India’s Digital Personal Data Protection (DPDP) Act, 2025, marks a decisive shift in how organisations are expected to treat data — transforming it from an IT or legal responsibility into a core enterprise governance priority with direct implications for financial risk, operational continuity, and board-level accountability.

For CFOs, the DPDP Act cannot be treated as routine compliance. It changes how employee data, vendor information, customer records, and transactional data must be handled across finance systems. More importantly, it introduces real financial consequences for weak controls, fragmented systems, and unclear ownership.

This article explains the DPDP Act 2025 from a CFO and enterprise lens — what the law actually requires, where businesses are most exposed, and how finance leaders can prepare without adding operational drag.

What Is the DPDP Act 2025?

The Digital Personal Data Protection Act, 2025, is India’s primary legislation governing the collection, processing, storage, and protection of digital personal data. Any organisation that handles personal data in digital form—whether of customers, employees, vendors, or partners falls within its scope.

Personal data under the Act includes any information that can identify an individual, either directly or indirectly. This ranges from obvious identifiers such as names and phone numbers to financial details, payroll records, KYC data, and even transactional metadata when it can be linked to a person.

Introduced to align India with global data protection standards while accounting for local business realities, the DPDP Act places responsibility squarely on organisations—not just technology providers or consultants to ensure data is handled lawfully and securely.

Who Does the DPDP Act 2025 Apply To?

The DPDP Act applies to any organisation that processes digital personal data, regardless of size or industry. From an enterprise finance lens, this includes:

- Companies collecting, storing, or processing employee data (payroll, benefits, KYC)

- Businesses handling customer billing, payments, or transaction records

- Organisations managing vendor, consultant, or contractor information

- Indian entities processing personal data of individuals, even if systems are hosted outside India

- Foreign entities offering goods or services to individuals in India and processing their data digitally

If personal data touches your ERP, banking stack, HR system, or finance workflows, the DPDP Act applies.

Consent Under DPDP Act 2025: What Changed?

Consent is fundamentally redefined under DPDP 2025. It’s no longer implied, assumed, or buried in lengthy terms and conditions.

To be valid, consent must be:

- Clear and specific to a defined purpose

- Captured through an affirmative action (no pre‑ticked boxes)

- Informed and transparent about data use

- Easily withdrawable by the individual

- Traceable and auditable for regulators during inquiries.

For CFOs, this matters because consent is often captured outside finance (in HR, marketing, or sales platforms) — yet relied upon inside finance systems (e.g., for payroll communications, customer billing, or vendor onboarding). If consent records and usage are not aligned, compliance gaps emerge quickly.

Penalties Under the DPDP Act 2025: Financial Exposure Enterprises Must Assess

The DPDP Act 2025 introduces significant financial consequences for non-compliance. Unlike earlier regulatory frameworks, where penalties were sporadic or symbolic, this data protection law in India is designed with teeth for enforcement.

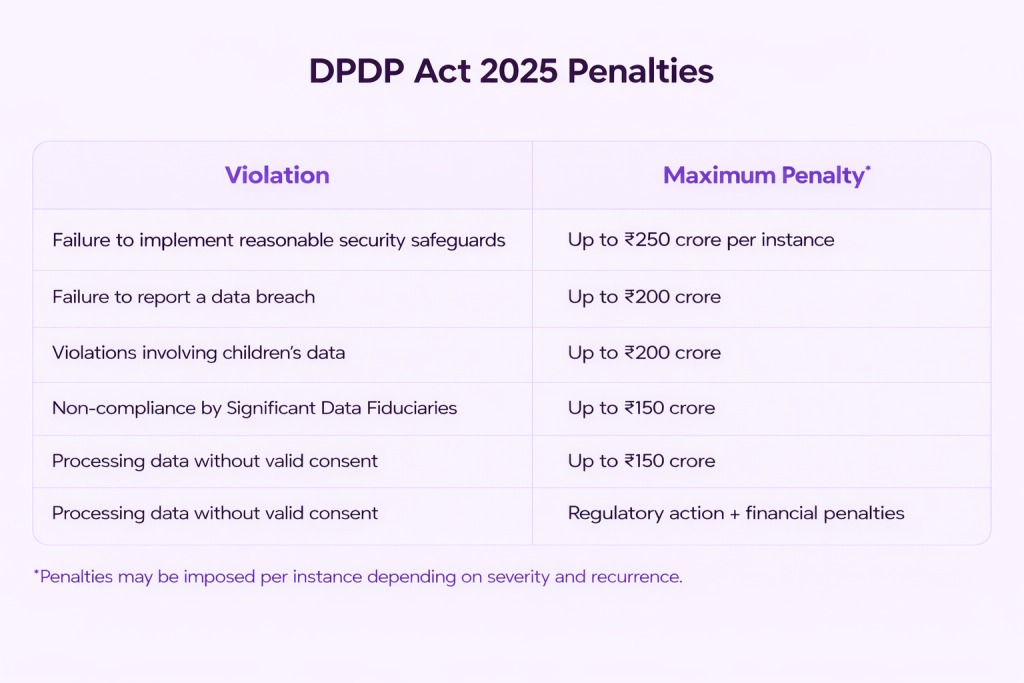

Under the Act and the evolving DPDP Rules 2025, penalties are linked to the nature and severity of violations. These include:

Failure to Implement Reasonable Security Safeguards

If an organization fails to protect personal data with adequate technical and organizational controls, penalties can extend up to ₹250 crore per instance.

Failure to Report Data Breaches

Delays or failure in notifying the Data Protection Board and affected individuals can attract penalties of up to ₹200 crore.

Processing Data Without Valid Consent

Using personal data without clear, affirmative, and auditable consent exposes organizations to substantial regulatory action and financial penalties.

Violations Involving Children’s Data

Stricter compliance requirements apply when processing children’s personal data, with penalties reaching up to ₹200 crore.

Non-Compliance by Significant Data Fiduciaries

Entities classified as Significant Data Fiduciaries (based on volume, sensitivity, or risk profile) face enhanced obligations under DPDP compliance in India, including data audits and impact assessments. Non-compliance can attract penalties up to ₹150 crore.

For CFOs, these DPDP Act penalties are not abstract risks. They sit alongside tax exposure, regulatory fines, and operational losses. More importantly, penalties are assessed per instance, meaning repeated failures or systemic weaknesses can multiply financial impact.

In practical terms, the DPDP Act 2025 shifts data protection into the financial risk register. Enterprises that lack visibility into where personal data resides across finance systems may not detect compliance gaps until scrutiny begins.

Enterprise Readiness Under DPDP: CFOs Should Prepare for Governance‑Driven Compliance

Enterprise readiness is not about ticking boxes — it’s about visibility, ownership, and repeatable processes embedded into daily workflows.

DPDP 2025 readiness typically intersects with:

- Fragmented systems

- Shared ownership across teams

- Reliance on third‑party platforms

These realities don’t disappear with policies — they require better operational design.

The most prepared enterprises approach DPDP the same way they approach financial controls: with visibility into data flows, clear accountability, and consistent processes that scale. As one CXO guide puts it, compliance must be provable — not just documented.

Where DPDP Exposure Hides in Finance Operations

Common DPDP exposure hides in places many CFOs overlook:

- Payroll and HR systems: Sensitive employee data with strict consent and access requirements.

- Vendor onboarding and payments: Bank details, PAN, and contact data are often scattered across tools.

- ERP and accounting platforms: Data copied across modules without consistent access control.

Spreadsheets and offline records: High risk, low visibility, and hard to audit. - Third‑party SaaS tools: Data shared externally without continuous oversight.

These exposures map directly to financial controls and audit processes — a strong argument for treating DPDP as a governance discipline, not a side project.

Common DPDP Mistakes Enterprises Make

Organisations often misjudge DPDP readiness in these ways:

- Treating DPDP as a legal or IT‑only initiative.

- Assuming vendors inherently manage compliance on your behalf.

- Relying on manual processes for consent and access tracking.

Ignoring finance systems during data audits. - Preparing only after a notice or breach occurs.

Each of these mistakes creates a material gap between policy and operational reality and increases financial exposure

DPDP Act 2025 and Modern Finance Infrastructure

As enterprises scale, compliance cannot depend on coordination across disconnected tools.

DPDP reinforces the need for modern finance infrastructure that is connected by design, where approvals, records, access, and audit trails are inherently aligned with data governance needs.

AI, cloud platforms, and integrated ERP systems can significantly improve compliance, but only if:

- Data flows are mapped end‑to‑end.

- Consent mechanisms are embedded into workflows.

- Access controls and logging are consistent and audit‑ready.

- Vendor and third‑party risks are continuously monitored.

This infrastructure shift turns compliance into a competitive advantage — a trust signal to customers, partners, and regulators alike.

Final Take: DPDP Is a CFO-Led Governance Challenge

The DPDP Act 2025 is not a roadblock to growth; it’s a signal that governance expectations have matured.

For CFOs, the real question is not whether you can comply, but whether data protection is embedded into finance operations or bolted on reactively when issues arise.

Enterprises that treat DPDP as part of financial discipline and risk governance will adapt smoothly. Those who don’t will feel the pressure when scrutiny increases and when the financial consequences are realised.

As data regulations tighten, finance leaders need systems that deliver control, visibility, and audit readiness by default. Compliance should be a built‑in outcome of daily workflows, not a checklist rushed at the last minute. Open Money helps enterprises build finance operations that scale responsibly, keeping compliance and governance integrated from the start.

FAQs

1. What is the difference between the DPDP Act 2025 and the DPDP Rules 2025?

The DPDP Act 2025 is the primary legislative framework that sets out principles, duties, and penalties for processing personal data in India under the new data protection law in India. The DPDP Rules 2025 are subordinate regulations issued to operationalize the Act, detailing consent notice design, breach reporting timelines, rights workflows, and governance mechanisms like Consent Managers and the Data Protection Board.

2. Does the DPDP Act 2025 apply to foreign companies?

Yes. DPDP compliance India extends to foreign entities that offer goods or services to individuals in India or monitor their behaviour online—even if systems and servers are located outside India. This means global fintechs, SaaS providers, payment gateways, and platforms serving Indian customers must align with DPDP obligations.

3. Can a failure to comply with DPDP also harm reputation or business continuity?

Yes. Beyond direct DPDP Act penalties, non-compliance can trigger:

- Regulatory inquiries and audits

- Operational restrictions or mandated corrective orders

- Loss of customer trust and reputational damage—especially critical in fintech services where trust is foundational.

These consequences reinforce why CFOs must treat DPDP compliance as a financial and governance risk, not a checkbox exercise.