For any GST (Goods and Services Tax) registered business, the most important thing is timely filing of Returns and Challan payments. The GST Council of India has lately laid out a few requirements for the GST registered companies to comply with the regime.

While you may already be aware of basic procedures such as GST calculations, we’ll now shed more light on the finer aspects of GSTR-1 filing. All GST registered businesses are required to specify the details of outward supplies and calculate the amount of tax they are required to pay. This can be done by submitting sales invoices under the GSTR-1 filing. In this article, we will take you through the important aspects on how to file your GSTR-1 with Open and the easiest way to accomplish the process.

Without any delay, let’s get started –

Who needs to file GSTR-1?

Every registered person/ taxpayer other than

- Input Service Distributor

- Composition Taxpayer

- Taxpayer liable to collect TCS

- Taxpayer liable to deduct TDS

- Non-resident taxable person

- Suppliers of Online Information and Database Access or Retrieval Services (OIDAR)

is bound to file GSTR-1. While doing this, the taxpayer shares complete details of their sales; i.e outward supplies made during a month or a quarter. Filing GSTR-1 is mandatory for any registered taxpayer, irrespective of the transactions or sales for that period.

Based on its annual turnover, a business can choose to file returns either monthly or quarterly. Check the details below to understand the monthly/ quarterly GSTR1 filing requirements.

| Turnover | Month/Quarter |

| More than 5 Cr | Monthly returns

(11th of subsequent month) |

| Less than 5 Cr (opted for QRMP) | Quarterly returns

(13th of the first month of subsequent quarter) |

| Less than 5 Cr (not opted for QRMP) | Monthly returns

(11th of subsequent month) |

[su_button url=”https://register.open.money/compliance/?utm_source=button_top&utm_medium=image&utm_campaign=GSTR-1_Filing” target=”blank” background=”#663399″ size=”5″ center=”yes” icon_color=”#663399″]File your GSTR-1 now![/su_button]

It is important to remember that in case the taxpayer does not file his returns within specified due dates mentioned on the GST portal, he is obliged to pay a late fee as a penalty.

However, filing returns on the GST portal brings along a bunch of challenges:

- Limited activation time on the platform – while the process takes hours

- Tedious document upload and verification process

- Confusing invoice errors and difficult to make amendments

- Issue while adding new invoices to respective sections

- System failure when there is a user overload

- Capacity issue – incapable to create a view, in case the number of invoices exceeds 500

- Ineffective support in sales and purchase transactions involving e-commerce operators

Well, not anymore! With Open’s Tax & Compliance module, filing GSTR-1 gets as easy as it could be.

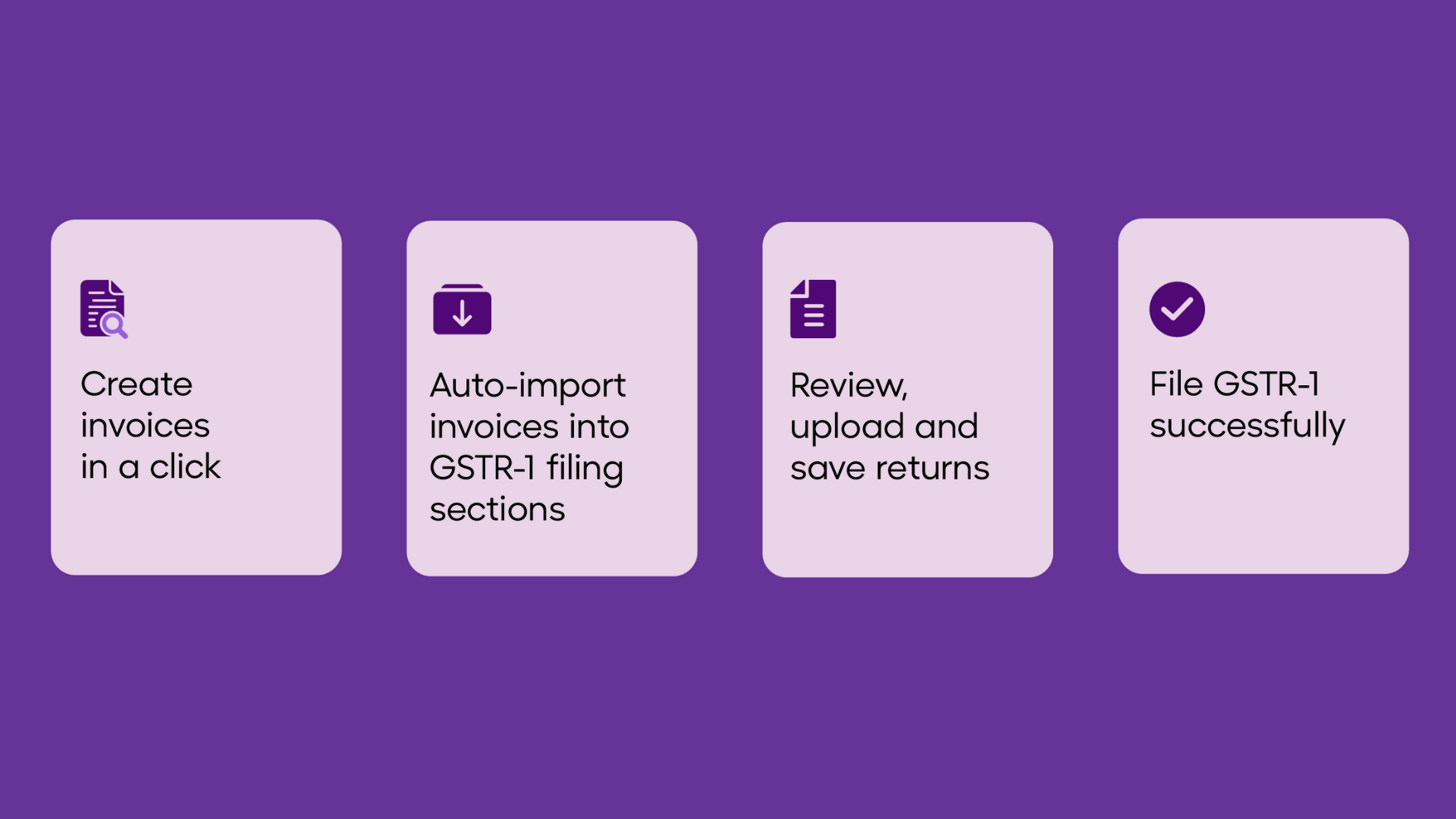

The foremost benefit that Open offers is that you can create GST – compliant invoices and also integrate other accounting software with ultimate ease. These invoices get auto-categorised under GSTR-1 and can be viewed under the Accounting and Taxes section on the Open dashboard.

How can filing GSTR-1 via Open’s Tax module benefit you?

1. Process end-to-end filing – Upload bulk invoices for various sections of GSTR-1 and file returns simply via EVC OTP verification.

2. Auto-classification of invoices in GSTR-1 sections – Open enables you to monitor all your invoices created under respective GSTR-1 sections.

3. Ensure 100% accurate returns filing – Edit invoices with errors at any time and re-upload error-free invoices on the portal with ease.

4. Analyse invoices based on different sections – Drill down to the invoice level from the selected section for precision; oversee HSN reports.

5. Track the filing status of your business – Get a complete overview of all your return filing on a single dashboard.

Now, let us quickly traverse through how easy it is to file GSTR-1 with Open.

File your GSTR-1 with Open

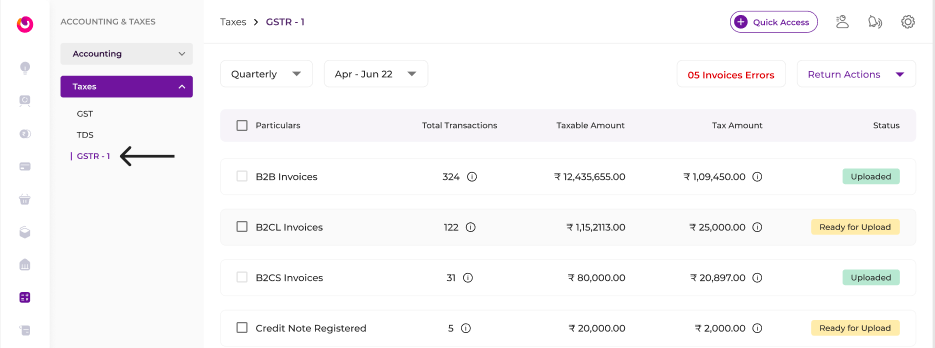

In the GSTR-1 section you can view the list of sections, choose the sections that you wish to upload on the GST portal.

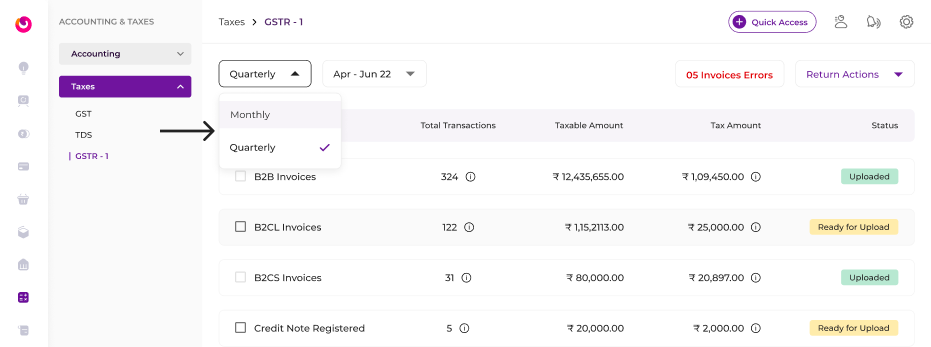

To start with, choose the applicable period on the left top. You can view the cumulative tax value, along with the transaction value under the selected section. You can now proceed to save the details for the Ready to Upload sections.

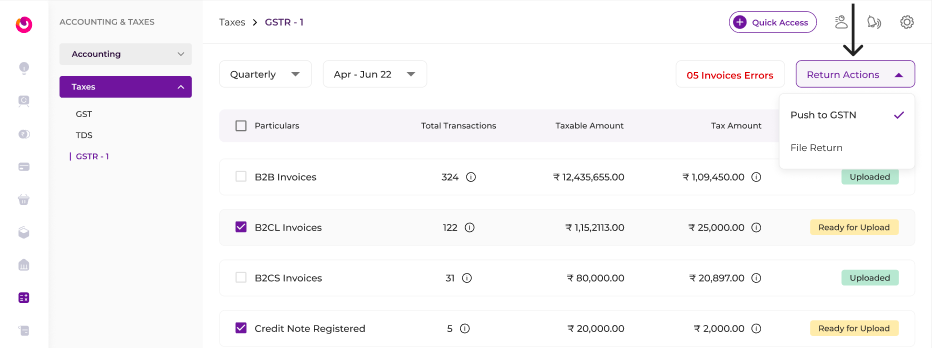

To ensure precision, you can view the invoices with errors in the top right corner. You can rectify the necessary information from the list of invoices available under Sales section on your dashboard. Once you have the error-free invoices listed, you may click on Push to GSTN under the Returns Action dropdown to save the rectified invoices. The Save action will upload all the invoices under the selected sections directly to the GST portal.

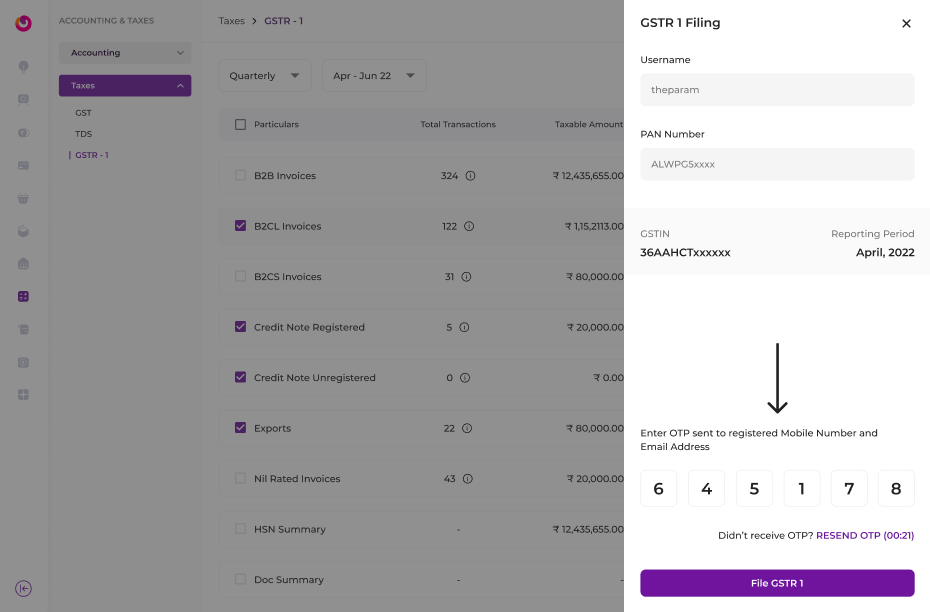

Just insert the username once, to proceed. You will receive an OTP (One Time Password) on your registered mobile number for verification. Fill in the OTP and you are good to go with save your returns details on the portal.

*Note – Based on the validity of API access of the user (validity can either be 6 hours or 30 days), the user can upload the details to Push to GSTN.

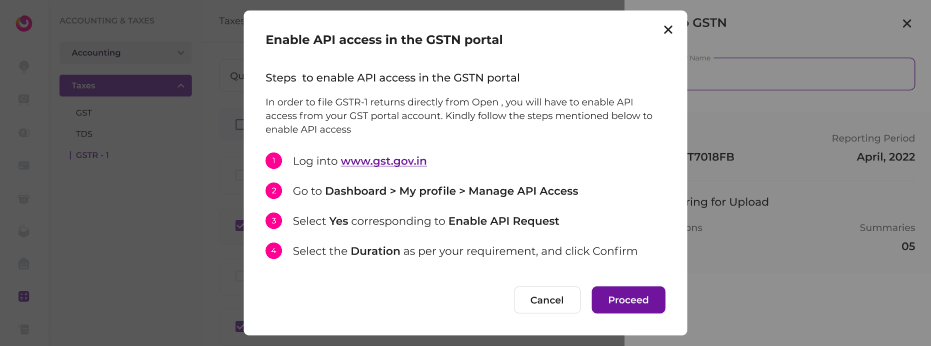

In case of an authentication error, a pop-up may appear to enable you to manage your API access from the GST portal.

*Note – Once the user enables API access in the GSTN portal, he can seamlessly file GSTR-1 as many times as he wants

Once the data is uploaded, you can proceed with filing the returns. Fill in your PAN details to receive an EVC OTP (Electronic Verification Code One Time Password) on your registered mobile number. Insert the EVC OTP to successfully file your GSTR-1.

With Open, it gets easier to stay on top of all your tax and compliance tasks. Signup now to narrow in to how you can make the most out of Open’s GST module.

[su_button url=”https://register.open.money/compliance/?utm_source=button_bottom&utm_medium=image&utm_campaign=GSTR-1_Filing” target=”blank” background=”#663399″ size=”7″ center=”yes” icon_color=”#663399″]File your GSTR-1 now![/su_button]