You’ve probably heard the saying, “Coming together is a beginning, staying together is progress, and working together is a success.” This can apply to many areas of life, work or otherwise, but it’s especially true about the relationship between businesses and vendors. The core of doing any business is managing people and processes. Understanding who your vendors are and how they operate is inevitably important for mutual growth and success. Essentially vendor management is about managing relationships with vendors strategically to enhance ROIs, fortify partnerships, and streamline the processes. It includes activities such as selecting and onboarding vendors, negotiating contracts, managing performances and many more.

Why is Vendor Management Required?

Research has shown that 57% of businesses have faced revenue impacts due to issues in supply chain and vendor management. The standard reasons that emphasize the importance of vendor management are:

- Control Costs: Research has shown that a top-notch procurement team can save a business up to 8-12% of direct cost. Hence it becomes an essential part for

- Risk Mitigation:

- Efficient Operation

Keeping communication open and transparent helps businesses receive changes in the flow of operations from either side.

Challenges in Vendor Management

- Lack of visibility: Not having access to the vendor data and the payment processes/ status, including procurement teams, and accounts payable can slow down the vendor management process and pile up payments and other essential tasks. Eventually, it will impact the trust of the vendor. As vendor management is a collaborative process, having a centralized online portal can get everyone their approved level of access to your vendor’s data.

- Manual Vendor Management System: Manual handling of vendor functionalities often leads to errors and inconsistencies in data entry. Manual tasks are inherently time-consuming and labor-intensive. Employees must spend valuable time on repetitive tasks like data entry, filing paperwork, and coordinating communication with vendors. Specially, When it comes to facilitating payments to multiple vendors, it takes up an enormous amount of time and effort. Besides, it also creates loopholes, such as suspended accounts without any head and tail of the payment details. With manual vendor management, there are chances of missing out on purchase orders, which makes the tracking of the orders even more difficult, leading to vendor dissatisfaction.

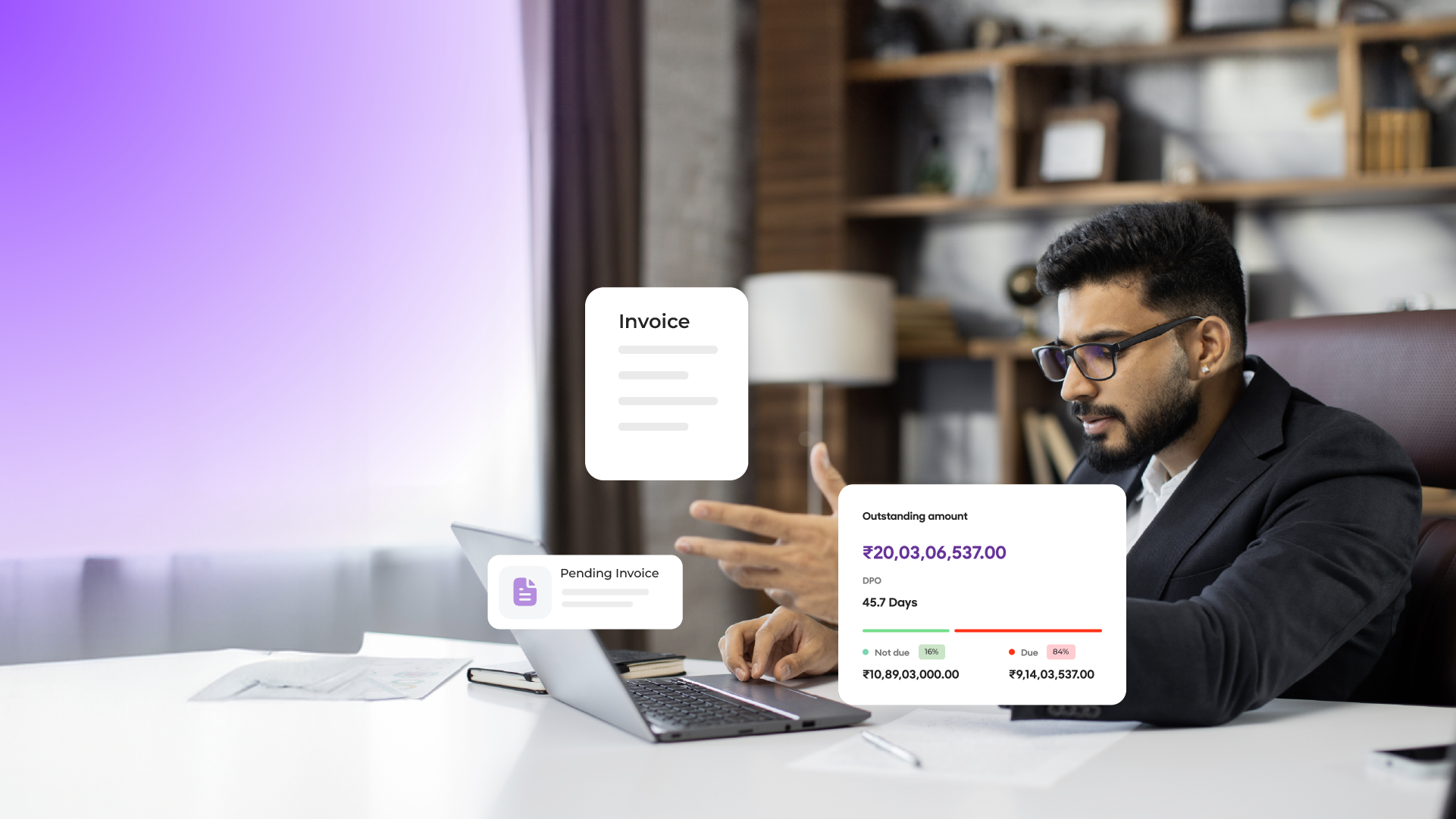

- Managing Vendor Invoices: Handling a large volume of vendor invoices often results in problems with regard to tracking the invoices and their due dates. It may all seem a little too overwhelming, especially when you miss some of the due dates. This results in the levy of interest charges or penalties for late payments that could have been avoided. Moreover, poor management of vendor invoices tends to affect vendor relationships.

Leveraging AP Automaton for Stronger Supplier Relationships

If we highlight the importance of Accounts Payable automation, it simplifies and automates manual tasks. It not only helps to save time and resources but also, provides better visibility and control over financial data.

But how AP automation can help your business with supplier relationship management?

- On-time and Accurate Payments: At some point, your business must have been part of a transaction where an invoice, communication, or payment was late. There’s no doubt that the best way to make your supplier/ vendor happy is to ensure prompt and accurate invoice payments. Automation validates the invoices and makes direct payments to the suppliers, with minimum manual interventions. An industry-leading AP Automation will help you attain up to 80% straight through the process. Automating payments makes the entire process transparent and timely. Improving your standing with your vendors pays off in multiple ways. Additionally, AP Automation Solutions offers early payment discounts along with many discounting programs.

- More visibility and transparency: AP Automation includes features like a vendors’ portal, that provides comprehensive insights to the vendors about the payment activities. The self-service features which enable vendors to track real-time payment status updates, offer convenience while gaining the trust of the supplier/vendor. Increasing transparency into invoice payment statuses can be another effective way to manage supplier relationships.

- Better Communication: Improve communication between your AP team and suppliers with an online portal. Emails can lead to misunderstandings, while phone calls lack documentation. This delays issue resolution and frustrates suppliers. An online supplier portal that enables virtual communication and collaboration can mitigate many of the delays that come with back-and-forth exchanges. By allowing suppliers and AP teams to leave comments directly on invoices and engage in real-time chats to resolve disputes, teams can address issues swiftly and efficiently, leading to more productive and efficient resolutions. This system makes communication smoother and ensures better collaboration for efficient outcomes.

Pro Tips (Things to keep in mind):

- Automated vendor payments boost accuracy, timeliness, and efficiency. Tracking due dates becomes easier with reminders in modern accounting software and digital invoicing.

- Choosing suitable vendors is crucial. Regularly reviewing service-level agreements and contracts ensures adherence to terms.

- Designing a smooth process, from issuing purchase orders to completing payments, is key. Modern accounting software streamlines processes, speeding them up while maintaining accuracy.

- Storing data on the cloud ensures safety and security, with regular backups meeting legal compliance requirements for record maintenance and storage.

- Before payment, it’s best practice to verify items against the purchase order and invoice to ensure complete delivery. This ensures smooth payments without any issues.