So you’ve decided to open a current account for your business.

Perhaps you want to open a second one for your cash inflow, or a new account altogether, to streamline your business transactions. Or maybe you’ve chosen a dedicated current account to build your credit score and avail a loan eventually.

Whatever be your reason for opening a current account, there are several factors you should consider before you choose the best one for your needs.

Let’s explore them in this blog, and look at how to arrive at an informed decision on the current account – one of the most important aspects of running a business.

Current Account: The Control Centre of Your Business Finances

As an important financial tool, a current account is a critical part of your business, regardless of its size or industry. It helps you track your income and expenses and monitor your cash flow, so that you can make strategic decisions. Moreover, having a dedicated current account is a mark of professionalism for your business, and demonstrates that you are serious and committed to its operations.

7 Features To Evaluate Current Accounts

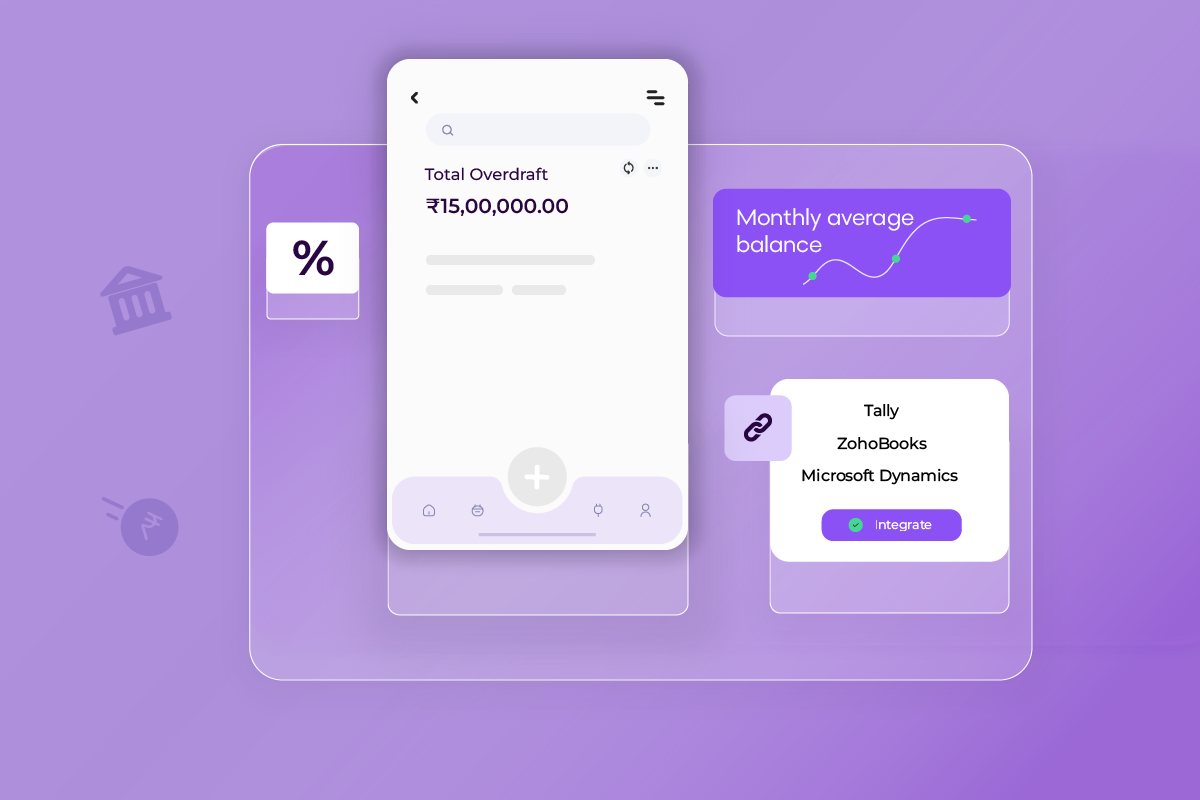

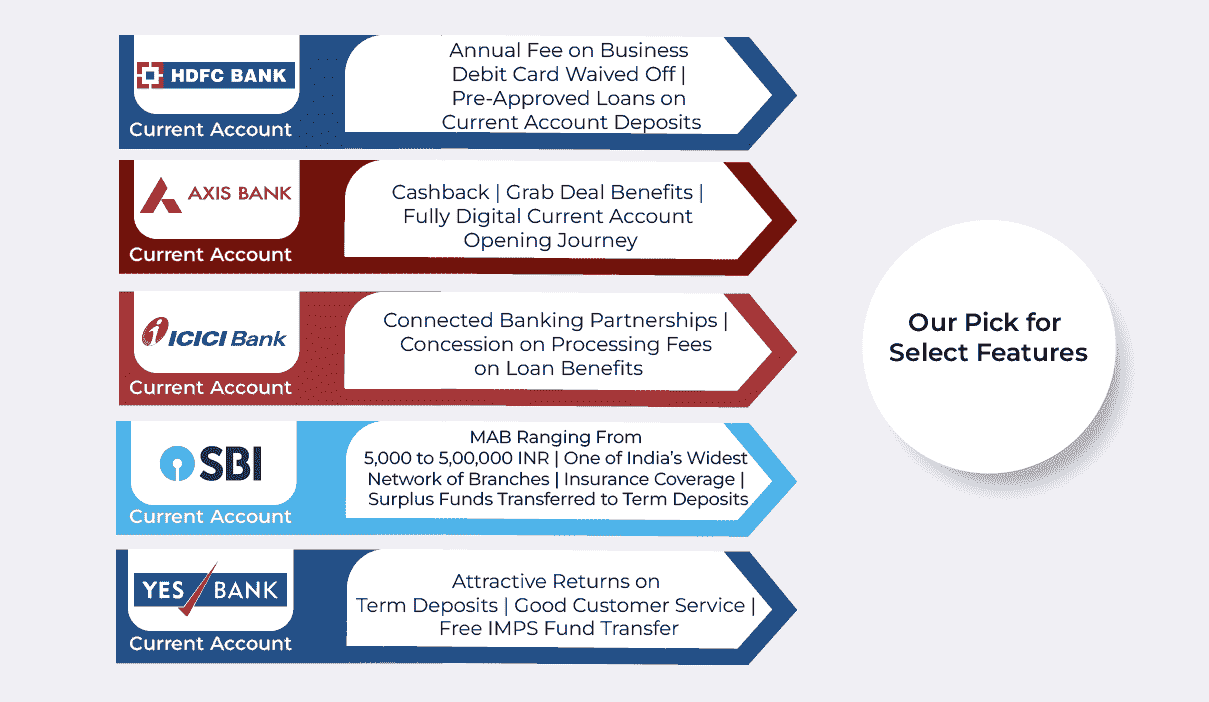

With the range of account offerings by the many banks in the country, it is important to evaluate them according to clearly defined parameters like monthly account balance, overdraft facilities, interest rates or additional benefits and services. Depending on the nature of your business, your cash flow patterns or your credit requirements, you might want to prioritise one feature over the other.

For example, for a business with irregular or seasonal cash flow, a low-balance current account becomes important as it saves the business from penalties or fees during lean months. On the other hand, for high-volume businesses like retail, where a significant part of the sales may be in cash, charges and fees levied on cash and non-cash transactions, or bank deposit fees might become a key deciding factor.

| Feature | What to look for | Points to consider |

| MAB/QAB to be maintained:

The monthly or quarterly average balance of a current account is the minimum amount to be maintained over a period of time. |

Some businesses prefer an account with a higher MAB/QAB for the benefits that come with these accounts, like special cards, free transactions, or higher interest rates. | Penalties for non-maintenance, especially during lean months |

| Rate of Interest:

The returns that a bank might offer on your balance |

If your business cash flow pattern allows for a higher balance, you might want to consider a current account that yields a higher rate of return. | Lower interest rates compared to other account types |

| Overdraft Facility:

An overdraft facility in a current account allows you to withdraw even if your account balance is zero, depending on your current account value, repayment history, credit score, etc. |

An overdraft facility can prove to be beneficial during a sudden or unplanned financial situation. | High-interest rates on overdrafts |

| Connected Banking:

The ability to connect your current account with your business and accounting tools or ERP software so that you can pay, collect payments, or reconcile transactions with real-time data updates. |

Connected banking makes setting up single or bulk payouts, adding beneficiaries, collecting payments, and linking all money movement with accounting and tax compliances easier and more seamless, reducing manual errors. | Charges for connected banking services, or use of third-party software, and accounting integration |

| Transaction Limit:

Most current accounts have no limit on the maximum number of transactions, although some premium accounts levy charges for transactions beyond a point |

If your business has high transaction volumes or frequent transactions, you should pay attention to any limits or charges associated with the account. | Additional charges for exceeding transaction limits |

| Cards and Expense Management:

Availability of debit/credit cards and access to third-party expense management tools. |

Depending on the kind of current account, banks offer debit and credit cards with limits for ATM withdrawal or shopping. Some banks also offer access to expense management tools to review or approve payments, or submit receipts. | Hidden fees or charges for debit/credit cards or expense management tools |

| Additional Benefits | Look for any additional benefits offered, such as cashback rewards, loyalty points, or discounted services. | Limited availability of benefits or rewards, or benefits against requirements like MAB/QAB etc. |

How to Open a Current Account

While some banks allow business owners to instantly open a current account online via video KYC, the process may take a while for others.

| 💡Did you know?

You can open an Axis Current Account in a fully digital process via OPEN. Not just Axis Bank, if you wish to open a Yes or ICICI bank account, OPEN can make it super easy for you. You can complete the account opening process 100% from the comfort of your home, office, or chosen location. |

Verification of documents is core to opening a current account.

KYC documents for individuals and sole proprietors:

- Address proof

- Pan card

- Passport size photograph

Document for public and private companies

- Pan card of the company

- Certification of memorandum of association, articles of association, and incorporation

- Certificate of commencement

- Address proof

- ID proof

- Passport size photographs

- List of directors and their DIN (director identification number)

- Copy of Foreign Account Tax Compliance Act (FATCA) declaration

- Income tax return filing

- TAN allotment letter

- Registration licence

- Utility bills such as electricity, water, and landline telephone bills.

Additionally, requirements for submission of documents are subject to change as per business operations.

Frequently Asked Questions

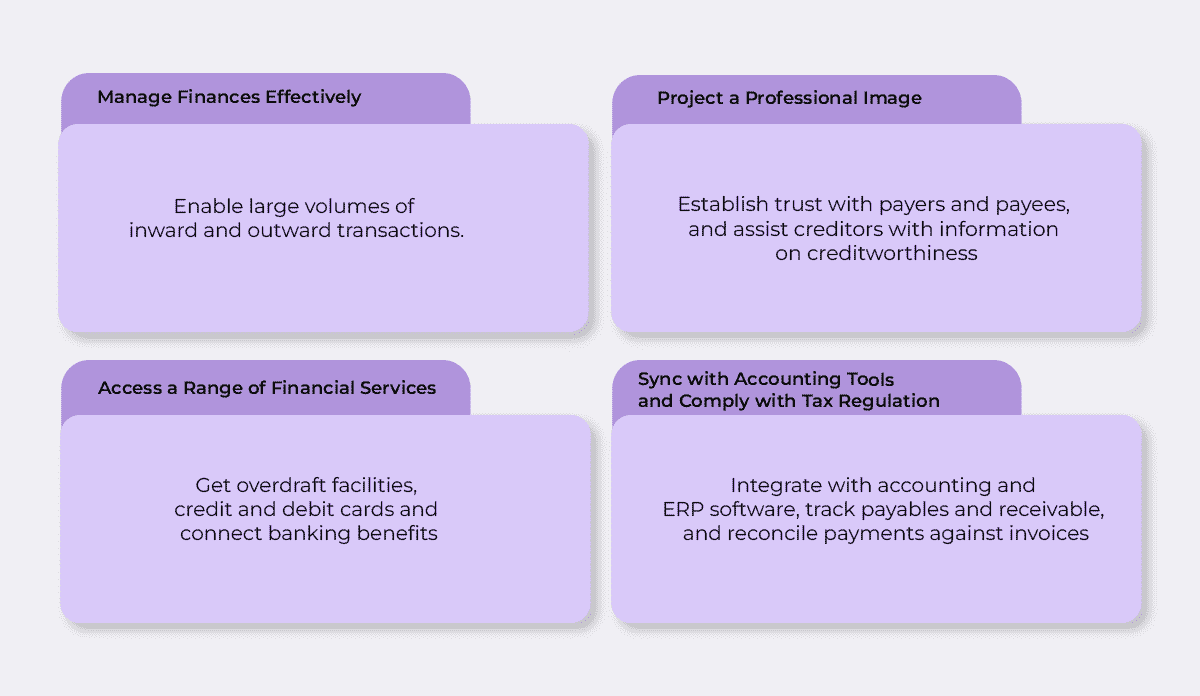

- What are the benefits of a current account?

A current account offers several benefits for businesses, including efficient financial management and higher credibility. It facilitates high-volume transactions, both inward and outward, and offers overdraft facilities. Convenient features like internet and mobile banking enable prompt business transactions. Additionally, current accounts establish creditworthiness through interbank connections, assisting creditors. Overall, a current account is essential for businesses, providing efficient financial management, credibility, and easy access to banking facilities. - What are the eligibility criteria for opening a current account?

If you fall into any of the following categories, you are eligible to open a Current Account

– Resident Individual

– Sole Proprietorship Firms

– Partnership Firms

– Limited Liability Partnership Firms

– Private and Public Limited Companies

– Trust - What is a minimum account balance (MAB/QAB)?MAB refers to Monthly Average Balance and QAB refers to Quarterly Average Balance. It is the minimum average balance the bank requires you to maintain over a fixed period of time (month or quarter). It is calculated as the average of daily closing balances of each day spread over the period.

- What if I already have a current account?

If you already have a current account, you might want to link it with OPEN to make it even more powerful. You can even connect multiple current accounts to get a consolidated dashboard view with balance, and accounts payable and receivable. With OPEN, you can schedule single or bulk payouts with ease, file your GST, run your payroll and sync all your payment data with your accounting software. - What are the different ways of depositing cash in a current account?

You can deposit funds into your current account via wire transfers (RTGS / NEFT / IMPS / Credit or Debit Card / UPI etc.) or money orders. You can also deposit cash by physically visiting a bank branch. A deposit slip can help you transfer funds into your bank account via cheque or cash. - What are the different kinds of access provided by the current account?

A current account facilitates daily cash transactions, and deposits and withdrawals at any branch location. It also gives you easy access to overdraft facilities up to a certain limit. A current account adds to the legitimacy of your business, and becomes an instrument for recording your transactions, which can be used for other functions later like accounting, tax filing, reconciliation, drafting reports and forecasting. - What do I do if I have multiple accounts?If you have multiple current accounts, the first thing you should consider doing is connecting them all to one place, so that you can see activities on all of them at once. This can help you be aware of your cumulative working capital, move funds from one account to another and allocate resources more judiciously. Next, you can also look into moving your financial processes like invoicing, billing, and reconciliation, to one place, and connecting them to your current accounts. Get in touch with our experts to know how you can do this! Checkout our product demo and see how OPEN can help your business: https://register.open.money/product-demo/