For most Indian businesses, GST has become a routine part of monthly compliance. Yet even well-managed organisations – startups, SMEs, enterprises, and even CA firms, often find themselves asking the same question:

“Why did we get a GST notice?”

With GST entering a more mature phase and data intelligence becoming sharper, notices have become more frequent, even for businesses with strong internal controls.

This guide breaks down common reasons for GST notices, the solutions, and what businesses can do to stay audit-ready.

1. Mismatches Between GSTR-1, GSTR-3B, and GSTR-2B

Why it happens

- Sales reported in GSTR-1 do not match the tax paid in GSTR-3B.

- ITC claimed in 3B exceeds auto-populated credit in GSTR-2B.

- Vendors file GSTR-1 or GSTR-3B late or incorrectly.

- A single invoice error impacts multiple months.

Impact

- Scrutiny notices (ASMT-10)

- Demand notices under Section 73/74

- ITC reversals and blocked credit

What you can do

- Run monthly/periodic GSTR-1 vs 3B and GSTR-2B vs 3B reconciliations.

- Track vendor filing consistency.

- Automate reconciliation and avoid Excel-based matching.

2. Excessive or Incorrect ITC Claims

Why it happens

- Claiming ITC on blocked credits.

- Claiming ITC on invoices not appearing in GSTR-2B.

- Claiming ITC in the wrong month.

- Vendor non-filing leading to missing credits.

Impact

- ITC mismatch notices

- Reversal of credit

- Interest payments under Section 50

- Detailed scrutiny requests

What you can do

- Maintain a vendor GST health score.

- Track invoices that don’t appear in GSTR-2B.

- Use automated ITC reconciliation tools.

3. Poor Vendor Compliance or High-Risk Suppliers

Why it happens

Even if your books are clean, a non-compliant vendor can affect your ITC. Common triggers include:

- Vendor not filing GSTR-1

- Suspended or cancelled vendor GSTIN

- Invalid GSTIN used

- Vendors linked to fake invoice networks

Impact

- ITC denial

- Mismatch-based scrutiny

- Repeated clarification notices

What you can do

- Validate vendor PAN/GSTIN at onboarding.

- Monitor vendor filing patterns.

- Conduct monthly vendor-level reconciliation.

4. E-Invoice, E-Way Bill, and GST Return Mismatches

Why it happens

- Manual entry mistakes in ERPs

- Wrong or outdated HSN codes

- Different taxable values reported

- Logistics and finance teams working in silos

Impact

- Scrutiny notices for turnover differences

- Queries related to under-reported or misreported supply

What you can do

- Sync ERP, e-invoice, and e-way bill systems.

- Standardize HSN codes and tax rates.

- Audit transport vs invoice data monthly.

5. Non-Filing or Late Filing of GSTR-1 / GSTR-3B

Why it happens

- Teams miss filing deadlines

- Dependence on vendors causes delays

- Peak-season bottlenecks in accounting

Impact

- Automated reminders, notices, and system alerts

- Disruption of ITC for customers

- Higher scrutiny for habitual delays

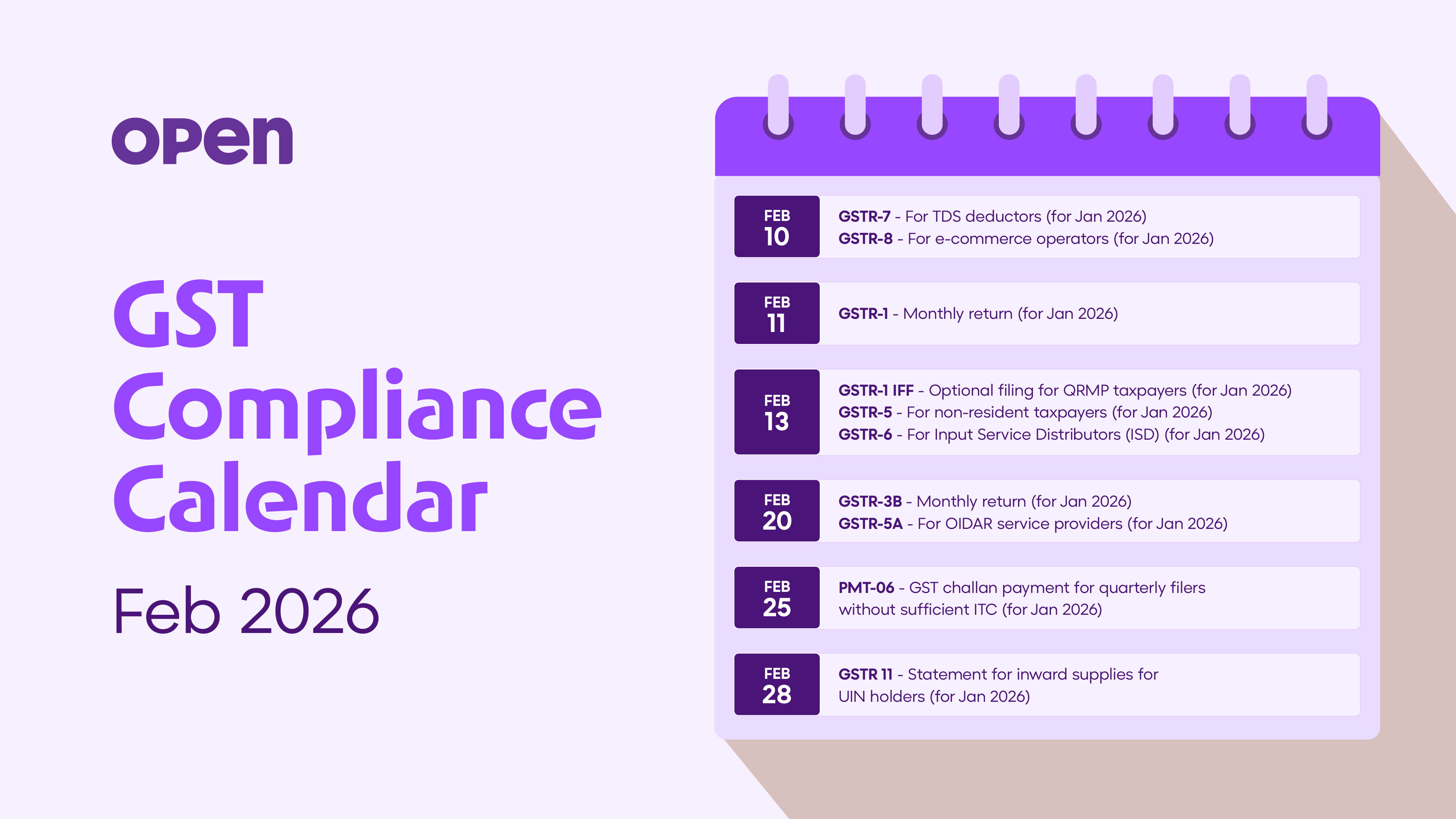

What you can do

- Calendarize return timelines.

- Automate reconciliation and downloads early in the month.

- Maintain a structured filing workflow.

6. Incorrect HSN/SAC, Tax Rates, or Classification Errors

Why it happens

- Wrong HSN/SAC code applied

- Using 12% instead of 18%

- Treating taxable supplies as exempt

- Following outdated notifications

Impact

- Demand notices for short payment

- Classification-based scrutiny

- Penalties for under-reporting

What you can do

- Standardize HSN across ERP, billing, and e-invoice.

- Conduct periodic internal audits.

- Keep track of rate notifications and circulars.

7. Amendment-Related Errors (B2B ↔ B2C | Wrong GSTIN | Missing Invoices)

Why it happens

- Wrong GSTIN entered in GSTR-1

- B2B reported as B2C or vice-versa

- Amendments made in incorrect periods

- Invoices missed or duplicated

Impact

- Queries for inconsistent reporting

- Scrutiny across multiple months

- Intimations regarding corrected liability

What you can do

- Implement invoice-level review workflows.

- Automate invoice matching across periods.

- Maintain an amendment tracker.

8. Cash Ledger, Credit Ledger, or Liability Ledger Mismatches

Why it happens

- Excess liability shown in returns

- Ledger not updated after amendments

- Double utilization of credit

- Incorrect interest calculation

Impact

- Notices asking for reconciliation

- Intimation for short payment or excess utilization

What you can do

- Reconcile ledgers monthly.

- Review ITC utilisation before filing.

- Use automated ledger-based reports.

9. Annual Return (GSTR-9/9C) Discrepancies

Why it happens

- Differences between annual turnover and monthly returns

- Missing adjustments not reflected in the monthly GSTR-3B

- Incorrect disclosure of ITC reversals

Impact

- Auditor-level queries

- Scrutiny based on year-on-year variance

- Notices seeking clarification on mismatches

What you can do

- Reconcile GSTR-1/3B with books before filing GSTR-9/9C.

- Review all annual adjustments carefully.

- Fix discrepancies in books and returns before submission.

10. High-Risk Transaction Patterns Flagged by GST Analytics

Why it happens

Authorities now use AI and data analytics to flag patterns such as:

- Sudden spikes in ITC

- Bulk amendments

- Negative liabilities

- Turnover mismatch between GSTR-3B and e-invoice

- Mismatch with income tax data

Impact

- High-risk taxpayer classification

- Deep scrutiny for multiple periods

- Repeated clarifications

What you can do

- Monitor monthly ITC patterns.

- Keep a health check on turnover trends.

- Perform periodic risk assessments.

11. Reverse Charge Mechanism (RCM) Errors

Why it happens

- Missed RCM liability

- Wrong accounting under RCM

- Claiming ITC without paying RCM first

Impact

- Liability notices

- Interest calculation mismatch

- Queries relating to RCM applicability

What you can do

- Maintain an RCM applicability checklist.

- Review expense ledgers monthly.

- Cross-check ITC against RCM payments.

12. Notices Triggered by Third-Party Data

Why it happens

GST data is compared with:

- Income Tax

- Customs

- E-way Bill systems

- DGARM analytics

- State intelligence reports

Impact

- Notice due to a mismatch in turnover, imports, or expenses

- Clarification requirements on cross-tax discrepancies

What you can do

- Align GST data with financial statements.

- Reconcile import data (ICES vs books vs GST).

Receiving a GST notice doesn’t mean your business has done something wrong. Most notices arise from common GST compliance mistakes, vendor issues, data mismatches, or timing gaps.

What truly matters is:

- identifying issues early

- responding on time

- maintaining reconciled, consistent data

With the right processes and the right system, GST notices become routine, manageable, and even predictable.

If you want a structured, stress-free way to manage GST notices across multiple GSTINs, consider centralising your workflows with a platform like Optotax.