The Goods and Services Tax (GST) came into effect on July 01, 2017 in India. Since then, most small and medium-sized businesses have geared up to make their operations compliant with the new tax laws.

One of the major changes with the implementation of GST is that the invoices must be compliant with the new tax laws. The same applies to e-Invoicing. e-Invoices are Electronic Invoices, that are used to authenticate B2B invoices electronically by e-Invoice portal for tax return purposes.

e-Invoice under GST

From August 1st,2023, every business crossing an aggregate turnover of over Rs 5 Cr. in the last financial year is required to follow the current e-Invoicing guidelines.

Under this system, a unique IRN (Invoice Reference Number) gets issued by the IRP (Invoice Registration Portal) against every invoice generated. All the invoice details get transferred to both the GST portal as well as the NIC (National Informatics Centre) portal in real-time via APIs. This eventually eliminates manual processing and helps businesses to file GST returns and to claim GST refunds with ease.

Note: A taxpayer who is already registered on the GST portal needs to register separately on the e-Invoice portal. A taxpayer registered on the e-way bill portal is not required to separately register on the e-Invoice portal. The person can log in to the e-Invoice portal using the same login credentials as the e-way bill portal.

Benefits of e-Invoicing for your businesses

- Eliminate the manual data entries and redundancies

- Avoid data mismatches

- Reduce reconciliation errors

- Track all the invoices in real-time

- Input tax credits with ease

- Monitor invoices with timely records

Generate e-Invoices with ultimate ease using Open

Open enables users to generate e-Invoices in a single click. Alongside, it also allows them to convert the existing applicable invoices to e-Invoices. With Open, the users can perform multiple tasks such as generate, cancel, download and view e-Invoices with 100% compliance.

Enable e-Invoicing

Under the GST section of Open’s Tax and Compliance module, the user is provided with an option to enable/disable e-Invoice.

Here, the user needs to choose the ‘Enable e-Invoice’ toggle based on their business requirement and also choose if they own an API e-Invoice ID and password.

If Yes, the user can record the existing username and password.

If No, the user can create an API username and password from the e-Invoice portal.

View more details on how to create a new API username and password on GST portal by clicking on ℹ️ .

Note – In case the user has not recorded the username and password under the Tax and compliance module, he can also record the same while creating an invoice by enabling the e-Invoicing toggle.

Once the user inserts the respective username and password, click on ‘Apply’ to save the credentials.

The user can now proceed with invoice creation (if not yet done). Once all the details have been filled in the invoice, click on ‘Save’.

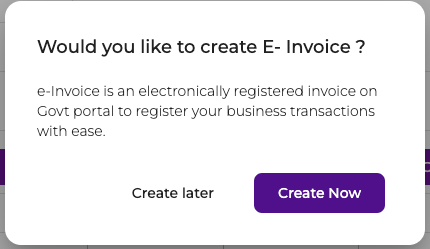

A pop-up will appear asking if the user wishes to create the e-Invoice – Now or Later.

By clicking on –

By clicking on –

Create Later –The user can view the applicable Invoice in the e-Invoice report, listed as ‘Not Generated’.

Create Now – The user can view the e-Invoice in the e-Invoice report listed as ‘Generated’.

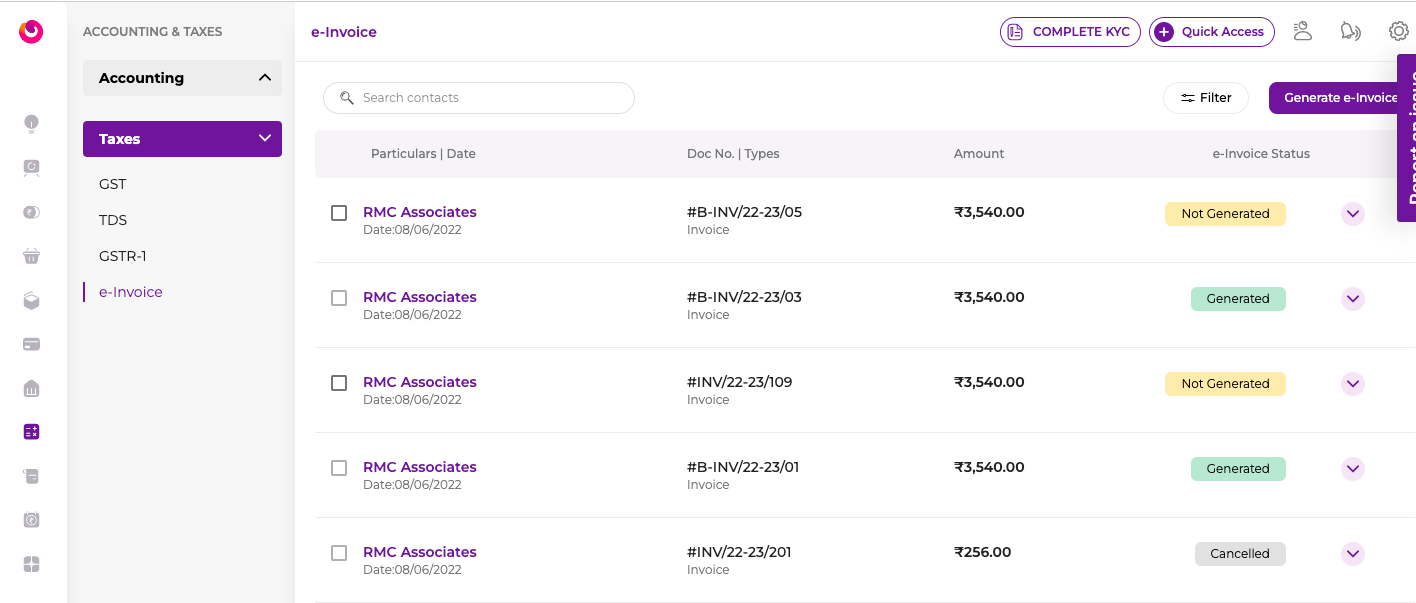

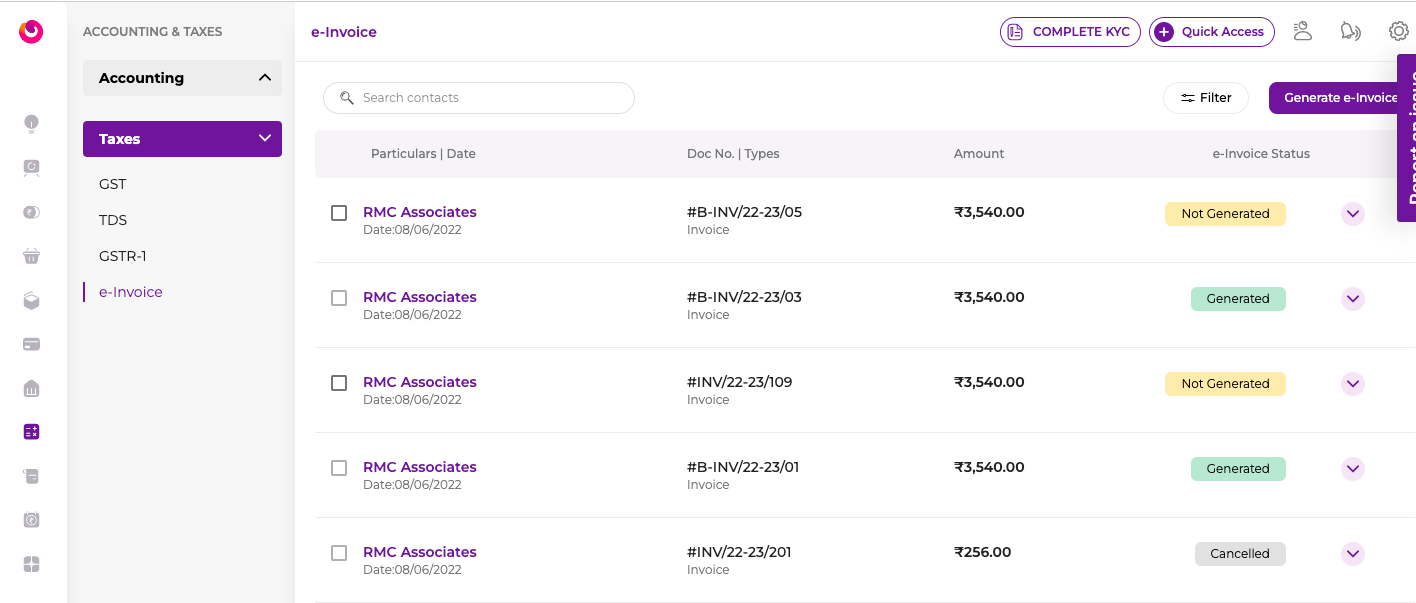

What is an e-Invoice report?

What is an e-Invoice report?

An e-Invoice report is the report that consists of the list of invoices where e-Invoice is applicable. Invoices that are applicable for e-Invoice creation, but not yet generated, will get listed in the report tagged as ‘Not Generated’.

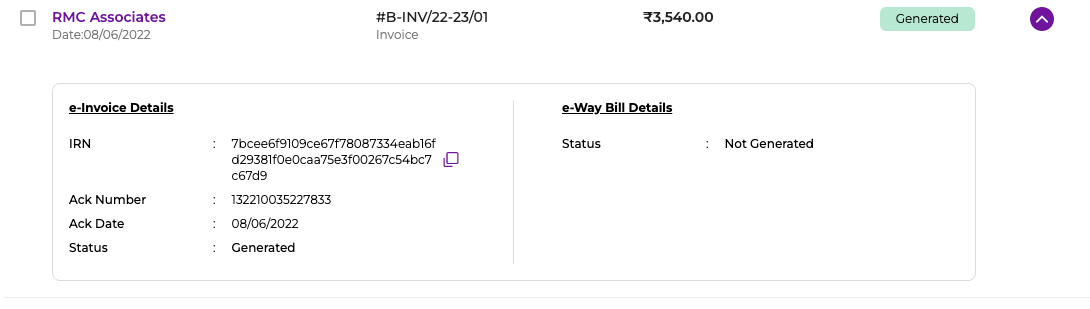

Moreover, the user can select single/bulk invoices tagged as ‘Not Generated’ from the list and click on the ‘Generate e-Invoice’ button to generate an e-Invoice. The user can click on the purple dropdown arrow in the right end of the row to view the summarised data of any ‘Generated’ e-Invoice by clicking on the purple down arrow provided in the right end of the row.

The user can view the auto-refreshed status of all the generated and non-generated e-Invoices in the report. To cancel a generated e-Invoice, the user can click on the ‘Cancel IRN’ option and view these invoices in the report, tagged as ‘Canceled’.

In addition, businesses that deal in movement of goods can also generate E-way bills in a single click. An e-Way bill is an electronically generated document. It is required for the movement of goods worth ₹ 50,000 or more from one place to another, anywhere in India.

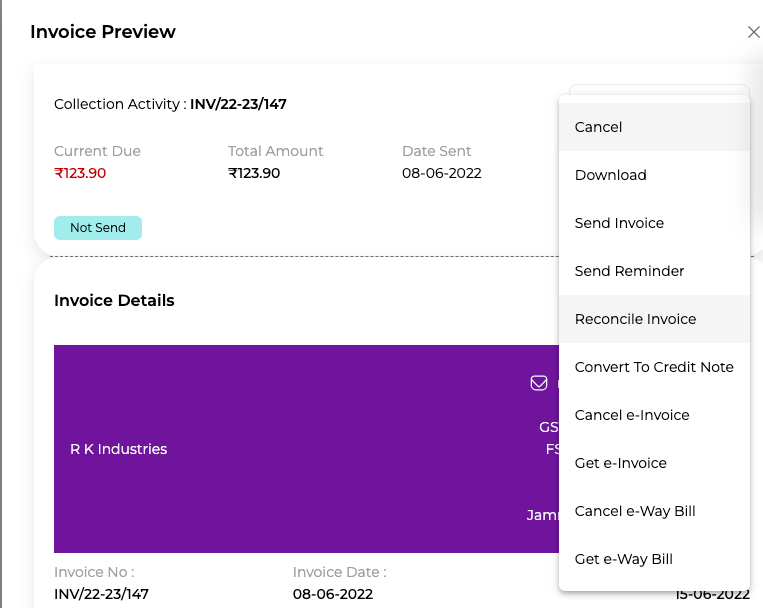

With Open, the user can create/ cancel e-Way bills directly from the dropdown on the invoice preview.

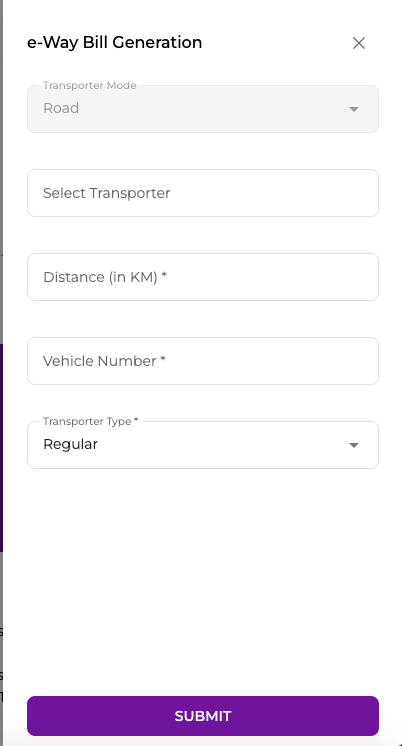

To generate an e-way bill, the user first needs to submit the invoice details and then proceed with the basic transportation details as mentioned below.

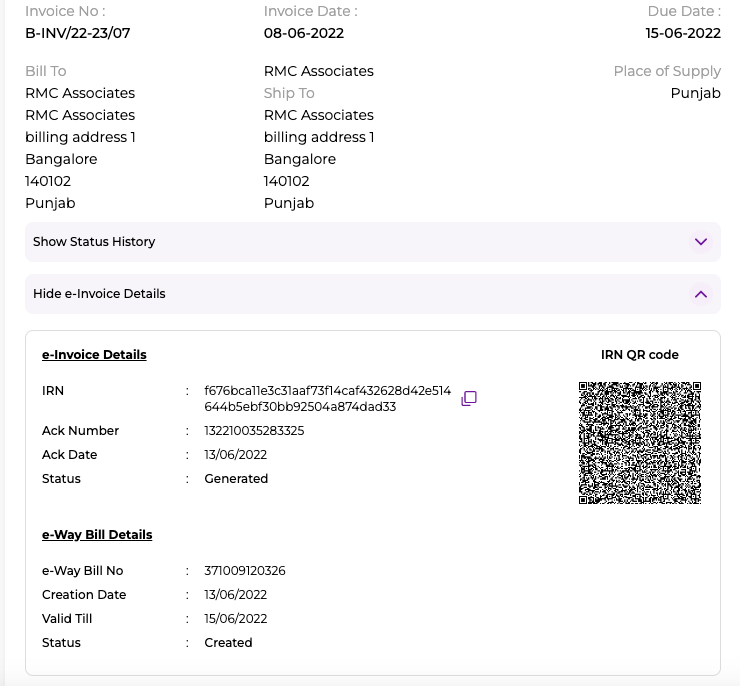

The user can also view all the details such as creation date, validity, and status for the generated e-Way Bill under the respective invoice summary.

The user can also view all the details such as creation date, validity, and status for the generated e-Way Bill under the respective invoice summary.

The user can also click on the invoice row in the report and preview the e-Invoice . Here, the user can choose to view the e-Invoice details such as creation date & time, IRN, QR code, e-way bill details, and status. These details can also be downloaded/ printed for user convenience.

Wasn’t that easy?

Checkout more insights on GST e-Invoicing in the FAQs.

To learn how OPEN can help, checkout our demo: https://register.open.money/product-demo/