Every tax professional knows that GST compliance is as much about accuracy as it is about system reliability. When a challan payment doesn’t reflect, a return fails to upload, or an OTP doesn’t arrive at the last minute, it’s not just an inconvenience; it directly impacts filings, deadlines, and client trust.

The GST portal has simplified compliance by digitizing most tax processes, but like any large system, occasional technical issues are inevitable. That’s why understanding the GST grievance redressal process matters. It gives professionals a structured way to report errors, track progress, and ensure that compliance work isn’t delayed by technical roadblocks.

Knowing when and how to raise a ticket on the GST portal can help save hours during busy filing cycles and prevent workflow disruptions for your clients or organization.

When Should You Raise a GST Complaint on the GST Portal?

Not every issue needs a ticket, but some do require formal escalation through the grievance mechanism. Generally, you should raise a complaint when you face:

- Technical glitches – Login errors, OTP not received, DSC registration failures, or return filing interruptions.

- Payment or challan issues – CIN not generated, payment marked as “failed” despite debit, or cash ledger not updated.

- Refund or registration delays – Applications or refunds stuck under “Processing” for extended periods.

- Ledger discrepancies – Mismatch between GSTR-2B and the Electronic Credit Ledger, or ITC not updating correctly.

However, for legal or policy clarifications – such as rate disputes or procedural doubts, it’s best to contact your jurisdictional GST officer instead of using the grievance portal.

Steps to Raise a GST Complaint Ticket Online

Filing a complaint on the official GST portal is a straightforward process. Here’s how you can do it:

Step 1: Visit the GST Portal

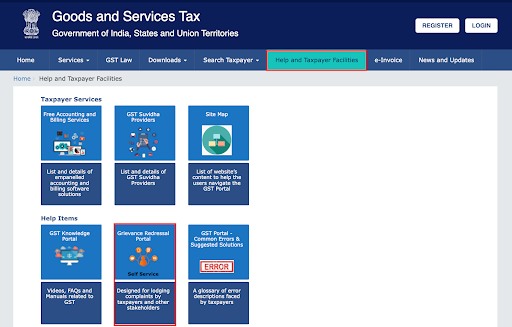

Go to www.gst.gov.in. On the header, click “Help and Taxpayer Facilities.” Under this section, select “Grievance Redressal Portal.”

Step 2: Report Issue

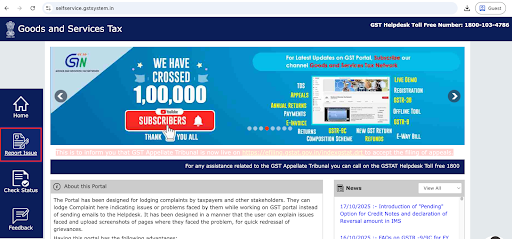

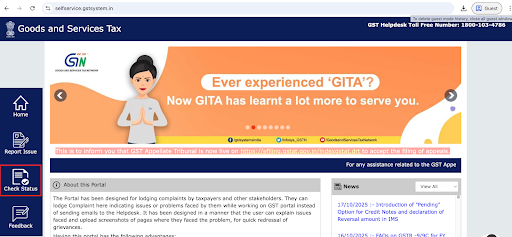

You’ll be redirected to the GST Self-Service Portal at https://selfservice.gstsystem.in/, where both registered and unregistered users can file complaints.

Click on “Report Issue” to raise a new ticket.

Step 3: Fill Out the Ticket Details

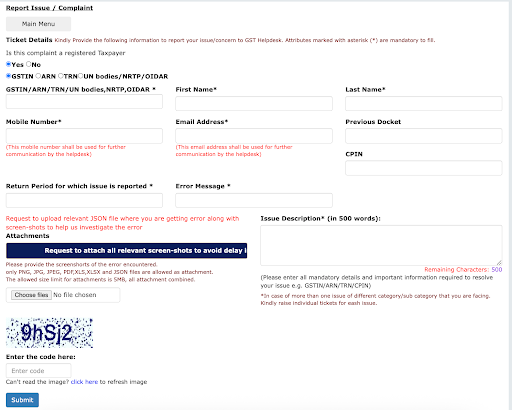

Select whether you are a registered taxpayer or an unregistered user, then fill in the required details such as:

- GSTIN/ARN/TRN/UN Body/NRTP/OIDAR details

- Name and contact information

- Return period for which the issue is being reported

- Exact error message (if displayed on the portal)

- Description of the issue. You can also upload supporting documents or screenshots (maximum file size: 5 MB). Avoid including sensitive credentials or unrelated attachments.

Step 4: Submit and Note the Ticket ID

Enter the captcha and click “Submit.”

Once submitted, you’ll receive a Ticket Reference Number which can be used to track your complaint’s progress.

You can revisit the same portal anytime to check the latest status of your ticket.

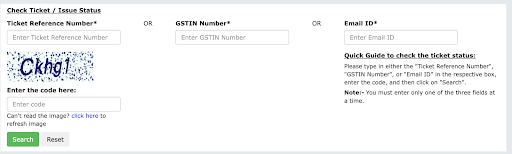

Step 5: Track Your Complaint

Go back to the Self-Service Portal and click “Check Status.”

Enter your Ticket Reference Number, GSTIN, or Email ID, complete the captcha verification, and view your ticket’s current status – whether it’s open, under review, or resolved.

GST Helpline and Support Services

For additional help, the GST Network (GSTN) provides multiple support channels alongside the online ticketing system:

- GST Helpdesk (Toll-Free): 1800-103-4786

- Email Support: [email protected]

- Official Twitter Handle: @askGSTech — for real-time issue notifications and system updates

If your ticket remains unresolved or delayed, you can escalate it to your State or Zone-wise Nodal Officer for GSTN issues, whose contact details are available on the same grievance portal.

Common Scenarios Where the GST Grievance System Helps

Many practical situations can be quickly resolved through this process:

- E-Challan not reflecting after payment: Submit the ticket with the challan copy and transaction ID.

- E-Invoice generation errors: Attach the JSON file and error screenshot; resolutions typically come within 24–48 hours.

- PAN not linked with GSTIN: Raise a request with a valid PAN document.

- Return showing validation error: Mention the return period, form type, and exact error message to help GSTN replicate and fix the issue.

Each case benefits from clear documentation, concise descriptions, correct category selection, and proper attachments ensure faster resolution.

Tips for Effective GST Complaint Resolution

- Prepare all documents first: Keep screenshots, challan copies, and transaction references handy.

- Avoid raising duplicate tickets: It can slow down processing.

- Standardize issue reporting: For recurring challenges across multiple GSTINs, use a consistent issue-reporting template.

These practices help tax teams stay organized, especially during high-volume filing seasons.

Final Thoughts

The GST grievance redressal system is not just a complaint form – it’s a structured support framework that ensures technical issues don’t interrupt compliance timelines. For professionals handling multiple entities, mastering this process can significantly reduce downtime and prevent last-minute filing stress.

FAQs

Q1. Can I raise a GST complaint without logging in?

Yes. Unregistered users can file complaints directly at https://selfservice.gstsystem.in/ReportIssue.aspx.

Q2. How long does GSTN take to resolve a ticket?

Most issues are addressed within 24–72 hours, depending on complexity and data verification needs.

Q3. Can I modify a grievance after submission?

No. Once submitted, the GST complaint form can’t be edited. However, you can reply to the follow-up email or raise a new ticket referencing the earlier one.

Q4. What should I do if my ticket remains unresolved?

You can escalate it by contacting your jurisdictional GSTN Nodal Officer or sending details to [email protected] along with your Ticket ID.