Taxes are an integral part of our financial ecosystem. Among the various forms of taxes that individuals and businesses need to pay, advance tax plays a critical role. As a taxpayer in India—whether you’re an individual, freelancer, or business owner—understanding advance tax, its due dates, and its financial implications is essential for smooth financial planning and compliance.

What is Advance Tax?

Advance tax, also known as “pay-as-you-earn” tax, is the income tax paid in installments rather than as a lump sum at the end of the financial year. It applies when an individual or business’s total tax liability exceeds Rs. 10,000 in a financial year. This provision helps reduce the burden on taxpayers by allowing them to pay smaller amounts periodically instead of a large sum all at once.

How is Advance Tax Calculated?

Calulate Advance Income Tax Here

To calculate advance tax, follow these steps:

- Estimate total income: Calculate your total income from all sources, including salary, business profits, rental income, capital gains, and interest income.

- Deduct eligible deductions: Subtract deductions available under Sections 80C, 80D, etc., of the Income Tax Act.

- Compute tax liability: Apply the applicable income tax rates to the taxable income to determine the total tax liability.

- Deduct taxes already paid: Reduce the amount of tax deducted at source (TDS) or tax collected at source (TCS) from the total tax liability.

- Pay the balance as advance tax along with interest u/s 234B and 234C (if applicable): If the remaining tax liability exceeds Rs. 10,000, you must pay it as advance tax.

For example:

A sole proprietor may have a total income of Rs. 8,00,000, but after applying eligible deductions (like Section 80C), its total tax liability may be below Rs. 10,000; in this case, he/she wouldn’t be required to pay advance tax.

Conversely, a business with a total taxable income of Rs. 12,00,000 could have a tax liability above Rs. 10,000 due to the applicable tax rate, meaning it would need to pay advance tax.

Who Should Pay Advance Tax?

Advance tax is applicable to:

- Salaried individuals: If they have income from sources other than salary, such as rental income, interest, or capital gains.

- Freelancers and professionals: Doctors, lawyers, chartered accountants, and other self-employed professionals.

- Businesses: Individuals running businesses, including sole proprietors, partnerships, and corporations.

Certain categories of taxpayers, such as senior citizens aged 60 years or above who do not have any business income, are exempt from paying advance tax.

Advance Tax Due Dates

The Income Tax Department has specified due dates for the payment of advance tax. These are:

For taxpayers opting for the presumptive taxation scheme under Sections 44AD or 44ADA, the entire advance tax liability must be paid in a single installment by 15th March of the financial year.

Advance Tax Due Dates For FY 2025-26 (1 April 2025-31 March 2026)

| Due Date | Installment | Amount Payable |

| On or before 15th June 2025 | First Installment | 15% of the total tax liability |

| On or before 15th September 2025 | Second Installment | 45% of the total tax liability |

| On or before 15th December 2025 | Third Installment | 75% of the total tax liability |

| On or before 15th March 2026 | Fourth Installment | 100% of the total tax liability |

For taxpayers opting for the presumptive taxation scheme under Sections 44AD or 44ADA, the entire advance tax liability must be paid in a single installment by 15th March 2026 of the financial year.

Check GST Calendar 2025 here.

Benefits of Paying Advance Tax

- Avoid interest penalties: Timely payment of advance tax helps businesses and individuals avoid interest penalties under Sections 234B and 234C of the Income Tax Act.

- Better financial planning: Paying taxes in installments allows taxpayers to manage their cash flow efficiently.

- Compliance with law: Regular payment of advance tax ensures compliance with tax laws, avoiding last-minute rushes and errors.

- Reduced year-end burden: Advance tax minimizes the burden of paying a large sum of money at the end of the financial year.

- Improve creditworthiness: Consistently fulfilling tax obligations can enhance a business’s credibility with lenders and investors.

Consequences of Non-Payment or Late Payment of Advance Tax

Failing to pay advance tax or paying it late can attract interest under:

- Section 234B: Applicable if 90% of the total tax liability is not paid by the end of the financial year.

- Section 234C: Applicable for delays in paying installments as per the due dates.

The interest is calculated at 1% per month or part thereof on the shortfall or delayed amount.

Common Misconceptions About Advance Tax

- Only for Businesses: Many believe that advance tax is only for businesses, but salaried individuals with additional income also need to pay it.

- Not required if TDS is deducted: While TDS reduces tax liability, you may still need to pay advance tax if the tax liability exceeds Rs. 10,000 after considering TDS.

- One-time payment: Advance tax is not a single payment but is spread across four installments.

How to Pay Advance Tax?

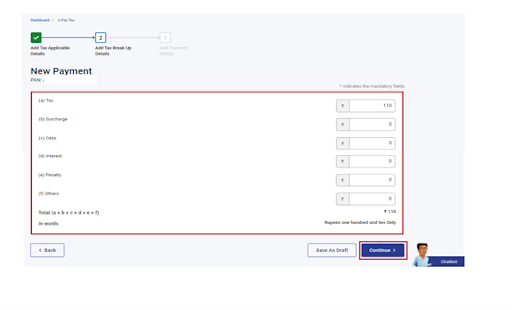

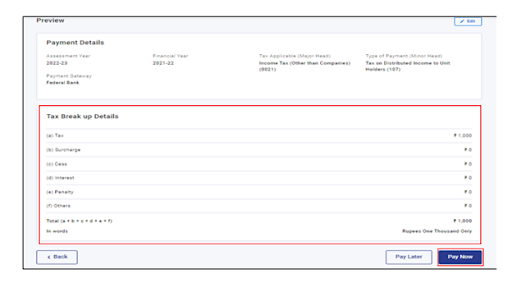

Advance tax can be paid online through the Income Tax Department’s official portal or offline at designated bank branches. Here’s how to pay it online:

- Visit the Income Tax e-filing portal (https://www.incometax.gov.in/).

- Navigate to the “e-Pay Tax” section.

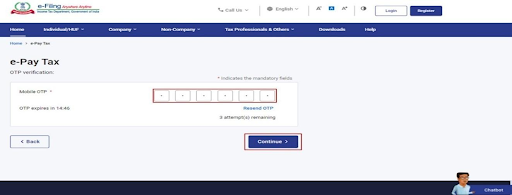

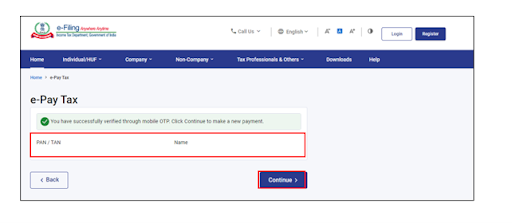

3. Enter PAN/TAN and mobile number for OTP verification.

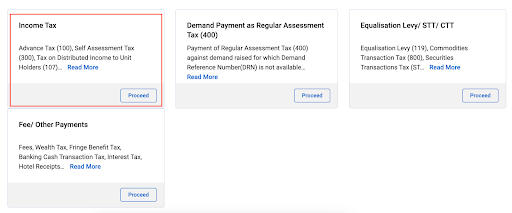

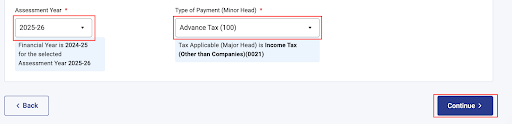

4. Select the appropriate challan and fill in the required details, including PAN, assessment year, and the amount payable.

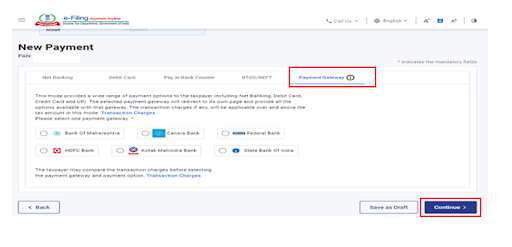

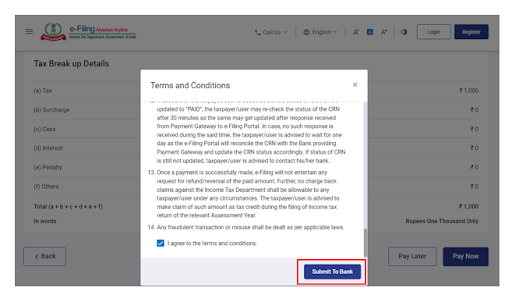

5. Complete the payment using net banking, debit card, or UPI.

6. Save the receipt for future reference.

After successful payment, you will receive a confirmation e-mail and an SMS on the e-mail ID and mobile number registered with the e-filing portal. The details of payment and Challan Receipt are also available under the Payment History tab on the e-Pay Tax page post-login.

Banks Onboarded on e-Pay Tax Service – Authorised Banks List

- Axis Bank

- Bandhan Bank

- Bank of Baroda

- Bank of India

- Bank of Maharashtra

- Canara Bank

- Central Bank of India

- City Union Bank

- DCB Bank

- Dhanlaxmi Bank

- Federal Bank

- HDFC Bank

- ICICI Bank

- IDBI Bank

- IDFC FIRST Bank

- Indian Bank

- Indian Overseas Bank

- IndusInd Bank

- Jammu & Kashmir Bank

- Karnataka Bank

- Karur Vysya Bank

- Kotak Mahindra Bank

- Punjab & Sind Bank

- Punjab National Bank

- RBL Bank

- South Indian Bank

- State Bank of India

- UCO Bank

- Union Bank of India

Conclusion

Advance tax plays a pivotal role in ensuring timely revenue collection for the government and easing the financial burden on taxpayers. Understanding what advance tax is, staying aware of advance tax due dates, and making timely payments can help you stay compliant and avoid penalties. Whether you’re an individual, a freelancer, or a business owner, proper tax planning is essential for smooth financial management and tax compliance.

FAQs

Do all businesses need to pay advance tax?

No, only businesses with a total tax liability exceeding Rs. 10,000 in a financial year need to pay advance tax. If your business has a taxable income, but the total tax liability after deductions, exemptions, and TDS is below Rs. 10,000, you do not need to pay advance tax.

Can I pay my advance tax through UPI or debit card?

Yes, you can make payments using UPI, debit cards, or net banking through the Income Tax Department’s online portal.

What happens if I miss an advance tax payment?

Missing an advance tax payment can result in penalties and interest charges under Sections 234B and 234C of the Income Tax Act, which could increase your overall tax burden.

Can I adjust advance tax payments if my income changes mid-year?

Yes, if your income increases or decreases significantly during the year, you can revise your advance tax payments by estimating your new tax liability.

Is advance tax applicable for salaried individuals with income from multiple sources?

Yes, salaried individuals who have additional income (e.g., from rental income, interest, freelancing income, or capital gains) and whose total tax liability exceeds Rs. 10,000 must pay advance tax. If you have income other than your salary, you must estimate your total income and pay advance tax accordingly.

Can I claim a refund if I overpay my advance tax?

Yes, if you overpay your advance tax, you can claim a refund when filing your Income Tax Return (ITR). The refund will be processed after the ITR is filed.

Does advance tax apply to freelance professionals or consultants?

Yes, freelancers, consultants, and self-employed professionals are required to pay advance tax if their total tax liability exceeds Rs. 10,000. This applies even if their income is from freelance work or consulting services.

Is there any penalty if I fail to pay the first installment on time?

Yes, if you fail to pay the first installment of advance tax by 15th June, you will be penalized under Section 234C for a delay in the payment of the first installment. The penalty will be 1% interest per month on the shortfall.

Is advance tax applicable to exempt income or non-taxable income?

No, advance tax is only applicable on taxable income. If you have income that is fully exempt under the Income Tax Act (such as agricultural income or certain government allowances), you don’t need to pay advance tax on that income.