The financial world is now witnessing a rapid shift led by the rise of “open finance” and “connected finance.” Open finance is an extension of the Open Banking concept, which translates to building financial solutions leveraging openly available APIs for institutions worldwide. Connected finance is a part of this open-scope concept, which translates to financial homogeneity.

This open finance concept goes much further compared to traditional information silos, allowing transparent movement of data amid financial systems and institutions. This propels the concept of connected finance systems and processes. In this article, we explore the potential connected finance has on reshaping our financial experiences.

Understanding Connected Finance

Connected finance helps accelerate financial management transformation by promoting the integration of the primary system, stages, and data using technology. It enhances operational efficiency, decision-making ability, and teamwork. By facilitating the use of fully integrated accounting software, ERP, and automation solutions, connected finance basically provides a framework to get real-time financial performance clarity.

The convergence aids in responding to market changes, discovering opportunities, and overcoming problems. All of this empowers organizations to navigate difficulties and make decisions that promote sustainable growth by creating an ecosystem of linked tools.

It’s automation but for better operational functionality

Automated functionalities within connected finance ease the process of invoicing, payment reminders, and application of cash flow, reducing limitations and thereby boosting the cash flows.

WeWork, which has over one million invoices yearly in 800 international regions, has transitioned to AP automation. By automating the reconciliation of invoices and 3-way matches, WeWork reduced the monthly invoice to 3000, saving costs and time.

Automation also helps check timely bill due clearances, thereby looking into challenges like slow payments or invoices that have errors. Integrating accounting software and ERP helps in the centralization of financial data, which allows bonding between departments and enables efficient decision-making. Such linkage increases collaboration, facilitates the elimination of data silos, and enhances compliance. By combining accounting software and ERP, financial data gets centralized, enabling different departments information access and sharability, which in turn improves collaboration and gets rid of information isolation. Such strengthens compliance by ensuring that the financial records are accurate, consistent, and auditable, automating compliance tasks, and reducing errors.

Through using connected finance solutions, namely, automation tools, accounting software, ERP, and other kinds, businesses discover excellence in their productivity levels, thereby making them competitive in the long run.

Accounts Payable Automation

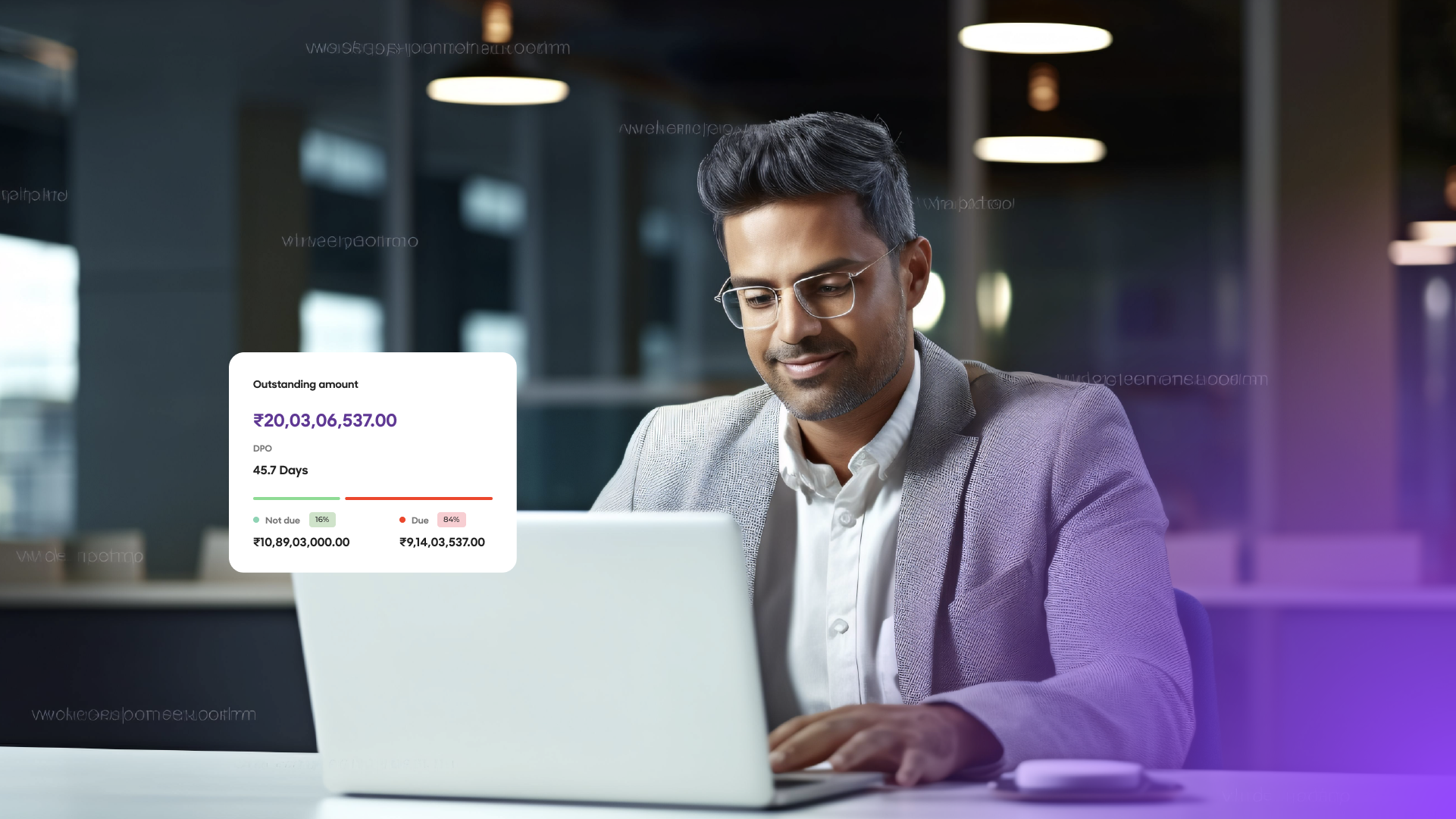

The old traditional system of accounts payable methods faces limitations that involve manual entries of data, challenges in the management of vendor invoices, missing records of purchase orders, limitations in managing vendors, slow processing, errors in the payment system, and maintenance of manual records. Automation facilitates the reduction of overall turnaround time by ten times and ensures 99% accuracy in data from invoices, thereby reducing costs to 65%. It also improves end-to-end security and reduces the processing time to less than 60 seconds.

Such challenges can result in errors, payment dues, the damaged reputation of vendors, and a rise in the cost of labor as well. Accounts payable automation can provide an efficient solution to the limitations, thereby providing advantages like effectiveness and accuracy in saving costs.

Examples of AP Automation benefits:

- SoulCycle, which has about 100 locations, faced challenges with production and operations accuracy. The adoption of AP automation helped them centralize purchases, consolidate invoices, and realize cost savings. It helped them manage operations and data, thereby boosting their agility.

- Lucidworks was struggling with manual bill payment processes and limited financial controls. Via AP automation and global payments software, Lucidworks gained better control over spending, achieved cost savings, and improved financial compliance.

Examples of famous AP automation tools that are trending at present are Tipalti, SAP Concur, Sage Intacct, and others. The tools assist the business in automating the AP process efficiently.

Accounts Receivable Automation

Accounts payable and accounts receivable automation are almost similar in terms of functionality but not synonymous. Both of the processes improve accuracy and offer financial benefits. AP automation mainly focuses on the management of suppliers’ outgoing payments. AR automation focuses on incoming payments from the consumer. AP automation includes processing invoices, scheduling payments, and managing the vendors, with AR automation managing invoices and providing reminders for payment and reconciliation.

Automating the AR process offers benefits. It boosts the process of payment, enhancing cash flow by decreasing the Days Sales Outstanding (DSO). Through the elimination of errors, AR automation improves overall accuracy and decreases the requirement to intervene in the resolution of problems manually. Organizations can more effectively experience rapid collection, enhanced production, and enhanced consumer satisfaction.

Numerous successful stories have shed light on the effect of AR automation.

- Shurtape successfully reduced its dues by more than 50% by streamlining the process and automating the deduction resolution.

- Summit Electric Supply and Co., which achieved a 98% hit rate, improving its effectiveness and reducing DSO.

- FleetPride also enhanced its productivity by more than 145% through the automation of data aggregation, collections, and reconciliation.

Some of the AR and AP solutions are Centime, Tesorio, HighRadius, BillTrust, and others. GETPAID is another solution provided by FIS Global, which serves organizations with large invoices.

Integrations Across ERP and Payroll

Financial systems integration with ERP and payroll software is critical for the organization’s efforts to streamline operations and enhance decision-making abilities.

In a more technical context, connected finance leverages APIs to establish direct communication channels between ERP and payroll systems. These APIs facilitate real-time data exchange, including employee details, payroll transactions, and tax information, by sending and receiving JSON or XML formatted messages over secure HTTPS protocols. Internally, both systems utilize database triggers and stored procedures to automatically process this data, ensuring that financial entries are synchronized and reflect the latest updates, thereby maintaining data integrity and supporting complex financial analytics.

Organizations may benefit from the seamless integration of both systems, which provides insights into financial health, worker compensation, and resource allocation. Such integration can improve data accuracy, minimize manual procedures, and streamline reporting, resulting in better financial management and compliance.

A 7-Step Guide to ERP Integration Across Any Finance Platform

Step 1: Identify integration requirements

Identify which data should be merged between the ERP and payroll systems, like employee information, time and attendance data, and financial data.

Step 2: Choose the integration method

Choose the best integration method, for instance, API, flat file transfer, or middleware solutions, depending on the capabilities of your ERP and payroll systems.

Step 3: Map data fields

Draft a data map that connects the corresponding fields of the ERP and payroll systems to make sure that the data is transferred accurately.

Step 4: Establish data transfer protocols

Explain the frequency, format, and security of the data transfers between the systems.

Step 5: Test the integration

Test the integration thoroughly to ascertain that the data is accurate, complete, and up-to-date.

Step 6: Train employees

Offer workforce professional guidance on how to use the integrated system efficiently and effectively.

Step 7: Monitor and maintain

Constantly check the integration to detect and fix any problems, as well as do the necessary maintenance so as to have the best performance.

Achieving trouble-free integration across several platforms comes with limits in terms of data interoperability, complicated systems, and security. Despite the constraints, the benefits of integration include increased productivity and reduced mistakes based on real-time information.

Want to know more about AP Automation? Check out our latest e-book!

Some of the famous companies that have utilized ERP and payroll integration are Amazon, Starbucks, and Toyota. All of these behemoths have utilized integrated systems to streamline their financial process and improve the management of payrolls. For managing integration, organizations are required to comply with practices like selecting efficient partners and making the linkage of processes with technology the main priority. Through such practice, companies can maximize profits for their financial systems and boost sustainability.

Future Trends: How AI, ML, and Blockchain Innovate Connected Finance

Trending technologies like artificial intelligence and blockchain efficiently structure the future of connected finance.

Artificial Intelligence

Artificial intelligence critically improves predictive analytics, inheriting automation of tasks, and also provides deep insight into financial trends. It will help in making decisions faster and more accurately, thereby helping the financial expert adapt to the ups and downs in marketing conditions.

Machine Learning

Improved machine learning algorithms boost the evolution of financial automation and integration of solutions. The technologies help optimize workflows, automate regular tasks, and enhance data processing. With the help of this, the financial teams are able to lay their focus on strategic planning and analysis, which leads to higher productivity levels.

Blockchain Technology

Blockchain technology also helps in the transformation of the financial sector by offering transparency and security to transactions. It will help facilitate digitalized assets similar to cryptocurrency, thereby streamlining the process with the assistance of features like smart contracts and decentralized finance platforms.

Search creativities help in unlocking opportunities for businesses to access financial services and thereby inherit management of the asset more effectively.

But alongside the mentioned opportunities, there also comes challenges.

Data privacy and fairness within the AI-boosted algorithms have always been a factor of concern. As for fintech agency and neo-bank fronts, blindly fixating upon regulatory frameworks to address technological usage can limit technological readiness, thereby leading to lesser scopes of workforce upskilling. Also, with prevalent automation, there might be limitations on the displacement of jobs and the urgency to upskill the workforce to adapt to the new roles.

FAQs

1. What is connected finance?

Connected finance is a financial management approach that utilizes technology and data analytics to unify organizational accounting functionality and data sharing. It can facilitate better decision-making and collaboration among in-house units.

2. What are the benefits of accounts payable (AP) automation?

A few benefits that organizations can reap from AP automation include cost-saving, improved security, better accuracy, and reduced processing time. It enables better management of operations and business data.

3. How does accounts receivable (AR) automation help businesses?

AR automation significantly reduces Days Sales Outstanding (DSO), increases accuracy, and improves customer satisfaction. It can simplify financial procedures while improving cash flow and productivity.

4. Why is integrating financial systems with ERP and payroll important?

Integrating financial systems with ERP and payroll software leads to real-time insight into financial health, worker compensation, and resource allocation. This assists with improved decision-making and organizational compliance management.

5. What emerging technologies are shaping the future of connected finance?

Artificial intelligence (AI) and Blockchain can shape the future of connected finance. AI can enhance predictive analytics, automation, and decision-making, whereas Blockchain can strengthen financial transaction transparency and security.

6. What are some potential challenges associated with connected finance adoption?

Probable challenges associated with connected finance adoption include data privacy concerns, fairness of AI-driven algorithms, and regulation for responsible usage of technology. Others may include tech-adoption-centric unemployment problems and the necessity of upskilling the workforce.

7. What are the crucial stages of setting up a connected finance solution?

The entirety of a connected finance solution includes several essential activities. Initially, evaluate financial procedures and pinpoint the parts that need to be refined. Define project scope and objectives, and then choose the appropriate technology solutions and vendors. Create an execution plan with time and resources and detail it out. Incorporate the systems and migrate the data, then test and verify the integrated solution. Train the users and then introduce the solution. Finally, monitor and fine-tune performance to identify faults or errors..

8. What are the cost implications of adopting connected finance?

Expenses of connected finance depend upon the size of the organization, its complexity, and the customization. Software licenses, subscription fees, hardware, infrastructure, implementation, and consulting services are the major cost components. Besides data migration, integration, training, and change management also involve costs. The maintenance and support costs are to be considered while finalizing the decision. A complete plan with the initial and the continuous costs is very important. Long-term gains and ROI should be carefully analyzed.

9. How much is the potential return on investment of the connected finance projects?

Connected finance initiatives can increase the ROI by cost savings and efficiency. Cutting down the manual procedures, quicker reporting cycles, cash flow management enhancement, and working capital optimization are the factors that add to ROI. Besides the increase in compliance, risk management, and strategic decision-making, better performance is also another advantage. Productivity and job satisfaction of the employees are the factors that make ROI higher. In order to determine ROI, take into account the total cost of ownership and the quantifiable benefits. Successful projects can provide the desired ROI within 1-3 years, depending on the particular situations of the organization.

Final Thoughts

The advent of connected finance presents exciting prospects of a financial management revolution via seamless technological integration and data-driven insights. Regardless, challenges related to data privacy, adherence to ethics, and safe AI usage still exist. Workforce displacement is still the major shallow aspect that stems from the rapid adoption of connected finance within organizations. Businesses should prioritize responsible tech adoption, all the while upskilling their workforces and placing relevant regulators to maintain a manual-automatic workforce balance. Lastly, by embracing new-age techs such as AI and Blockchain, businesses can revolutionize connected finance to facilitate expedited performance and long-term growth.

Visit Open.money for more information!