Two-way sync or widely known as “Tally synchronisation”, a dynamic data exchange mechanism, holds the potential to revolutionise how businesses manage their financial records.

This synchronisation allows businesses to quickly extract information like invoices, bills, and inventory from Tally and update it in ERPs, CRM, and e-commerce platforms. Moreover, it helps push payment and collection entries smoothly from different sources, including payment gateways, online businesses, and connected banking platforms, right into Tally accounting software.

This blog explains in detail about seamlessly exchanging and updating data between Tally and business payments systems such as OPEN

Tally Synchronisation with Connected Banking:

What is Connected Banking? A groundbreaking innovation that interconnects banking and accounting tools. It helps businesses connect their multiple current accounts to their accounting tools. This gives a complete overview of cash flow, simplifies vendor payments, fastens collections from customers, and automates reconciliation.

The need for Tally synchronisation:

The integration of Tally with Connected Banking addresses modern demands for real-time financial insights. This synchronization ensures that financial transactions, invoices, and statements flow seamlessly between Tally accounting software and Connected Banking platforms, enabling businesses to make informed decisions promptly.

Features and benefits of Tally synchronisation with OPEN

Exploring OPEN:

Before we dive into the specifics, let’s acquaint ourselves with OPEN. It’s a financial platform designed to empower business payments using connected banking. To grasp the full scope of OPEN’s offerings, visit the OPEN website.

When Tally accounting software and OPEN work together, some amazing features come to life. Real-time syncing of data in Tally takes the spotlight, making automatic Journal Voucher (JV) creation happen for each Tally transaction.

Reconciliation gets super easy with just a click, helping businesses achieve quicker Bank Reconciliation Statements (BRS). Most importantly, this integration guarantees that your books are accurate and up-to-date, showing the latest financial info whenever you need it.

Automatic Tally Synchronisation:

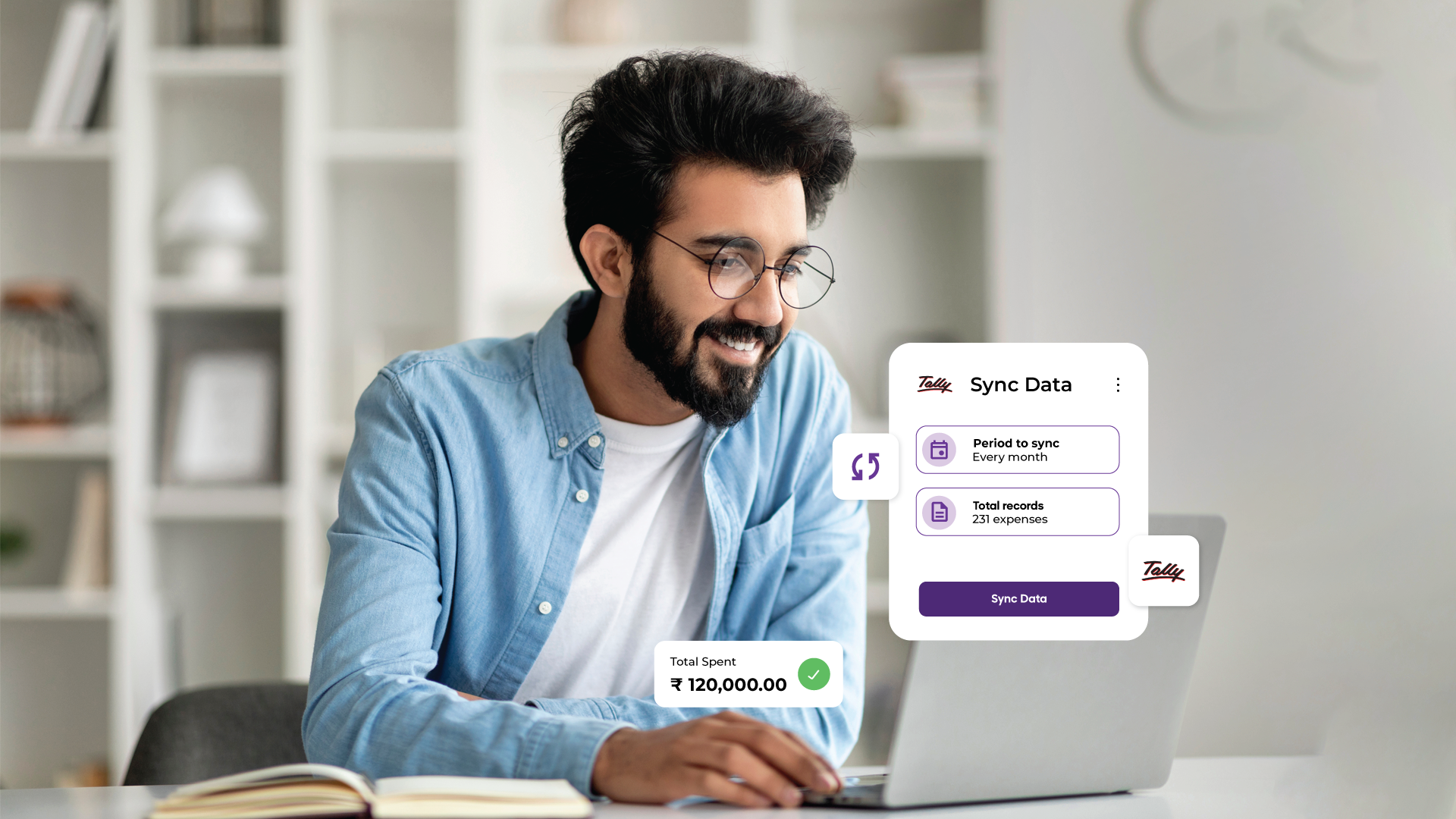

In the fast business world, getting information quickly is crucial. Tally and OPEN’s integration ensures real-time syncing of data. Invoices and bills you make in Tally can be synced with OPEN. This simplifies payments and collections processes that happen on OPEN. Also, these transactions made on OPEN get updated on Tally automatically. Hence, with zero manual effort, OPEN promises streamlined financial workflows through tally synchronisation

Effortless BRS preparation:

Traditional Bank Reconciliation Statements (BRS) can take a lot of time. But with Tally data synchronisation with OPEN, BRS becomes as easy as a click. Matching e-statement transactions with Tally entries becomes accurate, and finding missing entries becomes effortless – saving time for other important tasks.

Accurate Bookkeeping:

Manual data entry can lead to mistakes, causing problems in decision-making. Tally + OPEN integration avoids this. Every transaction is automatically recorded, ensuring your books are accurate and trustworthy, reducing the chance of errors. With accurate bookkeeping comes accurate financial insights, in turn leading to precise decision-making

How does the Tally data synchronisation work with OPEN?

By embracing this tally synchronisation, businesses gain a competitive edge, freeing valuable time and resources to focus on strategic growth initiatives.

What is OPEN apart from this tally synchronisation?

It connects multiple current accounts of different banks (SBI, Axis Bank, ICICI Bank, Yes Bank, and 15 more) to its fully-functional accounting tool as well as pulls and pushes data from/to leading accounting tools such as Tally, ZOHO Books. Apart from that, you can:

-

- Create and process AP and AR with ease

- Pay multiple vendors and employees at one go

- Collect payments 30% faster with payment link-embedded invoices

- Reconcile in less than 5 mins

- File GSTR 1 on the go

Apart from automating payouts, collections, and reconciliation, OPEN also has expertise on

- Spend management: Track business and employee expenses with receipt collection and approvals

- Payroll: Monitor employee reimbursements, leaves, and pay from the OPEN platform directly

- E-invoicing: Easily create invoices and let OPEN generate e-invoices and IRN

- GST filing: OPEN will calculate GST for inward and outward supplies with GSTR1 ready to file. Additionally, it can fetch GSTR 2A for verification and submit GSTR 3B

The benefits of Tally’s two-way sync with OPEN extend far beyond the surface. This integration goes beyond data exchange; it’s a catalyst for transforming financial operations, optimizing processes, and elevating business performance.

Ready to embrace a future where your financial landscape is seamlessly synchronized? Explore the transformative possibilities of Tally’s data synchronisation with OPEN and embark on a journey of financial empowerment. Get Started!