Vendor onboarding is one of those business processes that quietly consumes time, money, and mental bandwidth—until it breaks.

Emails flying back and forth, missing documents, manual bank checks, compliance risks, delayed payments—Indian businesses know this story all too well.

This is where vendor onboarding automation, powered by API, is fundamentally changing how modern finance teams operate.

In this blog, we break down how API-driven vendor onboarding reduces up to 80% of manual verification work, improves compliance, speeds up payouts, and creates a scalable vendor onboarding workflow for Indian businesses—from fast-growing startups to large enterprises.

What Is Vendor Onboarding Automation?

Vendor onboarding automation refers to the use of digital workflows and APIs to collect, verify, validate, and approve supplier information—without manual back-and-forth.

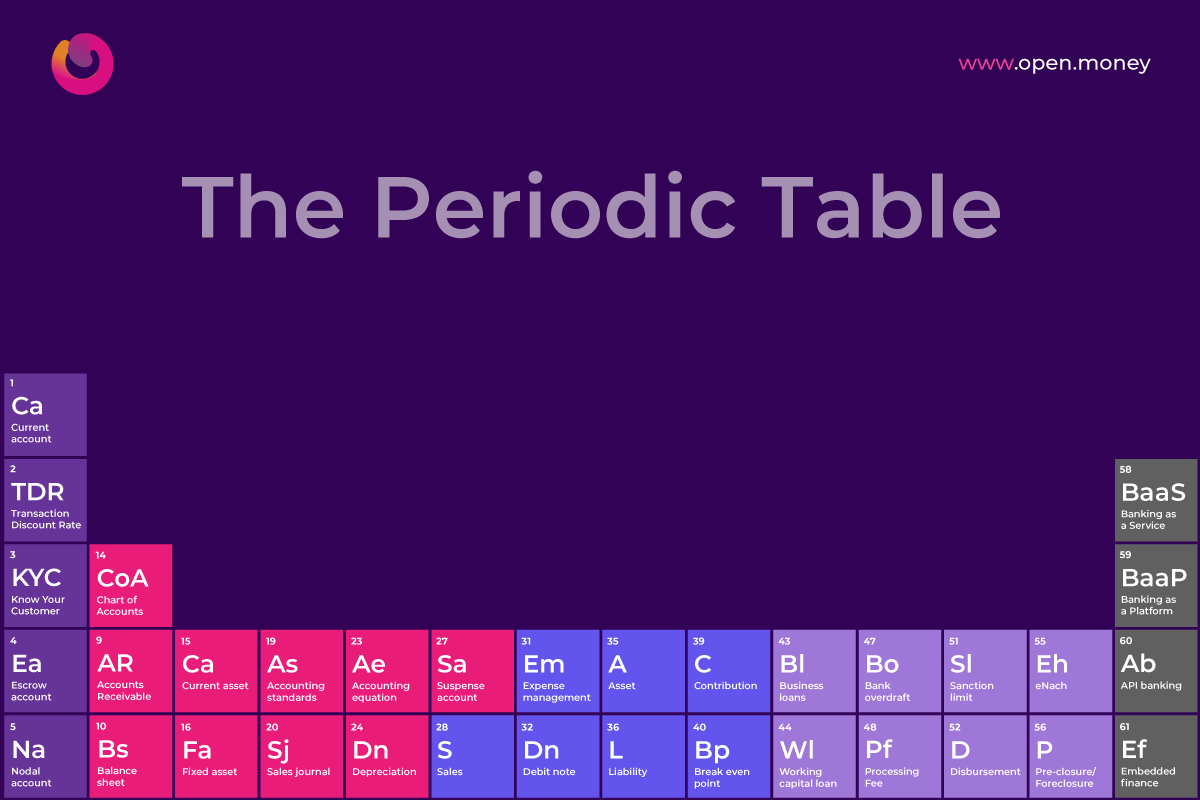

Instead of spreadsheets, PDFs, and manual checks, businesses use supplier data collection APIs, KYC/KYB verification APIs, and rule-based approvals to onboard vendors easily.

The Limitations of Manual Vendor Onboarding in India

Indian businesses often work with:

- Thousands of MSME vendors.

- Frequent vendor churn.

- Regional banking variations.

- Strict regulatory requirements.

Yet onboarding is still handled via:

- Email-based document sharing.

- Manual PAN and GST verification.

- Spreadsheet-based bank detail checks.

- Human approvals for every step.

The Real Cost of Manual Verification

| Challenge | Business impact |

| Missing or incorrect documents | Delayed vendor activation |

| Manual bank verification | Failed or reversed payouts |

| Human errors | Compliance and audit risks |

| Repetitive follow-ups | Ops team burnout |

| No audit trail | Regulatory exposure |

The Shift to API-Driven Vendor Onboarding

API-driven onboarding replaces fragmented processes with real-time, programmatic verification.

Instead of humans checking data, systems talk to systems.

What Changes with APIs?

| Manual process | API-driven process |

| Vendor email documents | Vendot files a secure digital form |

| Ops team manually verifies PAN/GST | Automated PAN/GST checks via verification APIs |

| Bank details checked manually | Bank account validation using penny-drop or account verification APIs |

| Approval via email | Rule-based approval workflow |

| Data re-entered into systems | Auto-sync with ERP |

Steps to Automate 8 Out of 10 Tasks in the Vendor Onboarding Process

API-driven vendor onboarding improves the onboarding process by moving repetitive verification and approval tasks from manual handling to structured, system-led workflows.

Below is a step-by-step view of how this works in practice.

Step 1: Automated supplier data collection

Instead of collecting vendor information over email or messaging platforms, APIs enable structured, digital supplier data collection.

What’s collected digitally?

- Business name and type

- PAN details

- GSTIN (if applicable)

- Bank account details

- Contact information

Why this matters

- Eliminates incomplete submissions

- Enforces mandatory fields

- Reduces follow-ups by default

Step 2: Real-time KYC/KYB verification via APIs

This is where some of the largest efficiency gains occur.

What are KYC/KYB verification APIs?

- KYC (Know your customer): Identity verification

- KYB (Know your business): Business entity validation

Using APIs, systems can automatically verify:

- PAN authenticity

- GST registration status

- Business name matching

- Entity type (proprietorship, LLP, Pvt Ltd)

Impact

- Significant reduction in manual document checks

- Near real-time verification outcomes

- Lower exposure to identity and compliance risks

Step 3: Automated bank account validation

Incorrect bank details are a common cause of failed or reversed vendor payouts.

API-driven automated vendor validation solves this through:

- Account number validation

- Account holder name matching

- Real-time confirmation

Result

- Fewer payout failures

- Cleaner reconciliation processes

- Improved vendor trust and experience

Step 4: Rule-based vendor onboarding workflow

Once data is verified, APIs trigger intelligent onboarding workflows.

Examples of workflow rules

- Auto-approve low-risk vendors

- Route high-value vendors for finance approval

- Flag data mismatches for manual review

- Auto-reject non-compliant entries

This ensures human intervention is required only for exceptions, significantly reducing manual effort.

Step 5: System-to-system sync (ERP, accounting, payouts)

With APIs, verified vendor data flows directly into:

- ERP systems

- Accounting software

- Payout and reconciliation platforms

Benefits

- No duplicate data entry

- Consistent records across systems

- Faster vendor activation

Common mistakes businesses make (and How to avoid them)

1. Treating vendor onboarding as a one-time task

What goes wrong:

Businesses design onboarding for a single use, leading to repeated manual effort every time a new vendor is added.

How to avoid it:

Build reusable, standardised vendor onboarding workflows that can scale across teams, locations, and vendor categories.

2. Relying on manual compliance checks

What goes wrong:

Manual PAN, GST, and business verification increases the risk of errors, delays, and audit gaps.

How to avoid it:

Use KYC/KYB verification APIs aligned with Indian regulatory requirements to enable consistent, real-time validation.

3. Operating with siloed systems

What goes wrong:

Vendor data is collected in one system, approved in another, and re-entered into accounting or payout systems—creating inconsistencies.

How to avoid it:

Ensure vendor onboarding workflows integrate directly with ERP, accounting, and payout systems from day one.

4. Over-engineering approval processes

What goes wrong:

Every vendor—regardless of risk or value—goes through the same multi-layer approval process, slowing down onboarding.

How to avoid it:

Adopt risk-based, rule-driven workflows that automatically approve low-risk vendors and escalate only when required.

Why Vendor Onboarding Automation Is Now a Strategic Advantage

In India’s fast-moving digital economy:

- Vendors expect faster activation

- Regulators expect cleaner compliance

- Finance teams expect scalability

API-driven onboarding is no longer optional—it’s foundational to enterprise-grade finance operations.

How OPEN Money Fits Into This Journey

OPEN Money helps businesses modernise vendor onboarding through API-first workflows that integrate easily with payouts, approvals, and core financial operations. By replacing manual checks and fragmented processes with structured data collection, automated validations, and system-level integrations, businesses can onboard vendors in significantly less time than traditional methods.

This approach reduces manual intervention across finance teams while supporting scalable, compliant, and efficient vendor onboarding workflows—built specifically for Indian businesses.

Frequently Asked Questions (FAQs)

1. What is vendor onboarding automation?

Vendor onboarding automation uses digital workflows and APIs to collect, verify, and approve vendor information without manual intervention.

2. How do KYC/KYB verification APIs work in India?

They validate PAN, GST, and business details in real time using authorised data sources aligned with Indian regulations.

3. Can SMBs use API-driven vendor onboarding?

Absolutely. Many SMBs adopt automation to handle scale without increasing finance headcount.

4. Does vendor onboarding automation reduce payment failures?

Yes. Automated bank validation significantly lowers payout errors and reversals.

5. Is GST mandatory for vendor onboarding?

Not always. APIs can dynamically handle GST-registered and non-GST vendors.