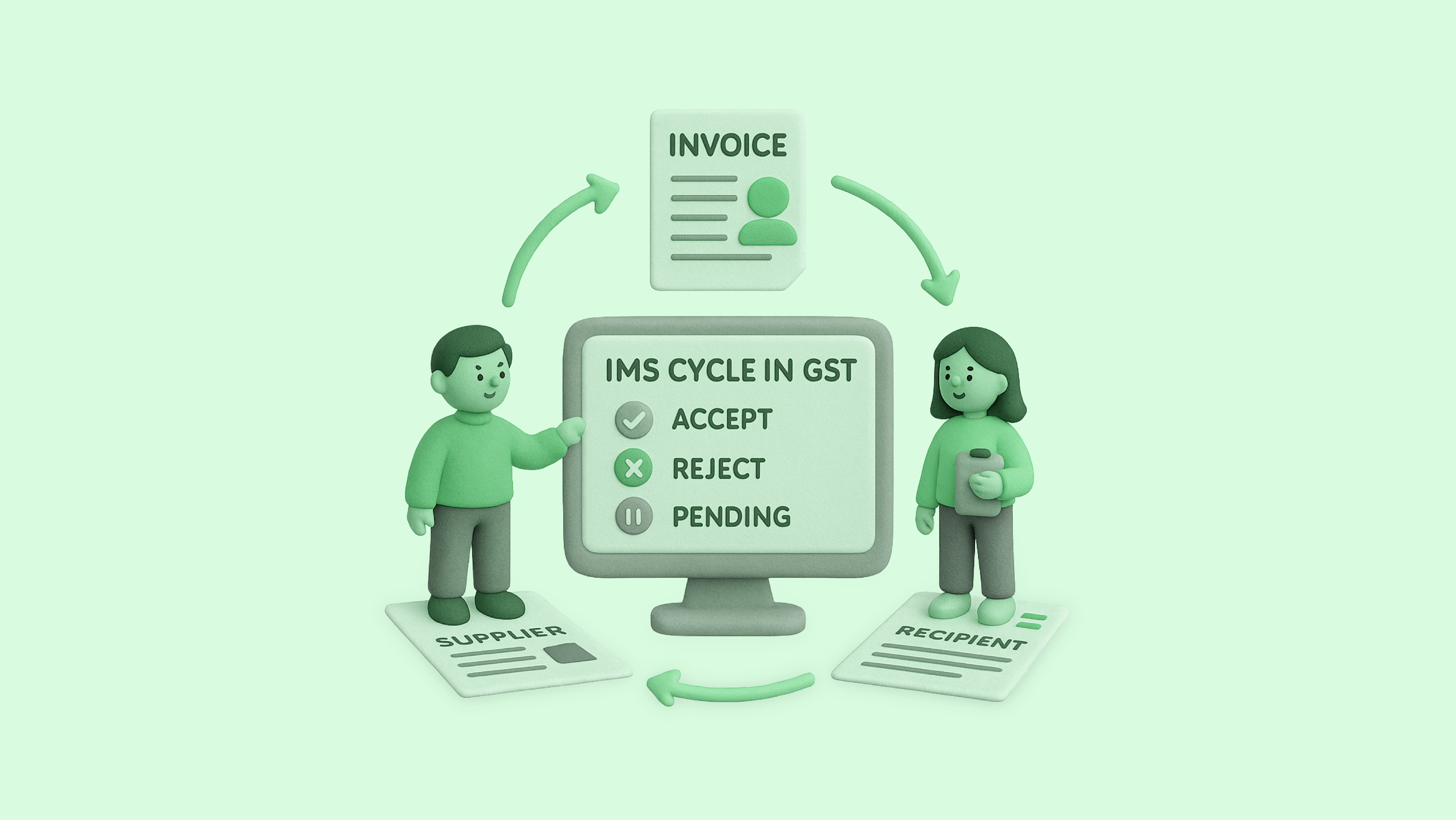

With the rollout of the Invoice Management System (IMS) on the GST portal, India’s indirect tax framework is entering a new phase of efficiency and accountability. Designed to simplify how suppliers and recipients reconcile their invoices, IMS ensures that Input Tax Credit (ITC) claims are cleaner, faster, and fully traceable.

For finance teams, tax professionals, and Chartered Accountants, this update isn’t just procedural. It reshapes how invoice reconciliation in GST is done. Here’s a closer look at what the GST invoice matching system means, how the IMS process works, and how automation can streamline compliance through technology.

What Is the Invoice Management System (IMS)?

The Invoice Management System is a digital framework introduced by GSTN to help taxpayers manage invoices more transparently. It enables recipients (buyers) to review all invoices uploaded by their suppliers in GSTR-1, IFF, or GSTR-1A, and take one of three actions:

- Accept – if the invoice matches your purchase records

- Reject – if the details are incorrect or not related to your business

- Keep Pending – if the goods or services are yet to be received or verified

If no action is taken, the invoice is treated as deemed accepted and automatically flows into your GSTR-2B for ITC computation.

Essentially, IMS functions as a GST invoice matching system, giving both suppliers and recipients a single source of truth and reducing mismatches that often trigger ITC disputes or notices.

Why IMS Matters for Compliance

Before IMS, invoice matching largely depended on manual reconciliation: comparing purchase ledgers with GSTR-2A or GSTR-2B data. This created gaps in visibility and timing, especially when suppliers delayed filing or made amendments.

With IMS, this process becomes structured and predictable. Recipients can now:

- Validate invoices before claiming ITC.

- Flag discrepancies directly to suppliers through the GST portal.

- Avoid claiming credits on mismatched or duplicate entries.

- Maintain a transparent audit trail of every invoice action taken.

The result is a more reliable and traceable system for GST compliance, where data and intent are aligned.

The IMS Process Explained

Let’s break down the IMS process into clear, actionable stages:

1. Supplier Uploads the Invoice

Suppliers upload their B2B invoices, credit notes, and debit notes in GSTR-1, IFF, or GSTR-1A. Once submitted, these invoices appear in the recipient’s IMS dashboard under “Inward Supplies.”

2. Recipient Reviews and Takes Action

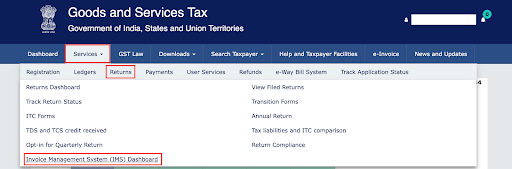

Recipients log in to the GST portal. Navigate:

Dashboard → Services → Returns → Invoice Management System (IMS) Dashboard

Here, each invoice can be reviewed and marked as:

- Accepted (eligible for ITC),

- Rejected (invalid or incorrect), or

- Pending (under verification).

If no action is taken before GSTR-3B filing, it is automatically deemed accepted.

3. Data Sync with GSTR-2B

Once actions are taken, the system updates GSTR-2B accordingly:

- Accepted or deemed accepted → ITC available

- Rejected → ITC unavailable

- Pending → deferred until future action

4. Supplier Visibility and Corrections

Suppliers can view the status of their invoices – Accepted, Rejected, or Pending, and take corrective action where required. This two-way communication reduces disputes and strengthens trust between trading partners.

5. Cut-off and Expiry

Invoices can only remain in “Pending” until the statutory deadline under Section 16(4) of the CGST Act (currently November 30 of the following year or filing of the annual return). After that, unaccepted invoices lose ITC eligibility.

How IMS Strengthens Invoice Reconciliation in GST

The IMS eliminates the guesswork from invoice reconciliation in GST by:

- Aligning supplier filings with recipient records in real time.

- Creating a clear workflow for ITC validation.

- Reducing dependency on spreadsheets and manual checks.

- Providing legal traceability through timestamped actions.

In short, IMS ensures that every ITC claimed is backed by verified data, strengthening both compliance and cash flow management.

Building Automated GST Invoice Management Workflows

Manual review might work for a few invoices, but at scale, automation becomes essential. Adopting automated GST invoice management tools helps businesses handle reconciliation with precision and speed.

Here’s what automation brings to the table:

- Real-time invoice sync from the GST portal.

- AI-based matching between IMS data and purchase registers.

- Auto-alerts for mismatched or pending invoices.

- Vendor communication templates for rejected records.

- Section 16(4) deadline reminders for timely action.

These capabilities allow teams to move from reactive corrections to proactive compliance.

Key Benefits of IMS + Automation

| Benefit | Outcome |

| Accurate ITC claims | Reduces chances of ineligible or excess claims |

| Lower notice risk | Early identification of mismatches |

| Operational efficiency | Less manual reconciliation effort |

| Vendor accountability | Transparent communication of invoice status |

| Audit readiness | Every action is traceable and time-stamped |

Best Practices for Businesses and CAs

- Act before GSTR-3B: Don’t wait till the deadline to review invoices.

- Keep vendor masters clean: Ensure correct GSTINs and details are captured at the source.

- Use “Pending” strategically: Avoid unnecessary delays in ITC claims.

- Automate wherever possible: Integrate your ERP or accounting system with GST software like Optotax for seamless reconciliation.

- Review exceptions monthly: Track rejections and pending invoices to prevent ITC leakage.

Final Thoughts

The IMS cycle in GST marks a major step forward in how India manages invoice-level reconciliation. For businesses and CAs, it means less uncertainty and more control.

By combining the power of the GST invoice matching system with automated GST invoice management, organizations can strengthen compliance, reduce notice risk, and optimize working capital.