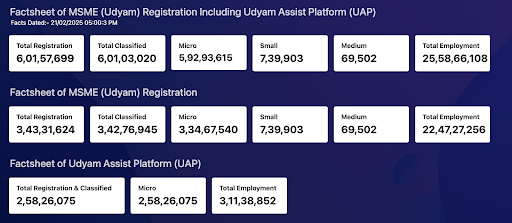

Micro, Small, and Medium Enterprises (MSMEs) form the backbone of the Indian economy, contributing significantly to employment generation and GDP growth. To support and streamline their operations, the Government of India introduced Udyam Registration—a digital-first initiative that makes formalization simple, seamless, and rewarding.

Whether you are an entrepreneur looking to formalize your business or an existing MSME seeking government incentives, understanding Udyam Registration is crucial. This guide covers everything from eligibility, registration steps, benefits, and compliance requirements to help businesses navigate the process effortlessly.

What is Udyam Registration?

Udyam Registration is the official recognition for MSMEs in India, introduced by the Ministry of Micro, Small, and Medium Enterprises (MoMSME). It has replaced the Udyog Aadhaar Memorandum (UAM) system and is entirely digital, eliminating paperwork and simplifying compliance.

Registered MSMEs gain access to government incentives, financial aid, and legal protections, helping them scale efficiently while enjoying priority treatment in procurement and funding.

Eligibility Criteria for Udyam Registration

A business must qualify under the MSME classification, which is based on investment in plant & machinery or equipment and annual turnover. To encourage growth and enable businesses to scale without losing MSME benefits, the Union Budget 2025 introduced revised investment and turnover limits:

| Enterprise Category | Previous Investment Limit | Revised Investment Limit (as per Budget 2025) | Previous Turnover Limit | Revised Turnover Limit (as per Budget 2025) |

| Micro Enterprise | Up to ₹1 crore | Up to ₹2.5 crore | Up to ₹5 crore | Up to ₹10 crore |

| Small Enterprise | Up to ₹10 crore | Up to ₹25 crore | Up to ₹50 crore | Up to ₹100 crore |

| Medium Enterprise | Up to ₹50 crore | Up to ₹125 crore | Up to ₹250 crore | Up to ₹500 crore |

If an enterprise exceeds either the investment or turnover threshold, it will be automatically reclassified to the next category.

Steps to Register for Udyam Registration

The Udyam Registration process is entirely online and does not require any physical documents. Here’s how businesses can complete their MSME registration:

Step 1: Visit the Udyam Registration Portal

- Go to the official website: udyamregistration.gov.in.

- Click on ‘New Registration’ to begin.

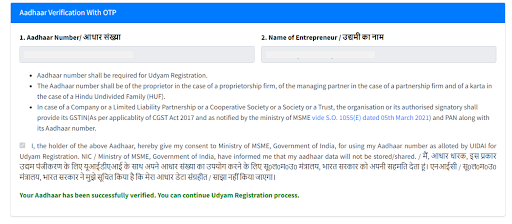

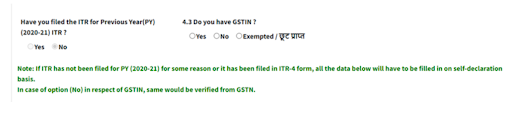

Step 2: Aadhaar Verification

- Proprietorship: Aadhaar number of the proprietor is required.

- HUFs: Aadhaar number of the Karta is required.

- Partnerships: Aadhaar number of the managing partner is needed.

- Companies, LLPs, Societies, and Trusts: Aadhaar number of the authorized signatory along with GSTIN and PAN is required.

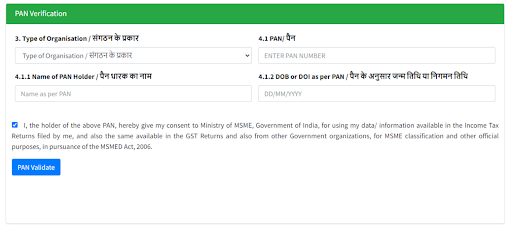

Step 3: PAN and GSTIN Verification

- The online system is fully integrated with Income Tax and Goods and Services Tax Identification Number (GSTIN) systems, and details on the investments and turnover of enterprises are taken automatically from government databases.

- Exports are not considered as part of turnover calculations.

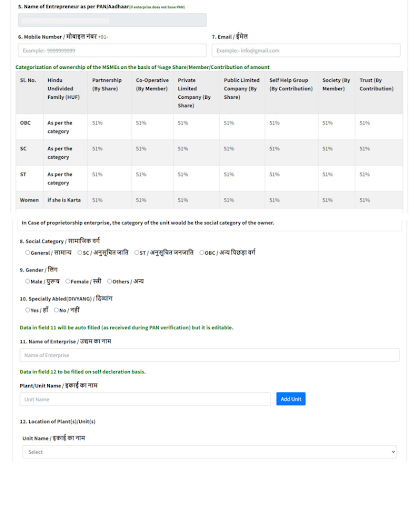

Step 4: Fill in Business Details

- Name and type of enterprise

- PAN details

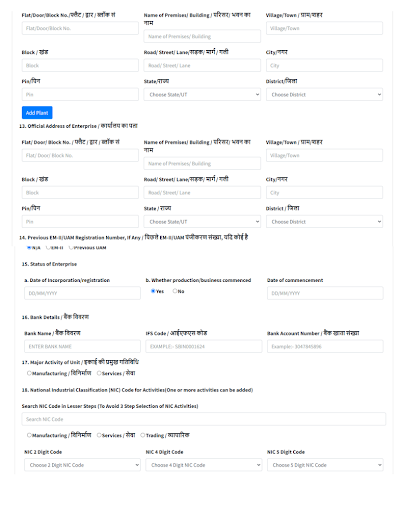

- Business location and address

- Bank details

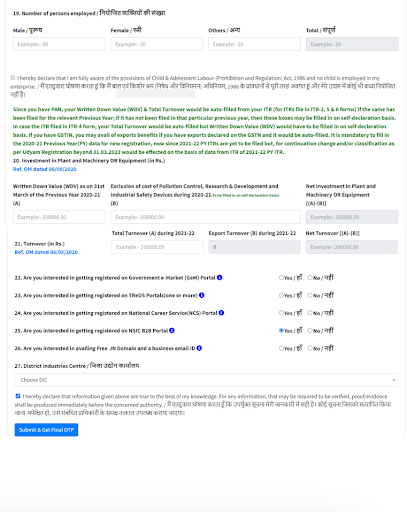

- Number of employees

- Investment in plant and machinery or equipment

Step 5: Submit the Application

- After reviewing the details, submit and validate the Udyam registration form.

- After successful registration, you will receive a message on your mobile number and email ID.

- You can download and print your Udyam Registration Certificate (e-certificate), which acts as proof of registration. This certificate will have a dynamic QR Code from which the web page on the portal and details about the enterprise can be accessed.

Note: There is no registration fee, and the process is self-declaratory.

Benefits of Udyam Registration

- Access to Government schemes & subsidies

- Credit guarantee schemes for collateral-free loans.

- Interest subvention on business loans.

- Subsidies on patent registration and barcode registration.

- Easier access to finance

- Priority lending benefits from banks and NBFCs.

- Lower interest rates on loans from financial institutions.

- Faster loan approvals under the MSME credit framework.

- Protection against delayed payments

- Registered MSMEs can file complaints against delayed payments under the MSME Samadhan scheme.

- Buyers are legally required to settle dues within 45 days.

- Exemption from certain compliances

- Relaxation in labor laws and compliance requirements.

- Exemption from the Companies Auditor’s Report Order (CARO) for certain MSMEs.

- Preferential treatment in Government tenders

- MSMEs receive a 25% procurement preference in government tenders.

- Exemptions from Earnest Money Deposits (EMD) in tender applications.

- Credit-linked Capital Subsidy Scheme (CLCSS)

- Financial support for MSMEs looking to upgrade technology.

- Zero-cost registration & lifetime validity

- No renewal is required, and registration remains valid for the lifetime of the business.

Difference Between Udyam Registration and MSME Registration

Many business owners still use the term MSME registration, but it is important to note that Udyam Registration has replaced all previous methods of registering as an MSME, including Udyog Aadhaar and EM-II.

| Aspect | Udyam Registration | MSME Registration (Old System) |

| Registration Type | Online, Aadhaar-based | Manual or online, with paperwork |

| Linked to PAN & GSTIN | Yes | No |

| Validity | Lifetime | Required renewal |

| Cost | Free | Could involve agent fees |

| Recognition | Official MSME recognition | System replaced in 2020 |

Note: If a business was registered under the old MSME registration system, it had to migrate to Udyam Registration by December 31, 2021, to continue receiving benefits.

Udyam Registration is a game-changer for small businesses in India, offering a simplified, digital-first approach to formalization. With zero cost, lifetime validity, and direct integration with government databases, it eliminates unnecessary paperwork and ensures MSMEs can fully leverage financial and legal benefits.

For MSMEs looking to expand, secure funding, or compete for government contracts, registering under Udyam is a crucial step toward long-term growth and stability. If your business falls under the MSME category, completing your Udyam Registration should be a top priority.

For financial solutions tailored to MSMEs, explore OPEN’s business banking services, offering seamless payments, credit access, and smart expense management.

FAQs

Is Udyam Registration mandatory for all MSMEs?

Yes. Since 2021, Udyam Registration has become mandatory for all MSMEs seeking to avail benefits under various government schemes, including priority sector lending, subsidies, and other support mechanisms.

Can an existing MSME register under Udyam Registration?

Yes, MSMEs that were previously registered under Udyog Aadhaar or other systems must migrate to Udyam Registration.

Is GSTIN mandatory for Udyam Registration?

Yes, for businesses required to register under GST. However, micro-enterprises that are not mandated to register under GST can apply without it.

Can I update my Udyam Registration details?

Yes, businesses can update their registration through the portal in case of changes in turnover, investment, or other business details.

What happens if my MSME outgrows its category?

The system automatically updates your classification based on the latest financial data.