Over the past few years, the way Indian businesses handle payments has changed dramatically. Most companies, whether small or large, now depend on digital platforms to pay vendors, manage invoices, and track expenses. This shift has made financial operations faster and more transparent, but it has also opened new gaps that fraudsters are quick to exploit.

In many accounts teams, especially in growing businesses, the focus is on clearing payments quickly and keeping vendors happy. But in that rush, small details can go unnoticed, an extra zero on an invoice, a new account number, or a slightly altered vendor email address. These may seem harmless, but they’re often how B2B payment fraud begins.

Across India, AP (Accounts Payable) departments are learning that strong controls and the right AP fraud prevention tools are just as important as efficiency. Payment fraud no longer happens only to large corporations; even smaller firms are being targeted through fake invoices and manipulated vendor details. Understanding how these frauds happen, and how to stop them is the first step towards building safer, more reliable payment systems.

The Hidden Cost of Convenience

In 2024, the Reserve Bank of India (RBI) reported a steady rise in digital payment fraud, a trend that has also affected business transactions. Small and mid-sized enterprises have become particularly vulnerable as they rely more on digital payments and online invoice processing.

Imagine a vendor sending a routine invoice, but this time the bank details have changed slightly. The AP executive, rushing to close month-end payments, processes it without verifying. A few hours later, lakhs of rupees are gone — transferred to a fraudster’s account.

Such incidents show that convenience in payments must always be balanced with strong AP fraud prevention tools and proper internal checks.

What B2B Payment Fraud Really Means

At its core, B2B payment fraud involves any deceptive act that manipulates the payment process between businesses. Fraudsters target weak links in workflows, vendor databases, or email communications to redirect funds or submit false claims.

The most common types of fraud that Indian AP teams face include:

- Fake or duplicate invoices: Fraudsters create invoices for goods or services that were never delivered. Sometimes, genuine vendors accidentally or intentionally submit the same invoice twice, which makes detecting duplicate invoices an important step in the AP process.

- Business Email Compromise (BEC): Attackers impersonate senior management or vendors to trick AP staff into transferring funds.

- Vendor payment fraud: This occurs when vendor bank details are changed without proper verification. In many cases, the email address looks authentic, making vendor payment fraud detection difficult.

- Internal fraud: Occasionally, employees with access to AP systems misuse their privileges to manipulate payments or vendor records.

Each of these scenarios shows how even small oversights can lead to significant financial losses.

Why AP Departments Are a Prime Target

The Accounts Payable function handles hundreds, sometimes thousands, of payments every month. With the growing use of digital invoices, online banking, and integrated ERP systems, AP teams have become a natural target for cybercriminals.

Some key reasons include:

- High transaction volume: A single mistake among hundreds of payments can easily go unnoticed.

- Multiple vendor relationships: With vendors spread across cities and sectors, verifying every detail becomes challenging.

- Manual processing: Many Indian businesses still rely on spreadsheets or partially automated systems, leaving room for human error.

- Pressure to process quickly: Deadlines and approval hierarchies often push teams to act fast — sometimes too fast.

When fraud happens, it not only affects the bottom line but also damages vendor relationships and internal credibility.

Red Flags Every AP Team Should Watch For

Fraud rarely appears obvious at first glance. It often hides behind regular-looking paperwork or familiar communication patterns. AP departments can strengthen their defense by paying attention to these warning signs:

- Vendors requesting payment to a new or foreign bank account.

- Invoices that slightly differ from past formats or amounts.

- Urgent or high-value payment requests coming from email IDs with minor spelling variations.

- Repeated or duplicate invoices for the same goods or services.

- Missing or unclear purchase order (PO) references.

- Sudden changes in vendor contact details without formal communication.

Training AP staff to pause and verify when they notice these signals can prevent a potential loss before it happens.

Reducing the Risk: Practical Steps for AP Teams

Reducing payment fraud isn’t about adding complexity; it’s about building smarter, safer workflows. Here are some steps AP departments can take to minimize risk:

1. Strengthen Vendor Verification

Before onboarding a new vendor, verify their business registration, PAN, and GST details. Always confirm bank account changes through a phone call or written confirmation from a known contact. Many AP fraud prevention tools now include built-in vendor verification features that automatically cross-check bank details against trusted databases.

2. Automate Invoice Matching

Manual invoice verification is time-consuming and prone to error. Using automation for detecting duplicate invoices or mismatched PO numbers helps identify irregularities early. Automated systems can also flag invoices that don’t match previous billing patterns.

3. Enforce Role-Based Approvals

Segregation of duties is essential. The person who approves a purchase order should not be the same person who releases payments. Implementing multi-level approvals and digital audit trails ensures accountability at every step.

4. Conduct Regular Audits

Routine internal audits help spot inconsistencies and unusual payment trends. Random checks, especially on vendor master data, can catch manipulation attempts before they escalate.

5. Train Employees Regularly

Fraud prevention is as much about awareness as technology. Periodic training on vendor payment fraud detection, identifying phishing attempts, and reporting suspicious activity can help build a more alert and responsible AP culture.

Technology as a Safety Net, Not a Shortcut

Modern AP automation tools have made fraud prevention far more effective, but they work best when combined with human judgment.

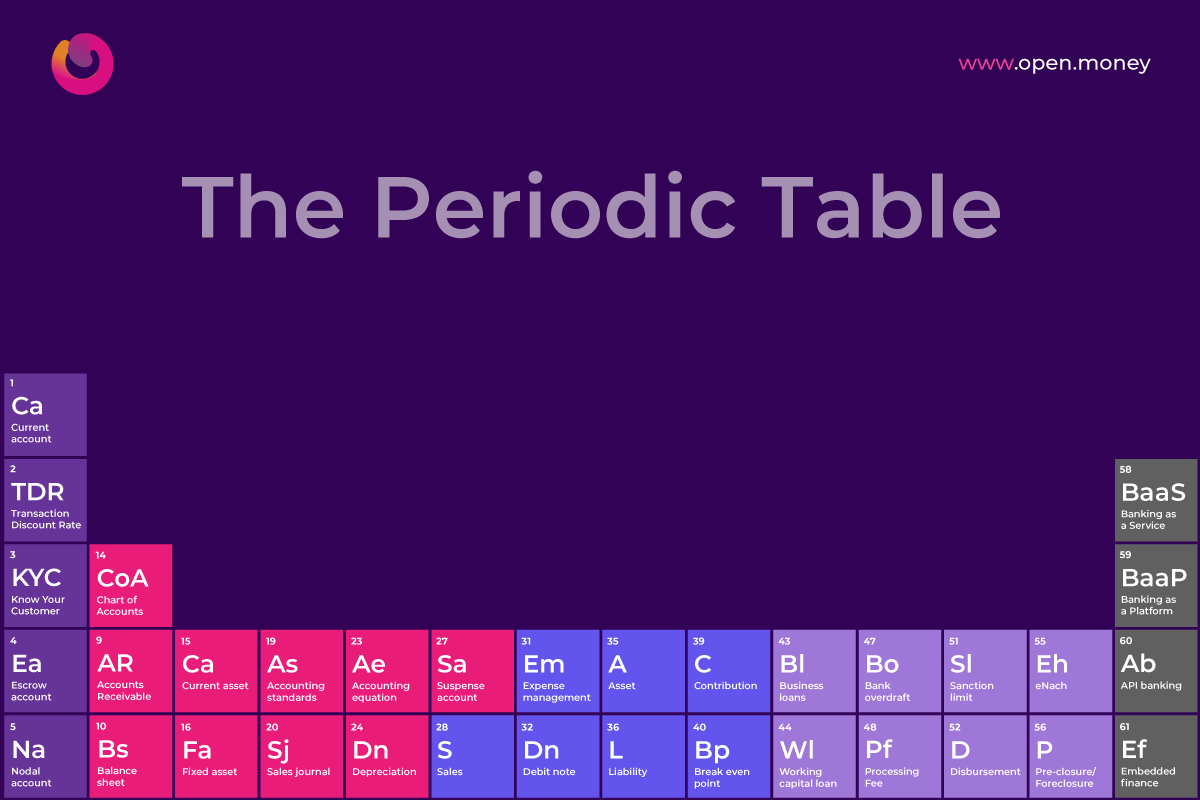

Here are some technologies and systems that support secure B2B transactions:

- Automated AP platforms: These systems integrate with ERP software and banking channels to simplify invoice approval and payment releases. They can detect anomalies such as duplicate vendor accounts or irregular transaction patterns.

- Payment gateways with two-factor authentication: Ensuring that every payment is authorized by more than one layer of security reduces exposure to unauthorized transfers.

- AI-based fraud detection: Some advanced systems use pattern recognition and predictive analytics to flag suspicious vendor activity before a payment goes out.

- Audit and reporting dashboards: These help AP teams monitor all payment activity in real time, improving transparency and traceability.

That said, even the most advanced system cannot replace the human instinct to question something that feels off. Technology should act as a guardrail, not a substitute for careful verification.

Building a Fraud-Resilient AP Culture

Fraud prevention is not the responsibility of one person or one department. It requires collective ownership across finance, procurement, and management. Creating a fraud-resilient culture starts with:

- Encouraging employees to report suspicious activity without hesitation.

- Establishing clear escalation procedures for potential fraud cases.

- Promoting collaboration between AP, IT, and compliance teams.

- Setting up periodic knowledge sessions on AP compliance and fraud risk, covering real-life case studies and lessons learned.

A simple internal rule — “verify before you pay” — can make a big difference.

From Risk to Readiness

As Indian businesses continue to scale and operate across borders, the need for secure B2B transactions has never been greater. Payment fraud is not limited to large corporations; even smaller enterprises are at risk when oversight is low or systems are outdated.

By combining the right mix of technology, internal control, and employee awareness, AP departments can transform themselves from potential weak spots into strong lines of defense. Investing in AP fraud prevention tools, improving vendor verification, and maintaining strong AP compliance and fraud risk frameworks are not just about protection — they also strengthen business credibility.

In the end, preventing payment fraud is about balance. Businesses must move fast enough to stay competitive but carefully enough to stay secure. For AP teams, that means building processes that prioritize both efficiency and trust — because in payments, every transaction is a reflection of your business integrity.