Businesses are constantly looking for ways to make payments easier for their customers. One of the simplest and most effective solutions is a payment link. It’s exactly what it sounds like — a link that lets customers pay online with just a few clicks. Whether you’re a small business owner, freelancer, or service provider–payment links can save you time, effort, and money. This guide will walk you through what payment links are and why they matter.

What are Payment Links?

A payment link can be in the form of URLs, QR Codes, or buttons that let customers make payments online. You generate the link and share it with your customers, and they can complete the payment from anywhere at their convenience. It’s a hassle-free method that’s fast, easy, and secure, making online transactions effortless.

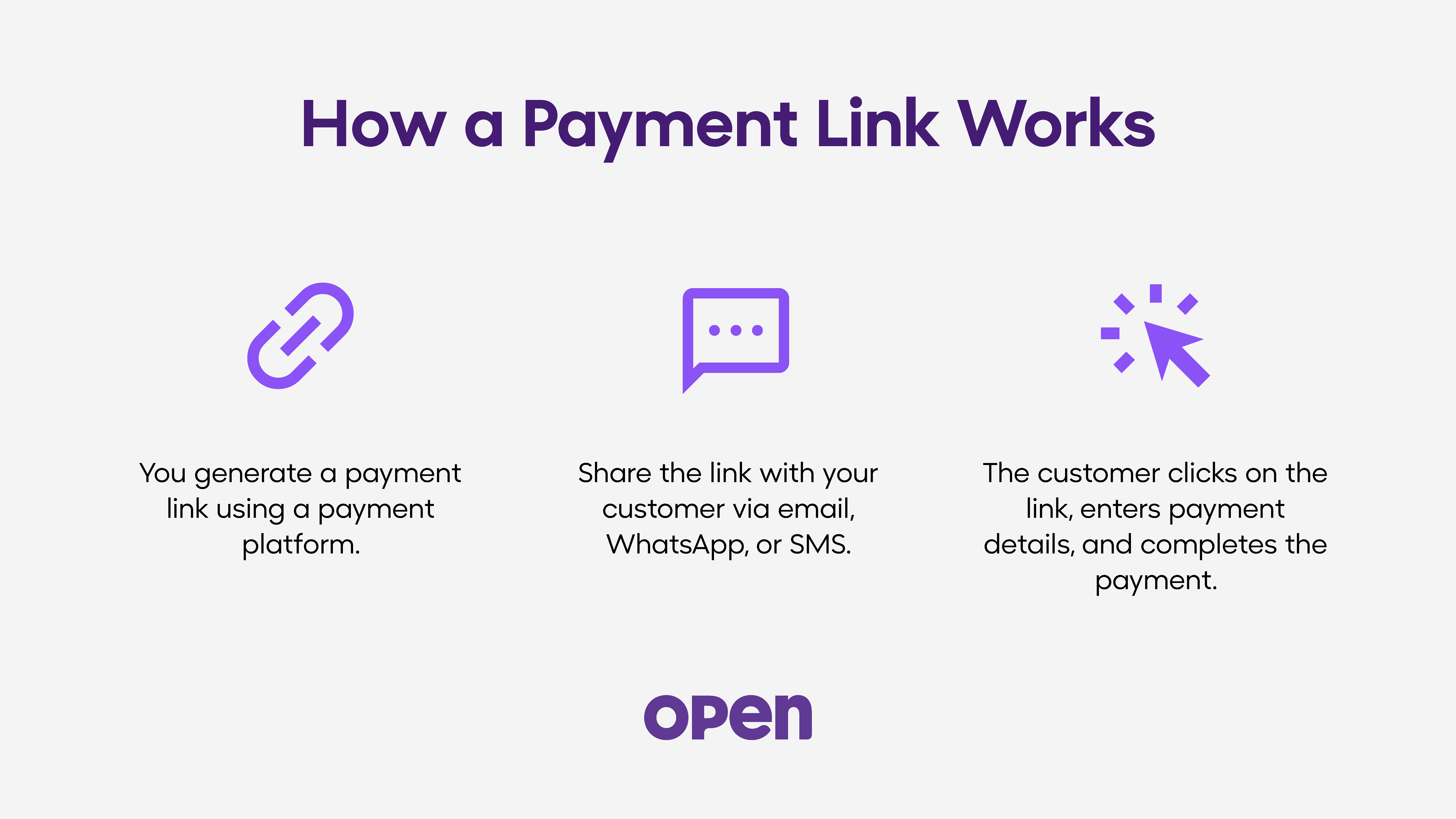

Here’s how a payment link works:

This is especially useful for businesses that don’t have a physical storefront, like freelancers, home bakers, or consultants. For example, if you’re a freelance graphic designer, you can send a payment link along with your invoice and let your client pay instantly.

Benefits of Using Payment Links for Businesses

Payment links are not just convenient; they come with lots of benefits:

- Flexibility: Payment links let you accept payments anytime, anywhere. There is no need for physical setups or point-of-sale (POS) terminals.

- Cost-effectiveness: Most payment providers charge minimal fees, making it a budget-friendly option for small businesses.

- Ease of use: Creating and sharing a payment link doesn’t require any technical skills. If you can send a message, you can send a payment link!

- Improved customer experience: Customers appreciate the convenience of paying online. No more fumbling with cash or waiting for account transfers.

- Payment options: Most leading payment providers allow users to choose from multiple payment methods such as UPI, credit/debit cards, digital wallets, etc.

Step-by-Step Guide to Creating a Payment Link

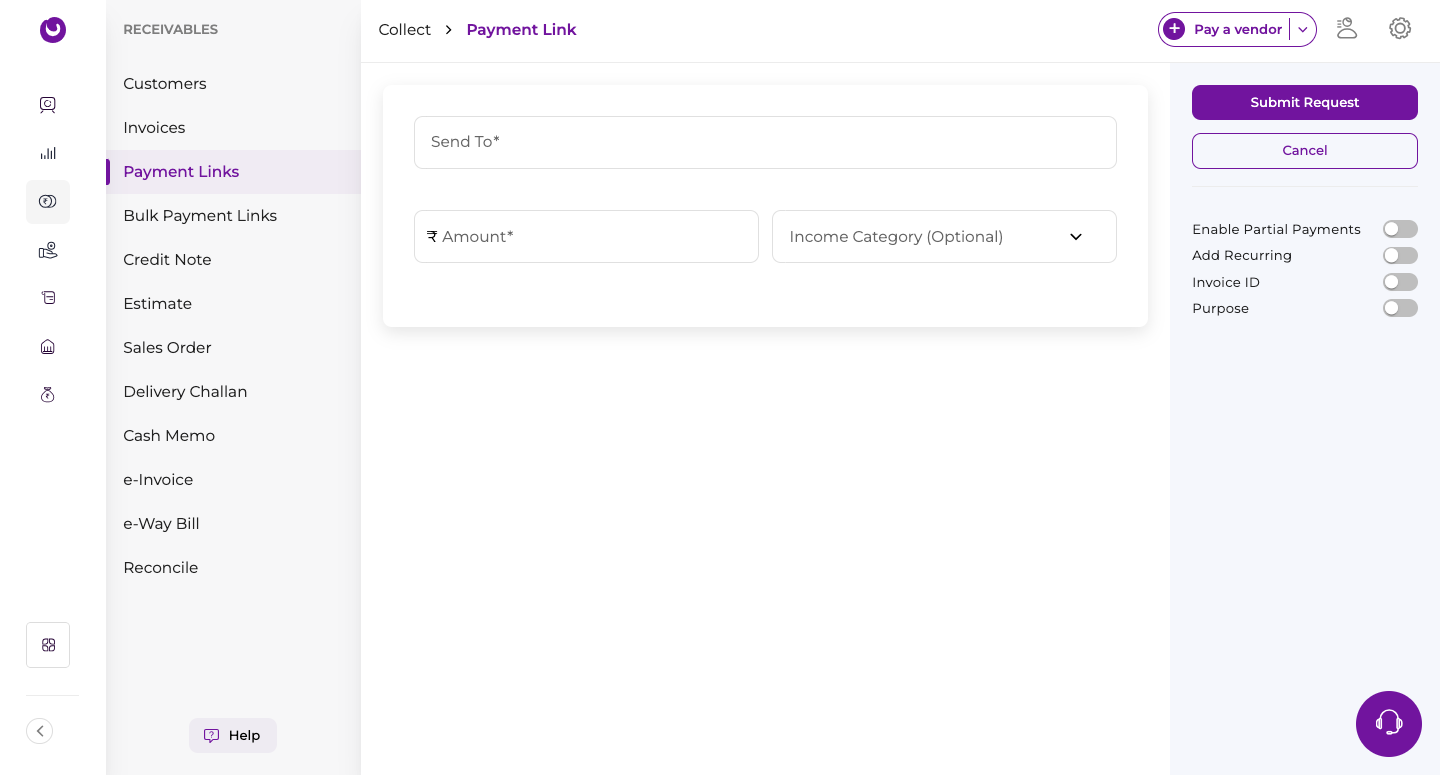

Creating a payment link is easier than you might think, and many platforms offer this feature to simplify online transactions. Here’s how you can create a payment link on OPEN Money:

- Step 1: Sign up or log in to your OPEN Money account.

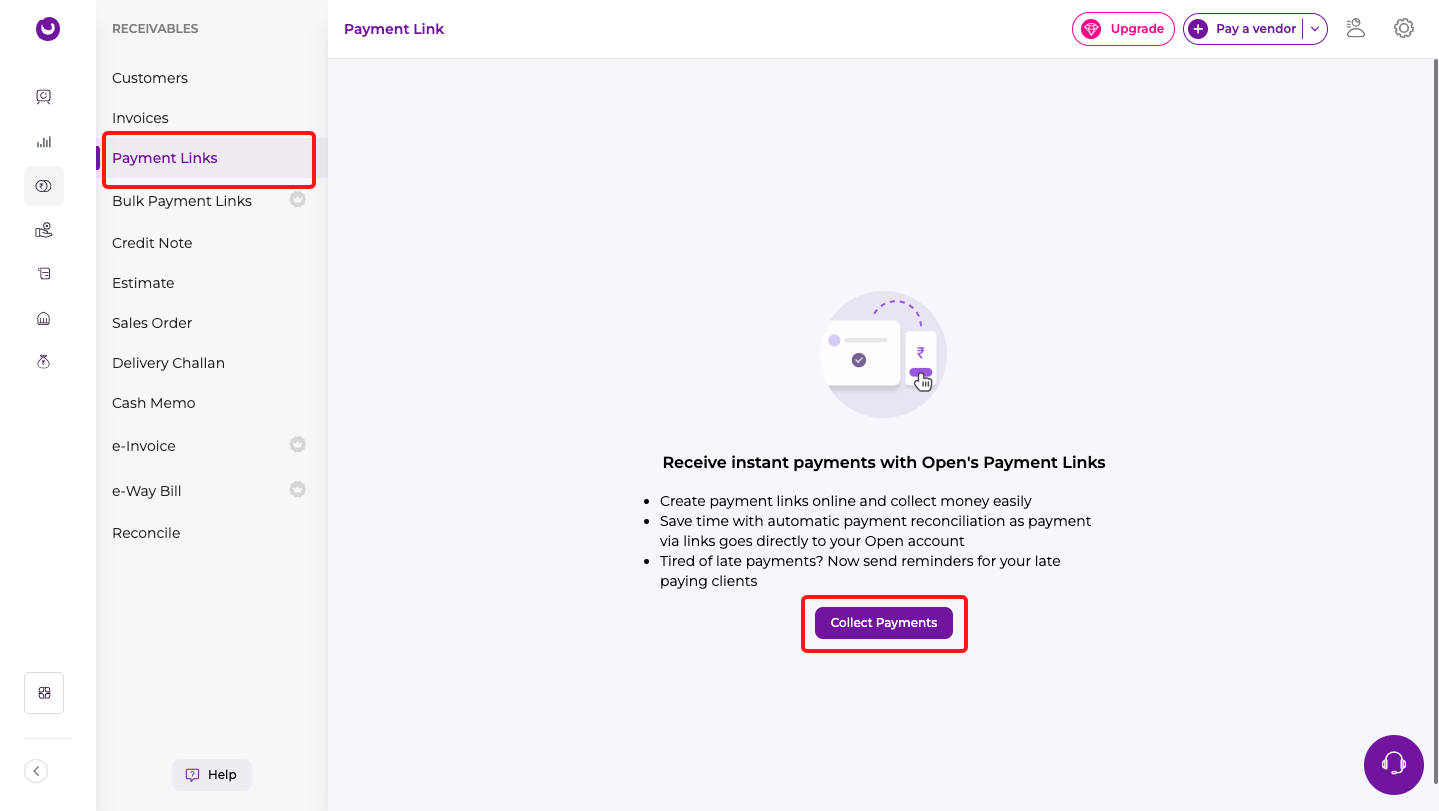

- Step 2: Once signed in, click on Receivables in the left panel.

- Step 3: Select Payment Links and then click on Collect Payments.

- Step 4: You will land on the Payment Link screen. Here, you need to provide a few details, such as the customer’s name, the amount you’re requesting, and the income category.

- Step 5: Once you’ve filled in the details, click on Submit Request. Your customer will receive a payment link via email and SMS to complete the payment.

Common Challenges and How to Overcome Them

Like any tool, payment links come with their challenges. Here’s how to tackle them:

- Failed payments: Payments can fail for various reasons, such as network issues, insufficient funds, or technical glitches. To handle such situations smoothly, choose a reliable payment provider with dependable customer support to resolve issues quickly.

- Customer hesitation: Customers new to payment links may hesitate to pay online due to concerns about security or uncertainty about how the process works. To ease their doubts, educate them about the safety and convenience of using payment links and reassure them that their data is protected.

By addressing these issues proactively, you can build a smoother payment experience for everyone involved.

Conclusion

Payment links are a game-changer for businesses of all sizes. They’re easy to set up and secure, making the payment process effortless for you and your customers. By following the steps outlined in this guide, you can start creating and using payment links today.

OPEN Money is a trusted platform for creating payment links, and providing secure and trustworthy financial solutions for businesses of all sizes. To ensure safe transactions, it meets global standards like RBI compliance, PCI DSS, ISO 27001, and AICPA SOC. With OPEN Money, you can generate GST-compliant invoices, send them with payment links, and receive payments online—all from a single platform.

Remember, the simpler the payment process, the more likely customers are to complete their transactions. So, why wait? Start exploring payment links and watch your business grow effortlessly!

FAQs

1. What are the benefits of payment links?

Payment links are flexible, simple, and cost-effective. It simplifies payment processes and enhances customer experience, making them ideal for businesses.

2. Can I reuse a payment link?

Yes. Whether a payment link can be reused depends on your payment provider. Many allow reusable links for fixed products or services, but some may restrict links to one-time use. Always check your provider’s policies to confirm.

3. Are payment links safe to use?

Yes, payment links are safe when created through trusted providers with encryption and security measures.

4. Can I use payment links for international transactions?

Yes, payment links can be used for international transactions if the payment providers support multiple currencies and global payments.

5. Do payment link supports multiple payment methods?

Yes, payment links can support multiple payment methods, such as UPI, credit/debit cards, bank transfers, and digital wallets, depending on the platform.