Have you ever faced uncertainty when a bank transfer takes longer than expected to reflect in your account? Such delays can be frustrating, even if they’re common. This is where the UTR (Unique Transaction Reference) number comes into play. As an essential tooLet’s break it down to understand how it works.

What is UTR?

UTR, or Unique Transaction Reference number, is a unique identifier assigned to every financial transaction made between two bank accounts. For instance, imagine you’re transferring money to a vendor. Once the payment is initiated, a UTR number is generated to track that specific transaction. This number helps you track your payment, making it easier to confirm it reaches the correct account and to resolve any issues that may arise.

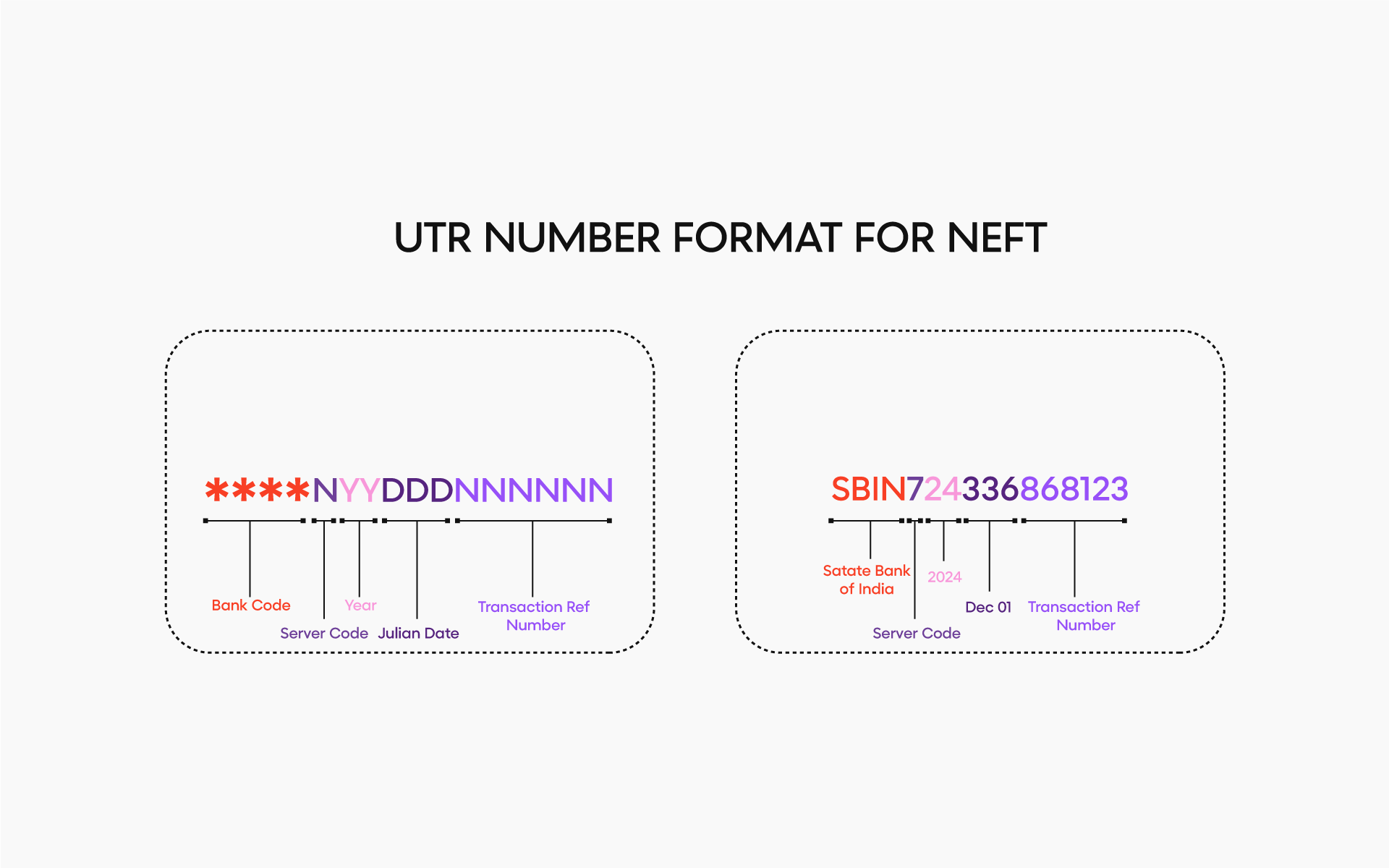

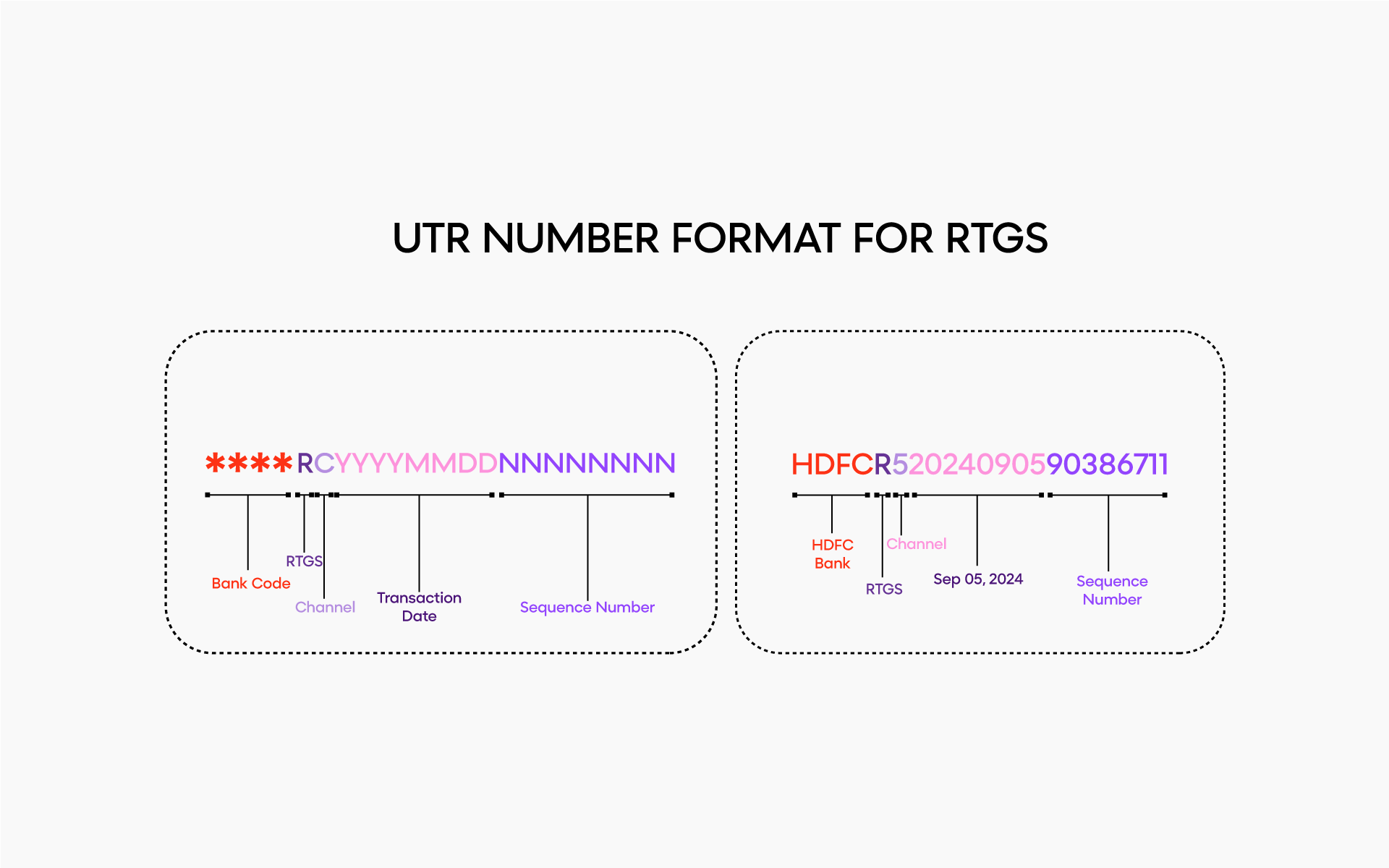

This is generated for transactions through different primary fund transfer methods for different banks in India: NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and UPI (Unified Payments Interface). A UTR number is generated for each transaction carried out using these methods. This unique identifier helps distinguish transactions, allowing banks and customers to track and verify payments accurately.

Importance of UTR

UTR (Unique Transaction Reference) plays an essential role in:

- Transaction tracking: If a transaction is delayed or not credited, the UTR number helps identify and resolve the issue efficiently. This helps in tracking payments to ensure they are processed correctly and without unnecessary delays.

- Transparency and security: Since each transaction has a unique identifier or UTR, it reduces errors and fraud. UTR numbers create a traceable record, enhancing the security and transparency of financial processes and ensuring transactions are documented and accessible.

- Resolving disputes: UTR numbers are clear proof for addressing transaction issues, allowing for quick and precise resolution. They ensure that specific transaction details can be referenced to resolve problems effectively.

Structure of a UTR number

A UTR number might look random, but it’s a well-structured code with important transaction details. For NEFT transactions, the UTR number is a 16-character alphanumeric code, while for RTGS transactions, it’s a 22-character alphanumeric code, as shown below.

How to find your UTR number?

Finding your UTR number is simple and depends on how you initiated the transaction. Here are the common ways to locate it:

- Bank statements: Check your bank statement online or in a printed copy (passbook). The UTR number is usually printed alongside the transaction details and may be labeled as Transaction ID or Reference Number.

- Mobile banking apps: Open your bank’s mobile app and go to the transaction history section. Select the relevant transaction to view its details, including the UTR number.

- Net banking portals: Log in to your bank’s online portal and access your account statement or transaction history. The UTR number will be displayed with the transaction details.

- UPI apps: If the transaction was made via a UPI app, go to the transaction history within the app. Select the payment to view the UTR, which will be visible under labels like Transaction ID or Reference ID.

- Customer Support: If you cannot locate the UTR number, contact your bank’s customer support. Provide details like the transaction amount, date, and beneficiary to retrieve the UTR. Be sure not to share sensitive information such as passwords, OTPs, or other personal data to keep your account secure.

Being able to locate your UTR number is important for tracking payments, resolving issues, and confirming transaction details.

Conclusion

Understanding the significance of a UTR number can make managing your financial transactions much smoother. The UTR number plays a crucial role in tracking payments, resolving disputes, and maintaining clear communication with your bank.

Knowing how to locate and use it helps resolve transaction-related issues quickly and efficiently. It may seem like a small detail, but it plays a significant role in maintaining clarity and trust in the financial process.

FAQs

1. What does UTR stand for?

UTR stands for Unique Transaction Reference, an alphanumeric code used to identify and track financial transactions.

2. When is a UTR generated?

A UTR is generated when a bank processes a payment through NEFT or RTGS.

3. Is UTR different for NEFT and RTGS transactions?

Yes, UTR numbers for NEFT are 16 characters long, while RTGS UTR numbers are 22 characters long.

4. Who generates the UTR number?

The UTR number is created by the bank that initiates the transaction.

5. Does UPI have a UTR number?

Yes, UPI transactions have a UTR number, also known as a UPI reference number. It is a 12-character alphanumeric code that helps track and identify the payment.