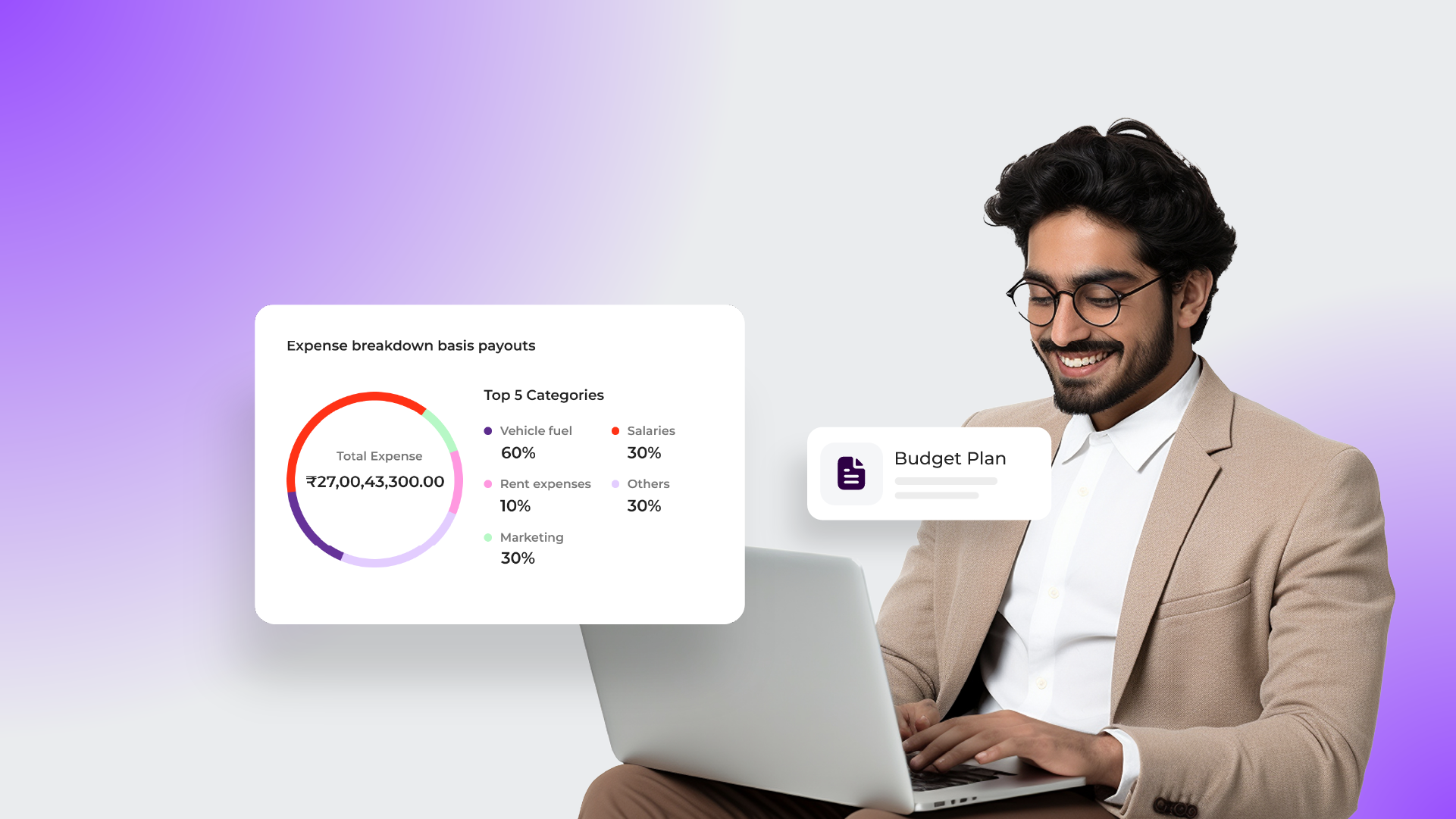

The financial landscape continues to be disrupted by new-age tech solutions and automation software like accounts payable automation solutions from OPEN. There’s an even greater need for CFOs to lead the transformation of the financial function to keep up with the changing market conditions.

CFOs use AI and analytics tools to gain deeper insights into cost and profitability, align performance with business strategy, and manage more accurate forecasts. These AI tools can help CFOs better understand the relationship between KPIs and actual performance. However, CFOs can also apply certain strategies to better implement these SaaS-based solutions within the organization’s internal structure and processes.

- A CFO must ensure that all the people who need access to these systems have been onboarded well.

- They should standardize all accounting, financial reporting, and operational templates and create a reporting calendar for the finance team to provide real-time analysis and leverage information to improve company-wide processes.

- CFOs must use the reports and analytics obtained from the tools to gain strategic insights into processes for improving financial and operational performance and standardizing databases.

- Take a proactive approach to address the issues and enable smooth AI and analytics tools integration into the internal systems.

- Encourage the development of cross-functional teams and healthy communication between them for a holistic understanding of how each functional area operates, which functional area contributes to the maximum profits, and to maximize financial performance.

Adopting budgeting evolution for long-term financial agility and success

With rapid technological innovations and a fast-paced business environment, CFOs are increasingly finding a year-long budget period too long to accommodate all ad hoc events and business volatility.

The budget needs to reflect an adequate time zone. CFOs need to be nimble and use the latest data management tools so that no information remains unanalyzed or unaddressed. Budgets will continue to play an important role in shaping business perspectives and priorities, but they must be combined with forecasting and automation software for quick decision-making, risk mitigation, and ensuring long-term goals are met.