Earlier, a regular day for any Accounts Payable manager used to be filled with papers, papers, and more papers – very different from what we see today. A manager spent days locating paper invoices, purchase orders, and delivery notes to match them. Then, they would move ahead, matching the supplier invoices and calculating the amount due, followed by writing cheques and more paperwork and getting them approved.

The cycle used to continue, leaving no room for creativity or out-of-the-box thinking.

The monotony of managing such large piles of paperwork and tallying each for accuracy can become exhausting and discouraging. But when accounts payable automation is introduced into these processes, all the manual processes are automated, paperwork is reduced to a minimum, and the reconciliation between various vendor/client accounts happens quickly.

Let’s take a detour into how a day for an accounts payable manager looks today with and without finance automation. Here’s a behind-the-scenes look into an AP manager’s daily routine:

Morning Routine

An AP manager’s day starts with several critical tasks, including cash flow management, task assignment, vendor/supplier communication, and more. Their tasks include:

- Checking emails and prioritizing tasks

- Reviewing invoices, purchase orders, and payment schedules from various sources, including suppliers, service providers, and even internal departments.

- Communicating with vendors and internal stakeholders regarding payment inquiries or discrepancies

The AP manager encounters several challenges during these tasks. The biggest issues are invoice errors, incomplete documentation, and discrepancies in recording. These issues make the morning routine painfully slow and unproductive.

Getting timely approvals from multiple departments can sometimes become challenging, leading to payment delays. Manual data entry, if part of the morning routine, can further inaccuracies in financial records. Inaccuracies can lead to payment delays and wrong financial records.

Midday Challenges

AP managers need to review Invoices for accuracy, compare them to purchase orders and receipts, and then send them for approval for payment. Communication with vendors is required in case of discrepancies, delays, or missing information. AP managers also have the responsibility of sending emails, making phone calls, and setting up meetings.

Besides, AP managers are also involved in tasks such as:

- Dealing with late or missing invoices and the impact on cash flow management

- Addressing data entry errors and reconciling discrepancies between invoices and purchase orders

- Managing a high volume of invoices and the strain it puts on time and resources Some of the challenges that AP managers encounter during these tasks are:

- Approval workflows often follow a multi-level chain of command. Few managers can achieve the feat of moving documents higher up the level or across departments without friction. The Accounts Payable team’s job is to streamline all the approval workflows so that invoices are routed to the right people, and discrepancies are addressed immediately.

- It is the job of an AP manager to work on financial reporting and analysis while performing the allied tasks. A regular reporting and analysis routine involves generating reports on payment status and outstanding invoices and analyzing financial metrics.

- While recording, AP managers also need to manage the audit and compliance, which is again a time-consuming task. Many times, the invoice format used by different vendors and departments may be structured, non-structured, or built differently. As such, keeping an organized document management system becomes an even greater task.

Afternoon Efficiency Boost

AP team’s responsibilities continue after the lunch break. Post-lunch responsibilities largely include:

- Building and managing vendor relationships via addressing inquiries, negotiating terms, and reconciling vendor issues if any

- Scheduling upcoming payments after deciding which invoices need to be paid, when, and via which payment method

- Payment processing involves generating checks, authorizing electronic transfers, and communicating with vendors that the payments have been received

- Troubleshooting tasks such as reconciling errors and discrepancies and liaising with other departments, vendors, and banks

- Archiving digital and physical documents such that records are properly stored and accessible.

These tasks might appear to be a tall order for anyone picturing AP teams and managers buried in heaps and heaps of files and phone wires. However, almost all successful businesses today employ some kind of finance automation to automate, streamline, and speed up tasks.

AP automation automates routine steps such as receiving invoices, coding, routing for approval, payment, and reconciliation. ~NetSuite

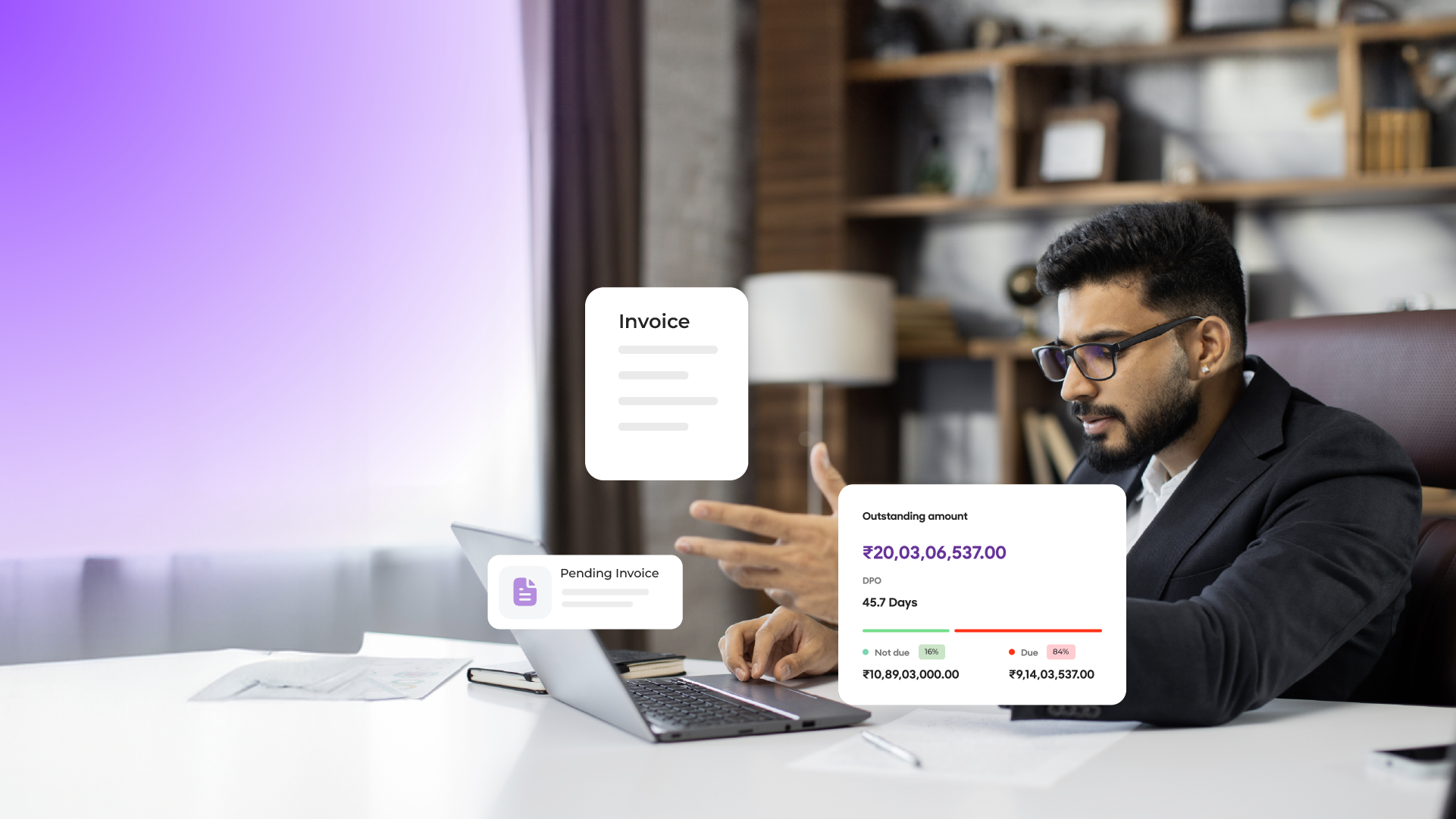

Finance automation, or specifically Accounts Payable automation software, streamlines invoice processing, reduces manual tasks, and improves operational accuracy.

How Automation Improves the AP Process

AP teams of mid to large-sized businesses have to deal with hundreds or thousands of invoices weekly. On average, it takes 4 – 16 days for AP teams to process an invoice from receipt until payment approval. Manual processing of invoices can cost as much as $23 per invoice.

Automation can reduce costs by up to 80%. However, cost reduction is not the sole reason why every business wants to automate its accounts payable processes. Finance automation, combined with RPA and AI, can automate a range of manual accounts payable tasks to eliminate most payment delays and human errors.

These manual tasks can be detecting purchase orders, extracting data for verification, scanning invoices, and pulling the data into an ERP system.

Data extraction is a big challenge that AP teams must handle when dealing with invoices. A good RPA bot is equipped with Optical character recognition (OCR) data extraction, which helps it convert images of typed or printed text into machine-encoded text from a scanned document.

Accounts Payable can help businesses with task automation spanning across functions such as:

- Intelligent data capture from invoices – whether physical copies, scanned, emailed, or fixed copies, etc

- Classification and sorting of invoices

- Checking and filtering duplicate invoices

- Data validation against ERP

- Flagging invoice exception, if any

- Routing of invoice approval

- Setting reminders for payment

- Allowing seamless sharing and flow of information across discrete processes and systems

- Reporting and analytics

A good accounts payable automation software can help achieve increased transparency in AP processes. It reduces costs and turnaround time, manages compliance and control, improves data accuracy by eliminating human errors, and more.

On the business front, an AP automation system can help with optimized cash flow, higher employee productivity and efficiency, improved vendor relations, and enhanced customer satisfaction.

Concluding Remarks

Smooth Accounts Payable processes are pertinent for the success and longevity of any business as they have a direct impact on cash flow, fraud prevention, and vendor relationships. Today technology has enabled greater improvements and advancements in these processes by way of automation solutions that can be customized and laser-focused for small to mid-sized organizations.

The onset of the AI ers, along with robotic process automation (RPA) and business process management (BPM) have added more functionalities to these systems aligning the workflows and cashflows in the day-to-day lives of AP managers and their teams.

Is your organization looking for good AP automation software with integrated banking? OPEN presents an array of structured solutions that are customizable to suit your business needs. With our dashboards and tools, you can ensure your AP processes are managed and streamlined with minimum interference on your end.

Streamline information and cashflows across all processes and systems, opt for AP automation software with OPEN today!