If you run a business or offer professional services, you already know that staying on top of GST payments is crucial. One key part of that process is learning how to generate GST challan correctly. Whether it’s for your monthly GST filing, paying penalties, or making voluntary payments, understanding the steps to generate a GST challan is important for smooth compliance.

In this guide, we’ll walk you through when you need a GST challan, where to create it, and how to do it step-by-step.

Benefits of GST Challan

A GST challan is more than just a payment slip — it plays an important role in managing your tax obligations effectively. Here’s why:

- Creates a Clear Payment Record:

Each challan acts as proof of payment, helping you maintain clean, verifiable records for audits and GST return filings. - Ensures Timely Compliance:

Filing GST returns often requires clearing dues first. A challan allows you to settle taxes promptly and avoid late fees. - Flexible Payment Methods:

You can pay through net banking, NEFT/RTGS, debit cards, or credit cards, depending on your preference. - Real-Time Ledger Update:

Payments made through a challan instantly reflect in your electronic cash ledger, making future filings faster and smoother.

Where to Generate a GST Challan

You can generate a GST challan directly on the official GST portal. This option is available for both registered and unregistered users, and the process is user-friendly, guiding you step by step to fill in the necessary details.

Step-by-Step Guide to Generate GST Challan

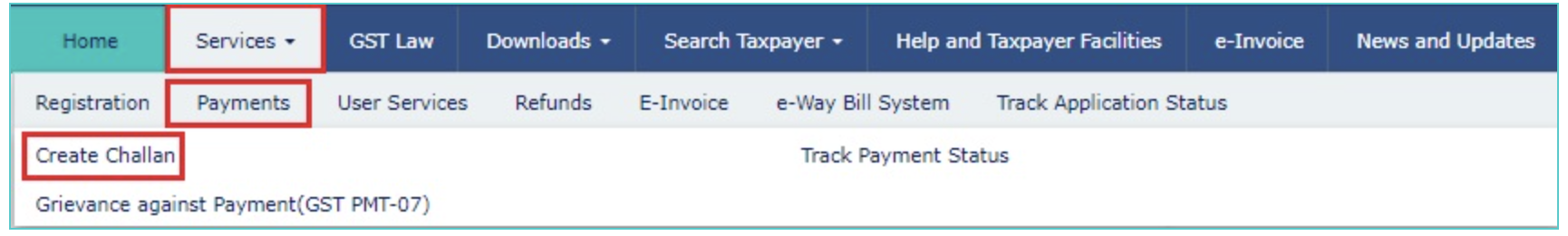

1. Start by visiting the GST Portal at https://www.gst.gov.in. Once you’re on the homepage, navigate to Services → Payments → Create Challan. This option is easy to find and available directly on the main menu.

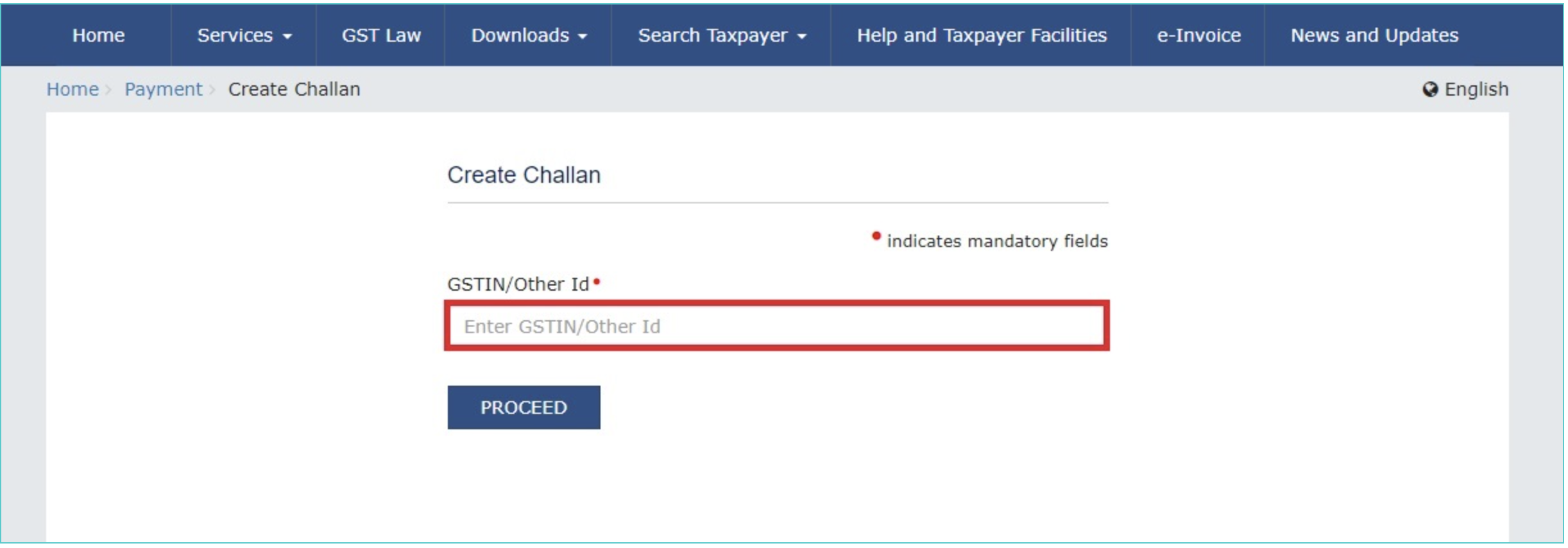

2. If you are registered, enter your GSTIN. For those with a Temporary ID, enter that instead.

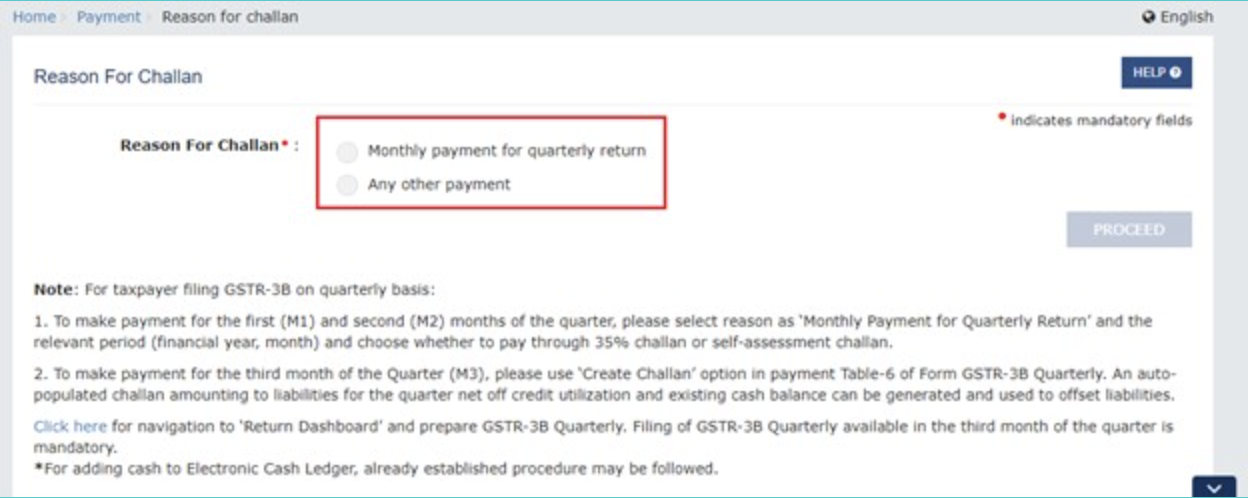

3. The ‘Reason for Challan’ page will appear. Choose the appropriate reason, either ‘Monthly payment for quarterly return’ or ‘Any other payment’.

Note: For taxpayers filing Form GSTR-3B quarterly under the QRMP Scheme and intending to make payments for the first two months of the quarter, the reason should be selected as “Monthly payment for quarterly return”. This will display the Financial Year, Period, and Challan Type fields. If “Any other payment option” is selected, you will be taken directly to the “Create Challan” page. However, taxpayers who have chosen monthly filing cannot generate a challan with the “Monthly payment for quarterly return” reason.

For taxpayers filing Form GSTR-3B on a quarterly basis under the QRMP Scheme:

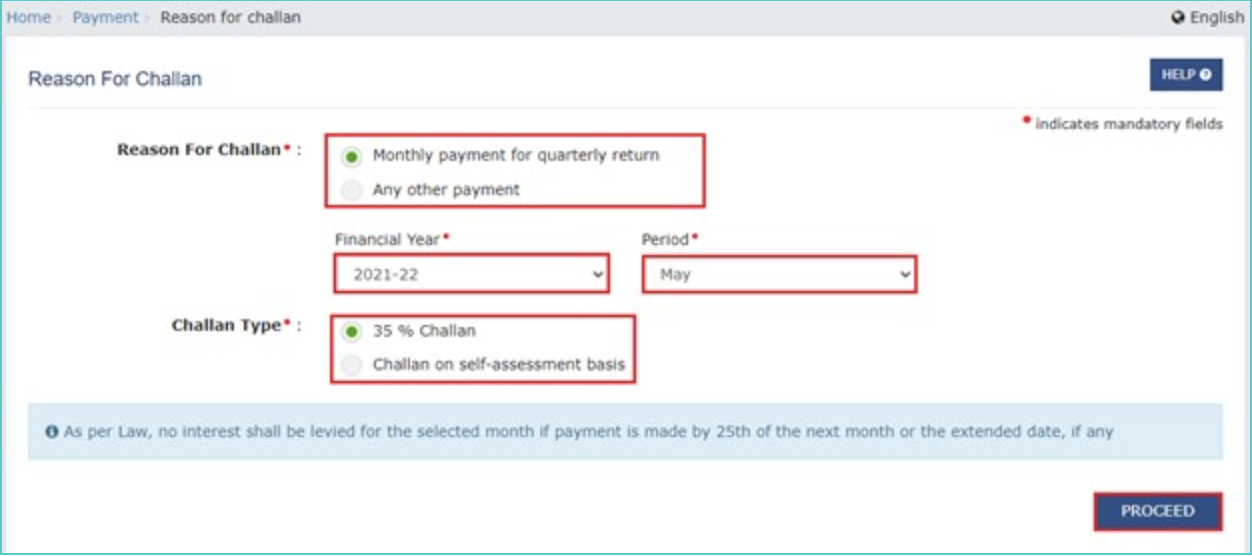

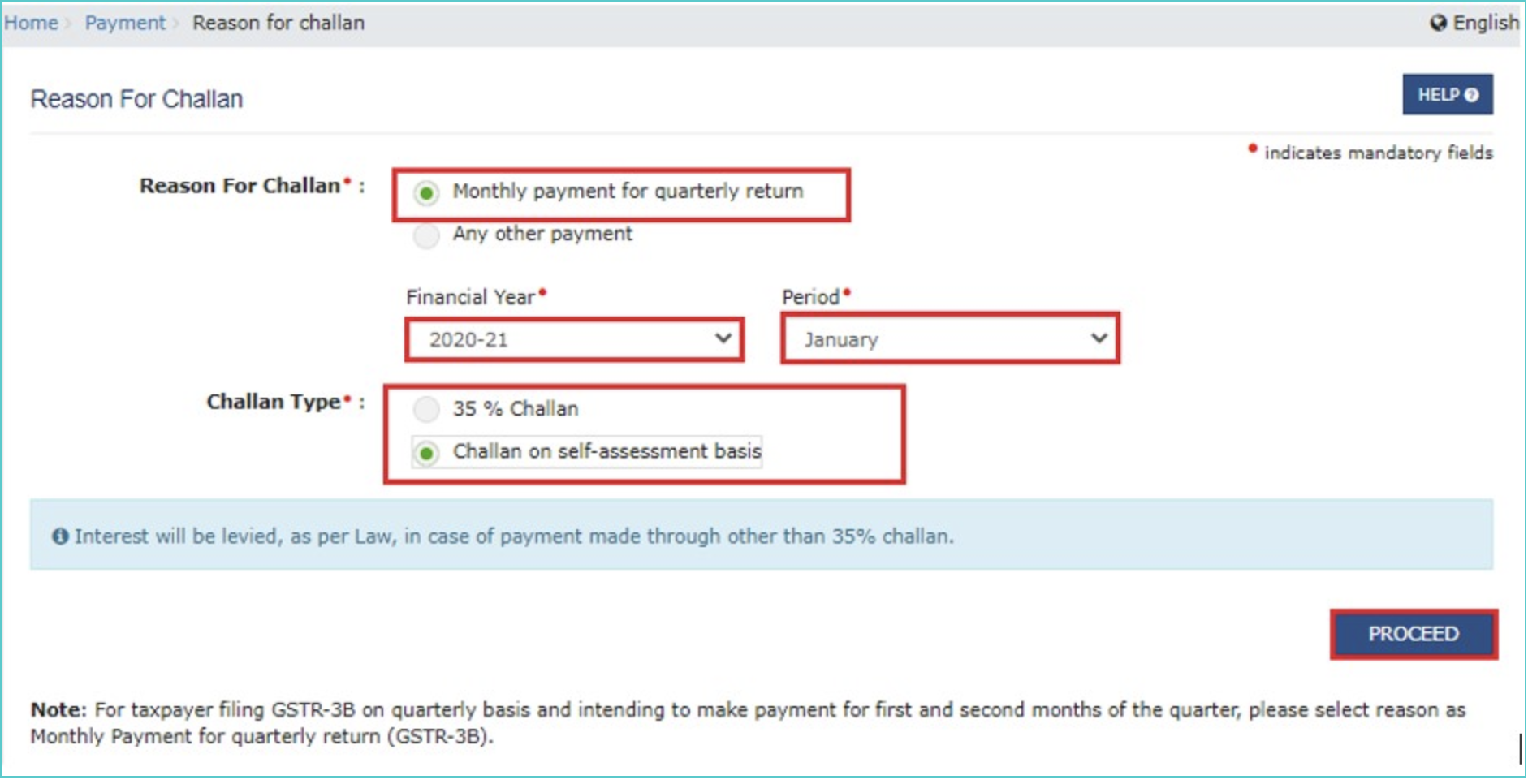

1. Select Monthly payment for quarterly return as the reason. From the Financial Year and Period drop-down lists, choose the relevant year and period for the challan. Then, select the Challan Type as either 35% Challan or Challan on self-assessment basis, depending on your case. Finally, click the PROCEED button to continue.

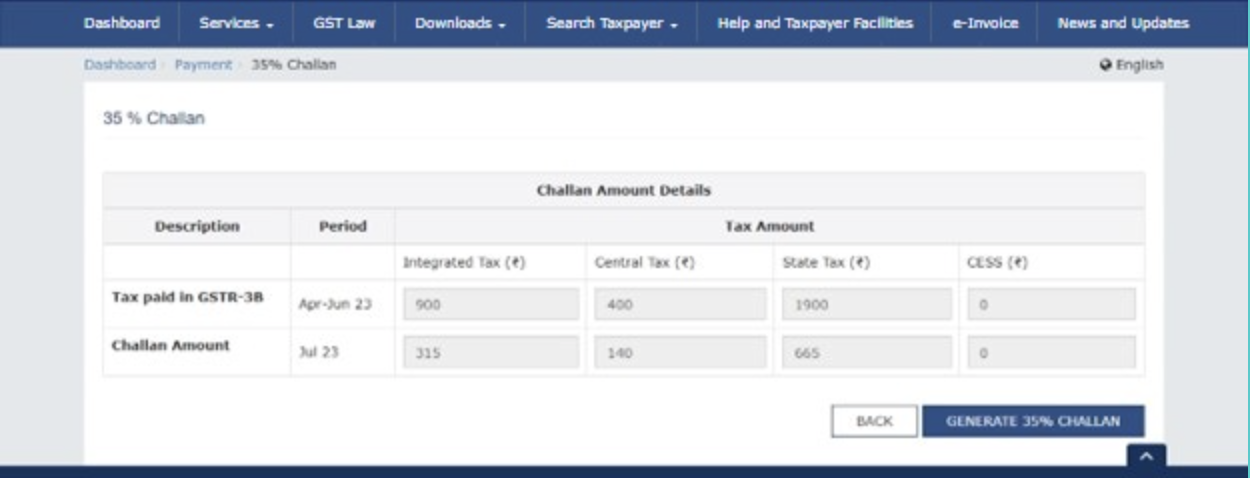

2. The Challan Amount Details section will automatically show 35% of the tax paid in cash in the previous quarter’s Form GSTR-3B as the challan amount. These details are auto-filled and cannot be edited or deleted. Simply click the GENERATE 35% CHALLAN button to proceed.

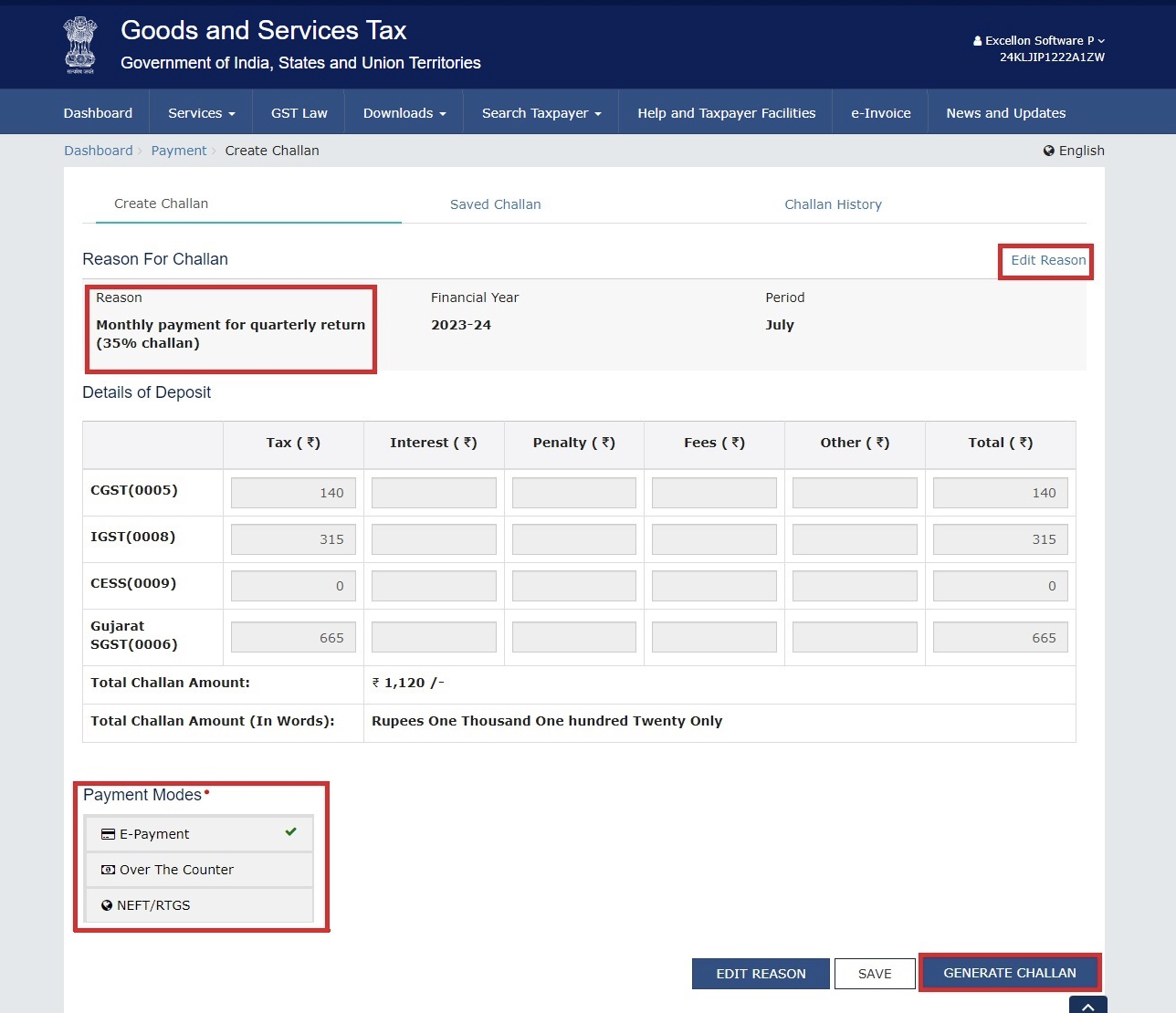

3. The taxpayer is directed to the Create Challan page, where the Details of Deposit are automatically filled in. The Reason for Challan will show as ‘Monthly payment for quarterly return (35% challan)’. Choose the payment mode and click GENERATE CHALLAN to complete the process.

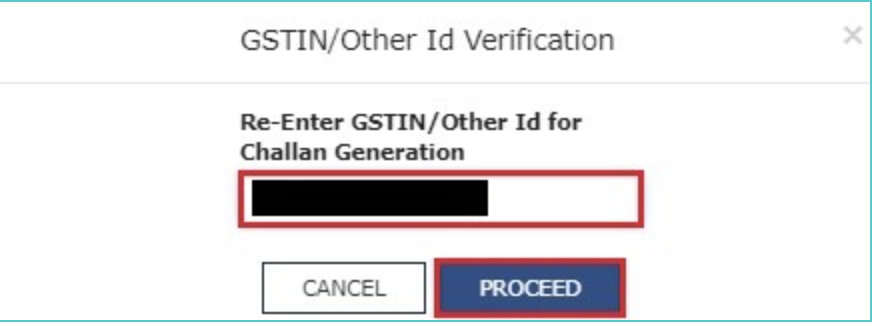

Note: In pre-login mode, re-enter your GSTIN or Other ID in the required field and click PROCEED.

If applicable, select “Challan on self-assessment basis” as the challan type and click the “PROCEED” button.

1. The Create Challan page will appear with Monthly payment for quarterly return pre-selected as the reason. Fill in the challan details under the Details of Deposit section, choose a payment mode, and click the GENERATE CHALLAN button to create the challan.

2. To change the reason for the challan, click the EDIT REASON button to go to the Reason for Challan page. The payment amount will be auto-filled in the Total Challan Amount fields.

In pre-login mode, re-enter your GSTIN or Other ID in the GSTIN/Other ID for Challan Generation field and click PROCEED.

Note: In pre-login mode, taxpayers have restricted payment options. Only Net Banking and NEFT/RTGS are allowed. Debit/Credit Card is available only after logging in.

In the case of generating a challan for non-return liabilities.

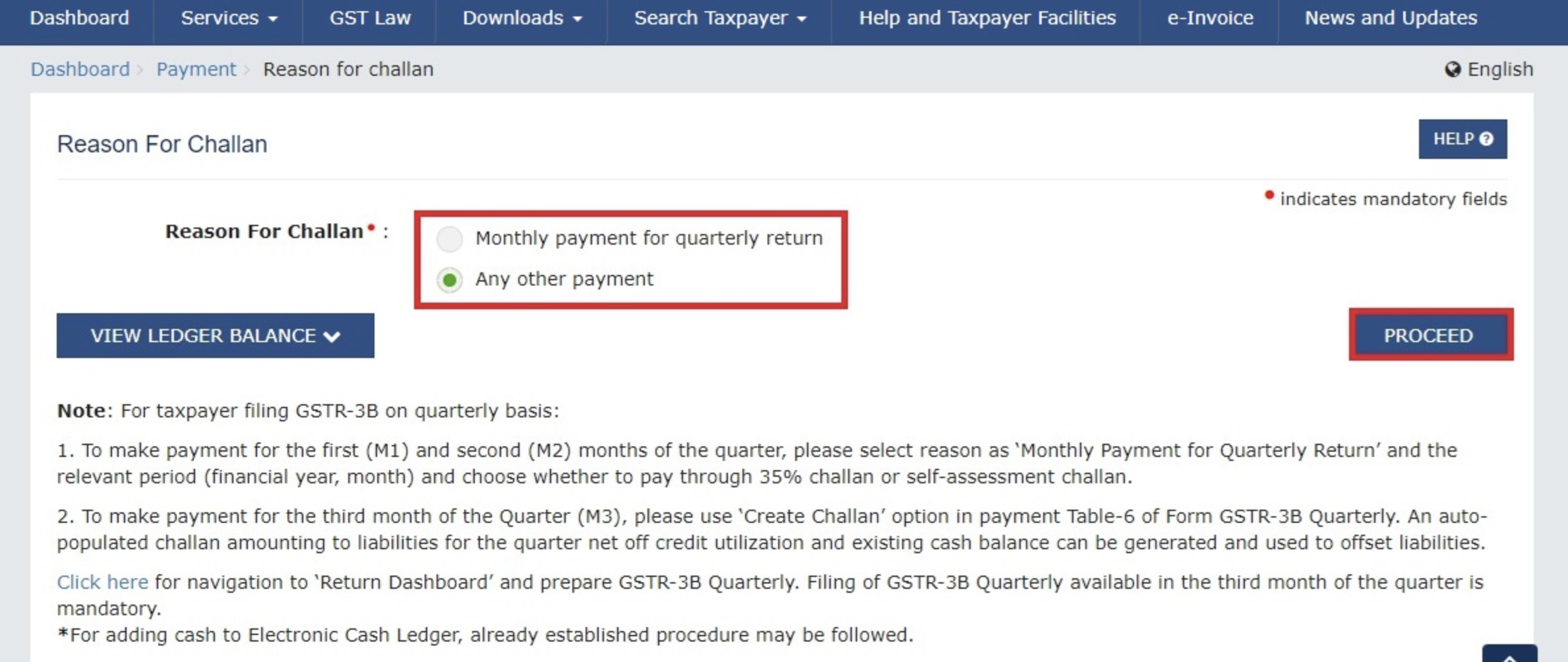

1. To generate the challan, select Any other payment as the reason and click the PROCEED button.

2. The Create Challan page appears. Enter the payment details and choose your preferred payment mode, such as E-payment, Over The Counter, or NEFT/RTGS.

Click GENERATE CHALLAN to proceed.

Note: If the taxpayer selects Over The Counter as the payment mode, the total tax amount cannot exceed ₹10,000 for a tax period. For payments over ₹10,000, choose a different payment mode.

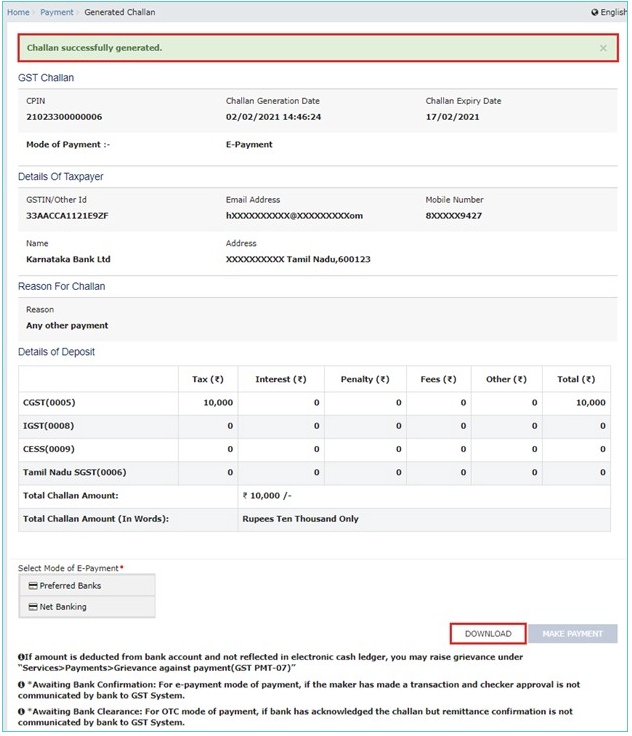

3. In pre-login mode, re-enter your GSTIN or Other ID in the GSTIN/Other ID for Challan Generation field and click PROCEED. A success message will appear, and you can download the generated GST challan by clicking the DOWNLOAD button.

Source: https://tutorial.gst.gov.in/userguide/payments/Create_Challan_(Pre_Login).htm

Common Mistakes to Avoid While Generating GST Challan

Even though the process is straightforward, a few common errors can cause problems:

- Selecting wrong tax heads: Always ensure you’re filling the correct boxes for tax, interest, penalty, or fees.

- Paying after CPIN expiry: CPINs are valid only for 15 days. Missing the window means you’ll need to redo the process.

- Not saving the CPIN or Challan copy: Always download or note the CPIN immediately. If payment issues arise, you’ll need it to track or report.

- Wrong payment mode selection: Choose the payment method based on how you actually intend to pay. Switching modes after challan generation is not allowed.

A few extra minutes spent reviewing the details can save a lot of future hassle.

Conclusion

Generating a GST challan isn’t complicated once you know the right steps. It’s a basic but crucial part of keeping your GST filings clean and up to date. Whether you’re paying monthly taxes, clearing interest dues, or handling voluntary payments, knowing how to generate a GST challan ensures that you stay compliant and avoid unnecessary penalties.

Take a little time, double-check the entries, and keep your business moving without any tax headaches. If you need assistance, OPTOTAX offers a suite of products to ensure your GST filings are always up to date and stress-free.