Ever wondered how businesses keep their finances on track and avoid cash mishaps? Proper financial record-keeping isn’t optional – it’s a critical foundation for any company’s long-term success. At the core of sound financial management is a fundamental tool: the cash book. This record-keeping system connects to broader concepts like cash flow and fund flow, which we’ll explore together to help you understand how to manage your business’s finances effectively.

What is a Cash Book?

A cash book is a detailed record where businesses track every cash transaction—both incoming and outgoing. Think of it as your business’s financial diary, meticulously documenting every rupee that moves through your organization. Unlike a traditional ledger, a cash book serves a dual purpose by combining journal and ledger functions specifically for cash transactions, making it an efficient tool for monitoring daily cash flow and ensuring complete transaction accuracy.

| Aspect | Cash Book | Cash Flow Statement | Fund Flow Statement |

| Purpose | Tracks daily cash transactions. | Provides a broader view of cash movements over a period. | Examines changes in financial position between two dates. |

| Focus | Immediate cash position. | Categorized cash activities: operating, investing, and financing. | Overall movement of working capital and funds. |

| Scope | Only cash inflows and outflows. | All cash movements are categorized by activity type. | Overall funds, not limited to cash transactions. |

| Timeframe | Daily tracking. | Periodic analysis (e.g., monthly, quarterly, annually) | Based on balance sheet comparisons over time. |

| Usage | Monitoring daily cash flow. | Understanding how cash is managed across business. | Insights into how funds are sourced and utilized. |

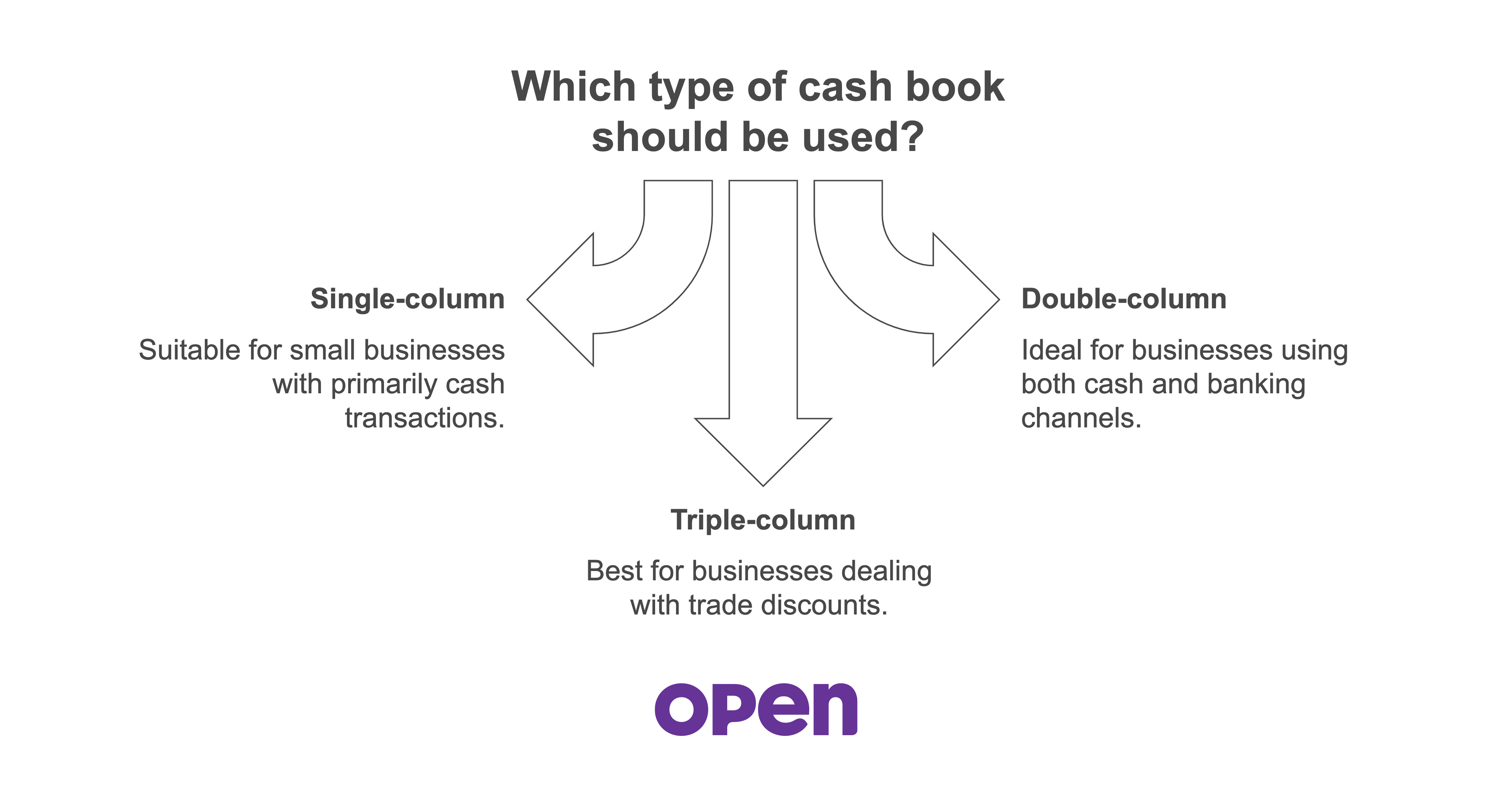

Types of Cash Books

- Single-column cash book: Perfect for small businesses or those dealing primarily in cash, this simple format records only cash transactions. It’s straightforward but limited in scope.

- Double-column cash book: This format tracks both cash and bank transactions side by side, offering a more complete picture of your financial position. It’s ideal for businesses that frequently use both cash and banking channels.

- Triple-column cash book: Building on the double-column format, this version adds a third column for discounts. It’s particularly useful for businesses that regularly offer or receive trade discounts.

How a Cash Book Works

A cash book is simple to use but demands consistency and precision. All cash inflows, like sales revenue or loan receipts, are entered on the debit side, while outflows, such as payments to suppliers or other expenses, are recorded on the credit side. By the end of a given period, the difference between the two reveals your current cash position—a vital detail that keeps you informed without waiting for monthly reports.

Benefits of a Cash Book

Maintaining a well-organized cash book offers numerous advantages:

- Provides real-time insight into your cash position

- Simplifies the process of bank reconciliation

- Creates a reliable audit trail for financial verification

- Helps in promptly detecting errors or discrepancies.

- Improves decision-making for cash flow management.

Challenges and Limitations

Cash books have notable limitations: they are susceptible to human error during manual entries, cannot capture non-cash transactions like depreciation, require consistent updating, and may not fully represent an organization’s financial health. To address these challenges, businesses can use accounting software for automated entries, implement accrual accounting methods, establish strong internal controls, and use detailed financial statements alongside cash books.

Whether you’re running a small business or managing personal finances, a well-maintained cash book is your first step toward financial clarity and control. By understanding how it connects with broader financial concepts like cash flow and fund flow statements, you’re better equipped to make informed decisions about your business’s financial future. Start your journey toward better financial management today by implementing these cash book practices in your business.

FAQs

What is the main difference between a cash book and a cash flow statement?

A cash book is a day-to-day record of cash transactions within a business, tracking individual cash inflows and outflows. A cash flow statement is a financial report that summarizes cash movements over a specific period, categorizing cash from operating, investing, and financing activities.

Can I maintain a cash book digitally?

Yes, you can maintain a cash book digitally. Many accounting software and spreadsheet applications offer digital cash book templates and tools that allow you to record, track, and reconcile cash transactions electronically, providing greater accuracy and easier management.

How often should I balance my cash book?

Ideally, balance your cash book daily or weekly. Monthly reconciliation is the absolute minimum. Regular balancing helps detect errors quickly, prevents discrepancies, ensures accurate financial records, and provides real-time insight into your cash position.