India has registered a massive rise in the number of startups. It has grown by 15,400% in the last couple of years – from 471 in 2016 to 72,993 as of 30th June 2022. [1]

Emerging as the 3rd largest ecosystem for startups globally with 77,000+ DPIIT (Department for Promotion of Industry and Internal Trade) – recognised startups, India today ranks second in innovation quality.[2] Most startups rooted in innovation, aim at fixing gaps in the existing products or creating new products. Their major investment goes into technological assets for innovation in the internet of things (IoT), robotics, artificial intelligence, analytics, etc. Major challenges that come along with this are on the financial front. One of the prime requirements here is to have a dedicated business account for startups. The Indian banking sector has, however, stepped up to the financial management needs specific to the startups.[3]

What is a Business Account for Startups?

A business account is a bank account that is created in the name of the startup specifically for its business transactions. A business account operates similarly to a personal bank account. However, business account holders can often access services that are unavailable to personal account holders, for example:

- Cross-border payments

- Credit checks on other businesses and suppliers

- Employee payroll processing

Why is a Business Account important for Startups?

A business account for startups helps in fulfilling all the essential requirements, such as paying bills and checking statements. Moreover, it also offers access to time-saving tools that support a startup’s growth, such as integrated accounting and direct invoicing. Here’s how a business account for a startup aids its growth.

Separate personal and professional funds

The main benefit of a business account for startups is that their personal transactions never cross paths with their business budget. This can make life easier when it comes to accurate accounting and expense management.

Easy accounting and tracking

Without a business account, sourcing the monthly and yearly expenses get extremely tedious. This results in a poor projection of the startup’s future expenses while designing a budget. Having a unified business account, however, enables a startup to store funds specific to the business and streamlines all vendor payouts. Moreover, a business bank account for startups also allows them to determine accurate profit margins.

Claiming tax deductions

Startups most likely deduce various expenses when it’s time to file taxes. Keeping a separate business account makes it easier to track those expenses and report them on the tax return precisely. The same goes for business income. When there is a dedicated business account, one can easily see what’s going in and out of the company’s balance.

Startup founders already have a lot on their plate to take care of. When the business bank account is separate from any other account, it mitigates major chances of errors and missed expense records. This results in better accuracy which saves tons of hours while filing tax returns.

Security to acceptance

The benefits of having a business account are much more than merely keeping business and personal spending separate. When a startup owner makes online vendor payouts, a business account assures a professional outlook of the business. Having a business account in the name of the startup allows the payees to feel affirmed regarding legitimate business security.

Depending on the benefits offered by the financial institution, a startup may be further applicable for

- Cheaper access to credit

- Professional services at negotiated rates

- Waiver of charges on debit cards

- Reduced minimum balance requirements

With this, let’s quickly learn the steps to open a business bank account.

Steps to open a Business Account for Startups

Step 1: A startup must register the business under either partnership, proprietorship, or a company under the Companies Act. Next is to apply for the licenses (based on the nature of your business) and register under other Acts as necessary, such as Customs, DGFT guidelines, Income Tax, etc.

Step 2: Apply for a startup business account online on the website of a bank/ financial institution. In case, the bank/ financial institution is not available online, visit the nearest branch for an account application.

Step 3: Collect all the necessary KYC documents required to open the business account and hand them over to the bank/ financial institution. The business bank account gets activated post-verification of all the documents.

Choosing the right Business Bank Account for Startups

To choose the best business bank account for startups, one must check the related business requirements. These might include:

- App-based access

- Business support for Startup growth

- Minimum balance requirement

- Access to foreign exchange

Documents required to open a Business Account for Startups

Check out the list mentioned below:

- Incorporation certificate or proof of business registration

- PAN of the entity

- Account opening cheque from an existing bank account

- Identity proof (any one): Voter ID card, driving license, Aadhaar card, PAN card, passport

- Address proof (any one): rent agreement, Aadhaar card, voter ID card, water bill, electricity bill, telephone bill, driving license, passport

- Latest passport size photograph

In the case of a partnership, one needs to submit KYC documents for all the authorized signatories of the startup. Whereas, for individuals, the documents mentioned above will suffice for the process.

Business Account for Startups by OPEN

A business account at the doorstep of every startup

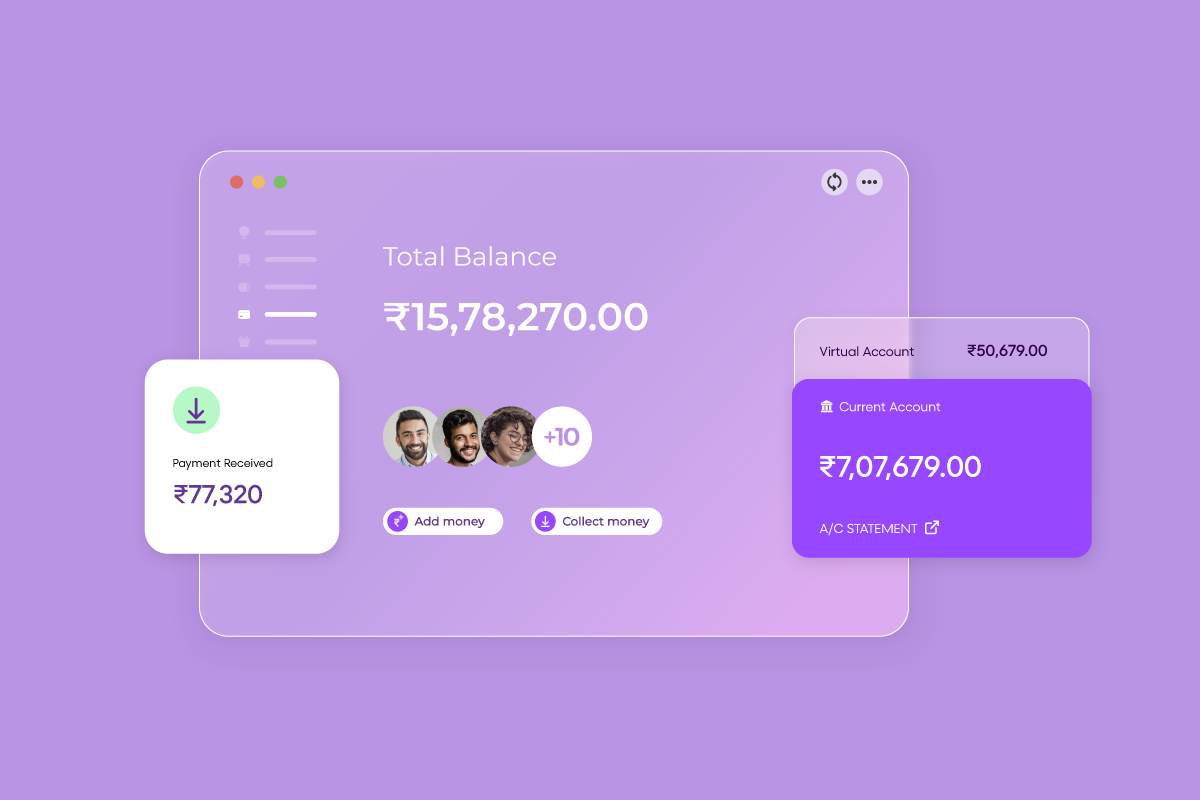

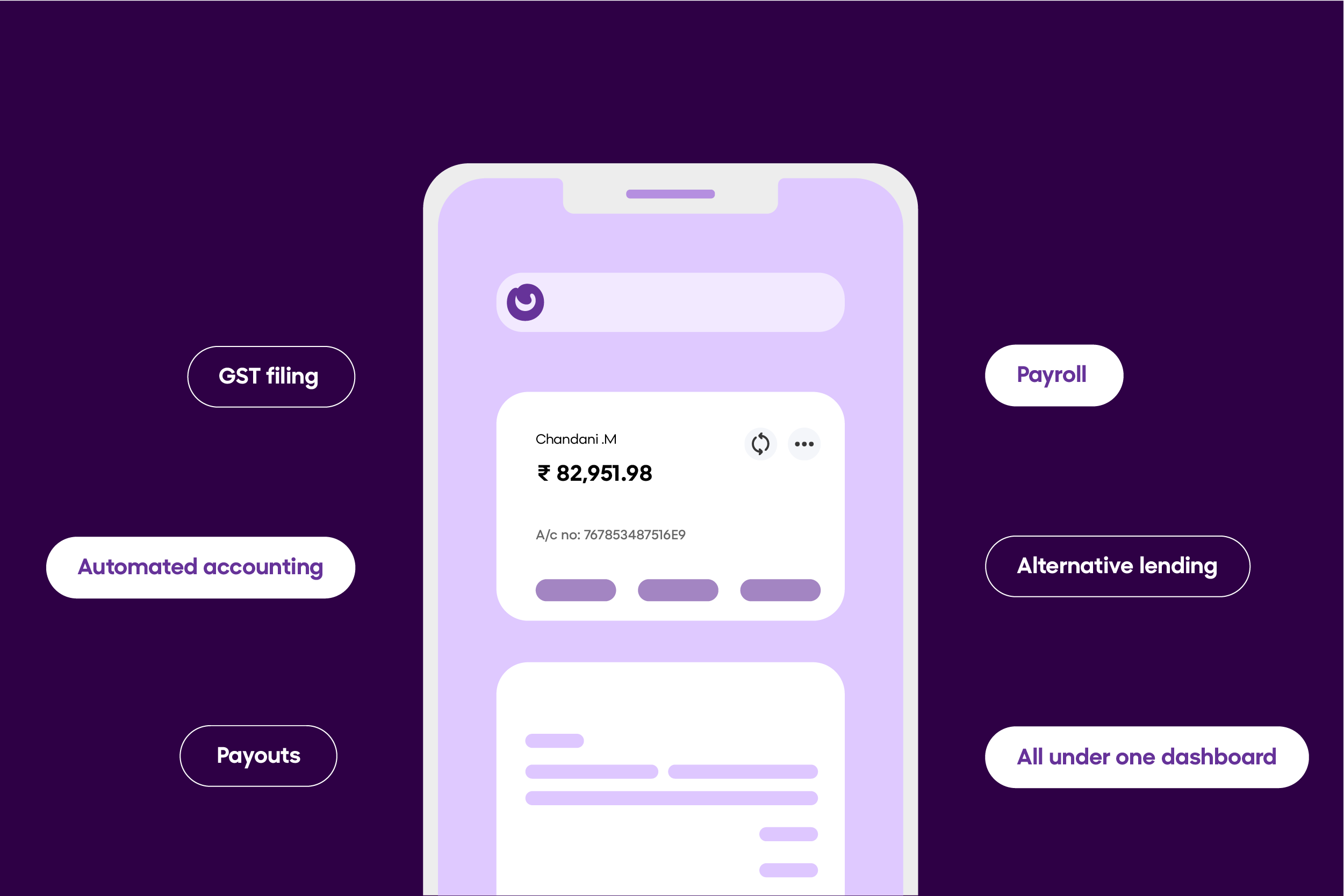

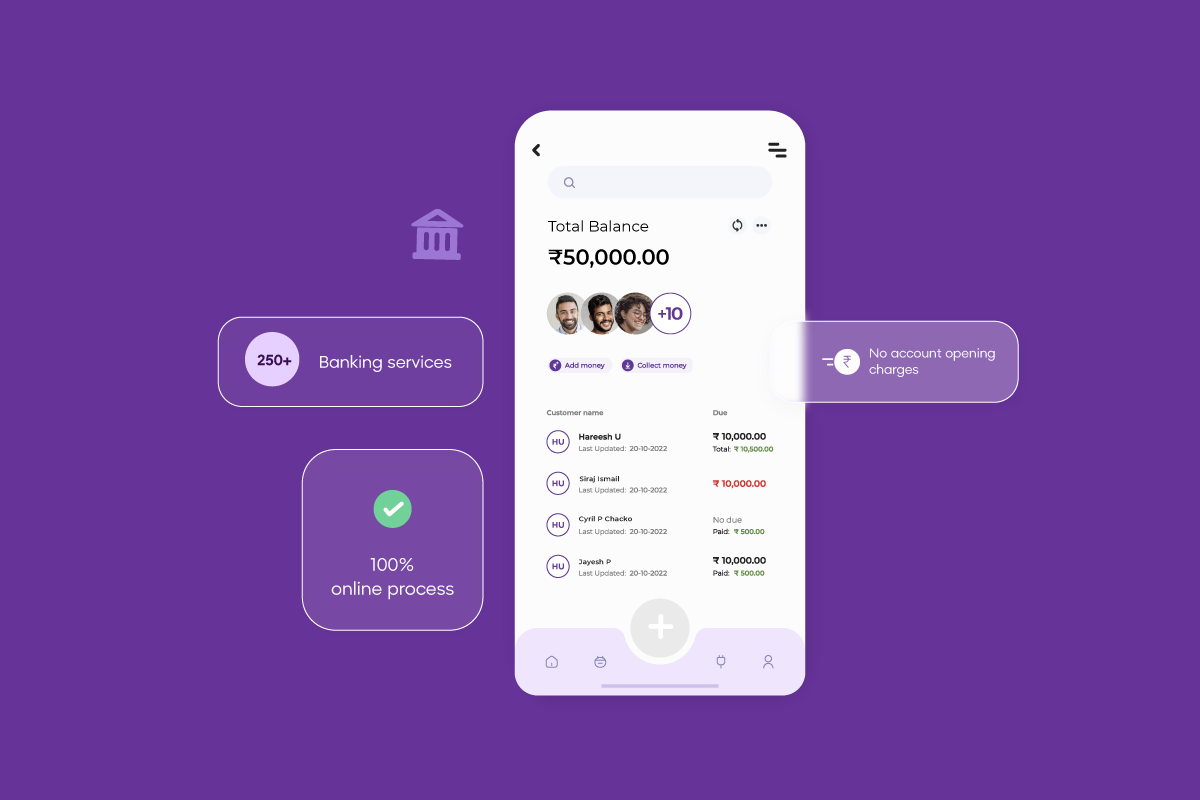

OPEN’s business account for startups is an all-in-one online business bank account that simplifies the business banking experience.

Moreover, the account allows easy GST-compliant invoice creation with in-built payment collection links. On top of that, one can link multiple current accounts and get complete control of their business banking from one dashboard. A user can link his existing current account easily, with Open Money. He is redirected to the partner bank portal and the account then gets linked by authorisation through Internet Banking Credentials. The connected banking feature helps users oversee all their business transactions done via Open Money with real-time updates, making their business banking journey remarkably smooth.

There’s a lot a startup can explore to grow with OPEN’s business bank account. Set up OPEN’s online bank account and get started on a more simplified way of business banking.