If you are a business owner with a lot of transactions to handle, you know how difficult it is to manage them. Most of the time, your accounting software is not directly connected to your current account and you have to repeatedly log into different portals for:

- Reconciling your payments

- Getting updates like checking balances for multiple current accounts

- Making vendor payments

- Knowing the status of your pending and completed payments and understanding your business cash flow

This is where Axis Bank Connected Banking comes in as a solution. OPEN has partnered with Axis Bank to ensure all such hurdles in the payment process are eliminated. Moreover, this partnership is made to ensure that you receive your payments from your customers timely. Also, this makes sure that you are always on time to pay your vendors by tracking your payment schedules in real-time.

All these services are provided to all Axis Bank current account holders through the OPEN platform.

What is Axis Bank Connected Banking?

Axis Bank Connected Banking enables you to connect your Axis Bank current account to OPEN’s business payment platform. Not only this, you can also connect your current account to your accounting software such as Tally, Zoho Books, Microsoft Dynamics, and more.

With these, you can pay your vendors directly, receive payments from your customers by sending them payment links, check transactions and account balance details, auto-reconcile all your transactions, and perform other such activities.

You can do all this under one dashboard without logging into different portals, a time-saving and convenient way to manage your business payments. Let’s know Axis Bank’s connected banking services in a little more detail.

Valuable features and benefits of Axis Bank Connected Banking

Know some of the top features and benefits of Axis Bank Connected Banking below:

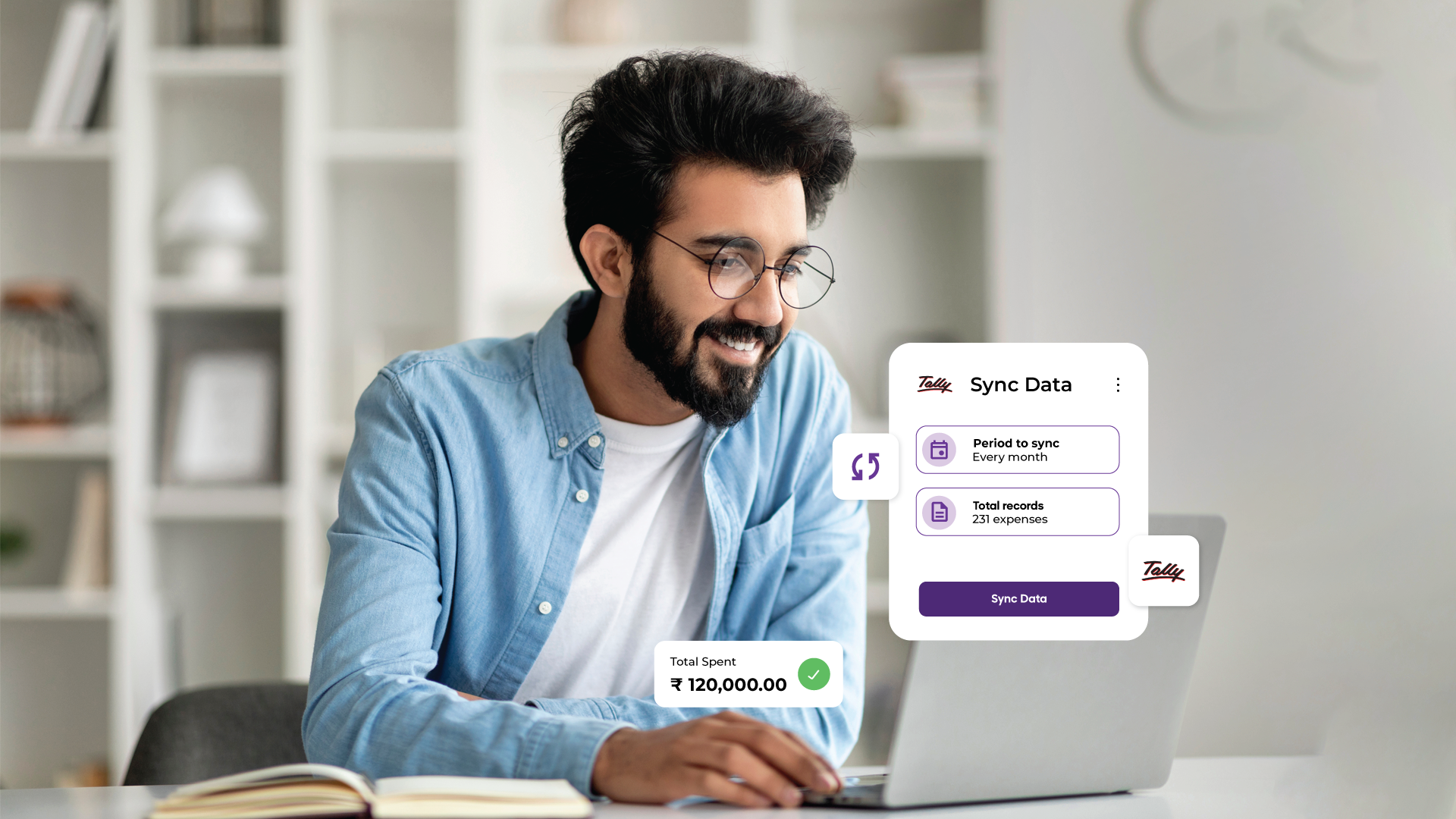

1) Auto reconciliation

You can connect your accounting software with your Axis Bank’s current account through OPEN platform. This will ensure that each payment you make through OPEN will be automatically reconciled on the platform and will also be automatically synched back to your accounting software. This means your all payment transactions can be viewed on OPEN as well as on your accounting software.

Benefit: Every bill and invoice raised for payouts and collections will be auto-reconciled without the need of going to and fro and matching them manually with e-statements. With this, you can save a huge chunk of time that can be used for making strategies to make your business grow.

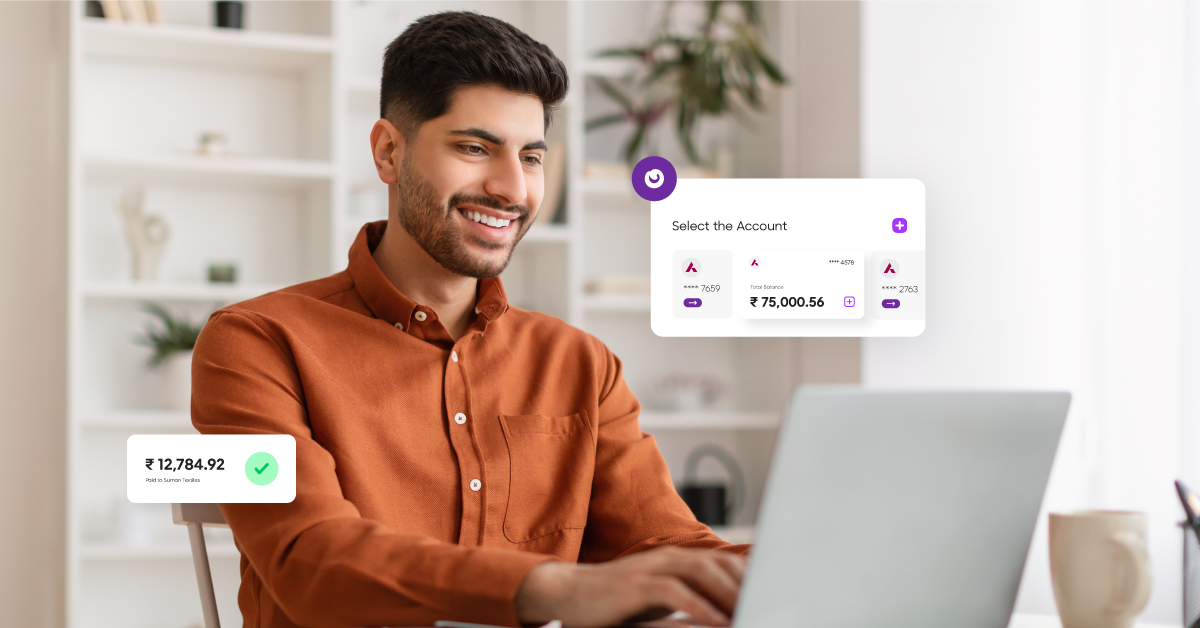

2) Perform payout activities easily under a single dashboard

Make payouts directly from OPEN’s dashboard from your linked Axis Bank’s current accounts. You can perform activities such as an account to account transfers, pay bills and track your payments.

Benefit: There is no need for you to maintain multiple passwords for your multiple current accounts as you can access them and make payouts through them on OPEN’s platform itself.

Additionally, you can also pay all your vendors in bulk without paying them one by one separately and without the need to prepare a lengthy Excel sheet to record details of each beneficiary and payment details.

With OPEN, you can pay a number of vendors at the same time. This will also eliminate the need of entering OTPs for each payout. All this can be done by entering the correct amount and bank details entry from OPEN’s system.

3) Get a bird’s eye view of your payments

With your Axis Bank Current Account linked to OPEN, you can view every payment activity. Be it your account balance, transaction history, pending and completed payments.

Benefit: This way, you will always remain on top of your business cash flow. Keeping track of your pending payments will help you to send payment reminders to your vendors on time and you will receive your payments timely.

Added advantages of Axis Bank Connect with OPEN

OPEN’s partnership offers business-specific tools that allow you to manage:

- Spend Management – Keep track of employees and business expenses by automated receipt collection and approvals.

- GST filing – Cut the hassles of calculating GST as OPEN does it for both inward and outward supplies with GSTR-1 ready for filing. Download GSTR-2A for verifying your transactions and file GSTR-3B. Do it all directly from the OPEN platform.

- E-invoicing – Follow the simple method and create invoices from OPEN platform. It will generate an e-invoice with the option available and also the IRN.

- Payroll – Monitor and manage employee reimbursements, leaves, and pay from the OPEN platform.

To reap such amazing benefits of the Axis Bank Connected Banking feature, connect your Axis Bank Current Account with OPEN today!

![]()