Automation in finance is transforming how organizations manage their financial operations and strategies. This shift involves integrating advanced digital technologies such as automation, Artificial Intelligence (AI), Machine Learning, and data analytics into financial processes. These technologies streamline operations, improve accuracy, and offer real-time insights for better decision-making. More and more businesses are turning to cloud-based solutions, fueled by the global push for digitalization. Medtronic reports that around 90% of companies are already utilizing cloud services.

By automating repetitive tasks and using predictive analytics, finance teams can focus on strategic activities that add value to the business. Moreover, it also enhances collaboration across departments, improves compliance and security, and ultimately, leads to more flexible and robust financial management. For CFOs, embracing automation is not just an option but a necessity to remain competitive in today’s fast-paced business environment.

The Importance of Accounts Receivable Management

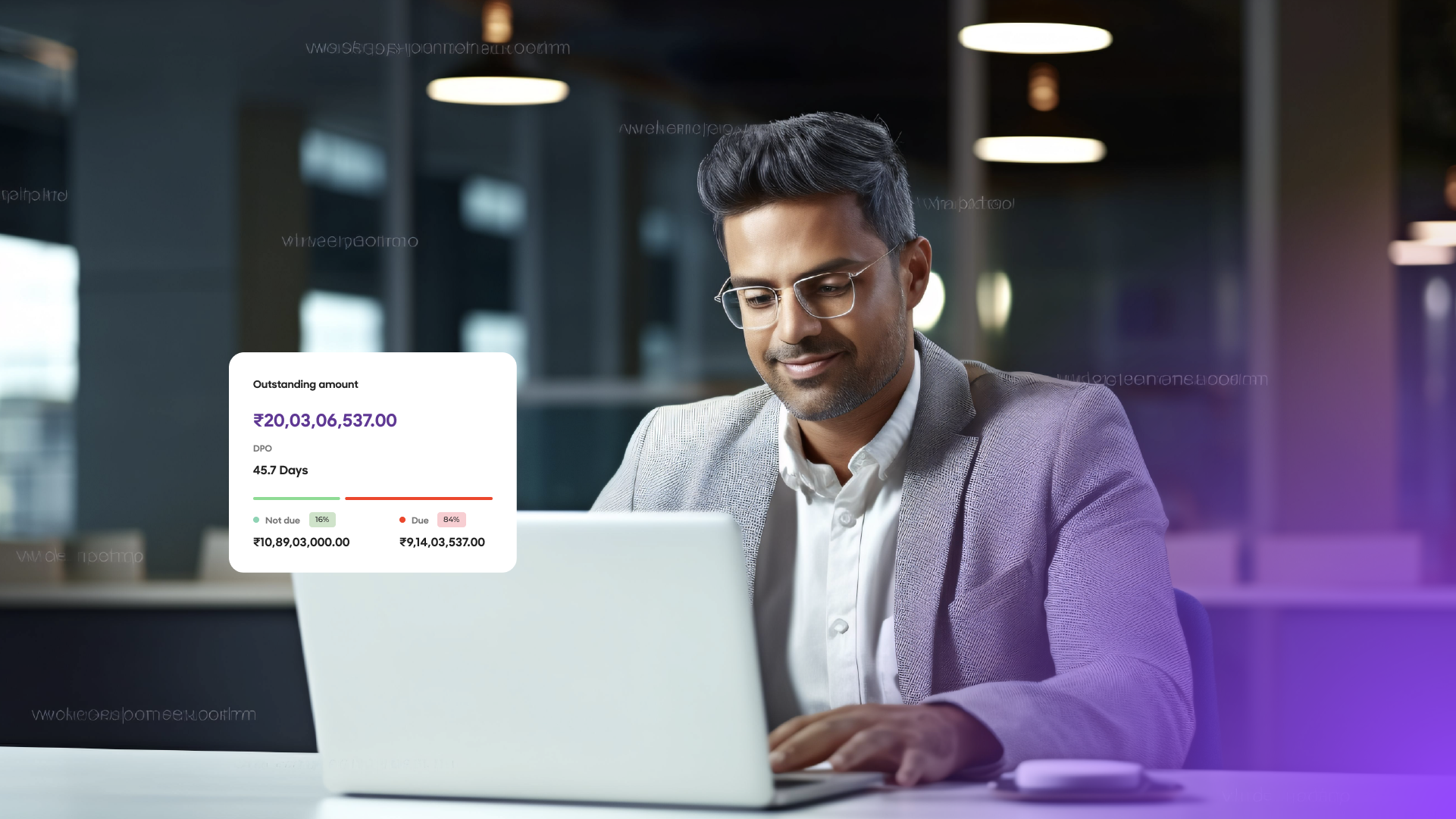

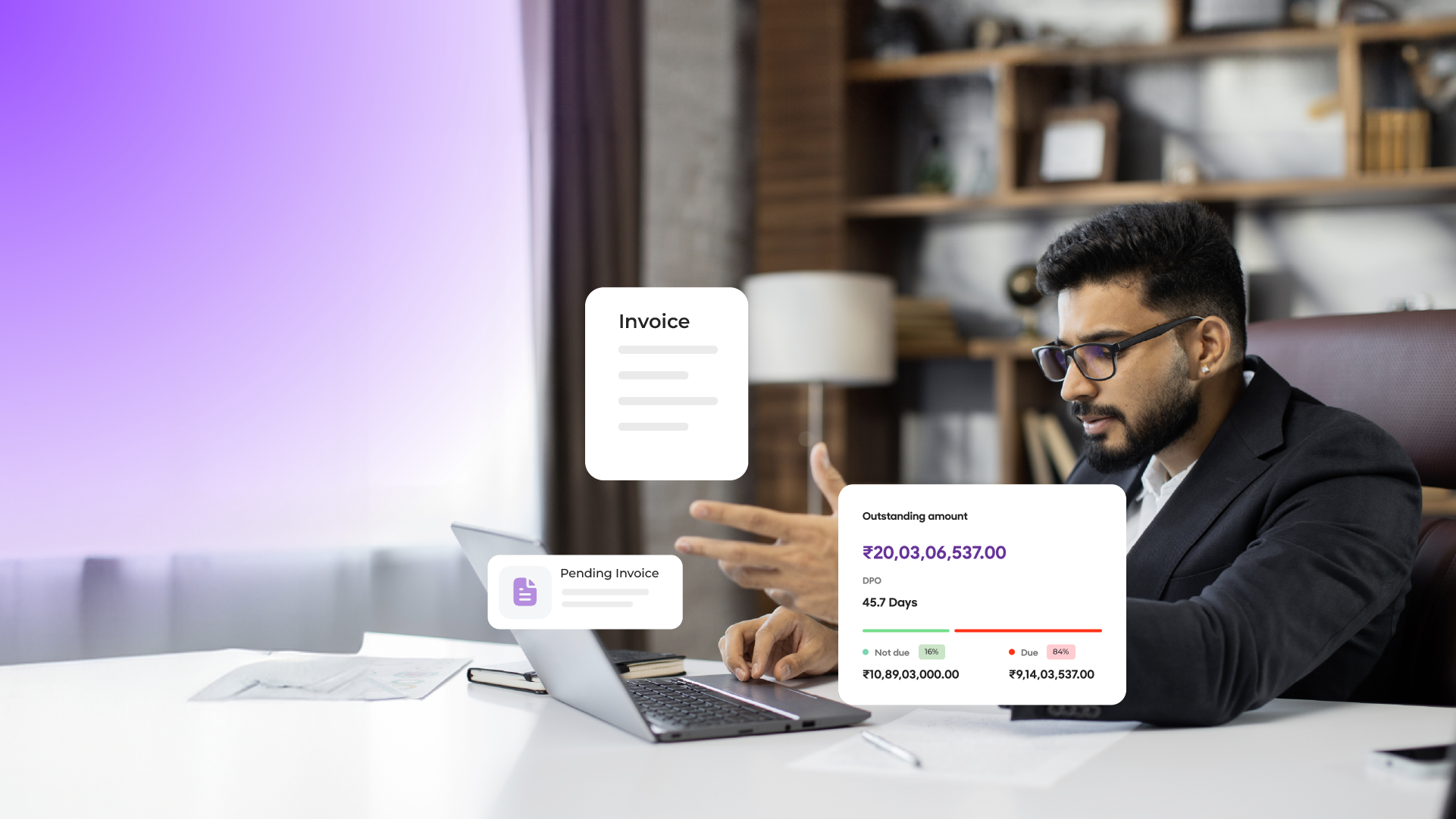

Accounts receivable (AR) is a critical component of a company’s cash flow, as it represents the outstanding invoices a company has yet to collect from its customers. Efficient management of AR is essential for maintaining a healthy cash flow. When AR processes are optimized, companies can ensure timely collections, reduce the number of Day Sales Outstanding (DSO), and minimize the risk of bad debt.

This steady inflow of cash allows businesses to meet their financial obligations, invest in growth opportunities, and improve overall financial stability. On the other hand, poor management of AR can lead to cash flow problems, affecting the company’s ability to pay suppliers, employees, and other critical expenses, which can impact business operations and growth. Therefore, a robust AR strategy is crucial for sustaining operational efficiency and long-term financial health.

The role of a CFO in leading digital initiatives is increasingly essential in the current business landscape. They play a central role in aligning technology investments with overarching business objectives, ensuring that digital initiatives are not only cost-effective but also strategically impactful. CFOs oversee the financial aspects of digital projects, from budgeting and resource allocation to risk management and performance evaluation.

Additionally, they promote a culture centered on data, using analytics to inform strategic decisions and fuel business growth. Leading digital efforts, CFOs open doors to improved efficiency, innovation, and competitive edge, shaping the organization’s future success.

Current Challenges in Traditional AR Process

According to research, companies that rely on manual processes for managing collections spend 15% of their time prioritizing activities, another 15% gathering information for collections, and only 20% actually communicating with customers about payments.

Here are a few challenges that come with the traditional AR processes:

- Manual data entry and processing are key challenges in the traditional AR process. This manual approach involves employees entering data from invoices and receipts into accounting systems, which is error-prone and time-consuming. It can lead to inefficiencies, inaccuracies, and scalability issues, affecting cash flow and operational efficiency.

- Delayed payment and cash flow issues is another challenge. When payments are delayed, it interrupts cash flow, making it harder to meet financial obligations. This can increase DSO, tying up working capital and impacting financial stability.

- Traditional AR processes lack real-time visibility and reporting. This means businesses struggle to access up-to-date information on outstanding invoices and payment statuses. Without this, finance teams find it difficult to manage cash flow effectively, leading to delays in identifying overdue payments and addressing AR issues promptly.

These challenges can be overcome by automating the entire process, which offers numerous solutions.

Here are some of the benefits of automating the AR processes:

- Increased Efficiency and Accuracy: By automating tasks such as data entry and invoice processing, organizations can achieve greater efficiency and accuracy. This streamlines operations, reduces errors, and provides real-time access to insights for informed decision-making. Ultimately, it boosts productivity and profitability.

- Improved Cashflow Management: It also enhances cash flow management by automating AR processes, and speeding up invoicing and payment collection. With real-time visibility into payment statuses, businesses can make informed decisions to address cash flow gaps promptly. This streamlining reduces DSO and reliance on costly financing, supporting overall financial stability and growth.

- Enhanced customer experience and satisfaction: Automation enhances customer experience by providing easy interactions, personalized services, and convenient digital payment options. It reduces errors and delays, ensuring timely transactions and improving satisfaction. Additionally, data analysis allows businesses to understand customer preferences better, leading to customized offerings and increased loyalty.

Steps for Implementing Automation in AR

- Audit the existing procedures to identify inefficiencies and areas for improvement. This includes scrutinizing each step of the workflow, from invoice generation to payment collection, and evaluating the performance of current systems. Identifying these pain points is essential for laying the groundwork for successful automation of Accounts Receivables.

- Set clear objectives and KPIs by defining goals for the automation and establishing Key Performance Indicators (KPIs) to measure success. These objectives may include reducing DSO (Day Sales Outstanding) to improve cash flow, increasing on-time payments to enhance liquidity, and improving accuracy while reducing errors to streamline operations. By clearly defining these objectives and KPIs, businesses can focus their efforts on achieving significant improvements in accounts receivable efficiency and performance.

- Choose the right technology solutions to establish criteria for selecting AR automation tools and platforms, considering factors like integration, scalability, and features such as automated invoicing and reporting. Leading software options include Xero, QuickBooks Online, and FreshBooks, offering features like invoice customization and real-time reporting to streamline AR processes effectively.

- Developing a comprehensive implementation plan and creating a timeline with milestones, allocating resources and budget, and defining stakeholder engagement and communication strategies. This includes setting deadlines, identifying resource needs, and ensuring stakeholders are informed and engaged throughout the process.

- Implement training programs for AR staff to familiarize them with new technologies and provide ongoing support for troubleshooting. This includes comprehensive training sessions on how to use the new AR tools effectively and address any challenges or questions that arise.

Future Trends in AR Automation

- Emerging Technologies in AR: Emerging technologies are set to transform accounts receivable (AR). Blockchain can enhance transparency and security in transactions, reducing fraud and ensuring data integrity. AI and Machine Learning (ML) can automate routine tasks, improve accuracy, and streamline processes. These technologies enable real-time data processing and intelligent decision-making, significantly enhancing AR efficiency and effectiveness.

- The Role of Predictive Analytics in AR: Predictive analytics plays a crucial role in modernizing AR by using historical data to forecast future trends. It can predict payment behaviors, identify potential defaults, and optimize credit management strategies. By leveraging predictive insights, businesses can proactively address issues, improve cash flow management, and reduce the risk of bad debt, ultimately enhancing financial stability.

- Expectations for the Future of AR Processes: The future of AR processes will likely be characterized by increased automation, real-time data access, and enhanced customer experiences. We can expect seamless integration with other financial systems, more sophisticated data analytics, and greater use of mobile platforms for invoicing and payments. These advancements will drive more efficient, accurate, and customer-centric AR operations, supporting overall business growth and adaptability.

Accounts Receivable automation is essential for improving efficiency, accuracy, and cash flow management. By adopting advanced technologies such as AI, machine learning, and predictive analytics, businesses can optimize their AR processes and enhance overall financial health. The CFO plays a vital strategic role in driving this change, ensuring that technology investments align with business goals and fostering a data-driven culture. By leading digital initiatives, CFOs can unlock significant value, positioning the organization for sustained success in an increasingly digital world.

With OPEN, you get customized payment solutions to streamline your financial management alongside connected banking. Through automating your Accounts Payable (AP) and Accounts Receivable (AR) processes, OPEN’s finance automation solutions enable you to cut hidden expenses, enhance productivity, and enable your finance team to concentrate on strategic projects that promote expansion. Visit Open.money for more information!