OPEN FOR BANKS

Deliver Fintech-Powered Business Banking to SMEs And Startups

From digital payments to automated accounting and tax management. From expense management to payroll and credit. Partner with Open to deliver a complete business finance management solution, integrated seamlessly with business banking.

Backed by

Secure & compliant

Join 16+ global banks, including 6 out of Top 10 banks in India, who have launched digital business banking, powered by Open

The Best Business Account for SMEs And Startups

Digital Banking Solutions to Win Fast-Growing Businesses

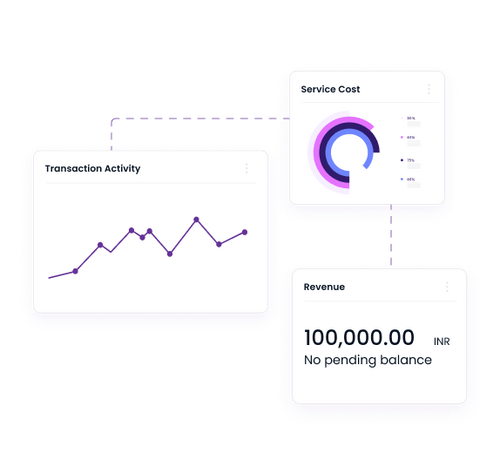

Connected Banking

Deliver a secure environment to connect customers’ banking, business and finance tools: Account Aggregation | Cashflow Management | eCommerce | Tax Reporting

Automated Accounting

Allow customers to integrate accounting solutions like Tally, with your platform, and offer end-to-end AP/AR automation.

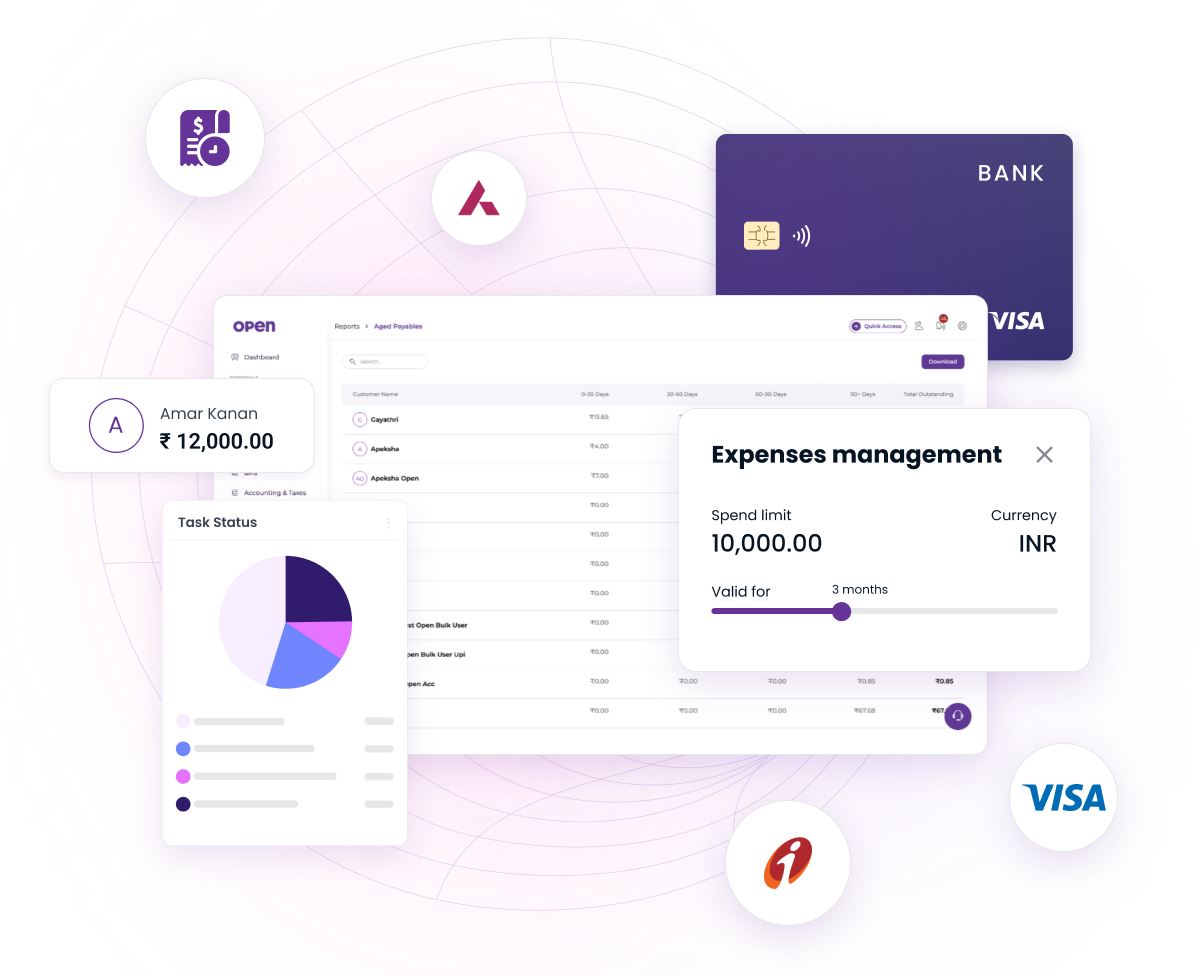

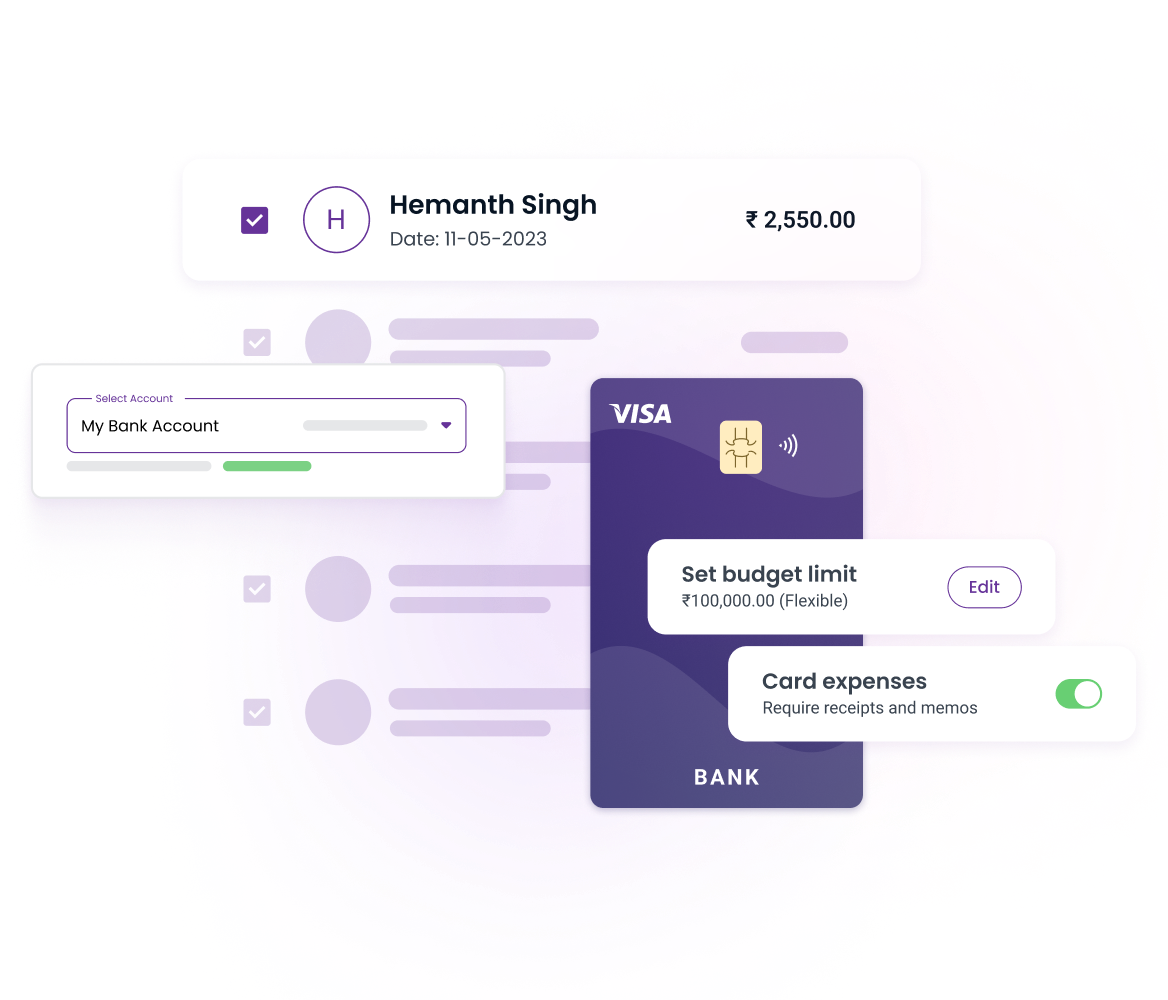

Cards And Expense Management

Give businesses complete expense management capabilities, from budgeting to employee reimbursements on one platform. Issue Visa-powered expense cards with smart controls to help businesses track and approve spends in real-time.

Payment & Collections

Help customers pay vendors, accept payments online and reconcile bills and invoices - all on the same platform.

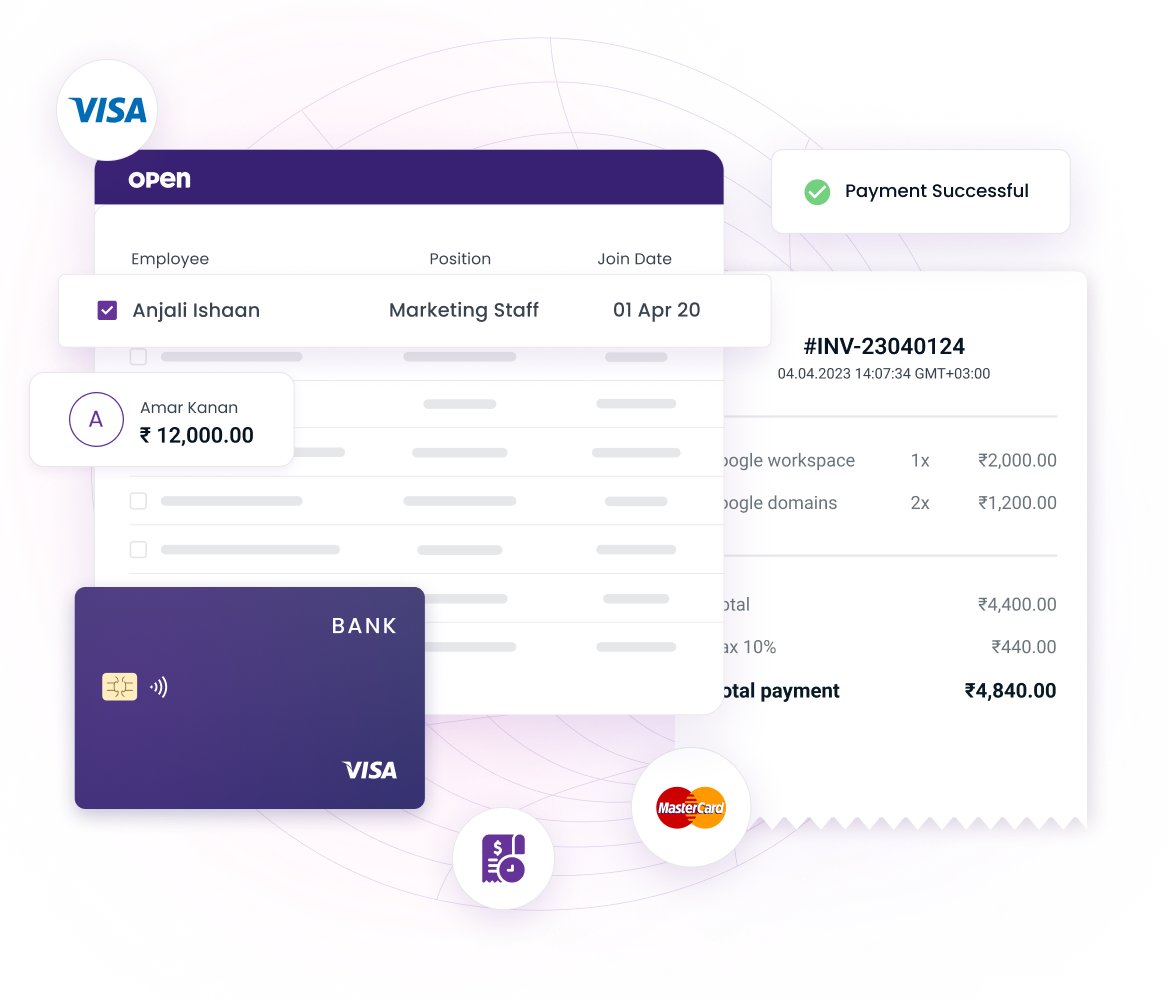

Value Added Services

Deliver everything a business needs to run and grow, within your own business banking platform: e-Invoicing | GST Returns | Open Accounting | Open Payroll | Amazon Integration

Alternative Lending

Leverage transactional data to scale business lending. Deliver the right offer, at the right price, at the right time.

Niche Solutions for Emerging SME Segments

Move away from one-size-fits-all banking. Offer emerging businesses a single platform to manage their revenue streams, and transform risk assessment models for new business models.

Startups

Become a growth partner for startups when they need it the most.

Connected Banking

Cards & Spend Management

Accounting Automation

Invoice Financing

Freelancers

Cater to the banking needs of the new, borderless workforce.

Online Payments

Invoice Management

Automated Bookkeeping

Cards & Expense Management

Future Proof Your Digital Banking Strategy

Capture New Markets

Launch digital banking solutions for niche segments like SMEs, Startups, D2C Businesses, Freelancers, & more.

Increase Wallet Share

Deepen engagement with great products and value added services.

Capture New Markets

Launch digital banking solutions for niche segments like SMEs, Startups, D2C Businesses, Freelancers, & more.

Increase Wallet Share

Deepen engagement with great products and value added services.