James Mcneill Stancill said, “You can’t pay bills with profits—only cash.” Well, it’s 2024, and his words still ring true. When you optimize cash flow management—aka the tracking of funds in and out of your business—it makes it easier to ensure the level of financial stability your company has.

Connected finance represents a paradigm shift in financial management. Banking, accounting, and ERP platforms are seamlessly integrated, bringing visibility into cash positions and transactions. In the wave of financial technology upgrades, software has advanced and provides integration solutions to businesses. However, some loopholes can still be addressed through Connected Finance.

Due to fragmented financial data, many organizations struggle to amp up their cash flow management. They face a plethora of challenges, such as

Limited Visibility:

Fragmented financial data spread across different systems and departments often lacks visibility into the organization’s financial health. Decision-makers lack real-time insights into cash flow, revenue, and expenses, making it difficult to make informed decisions.

Inefficient Data Management:

Managing fragmented financial data is inherently inefficient and time-consuming. Manual data entry and reconciliation processes are prone to errors, leading to inaccuracies in financial reporting. This increases the risk of compliance issues and hampers the ability to analyze financial performance accurately.

Delayed Reporting:

Consolidating data from disparate systems and sources takes time, resulting in delayed financial statements and reports, which can hinder the company’s ability to keep up with current market trends.

Ineffective Cash Flow Management:

Without a consolidated view of cash positions and transactions, businesses struggle to forecast cash flow accurately and anticipate liquidity needs. This can lead to cash shortages and increased reliance on short-term financing options.

Risk of Errors and Fraud:

Manual data entry and reconciliation processes increase the risk of errors and fraud, leading to misappropriation of funds and financial discrepancies that may go unnoticed until detected during audits or reconciliations.

Compliance Challenges:

Compliance requirements are becoming increasingly complex, making it difficult to ensure compliance with regulatory requirements and internal controls. Businesses may struggle to maintain accurate records, track transactions, and demonstrate compliance with audit trails and documentation.

Key Features of Connected Finance Solution

With Connected Finance, you can manage your finances a lot better and easier, as it provides-

Seamless Integration:

Connected finance solutions seamlessly integrate banking, accounting, and Enterprise Resource Planning (ERP) platforms. This integration allows for the smooth flow of financial data across platforms without manual intervention.

Real-time Visibility:

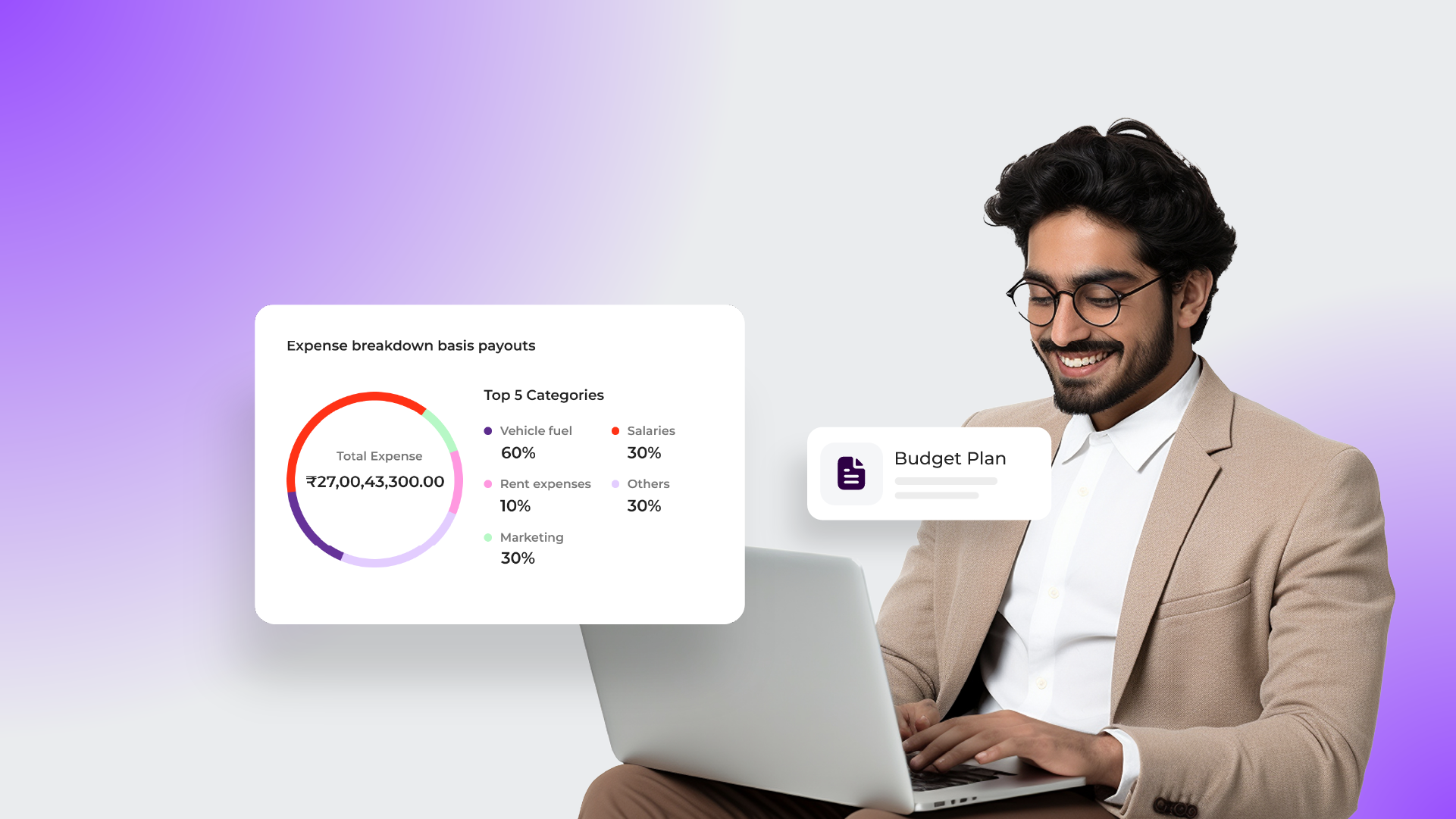

With connected finance solutions, businesses gain real-time visibility into their cash positions and transactions. Instead of relying on outdated or manually updated records, you can access up-to-the-minute information on cash flows, account balances, and transactions.

Manage Cash Flows accurately:

Connected finance solutions leverage advanced algorithms, enabling cash flow forecasting and reporting processes, saving time. These solutions generate accurate forecasts of future cash flows by analyzing historical data, market trends, and other relevant factors.

Centralized Financial Data:

Connected finance solutions centralize financial data in a unified platform. Instead of scattered spreadsheets, businesses have a centralized repository for all their financial information.

Connected finance offers several benefits for cash flow management:

1. Improved Visibility and Forecasting Accuracy:

By integrating the financials and data sources, connected finance provides a collected view of cashflow in real-time. This enables businesses to accurately identify patterns, trends, and potential cashflow issues, leading to better forecasting and planning.

2. Enhanced Decision-Making with Real-Time Insights:

Connected finance solutions offer access to up-to-date financial data and insights, enabling better decision-making. Real-time visibility into cashflow allows for agile responses to changing market conditions, customer behavior, or internal factors that may impact cash flow.

3. Streamlined Financial Operations and Reconciliation Processes:

Integration within connected finance platforms streamlines financial processes such as invoicing, payments, and reconciliation. This reduces manual errors, accelerates transaction processing, and improves overall efficiency, freeing time.

4. Better Compliance and Risk Management:

Connected finance platforms often provide compliance features and tools. These can include monitoring key risk indicators and fraud detection capabilities.

Connected finance offers a holistic approach to cash flow management, combining visibility, efficiency, compliance, and risk management to optimize financial performance and support business growth.

Getting Started with Connected Finance:

1. Evaluate Current Financial Processes:

Begin by thoroughly assessing your organization’s current financial processes. This includes examining everything from cash flow management, invoicing, and payment collection to budgeting, forecasting, and reporting. Identify pain points, bottlenecks, and areas where manual intervention is required. Consider factors such as data accuracy, timeliness, and process efficiency.

2. Identify Areas for Improvement:

Once current financial processes are evaluated, look for opportunities to streamline workflows, reduce manual tasks, and enhance visibility into financial data, reducing errors in data entry and reconciliation and improving the accuracy of financial forecasts.

3. Importance of Selecting the Right Connected Finance Solution:

When selecting a connected finance solution, consider your organization’s specific needs and goals. Look for a solution that offers robust features for cash flow management, real-time reports, and integration capabilities with existing systems.

4. Integration with Existing Systems:

Integration is key to maximizing the benefits of connected finance. Choose a solution that seamlessly integrates with your existing financial portals, such as accounting software, ERP systems, and banking platforms. This ensures smooth data flow across the platforms and avoids manual data entry or reconciliation. Work closely with your IT team and solution providers to ensure a successful integration process.

Selecting the right connected finance solution can have a significant impact on the organization, as the power of integration and automation can be used to great effect.

However, at the same time, the business has to choose the connected finance solution that complements and fits its business requirements, providing customized and flexible solutions.

Ready to optimize your cash flow management? Explore connected finance solutions today and see how they can advance your financial management.

Schedule a demo to learn more about Cash Flow Optimization with Connected Finance.

Visit our website now— www.openmoney.co.in

Watch our product demo & discover how Open can help your business!

You might be also interested in: https://youtu.be/Bui890PCozg?si=1_WOAseiI2U-2XnW